Question

Craft Ltd. held 80% of the outstanding ordinary shares of Delta Corp. as at December 31, Year 12. In order to establish a closer relationship

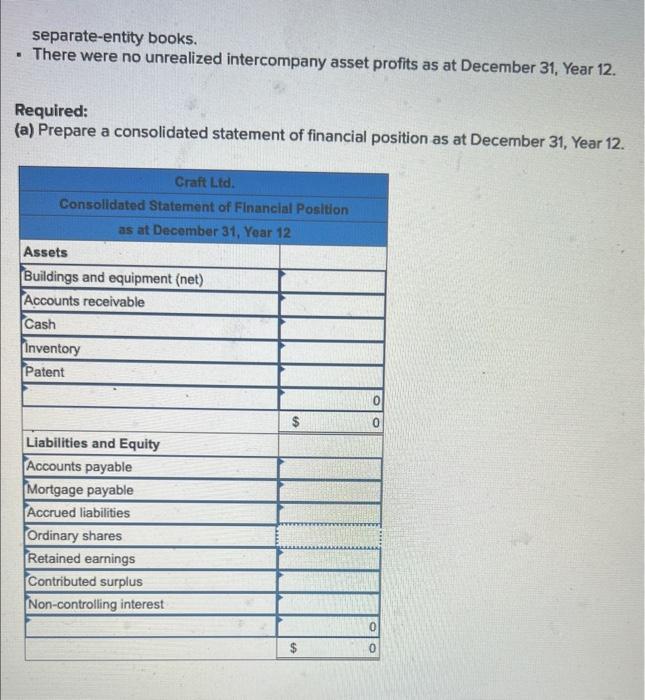

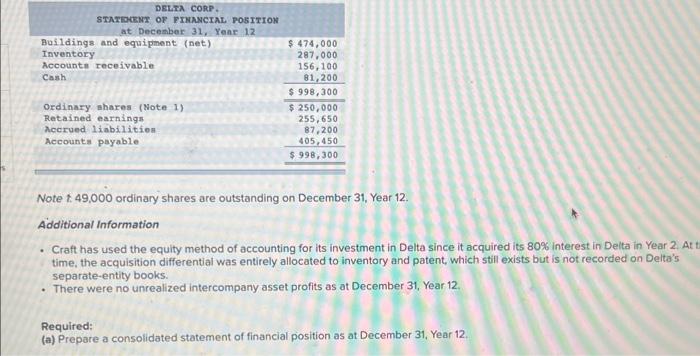

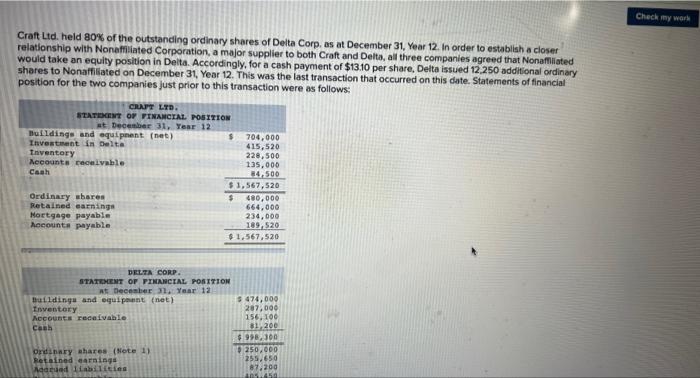

Craft Ltd. held 80% of the outstanding ordinary shares of Delta Corp. as at December 31, Year 12. In order to establish a closer relationship with Nonaffiliated Corporation, a major supplier to both Craft and Delta, all three companies agreed that Nonaffiliated would take an equity position in Delta. Accordingly, for a cash payment of $13.10 per share, Delta issued 12,250 additional ordinary shares to Nonaffiliated on December 31, Year 12. This was the last transaction that occurred on this date. Statements of financial position for the two companies just prior to this transaction were as follows: CRAFT LTD. STATEMENT OF FINANCIAL POSITION at December 31, Year 12 Buildings and equipment (net) $ 704,000 Investment in Delta 415,520 Inventory 228,500 Accounts receivable 135,000 Cash 84,500 $ 1,567,520 Ordinary shares $ 480,000 Retained earnings 664,000 Mortgage payable 234,000 Accounts payable 189,520 $ 1,567,520 DELTA CORP. STATEMENT OF FINANCIAL POSITION at December 31, Year 12 Buildings and equipment (net) $ 474,000 Inventory 287,000 Accounts receivable 156,100 Cash 81,200 $ 998,300 Ordinary shares (Note 1) $ 250,000 Retained earnings 255,650 Accrued liabilities 87,200 Accounts payable 405,450 $ 998,300 Note 1: 49,000 ordinary shares are outstanding on December 31, Year 12. Additional Information Craft has used the equity method of accounting for its investment in Delta since it acquired its 80% interest in Delta in Year 2. At that time, the acquisition differential was entirely allocated to inventory and patent, which still exists but is not recorded on Deltas separate-entity books. There were no unrealized intercompany asset profits as at December 31, Year 12. Required: (a) Prepare a consolidated statement of financial position as at December 31, Year 12.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started