Answered step by step

Verified Expert Solution

Question

1 Approved Answer

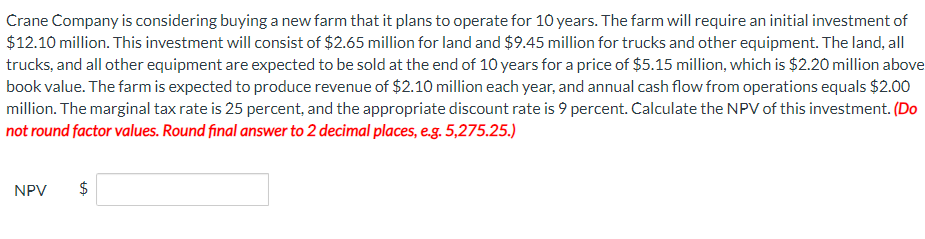

Crane Company is considering buying a new farm that it plans to operate for 1 0 years. The farm will require an initial investment of

Crane Company is considering buying a new farm that it plans to operate for years. The farm will require an initial investment of

$ million. This investment will consist of $ million for land and $ million for trucks and other equipment. The land, all

trucks, and all other equipment are expected to be sold at the end of years for a price of $ million, which is $ million above

book value. The farm is expected to produce revenue of $ million each year, and annual cash flow from operations equals $

million. The marginal tax rate is percent, and the appropriate discount rate is percent. Calculate the NPV of this investment. Do

not round factor values. Round final answer to decimal places, eg

NPV $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started