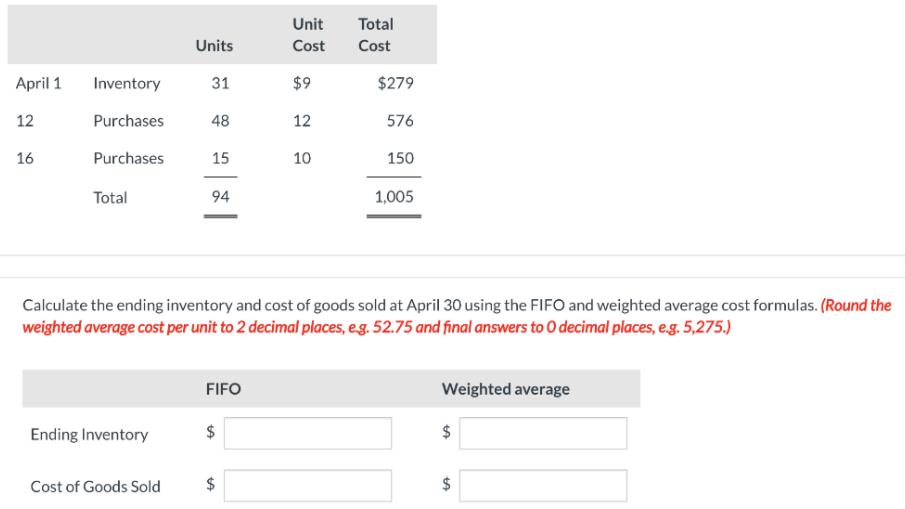

Crane Company uses a periodic inventory system Its records show the following for the month of April, with 24 units on hand at April 30:

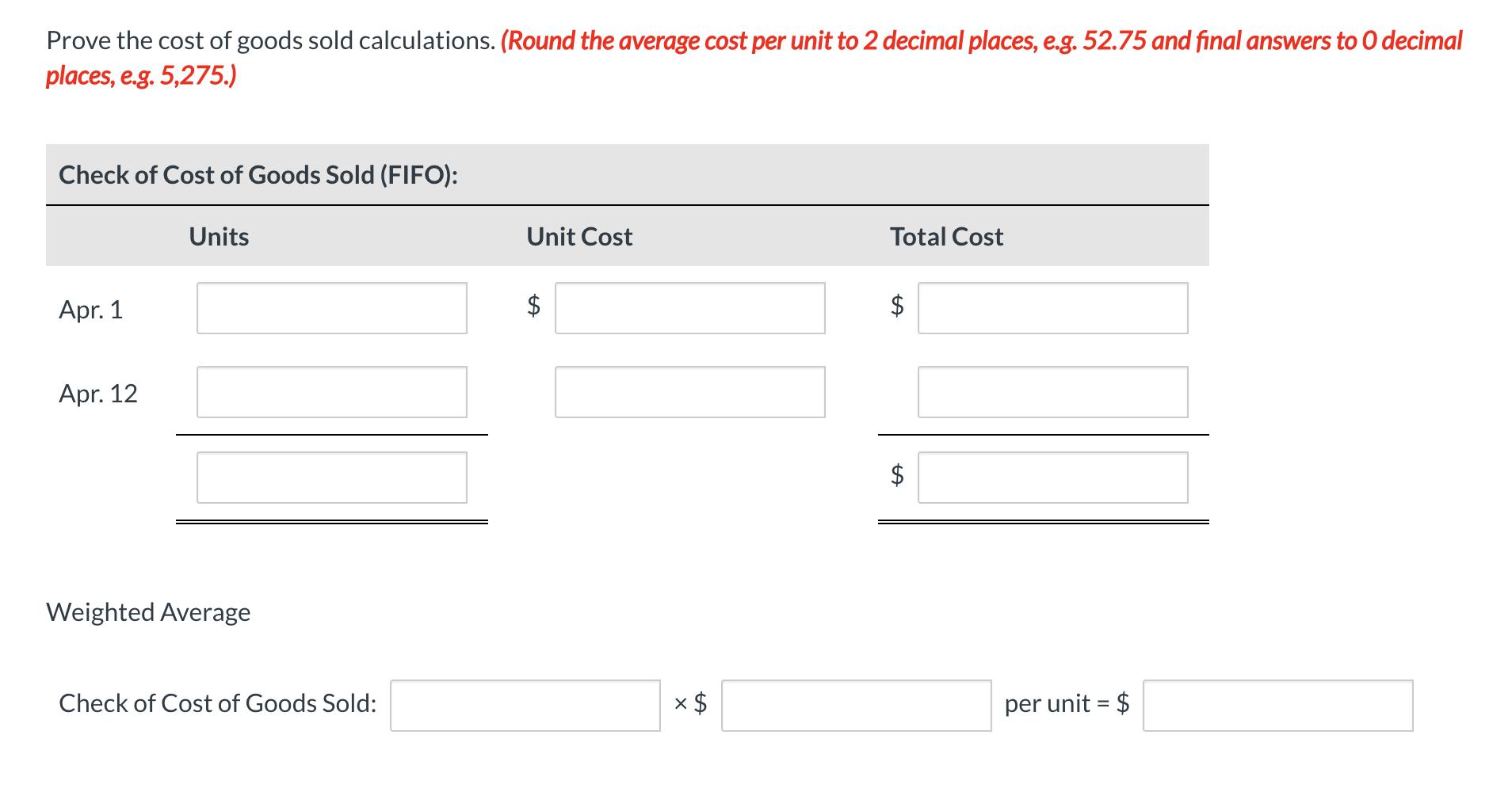

Unit Total Units Cost Cost April 1 Inventory 31 $9 $279 12 Purchases 48 12 576 16 Purchases 15 10 150 Total 94 1,005 Calculate the ending inventory and cost of goods sold at April 30 using the FIFO and weighted average cost formulas. (Round the weighted average cost per unit to 2 decimal places, eg. 52.75 and final answers to O decimal places, eg. 5,275.) FIFO Weighted average Ending Inventory 2$ 2$ Cost of Goods Sold %24 %24 Unit Total Units Cost Cost April 1 Inventory 31 $9 $279 12 Purchases 48 12 576 16 Purchases 15 10 150 Total 94 1,005 Calculate the ending inventory and cost of goods sold at April 30 using the FIFO and weighted average cost formulas. (Round the weighted average cost per unit to 2 decimal places, eg. 52.75 and final answers to O decimal places, eg. 5,275.) FIFO Weighted average Ending Inventory 2$ 2$ Cost of Goods Sold %24 %24 Unit Total Units Cost Cost April 1 Inventory 31 $9 $279 12 Purchases 48 12 576 16 Purchases 15 10 150 Total 94 1,005 Calculate the ending inventory and cost of goods sold at April 30 using the FIFO and weighted average cost formulas. (Round the weighted average cost per unit to 2 decimal places, eg. 52.75 and final answers to O decimal places, eg. 5,275.) FIFO Weighted average Ending Inventory 2$ 2$ Cost of Goods Sold %24 %24

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

salution Ques I FI FO method peu FIFO method also sold first goods ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started