Answered step by step

Verified Expert Solution

Question

1 Approved Answer

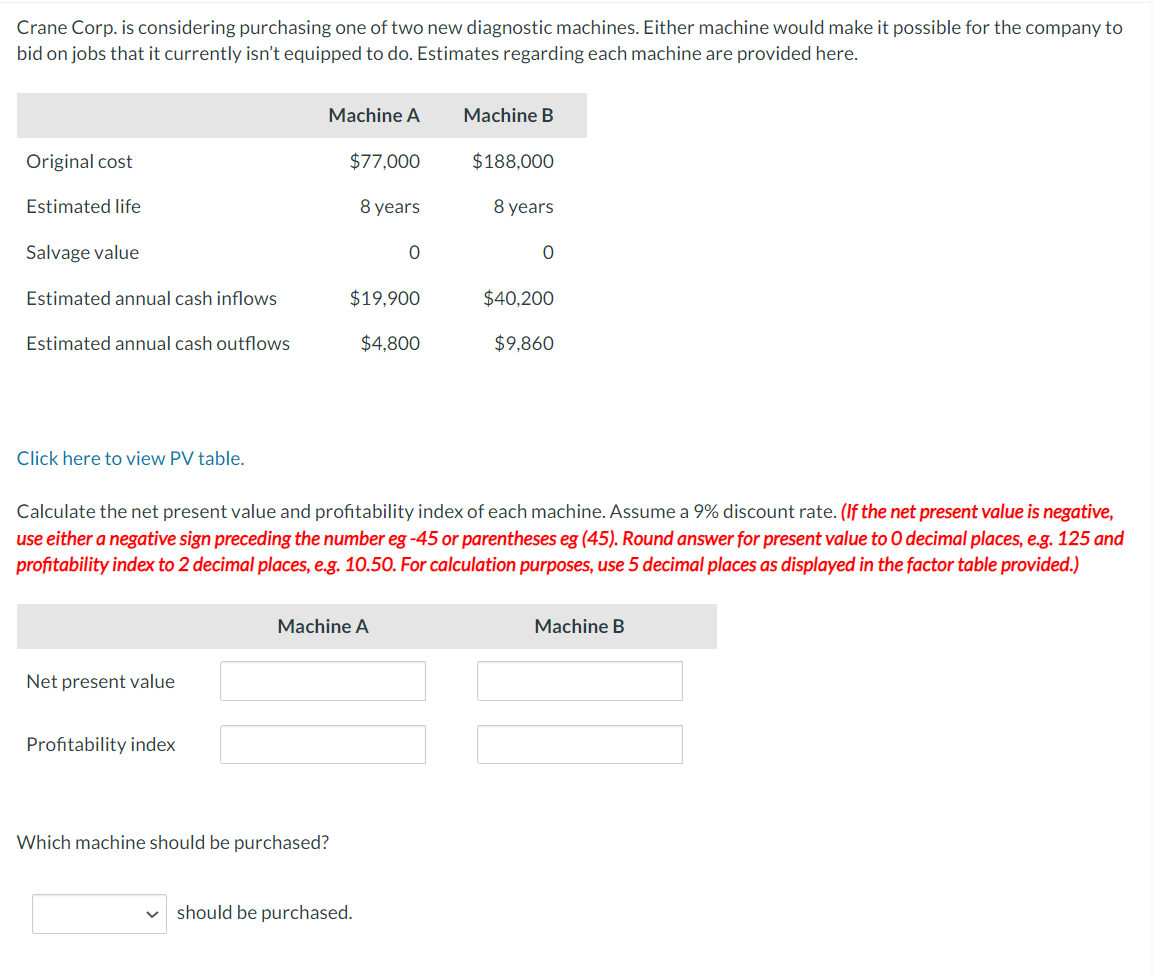

Crane Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs

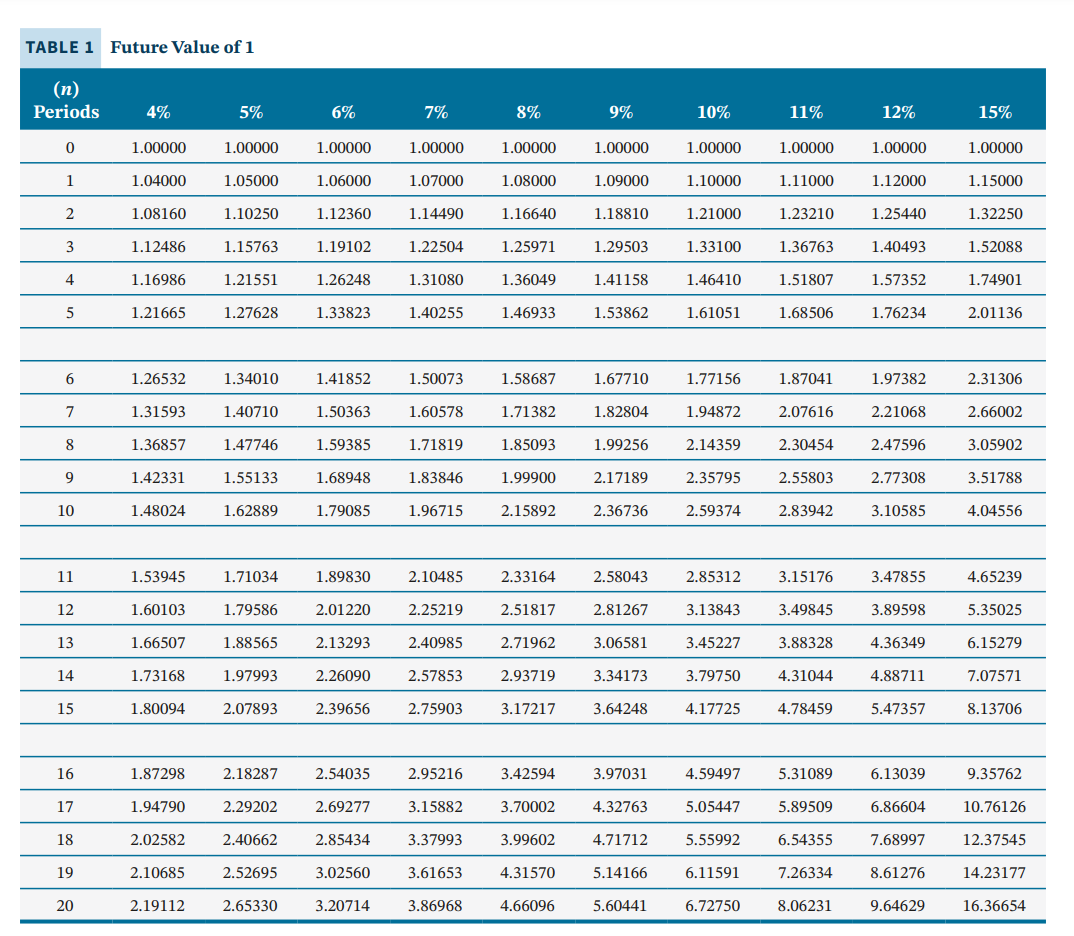

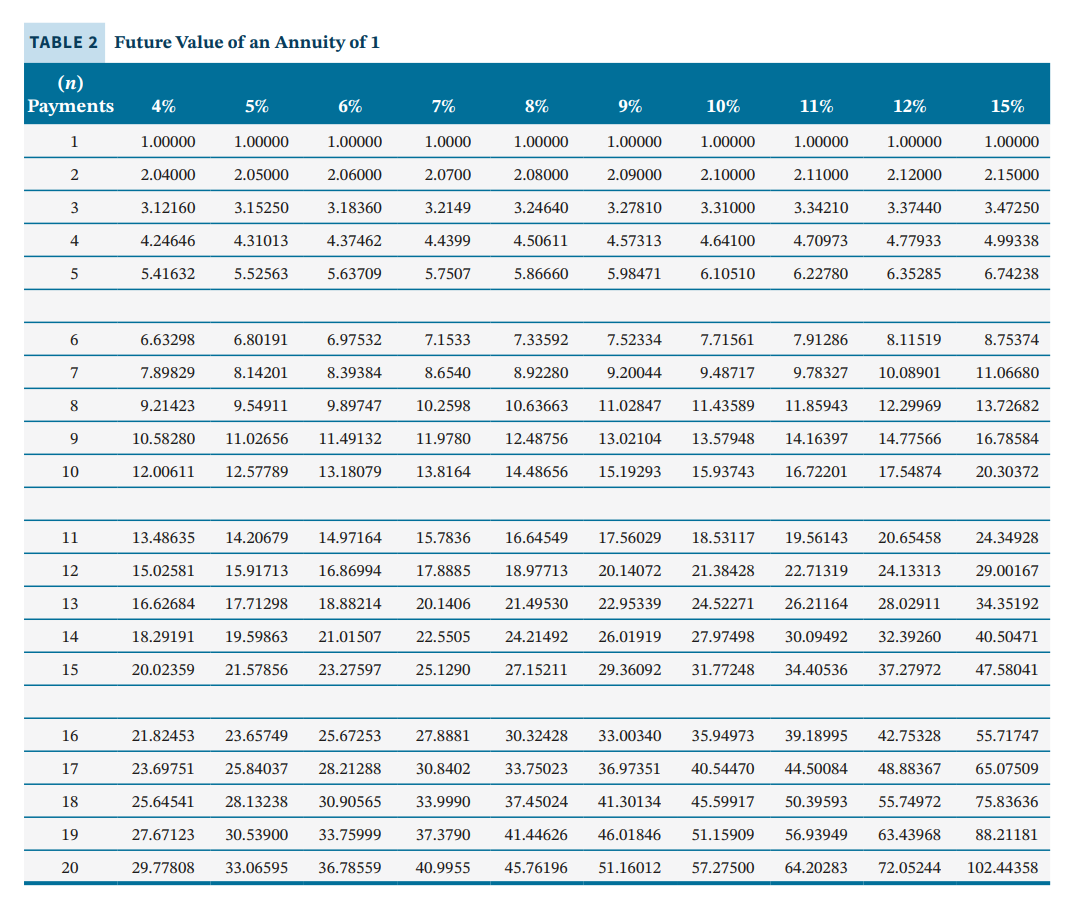

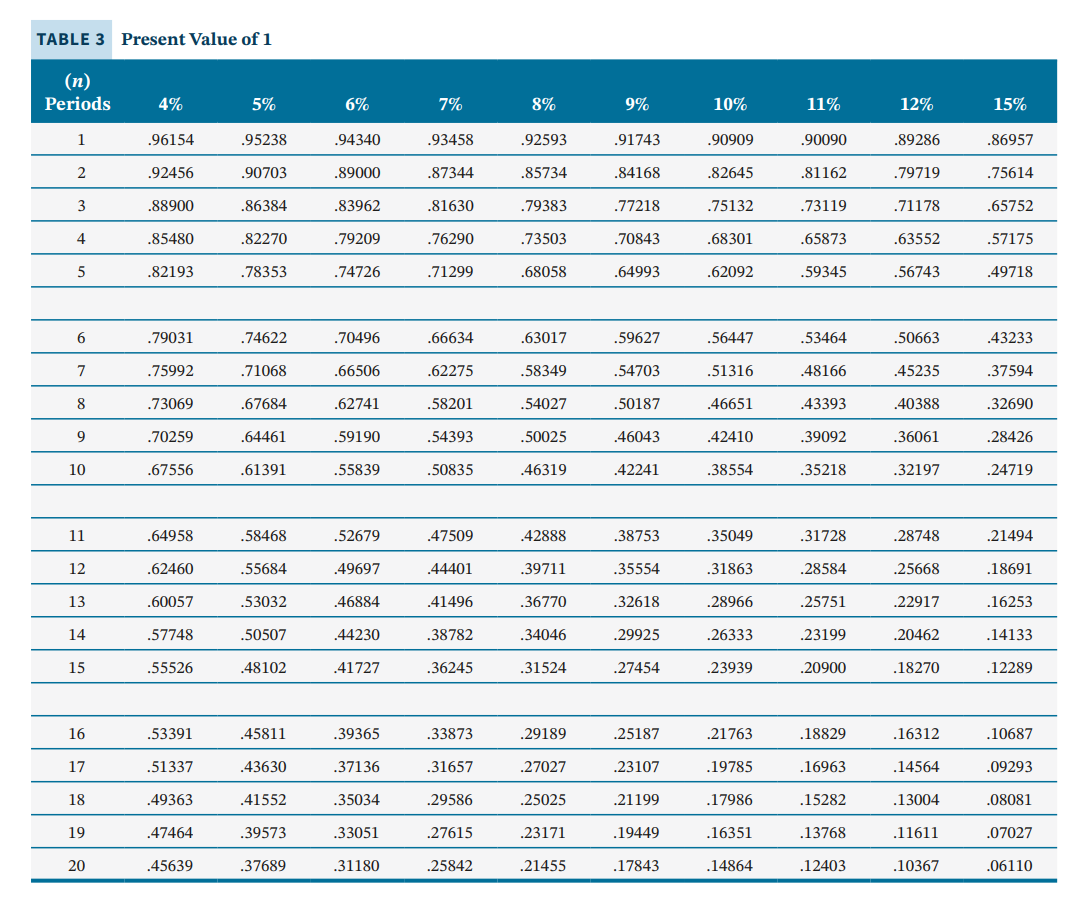

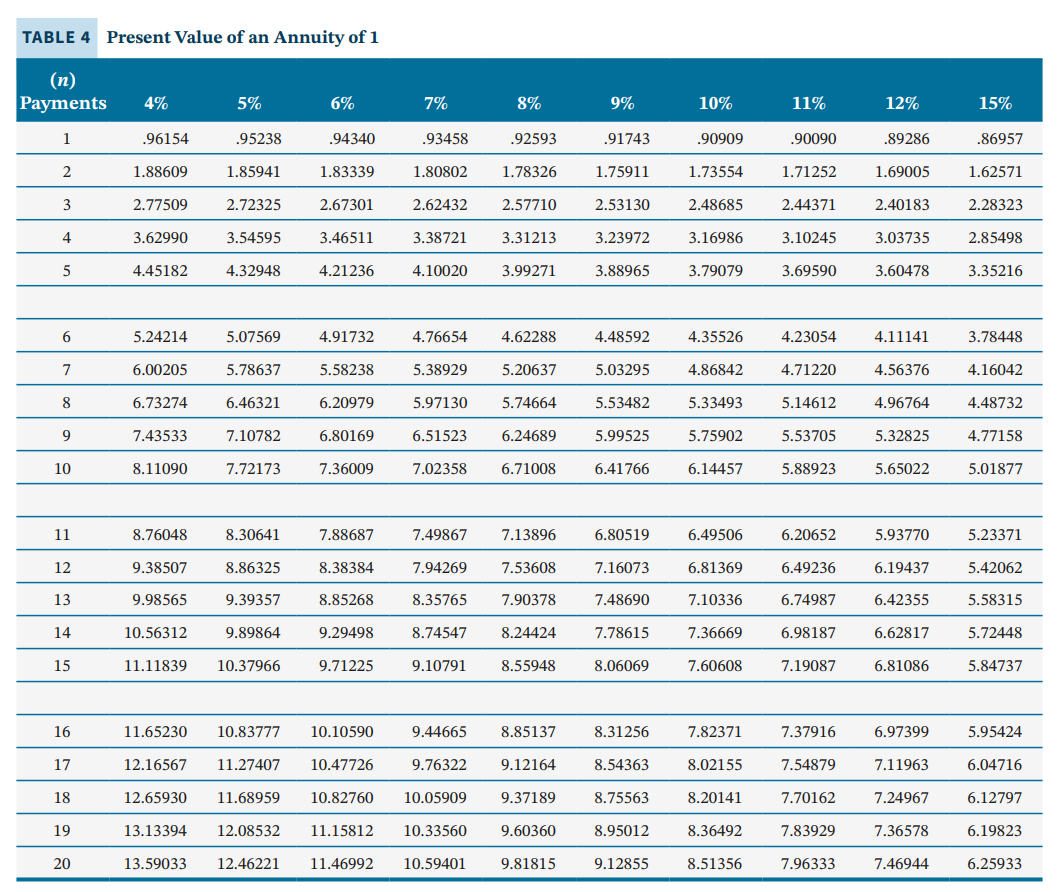

Crane Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here. Machine A Machine B Original cost $77,000 $188,000 Estimated life 8 years 8 years Salvage value 0 0 Estimated annual cash inflows $19,900 $40,200 Estimated annual cash outflows $4,800 $9,860 Click here to view PV table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to O decimal places, e.g. 125 and profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Net present value Profitability index Which machine should be purchased? should be purchased. Machine B TABLE 1 Future Value of 1 (n) Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% 0 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1 1.04000 1.05000 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.15000 2 1.08160 1.10250 1.12360 1.14490 1.16640 1.18810 1.21000 1.23210 1.25440 1.32250 3 1.12486 1.15763 1.19102 1.22504 1.25971 1.29503 1.33100 1.36763 1.40493 1.52088 4 1.16986 1.21551 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 1.74901 5 1.21665 1.27628 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 2.01136 6 1.26532 1.34010 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306 7 1.31593 1.40710 1.50363 1.60578 1.71382 1.82804 1.94872 2.07616 2.21068 2.66002 8 1.36857 1.47746 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596 3.05902 9 1.42331 1.55133 1.68948 1.83846 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788 10 1.48024 1.62889 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 4.04556 11 1.53945 1.71034 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 4.65239 12 1.60103 1.79586 2.01220 2.25219 2.51817 2.81267 3.13843 3.49845 3.89598 5.35025 13 1.66507 1.88565 2.13293 2.40985 2.71962 3.06581 3.45227 3.88328 4.36349 6.15279 14 1.73168 1.97993 2.26090 2.57853 2.93719 3.34173 3.79750 4.31044 4.88711 7.07571 15 1.80094 2.07893 2.39656 2.75903 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706 16 1.87298 2.18287 2.54035 2.95216 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762 17 1.94790 2.29202 2.69277 3.15882 3.70002 4.32763 5.05447 5.89509 6.86604 10.76126 18 2.02582 2.40662 2.85434 3.37993 3.99602 4.71712 5.55992 6.54355 7.68997 12.37545 19 2.10685 2.52695 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 14.23177 20 2.19112 2.65330 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 16.36654 TABLE 2 Future Value of an Annuity of 1 (n) Payments 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% 1 1.00000 1.00000 1.00000 1.0000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 2 2.04000 2.05000 2.06000 2.0700 2.08000 2.09000 2.10000 2.11000 2.12000 2.15000 3 3.12160 3.15250 3.18360 3.2149 3.24640 3.27810 3.31000 3.34210 3.37440 3.47250 4 4.24646 4.31013 4.37462 4.4399 4.50611 4.57313 4.64100 4.70973 4.77933 4.99338 5 5.41632 5.52563 5.63709 5.7507 5.86660 5.98471 6.10510 6.22780 6.35285 6.74238 6 6.63298 6.80191 6.97532 7.1533 7.33592 7.52334 7.71561 7.91286 8.11519 8.75374 7 7.89829 8.14201 8.39384 8.6540 8.92280 9.20044 9.48717 9.78327 10.08901 11.06680 8 9.21423 9.54911 9.89747 10.2598 10.63663 11.02847 11.43589 11.85943 12.29969 13.72682 9 10.58280 11.02656 11.49132 11.9780 12.48756 13.02104 13.57948 14.16397 14.77566 16.78584 10 12.00611 12.57789 13.18079 13.8164 14.48656 15.19293 15.93743 16.72201 17.54874 20.30372 11 13.48635 14.20679 14.97164 15.7836 16.64549 17.56029 18.53117 12 15.02581 15.91713 13 16.62684 17.71298 16.86994 18.88214 20.1406 17.8885 18.97713 20.14072 21.49530 22.95339 21.38428 24.52271 19.56143 20.65458 22.71319 24.13313 24.34928 29.00167 26.21164 28.02911 34.35192 14 18.29191 19.59863 21.01507 22.5505 24.21492 15 20.02359 21.57856 23.27597 25.1290 27.15211 26.01919 29.36092 27.97498 30.09492 32.39260 40.50471 31.77248 34.40536 37.27972 47.58041 16 21.82453 23.65749 25.67253 27.8881 17 23.69751 25.84037 28.21288 30.8402 18 25.64541 28.13238 30.90565 33.9990 37.45024 30.32428 33.00340 33.75023 36.97351 41.30134 35.94973 39.18995 42.75328 40.54470 44.50084 48.88367 45.59917 50.39593 55.71747 65.07509 55.74972 75.83636 19 27.67123 30.53900 33.75999 37.3790 41.44626 46.01846 51.15909 56.93949 63.43968 88.21181 20 29.77808 33.06595 36.78559 40.9955 45.76196 51.16012 57.27500 64.20283 72.05244 102.44358 TABLE 3 Present Value of 1 (n) Periods 4% 5% 99 6% 7% 8% 9% 10% 11% 12% 15% 1 .96154 .95238 .94340 .93458 .92593 .91743 .90909 .90090 .89286 .86957 2 .92456 .90703 .89000 .87344 .85734 .84168 .82645 .81162 .79719 .75614 3 .88900 .86384 .83962 .81630 .79383 .77218 .75132 .73119 .71178 .65752 4 .85480 .82270 .79209 .76290 .73503 .70843 .68301 .65873 .63552 .57175 5 .82193 .78353 .74726 .71299 .68058 .64993 .62092 .59345 .56743 .49718 6 .79031 .74622 .70496 .66634 .63017 .59627 .56447 .53464 .50663 .43233 7 .75992 .71068 .66506 .62275 .58349 .54703 .51316 .48166 .45235 .37594 8 .73069 .67684 .62741 .58201 .54027 .50187 .46651 .43393 .40388 .32690 9 .70259 .64461 .59190 .54393 .50025 .46043 .42410 .39092 .36061 .28426 10 .67556 .61391 .55839 .50835 .46319 .42241 .38554 .35218 .32197 .24719 11 .64958 .58468 .52679 .47509 .42888 .38753 .35049 .31728 .28748 .21494 12 .62460 .55684 .49697 .44401 .39711 .35554 .31863 .28584 .25668 .18691 13 .60057 .53032 .46884 .41496 .36770 .32618 .28966 .25751 .22917 .16253 14 .57748 .50507 .44230 .38782 .34046 .29925 .26333 .23199 .20462 .14133 15 .55526 .48102 .41727 .36245 .31524 .27454 .23939 .20900 .18270 .12289 16 .53391 .45811 .39365 .33873 .29189 .25187 .21763 .18829 .16312 .10687 17 .51337 .43630 .37136 .31657 .27027 .23107 .19785 .16963 .14564 .09293 18 .49363 .41552 .35034 .29586 .25025 .21199 .17986 .15282 .13004 .08081 19 .47464 .39573 .33051 .27615 .23171 .19449 .16351 .13768 .11611 .07027 20 .45639 .37689 .31180 .25842 .21455 .17843 .14864 .12403 .10367 .06110 TABLE 4 Present Value of an Annuity of 1 (n) Payments 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% 1 .96154 .95238 .94340 .93458 .92593 .91743 .90909 .90090 .89286 .86957 2 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 3 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 4 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 5 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 6 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 7 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 8 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 9 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 10 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 11 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 12 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 13 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 14 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 15 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 16 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 17 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 18 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 19 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 20 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started