Answered step by step

Verified Expert Solution

Question

1 Approved Answer

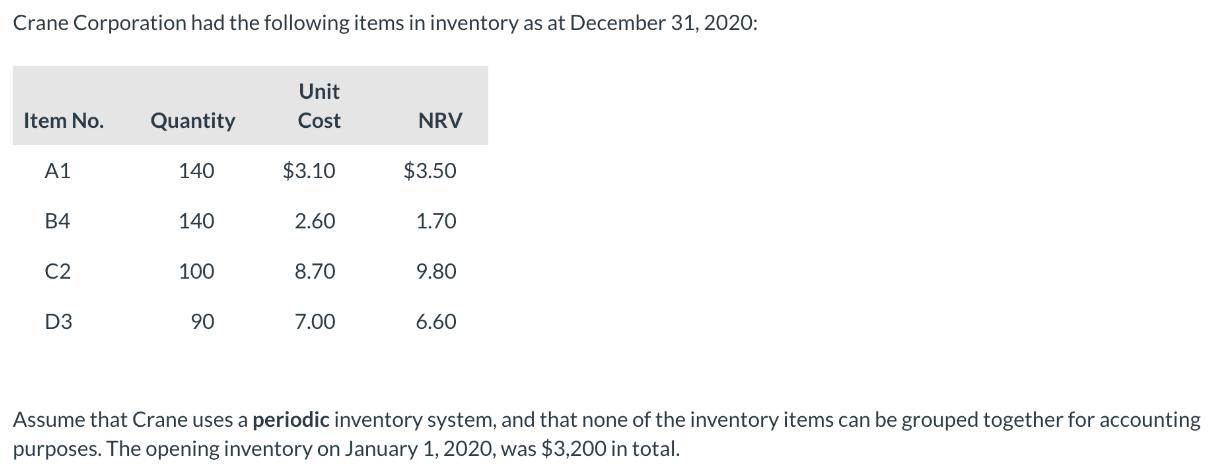

Crane Corporation had the following items in inventory as at December 31, 2020: Item No. A1 B4 C2 D3 Quantity 140 140 100 90

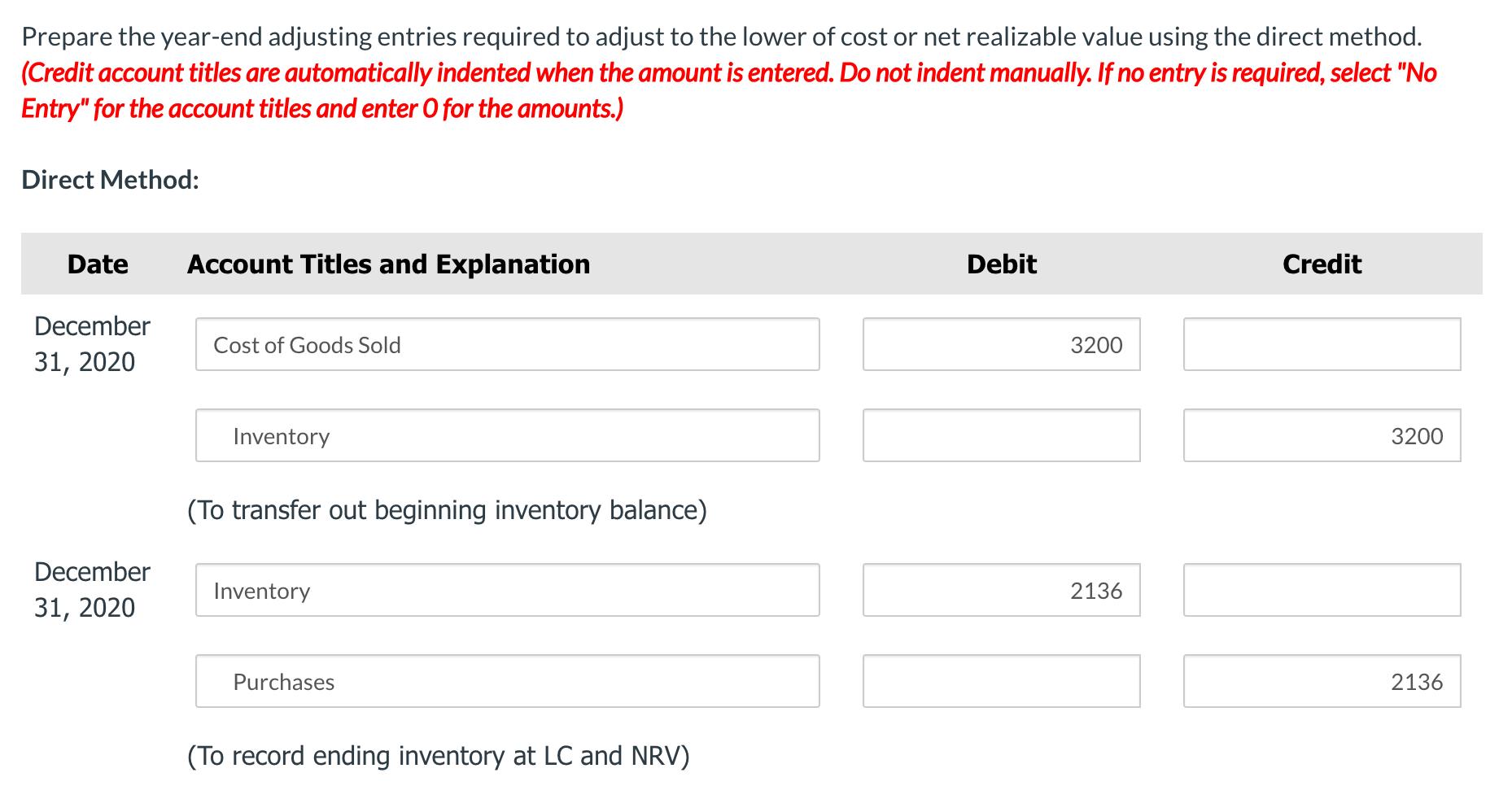

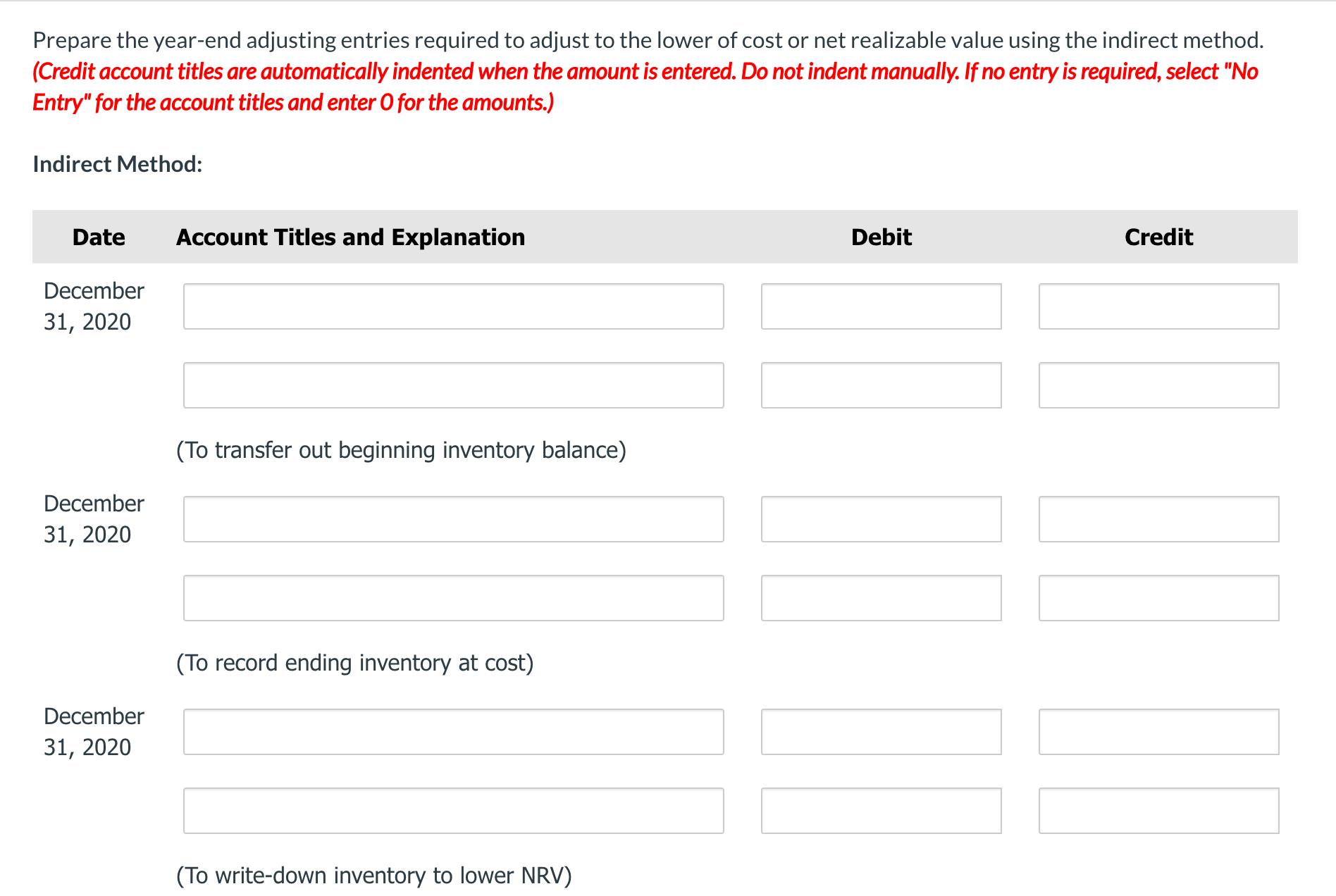

Crane Corporation had the following items in inventory as at December 31, 2020: Item No. A1 B4 C2 D3 Quantity 140 140 100 90 Unit Cost $3.10 2.60 8.70 7.00 NRV $3.50 1.70 9.80 6.60 Assume that Crane uses a periodic inventory system, and that none of the inventory items can be grouped together for accounting purposes. The opening inventory on January 1, 2020, was $3,200 in total. Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Direct Method: Date December 31, 2020 December 31, 2020 Account Titles and Explanation Cost of Goods Sold Inventory (To transfer out beginning inventory balance) Inventory Purchases (To record ending inventory at LC and NRV) Debit 3200 2136 Credit 3200 2136 Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the indirect method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Indirect Method: Date December 31, 2020 December 31, 2020 December 31, 2020 Account Titles and Explanation (To transfer out beginning inventory balance) (To record ending inventory at cost) (To write-down inventory to lower NRV) Debit Credit

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution Calculation of ending inventory based on low...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started