Crane Department Store is located in midtown Metropolis. During the past several years, net income has been declining because suburban shopping centers have been attracting business away from city areas. At the end of the companys fiscal year on November 30, 2022, these accounts appeared in its adjusted trial balance.

| Accounts Payable | | $ 73,200 |

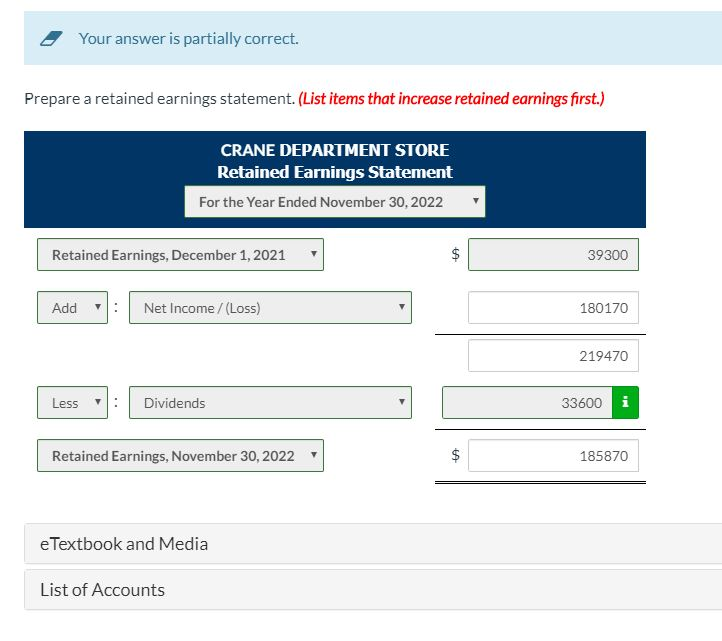

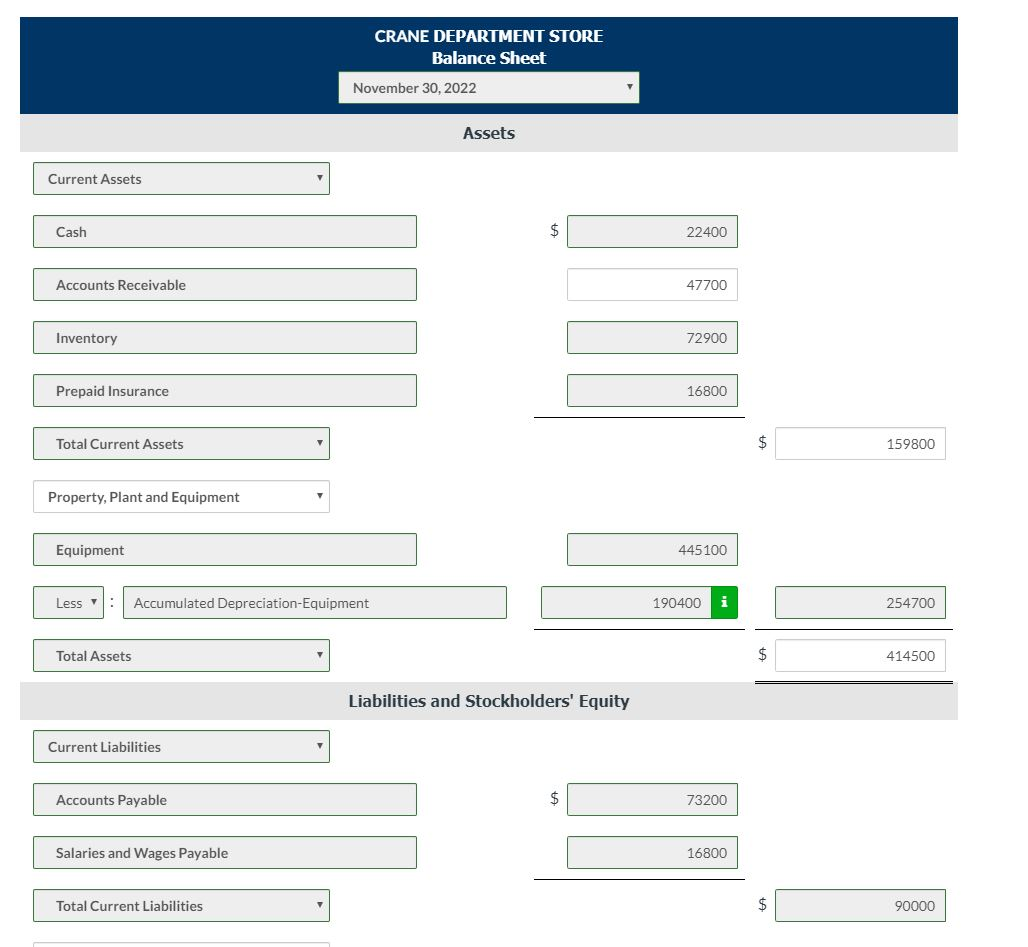

| Accounts Receivable | | 47,700 |

| Accumulated DepreciationEquipment | | 190,400 |

| Cash | | 22,400 |

| Common Stock | | 98,000 |

| Cost of Goods Sold | | 1,707,750 |

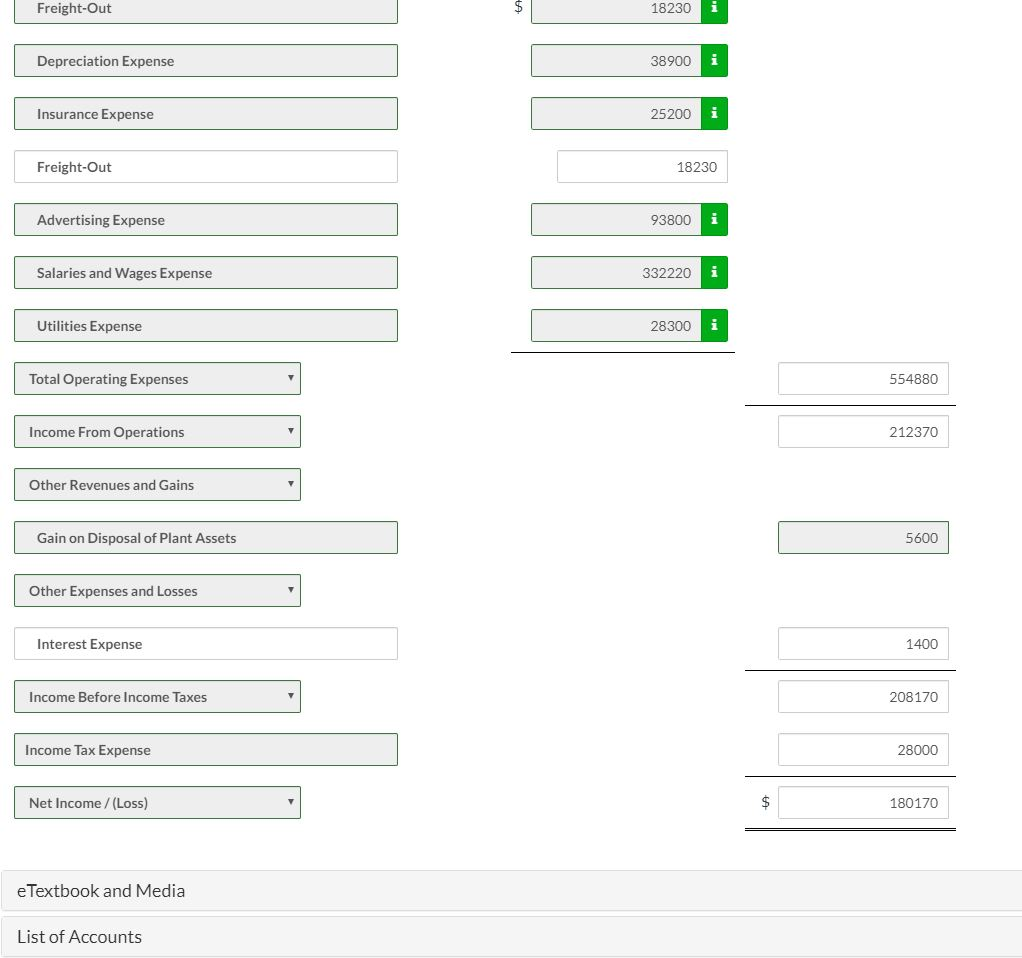

| Freight-Out | | 18,230 |

| Equipment | | 445,100 |

| Depreciation Expense | | 38,900 |

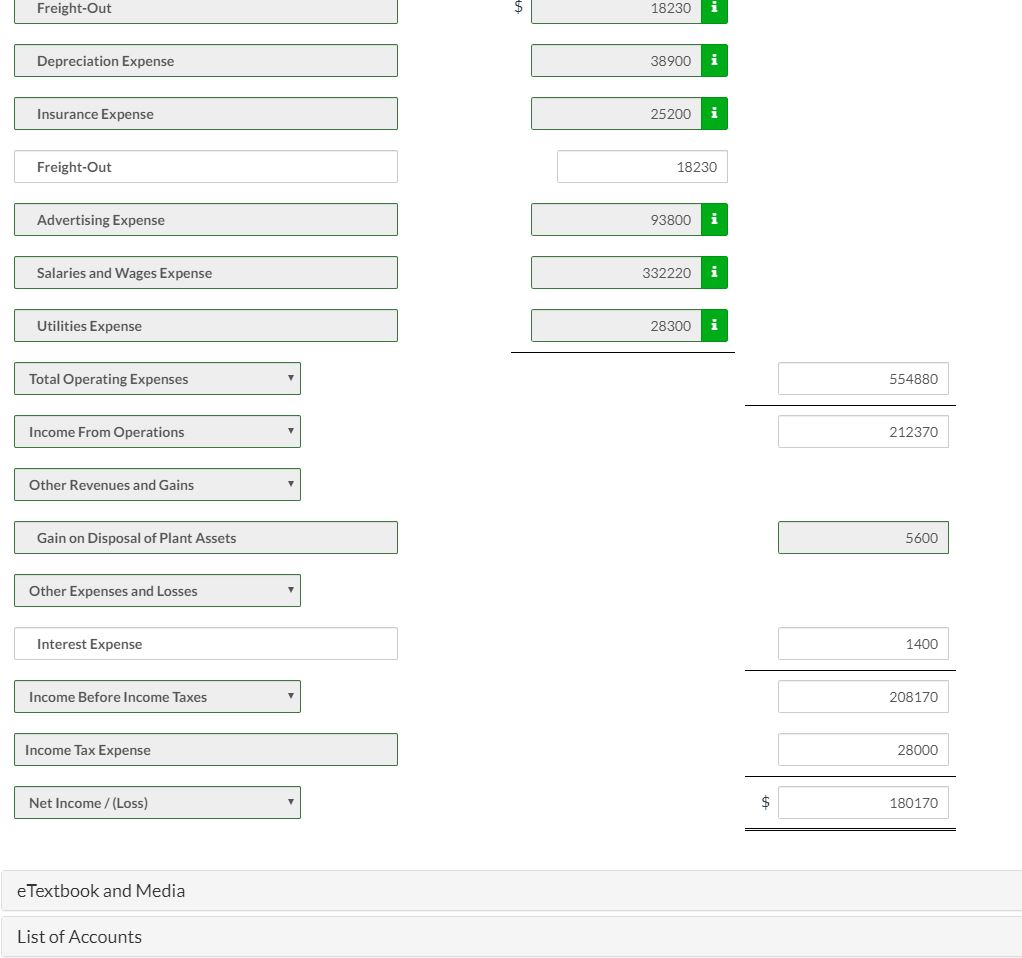

| Dividends | | 33,600 |

| Gain on Disposal of Plant Assets | | 5,600 |

| Income Tax Expense | | 28,000 |

| Insurance Expense | | 25,200 |

| Interest Expense | | 14,000 |

| Inventory | | 72,900 |

| Notes Payable | | 121,800 |

| Prepaid Insurance | | 16,800 |

| Advertising Expense | | 93,800 |

| Rent Expense | | 95,200 |

| Retained Earnings | | 39,300 |

| Salaries and Wages Expense | | 332,220 |

| Sales Revenue | | 2,531,000 |

| Salaries and Wages Payable | | 16,800 |

| Sales Returns and Allowances | | 56,000 |

| Utilities Expense | | 28,300 |

Additional data: Notes payable are due in 2026.

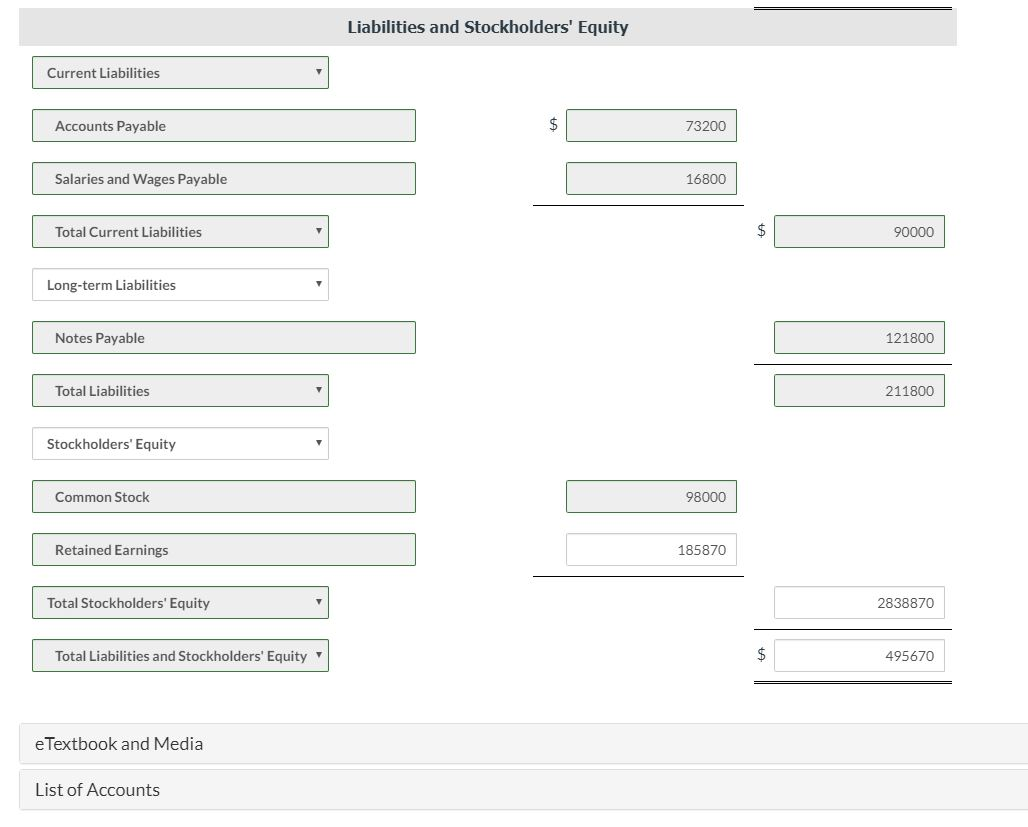

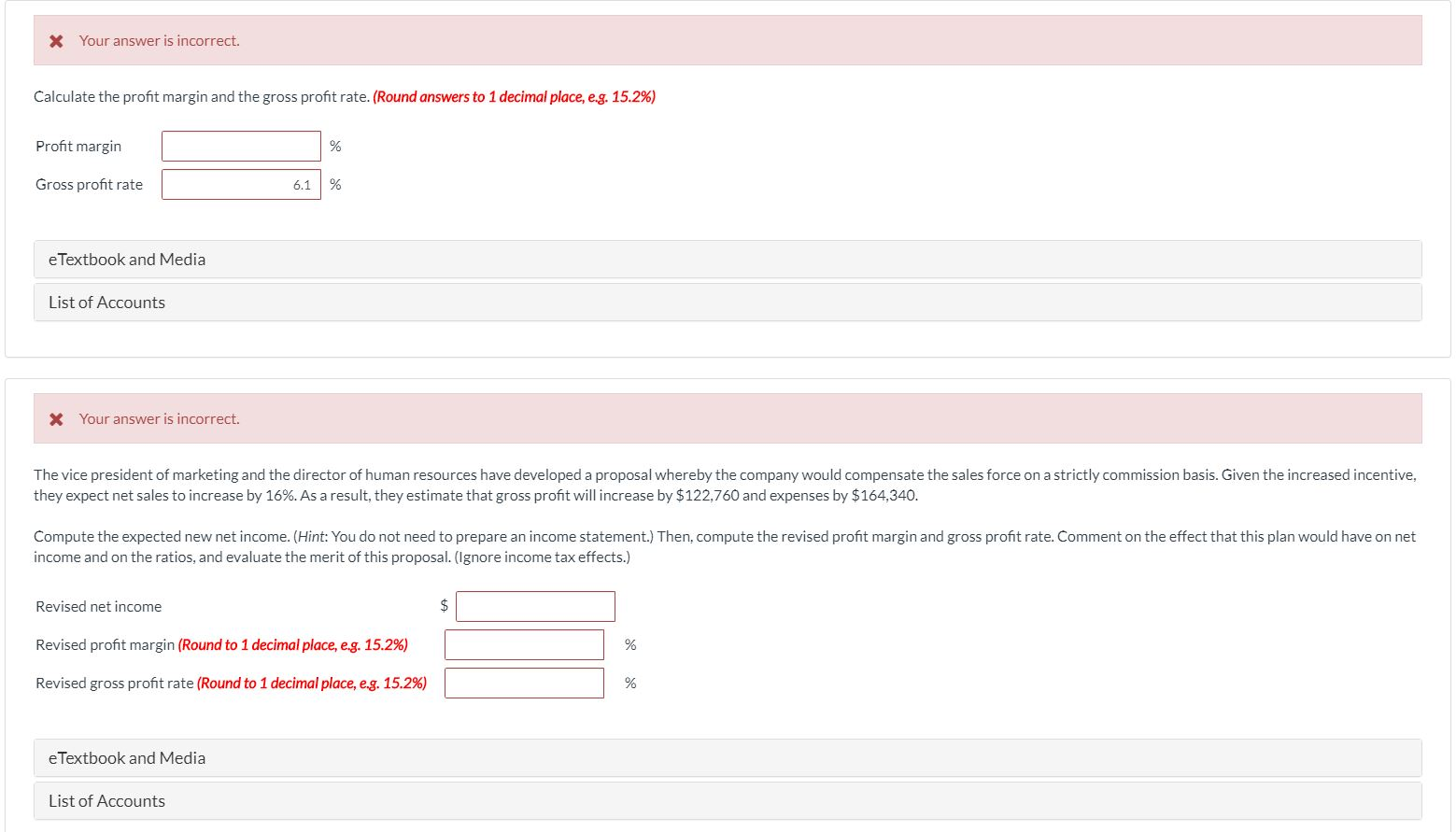

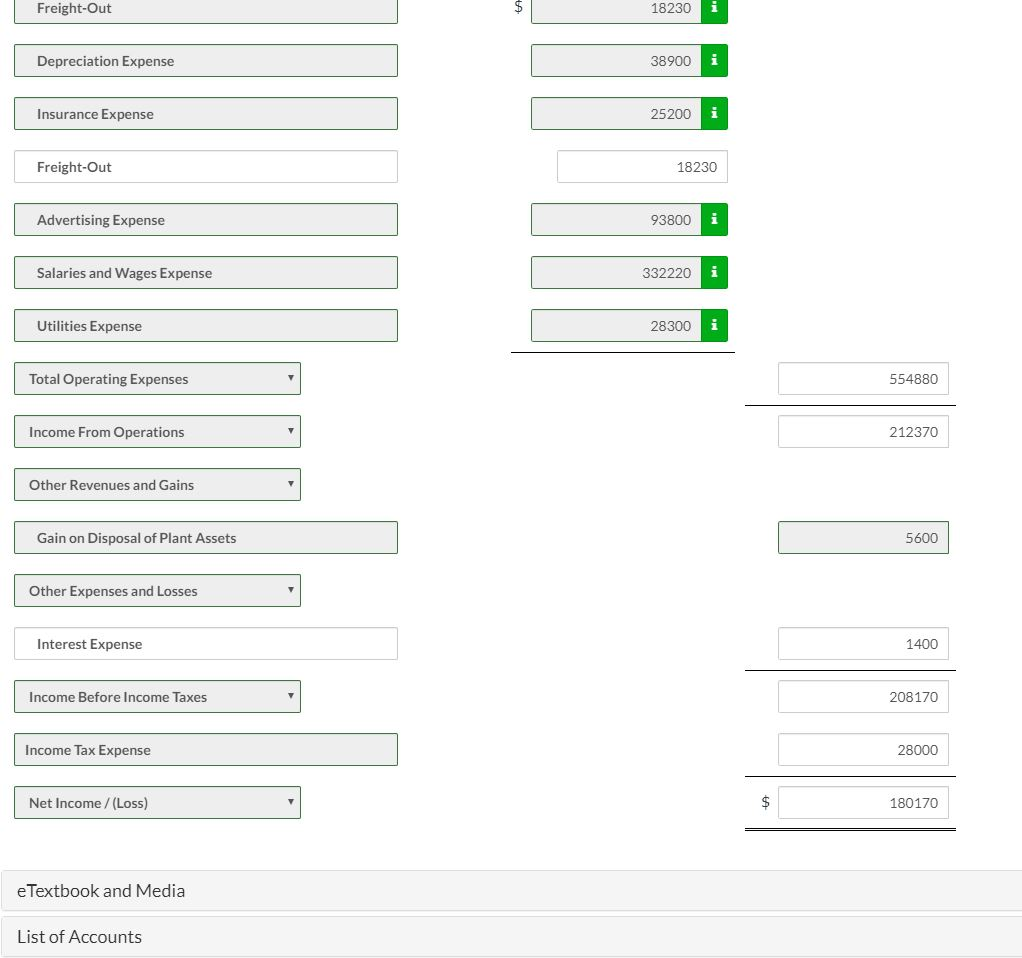

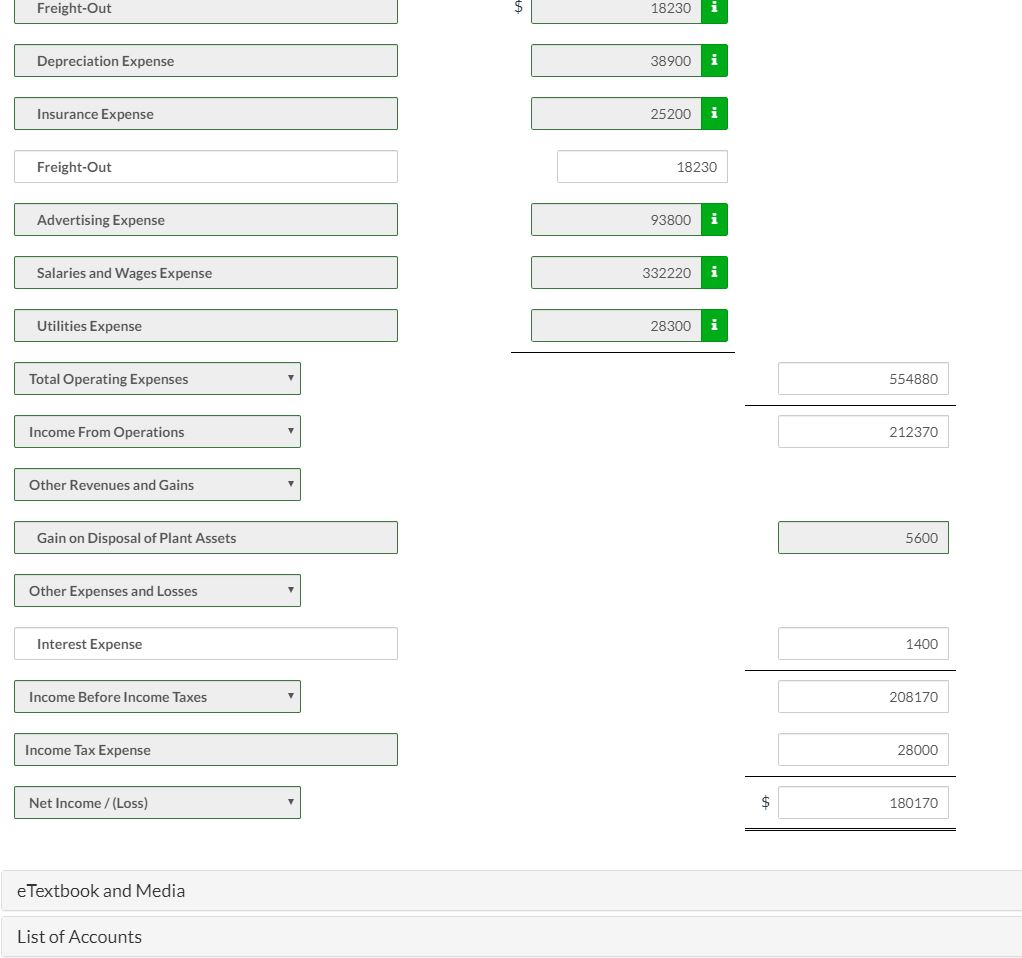

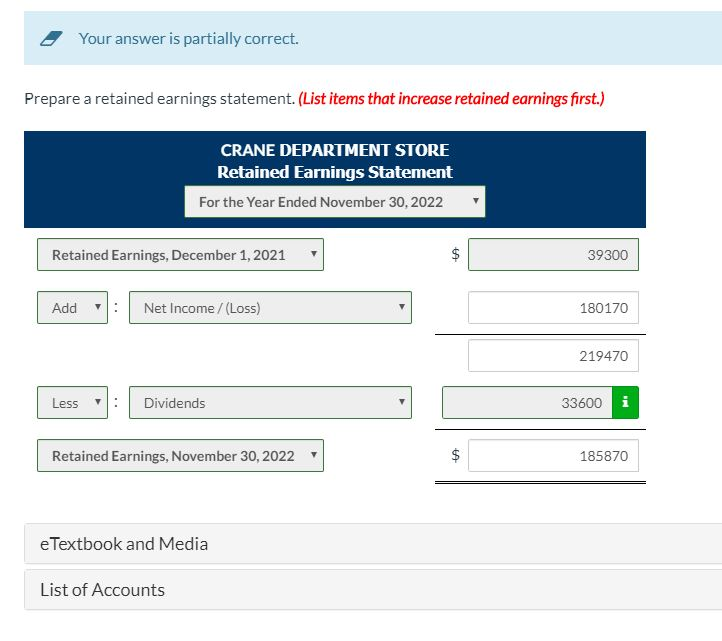

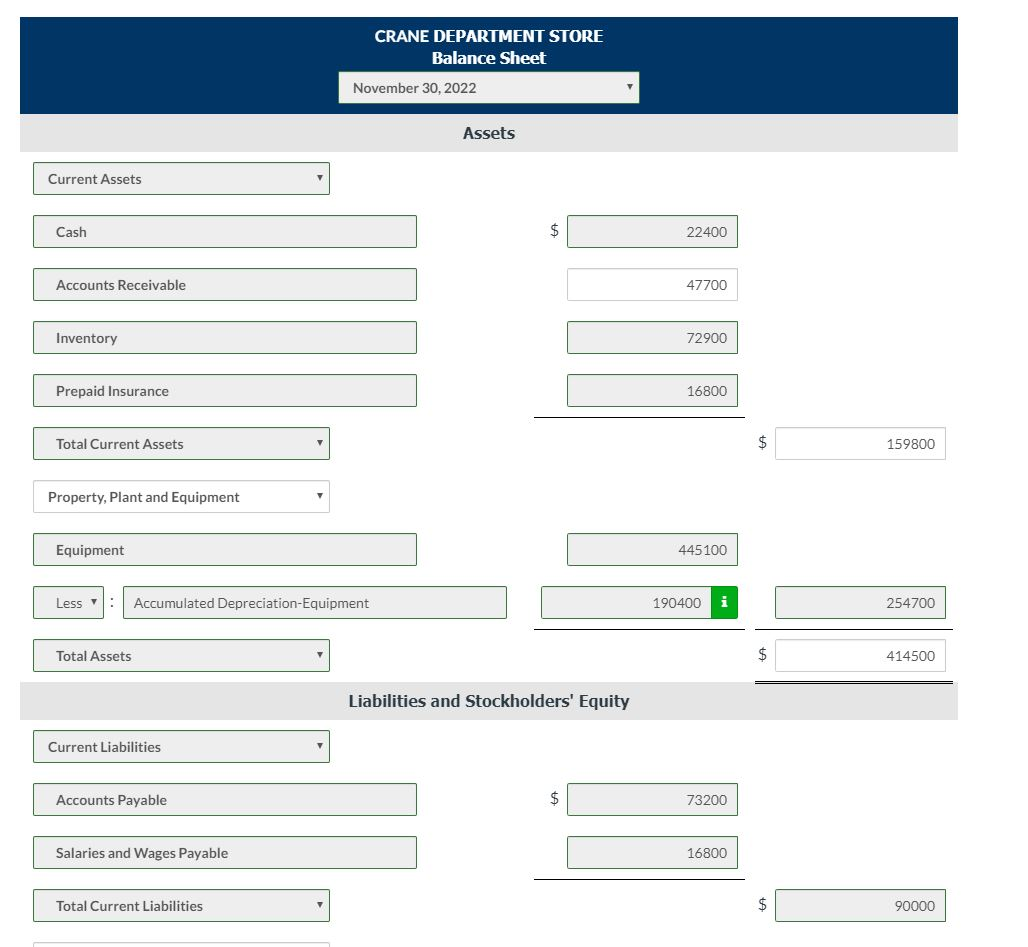

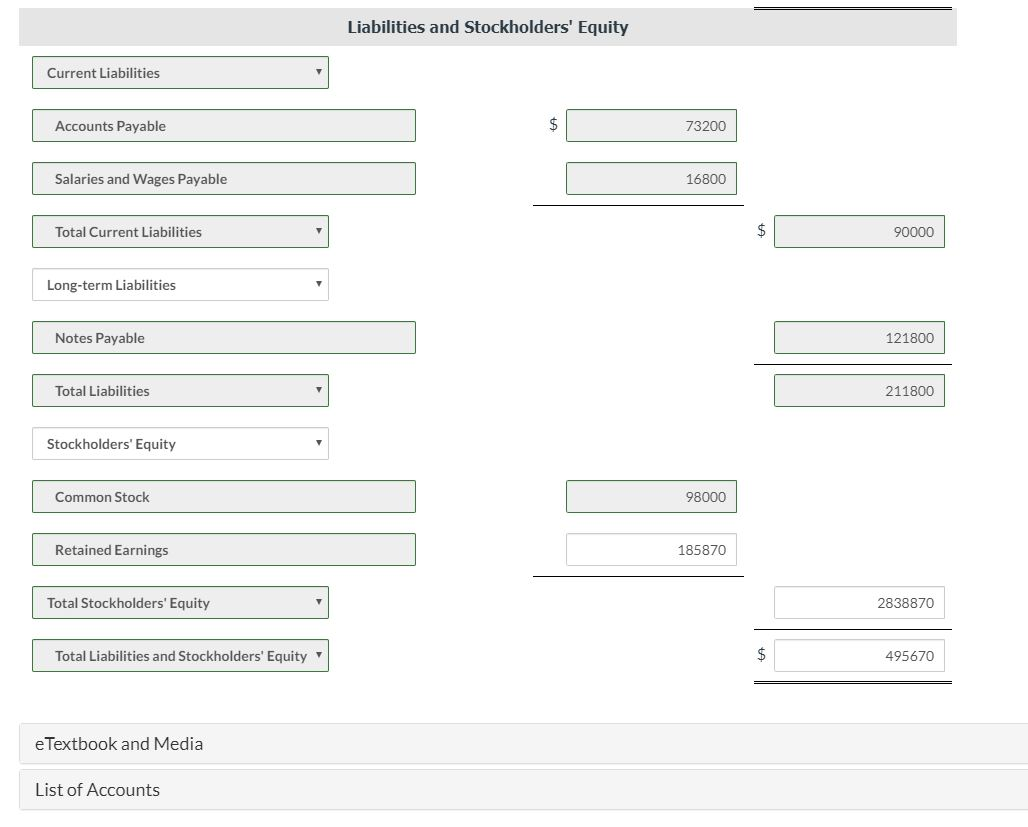

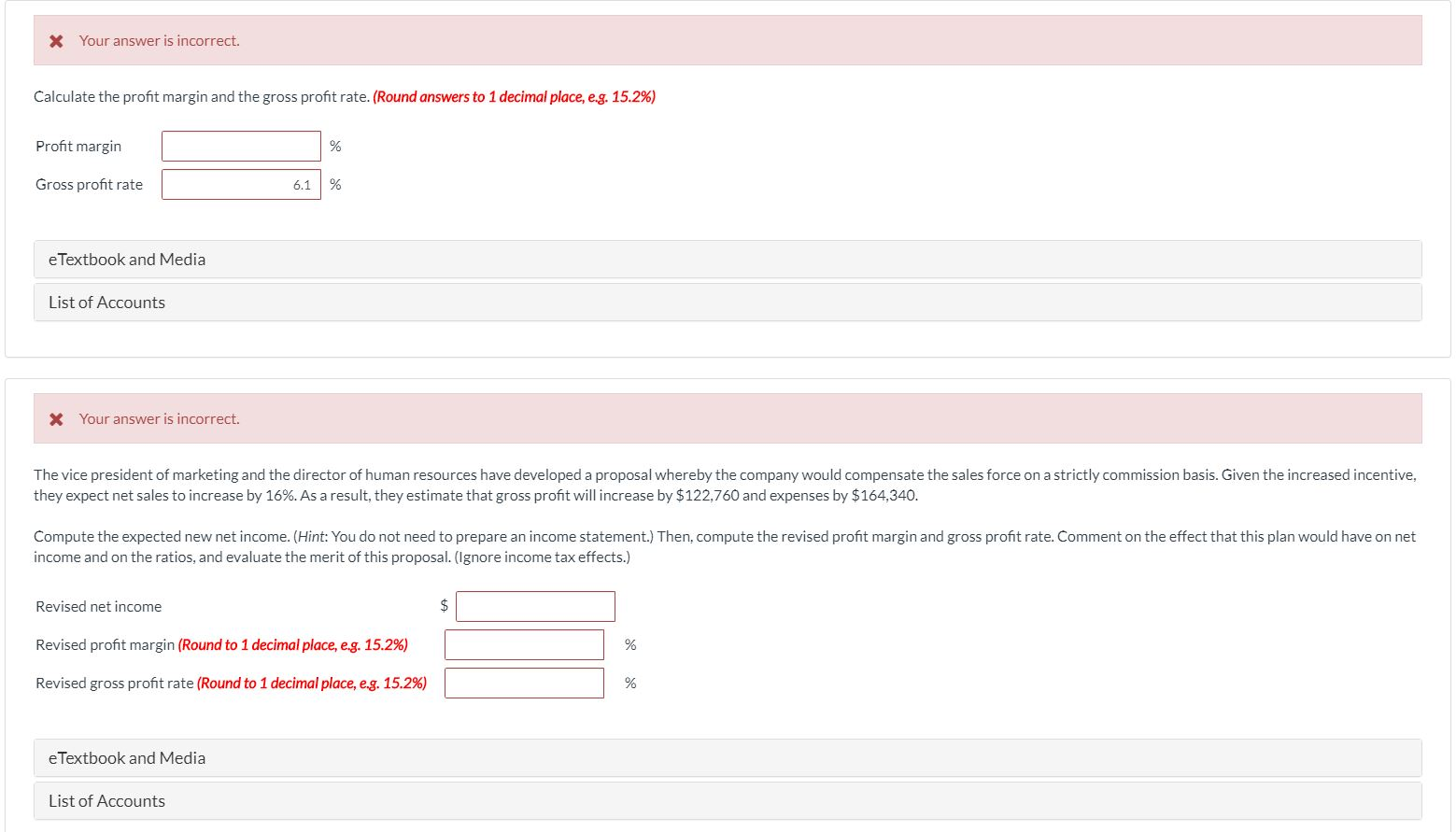

Freight-Out 18230 Depreciation Expense 38900 i Insurance Expense 25200 Freight-Out 18230 Advertising Expense 93800 i Salaries and Wages Expense 332220 Utilities Expense 28300 i Total Operating Expenses 554880 Income From Operations 212370 Other Revenues and Gains Gain on Disposal of Plant Assets 5600 Other Expenses and Losses Interest Expense 1400 Income Before Income Taxes 208170 Income Tax Expense 28000 Net Income /(Loss) 180170 e Textbook and Media List of Accounts Freight-Out 18230 Depreciation Expense 38900 i Insurance Expense 25200 Freight-Out 18230 Advertising Expense 93800 i Salaries and Wages Expense 332220 Utilities Expense 28300 i Total Operating Expenses 554880 Income From Operations 212370 Other Revenues and Gains Gain on Disposal of Plant Assets 5600 Other Expenses and Losses Interest Expense 1400 Income Before Income Taxes 208170 Income Tax Expense 28000 Net Income /(Loss) 180170 e Textbook and Media List of Accounts Your answer is partially correct. Prepare a retained earnings statement. (List items that increase retained earnings first.) CRANE DEPARTMENT STORE Retained Earnings Statement For the Year Ended November 30, 2022 Retained Earnings, December 1, 2021 39300 Retained Earnings, December 1, 2021 Adv ): Net Income (105) C C Add : Net Income /(Loss) 180170 219470 Less Less : Dividends Dividends 33600 i Retained Earnings, November 30, 2022 185870 e Textbook and Media List of Accounts CRANE DEPARTMENT STORE Balance Sheet November 30, 2022 Assets Current Assets Cash 22400 Accounts Receivable 47700 Inventory Inventory 72900 Prepaid Insurance 16800 Total Current Assets Total Current Assets 159800 Property, plant and Equipment Equipment 445100 Less : Accumulated Depreciation-Equipment 190400 i 254700 Total Assets 414500 Liabilities and Stockholders' Equity Current Liabilities Current Liabilities Accounts Payable 73200 Salaries and Wages Payable 16800 Total Current Liabilities 90000 Liabilities and Stockholders' Equity Current Liabilities Current Liabilities Accounts Payable 73200 Salaries and Wages Payable 16800 Total Current Liabilities 90000 Long-term Liabilities Notes Payable 121800 Total Liabilities 211800 Stockholders' Equity Common Stock 98000 Common stock Retained Earnings Retained Earnings 185870 Total Stockholders' Equity 2838870 Total Liabilities and Stockholders' Equity 495670 e Textbook and Media List of Accounts * Your answer is incorrect. Calculate the profit margin and the gross profit rate. (Round answers to 1 decimal place, e.g. 15.2%) Profit margin Gross profit rate e Textbook and Media List of Accounts x Your answer is incorrect. The vice president of marketing and the director of human resources have developed a proposal whereby the company would compensate the sales force on a strictly commission basis. Given the increased incentive, they expect net sales to increase by 16%. As a result, they estimate that gross profit will increase by $122,760 and expenses by $164,340. Compute the expected new net income. (Hint: You do not need to prepare an income statement.) Then, compute the revised profit margin and gross profit rate. Comment on the effect that this plan would have on net income and on the ratios, and evaluate the merit of this proposal. (Ignore income tax effects.) Revised net income Revised profit margin (Round to 1 decimal place, e.g. 15.2%) Revised gross profit rate (Round to 1 decimal place, e.g. 15.2%) e Textbook and Media List of Accounts