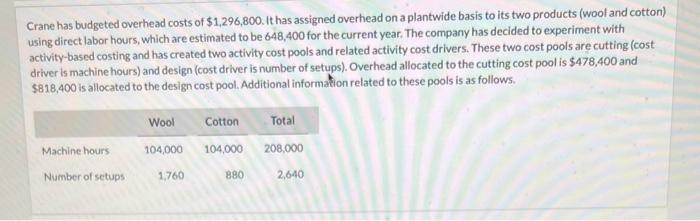

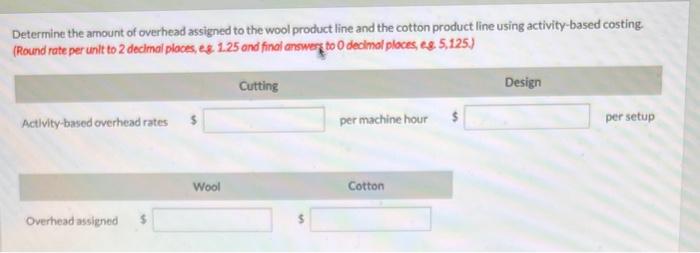

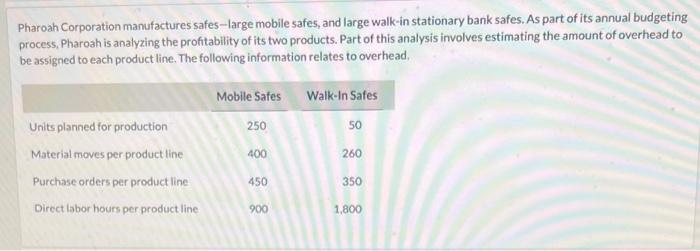

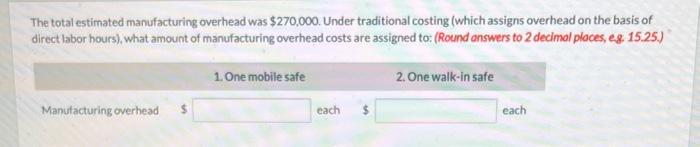

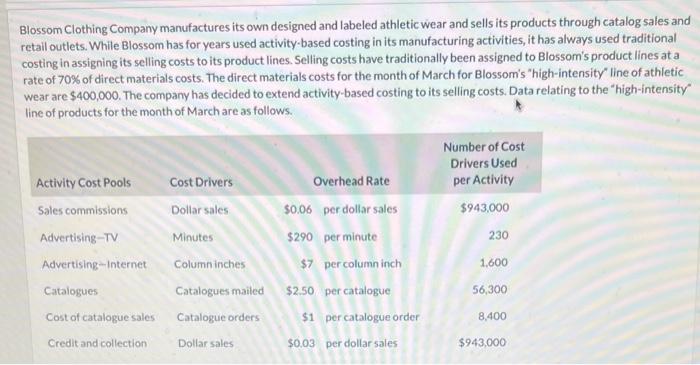

Crane has budgeted overhead costs of $1,296,800. It has assigned overhead on a plantwide basis to its two products (wool and cotton) using direct labor hours, which are estimated to be 648,400 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (cost driver is machine hours) and design (cost driver is number of setups). Overhead allocated to the cutting cost pool is $478,400 and $818,400 is allocated to the design cost pool. Additional information related to these pools is as follows. Determine the amount of overhead assigned to the wool product line and the cotton product line using activity-based costing. (Round rate per unit to 2 declmal places, es. 1.25 and final arswerg to 0 decimol ploces, e. . 5, 125) Pharoah Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Pharoah is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The following information relates to overhead, The total estimated manufacturing overhead was $270,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, eg. 15.25.) Blossom Clothing Company manufactures its own designed and labeled athletic wear and sells its products through catalog sales and retail outlets. While Blossom has for years used activity-based costing in its manufacturing activities, it has always used traditional costing in assigning its selling costs to its product lines. Selling costs have traditionally been assigned to Blossom's product lines at a rate of 70% of direct materials costs. The direct materials costs for the month of March for Blossom's "high-intensity" line of athletic wear are $400,000. The company has decided to extend activity-based costing to its selling costs. Data relating to the "high-intensity" line of products for the month of March are as follows. Compute the selling costs to be assigned to the "high-intensity" line of athletic wear for the month of March 1. using the traditional product costing system (direct materials cost is the cost driver). Selling costs to be assigned 2. using activity-based costing. Selling costs to be assigned