Question

Cranesville Inc is a energy firm which specializes in extraction of oil & gas. Assume today is December 31, 2019 and you are asked to

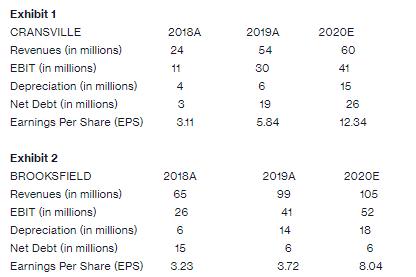

Cranesville Inc is a energy firm which specializes in extraction of oil & gas. Assume today is December 31, 2019 and you are asked to determine whether Cranesville stock is a good deal. Selected financial information for Cranesville is shown in Exhibit 1. All numbers for Cranesville are aggregate and in millions, except for earnings per share. Cranesville currently has 2 million shares outstanding.

Cranesville has a single comparable firm which is Brooksfield Inc. Both firms have December fiscal year ends and are highly similar in many operational aspects. Selected financial information for Brooksfield is shown in Exhibit 2. All numbers for Brooksfield are aggregate and in millions, except for earnings per share. Brooksfield has 4 million shares outstanding and is currently trading at a price of $50 per share.

A. Based on the information what is the implied PRICE PER SHARE (to the nearest cent) for Cranesville using the LEADING P/E MULTIPLE?

Exhibit 1 CRANSVILLE Revenues (in millions) EBIT (in millions) Depreciation (in millions) Net Debt (in millions) Earnings Per Share (EPS) Exhibit 2 BROOKSFIELD Revenues (in millions) EBIT (in millions) Depreciation (in millions) Net Debt (in millions) Earnings Per Share (EPS) 2018A 24 11 4 3 3.11 2018A 65 26 6 15 3.23 2019A 54 30 6 19 5.84 2019A 99 41 14 6 3.72 2020E 60 41 15 26 12.34 2020E 105 52 18 6 8.04

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the implied price per share for Cranesville us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started