Answered step by step

Verified Expert Solution

Question

1 Approved Answer

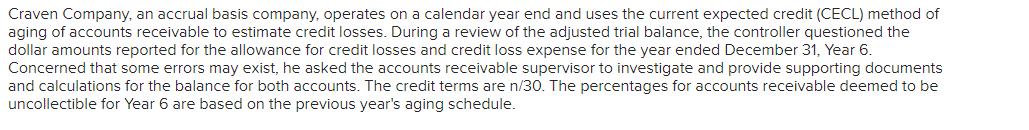

Craven Company, an accrual basis company, operates on a calendar year end and uses the current expected credit (CECL) method of aging of accounts

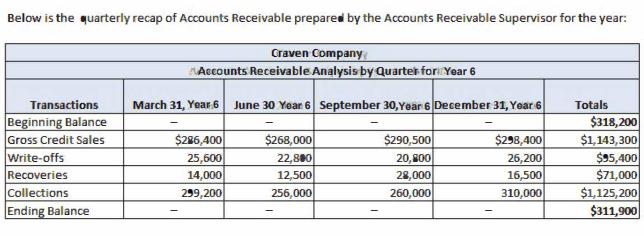

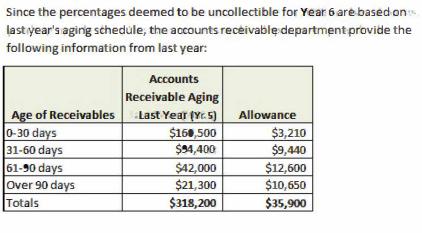

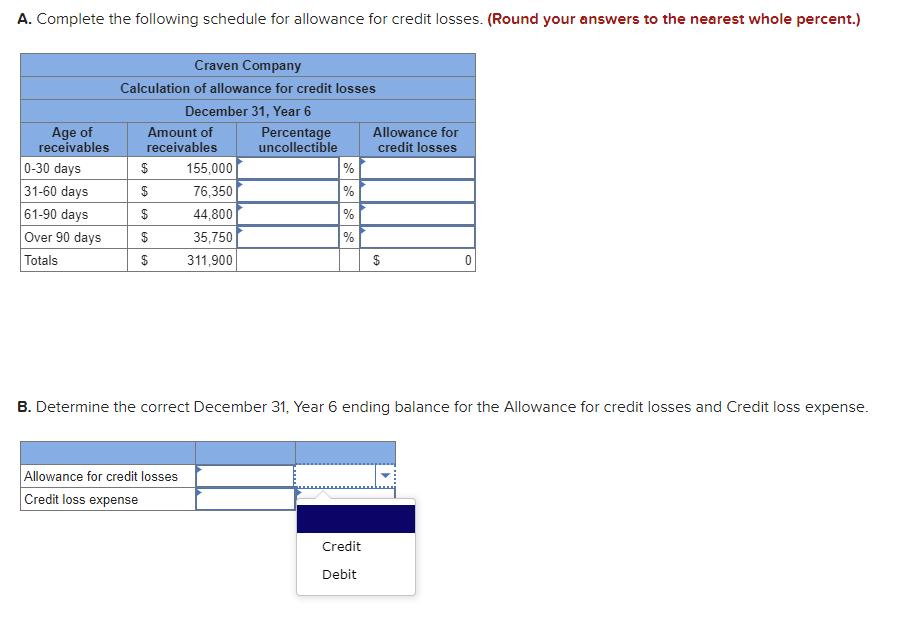

Craven Company, an accrual basis company, operates on a calendar year end and uses the current expected credit (CECL) method of aging of accounts receivable to estimate credit losses. During a review of the adjusted trial balance, the controller questioned the dollar amounts reported for the allowance for credit losses and credit loss expense for the year ended December 31, Year 6. Concerned that some errors may exist, he asked the accounts receivable supervisor to investigate and provide supporting documents and calculations for the balance for both accounts. The credit terms are n/30. The percentages for accounts receivable deemed to be uncollectible for Year 6 are based on the previous year's aging schedule. Below is the quarterly recap of Accounts Receivable prepared by the Accounts Receivable Supervisor for the year: Transactions Beginning Balance Gross Credit Sales Write-offs Recoveries Collections Ending Balance Craven Company Accounts Receivable Analysis by Quarter for Year 6 March 31, Year 6 $286,400 25,600 14,000 299,200 June 30 Year 6 September 30, Year 6 December 31, Year 6 $268,000 22,800 12,500 256,000 - $290,500 20,800 28,000 260,000 $298,400 26,200 16,500 310,000 Totals $318,200 $1,143,300 $95,400 $71,000 $1,125,200 $311,900 Since the percentages deemed to be uncollectible for Year 6 are based on s last year's aging schedule, the accounts receivable department provide the following information from last year: Age of Receivables 0-30 days 31-60 days 61-90 days Over 90 days Totals Accounts Receivable Aging Last Year (Yc5) $160,500 $94,400 $42,000 $21,300 $318,200 Allowance $3,210 $9,440 $12,600 $10,650 $35,900 A. Complete the following schedule for allowance for credit losses. (Round your answers to the nearest whole percent.) Age of receivables 0-30 days 31-60 days 61-90 days Over 90 days Totals Craven Company Calculation of allowance for credit losses December 31, Year 6 Amount of receivables $ $ $ $ $ 155,000 76,350 44,800 Allowance for credit losses Credit loss expense 35,750 311,900 Percentage uncollectible % % % % Allowance for credit losses B. Determine the correct December 31, Year 6 ending balance for the Allowance for credit losses and Credit loss expense. Credit Debit $

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer iThe correct December 31 Year 6 ending balance for the Allowance for credit l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started