Question

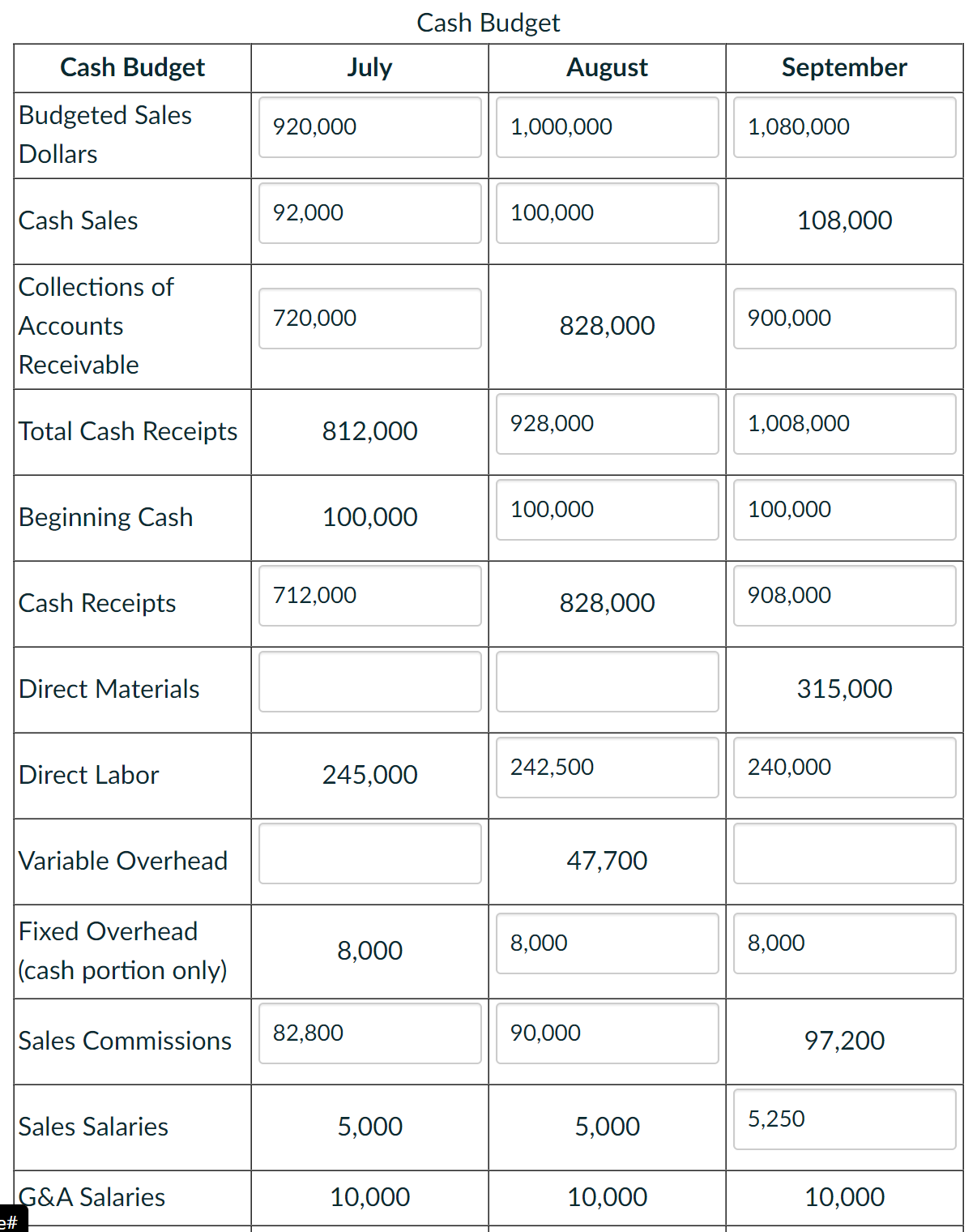

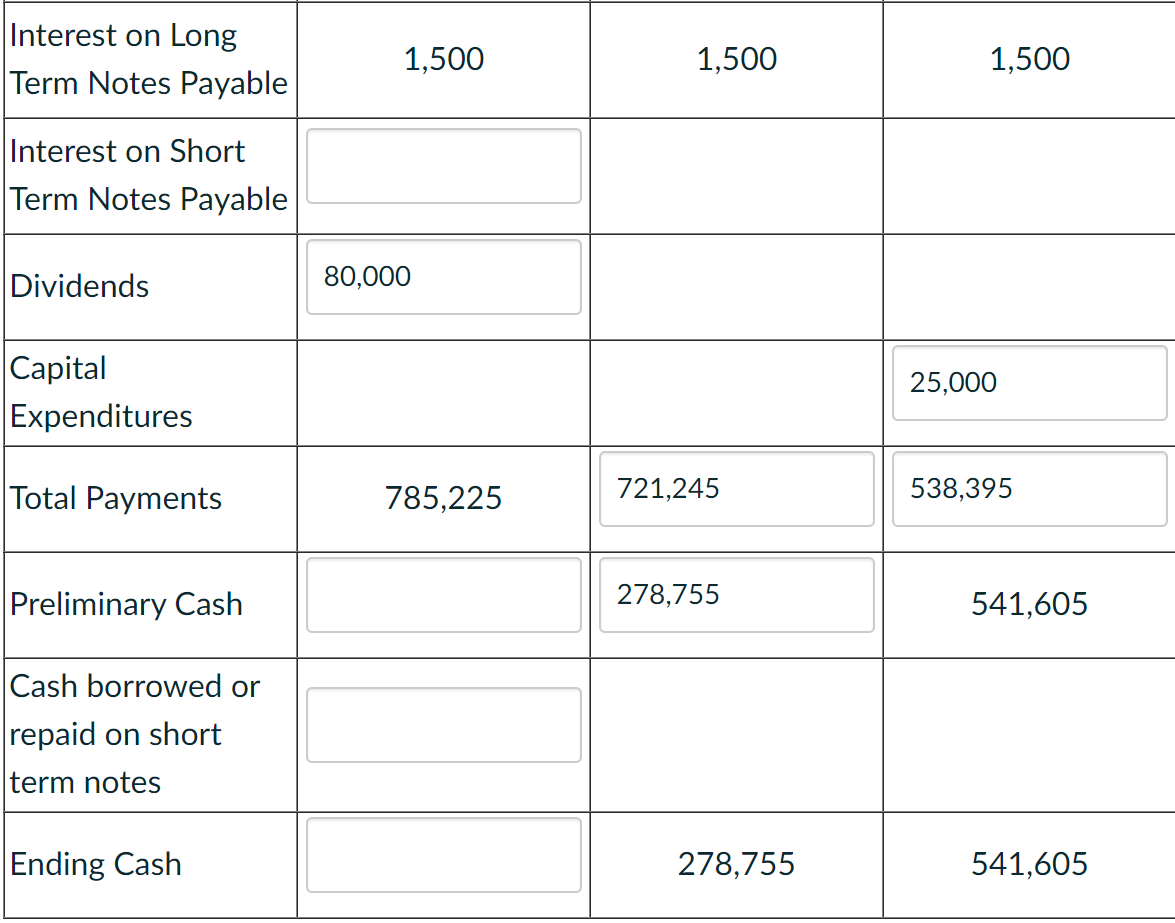

Creasy expects 10% of sales to be collected in cash from the customer immediately and 90% on credit. Credit sales are always paid in full

Creasy expects 10% of sales to be collected in cash from the customer immediately and 90% on credit. Credit sales are always paid in full in the following month.

All direct materials purchases are on credit and are paid in full in the following month. No other payables arise from any other transactions.

As of June 30, the Accounts Receivable balance is $720,000. The Accounts Payable balance is $308,700.

The minimum ending cash balance for all months is $100,000. If necessary, the company borrows enough cash using a short term note to reach the minimum.

Short term notes require an interest payment of 0.5% each month end (before repayment). If the ending cash balance exceeds the minimum, the excess will be applied to repaying the short term notes payable balance.

The company expects to declare and pay a dividend of $80,000 in July.

The company does not expect to make any payments for Income Taxes in the budgeted quarter.

Equipment purchases of $25,000 are scheduled for September. No disposals of fixed assets are anticipated.

Using this information plus the information you prepared in the previous questions, prepare the Cash Budget.

some of the Previous Questions, for context:

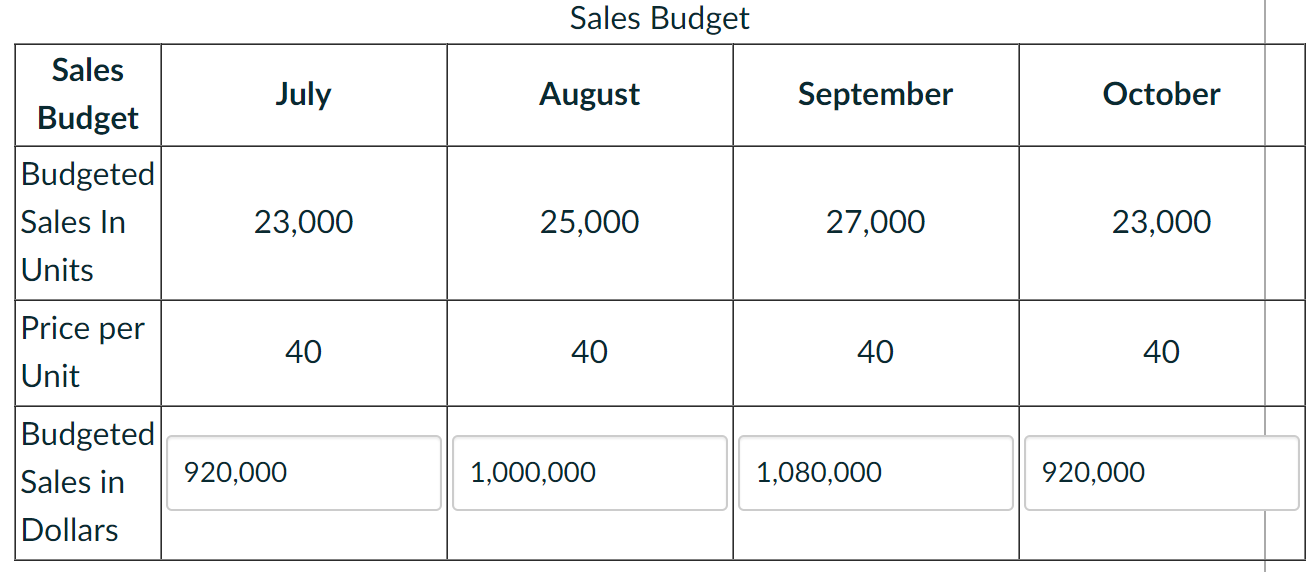

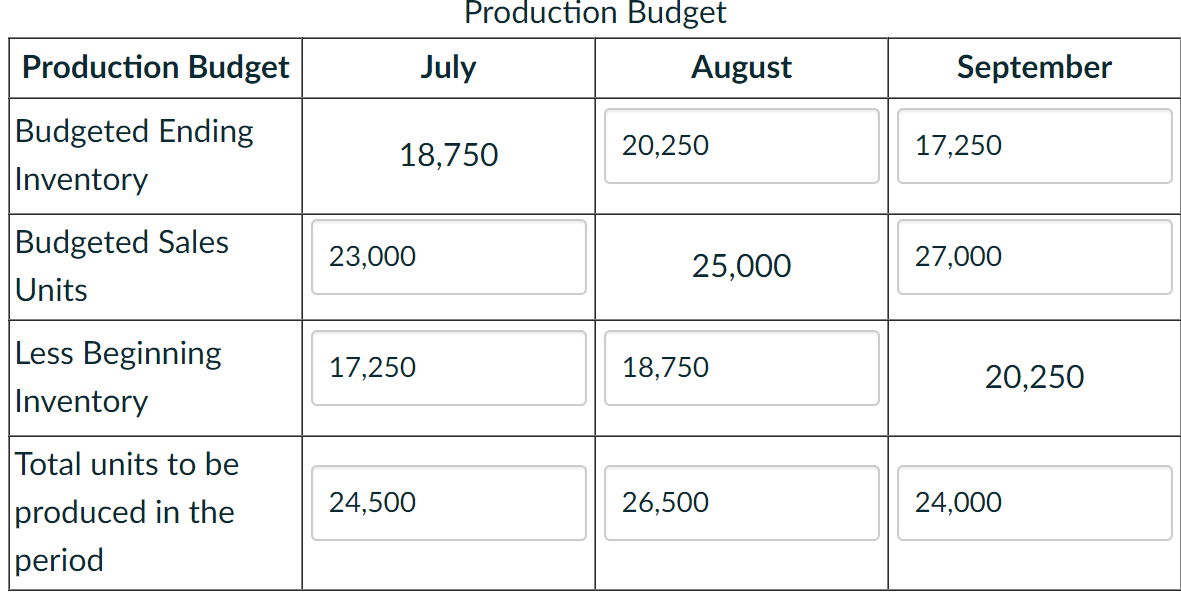

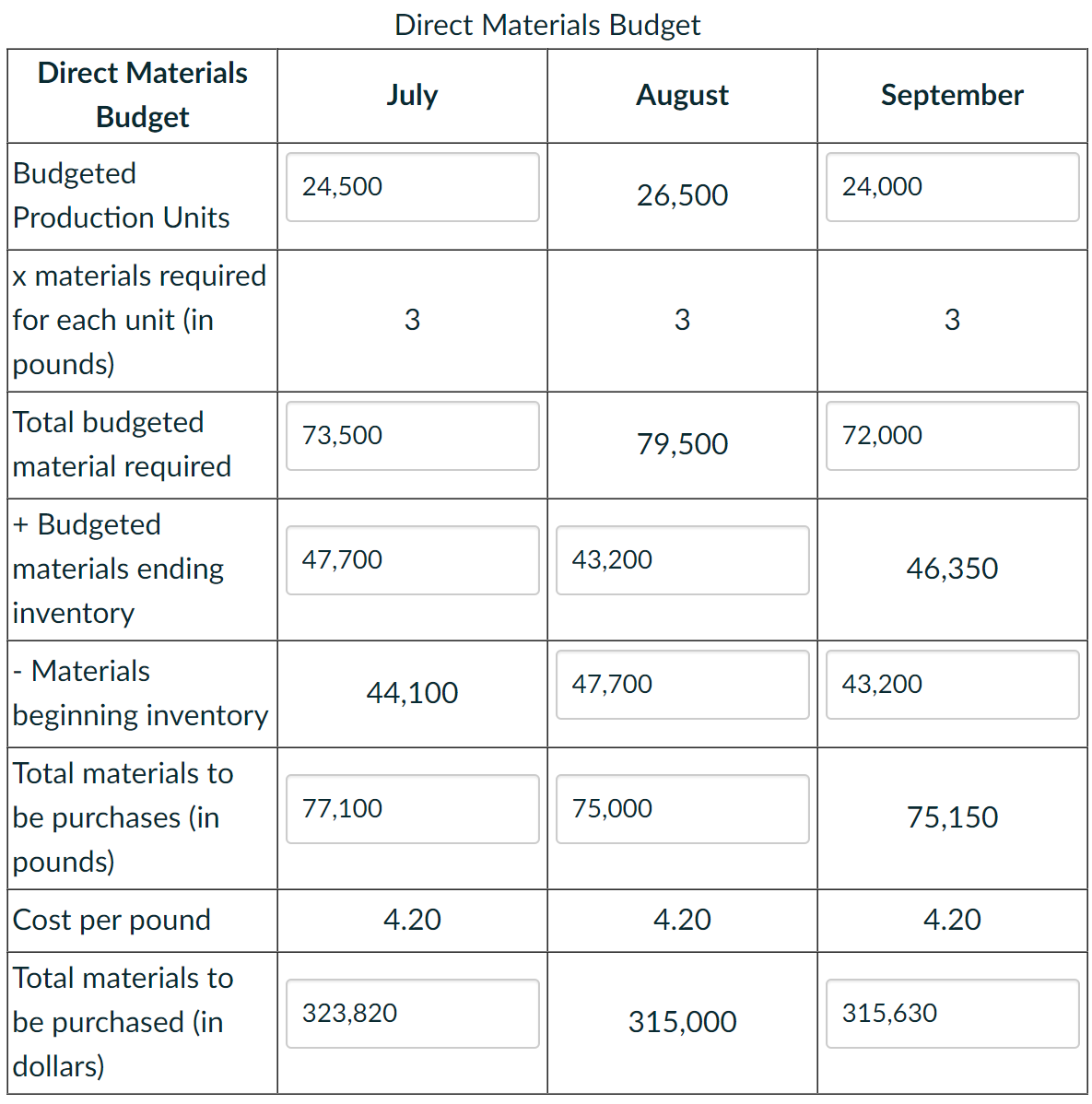

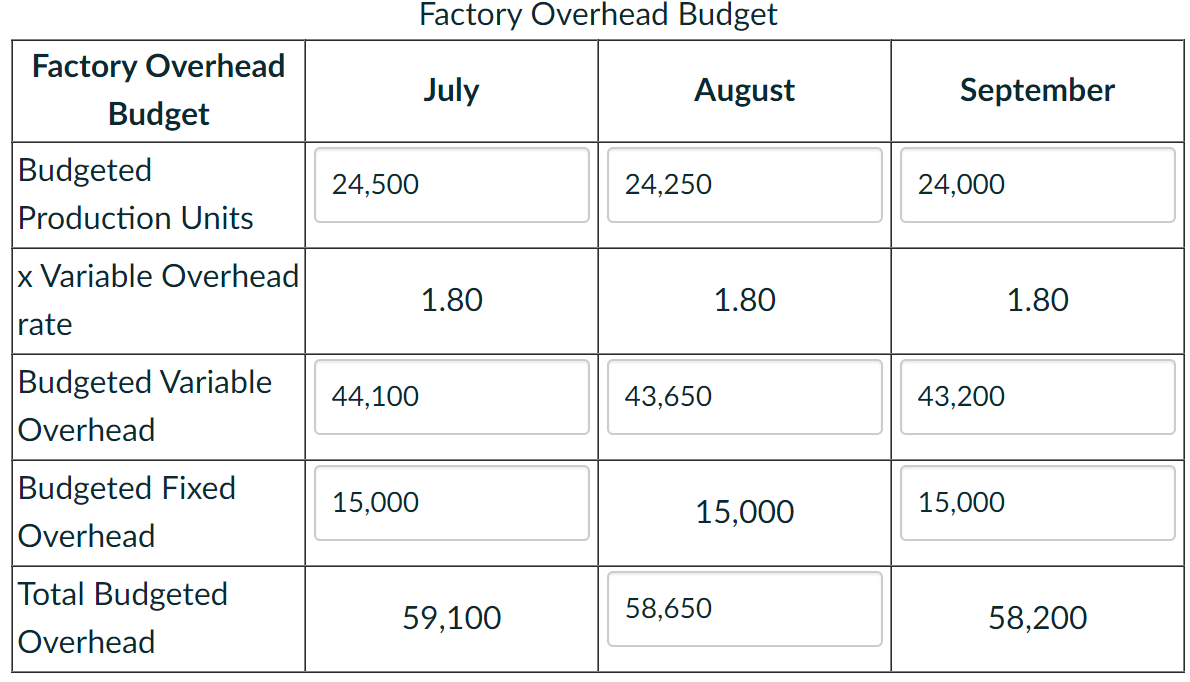

\begin{tabular}{|l|l|l|l|} \hline InterestonLongTermNotesPayable & 1,500 & 1,500 & 1,500 \\ \hline InterestonShortTermNotesPayable & & & \\ \hline Dividends & 80,000 & & \\ \hline CapitalExpenditures & & & 25,000 \\ \hline Total Payments & 785,225 & 721,245 & 538,395 \\ \hline Preliminary Cash & & 278,755 & 541,605 \\ \hline Cashborrowedorrepaidonshorttermnotes & & & \\ \hline \begin{tabular}{ll|l|l} Ending Cash \end{tabular} & & & \\ \hline \end{tabular} Sales Budget \begin{tabular}{|l|c|c|c|c|} \hline SalesBudget & July & August & September & October \\ \hline BudgetedSalesInUnits & 23,000 & 25,000 & 27,000 & 23,000 \\ \hline PriceperUnit & 40 & 40 & 40 & 40 \\ \hline BudgetedSalesinDollars & 920,000 & 1,000,000 & 1,080,000 & 920,000 \\ \hline \end{tabular} Production Budget \begin{tabular}{|l|l|l|l|} \hline Production Budget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedEndingInventory & 18,750 & 20,250 & 17,250 \\ \hline BudgetedSalesUnits & 23,000 & 25,000 & 27,000 \\ \hline LessBeginningInventory & 17,250 & 18,750 & 20,250 \\ \hline Totalunitstobeproducedintheperiod & 24,500 & 26,500 & 24,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{1}{c}{\begin{tabular}{c} Direct Materials \\ \multicolumn{1}{c}{ Budget } \end{tabular}} & \multicolumn{1}{c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 26,500 & 24,000 \\ \hline xmaterialsrequiredforeachunit(inpounds) & & & \\ \hline Totalbudgetedmaterialrequired & 73,500 & 3 & \\ \hline +Budgetedmaterialsendinginventory & 47,700 & 79,500 & 72,000 \\ \hline -Materialsbeginninginventory & 44,100 & 47,700 & \\ \hline Totalmaterialstobepurchases(inpounds) & 77,100 & 43,200 & \\ \hline Cost per pound & & & \\ \hline Totalmaterialstobepurchased(indollars) & 323,820 & 43,350 \\ \hline \end{tabular} Factory Overhead Budget \begin{tabular}{|l|l|l|l|} \hline FactoryOverheadBudget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 24,250 & 24,000 \\ \hline xVariableOverheadrate & 1.80 & 1.80 & 1.80 \\ \hline BudgetedVariableOverhead & 44,100 & 43,650 & 43,200 \\ \hline BudgetedFixedOverhead & 15,000 & 15,000 & 15,000 \\ \hline TotalBudgetedOverhead & 59,100 & 58,650 & 58,200 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline InterestonLongTermNotesPayable & 1,500 & 1,500 & 1,500 \\ \hline InterestonShortTermNotesPayable & & & \\ \hline Dividends & 80,000 & & \\ \hline CapitalExpenditures & & & 25,000 \\ \hline Total Payments & 785,225 & 721,245 & 538,395 \\ \hline Preliminary Cash & & 278,755 & 541,605 \\ \hline Cashborrowedorrepaidonshorttermnotes & & & \\ \hline \begin{tabular}{ll|l|l} Ending Cash \end{tabular} & & & \\ \hline \end{tabular} Sales Budget \begin{tabular}{|l|c|c|c|c|} \hline SalesBudget & July & August & September & October \\ \hline BudgetedSalesInUnits & 23,000 & 25,000 & 27,000 & 23,000 \\ \hline PriceperUnit & 40 & 40 & 40 & 40 \\ \hline BudgetedSalesinDollars & 920,000 & 1,000,000 & 1,080,000 & 920,000 \\ \hline \end{tabular} Production Budget \begin{tabular}{|l|l|l|l|} \hline Production Budget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedEndingInventory & 18,750 & 20,250 & 17,250 \\ \hline BudgetedSalesUnits & 23,000 & 25,000 & 27,000 \\ \hline LessBeginningInventory & 17,250 & 18,750 & 20,250 \\ \hline Totalunitstobeproducedintheperiod & 24,500 & 26,500 & 24,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{1}{c}{\begin{tabular}{c} Direct Materials \\ \multicolumn{1}{c}{ Budget } \end{tabular}} & \multicolumn{1}{c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 26,500 & 24,000 \\ \hline xmaterialsrequiredforeachunit(inpounds) & & & \\ \hline Totalbudgetedmaterialrequired & 73,500 & 3 & \\ \hline +Budgetedmaterialsendinginventory & 47,700 & 79,500 & 72,000 \\ \hline -Materialsbeginninginventory & 44,100 & 47,700 & \\ \hline Totalmaterialstobepurchases(inpounds) & 77,100 & 43,200 & \\ \hline Cost per pound & & & \\ \hline Totalmaterialstobepurchased(indollars) & 323,820 & 43,350 \\ \hline \end{tabular} Factory Overhead Budget \begin{tabular}{|l|l|l|l|} \hline FactoryOverheadBudget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 24,250 & 24,000 \\ \hline xVariableOverheadrate & 1.80 & 1.80 & 1.80 \\ \hline BudgetedVariableOverhead & 44,100 & 43,650 & 43,200 \\ \hline BudgetedFixedOverhead & 15,000 & 15,000 & 15,000 \\ \hline TotalBudgetedOverhead & 59,100 & 58,650 & 58,200 \\ \hline \end{tabular}

\begin{tabular}{|l|l|l|l|} \hline InterestonLongTermNotesPayable & 1,500 & 1,500 & 1,500 \\ \hline InterestonShortTermNotesPayable & & & \\ \hline Dividends & 80,000 & & \\ \hline CapitalExpenditures & & & 25,000 \\ \hline Total Payments & 785,225 & 721,245 & 538,395 \\ \hline Preliminary Cash & & 278,755 & 541,605 \\ \hline Cashborrowedorrepaidonshorttermnotes & & & \\ \hline \begin{tabular}{ll|l|l} Ending Cash \end{tabular} & & & \\ \hline \end{tabular} Sales Budget \begin{tabular}{|l|c|c|c|c|} \hline SalesBudget & July & August & September & October \\ \hline BudgetedSalesInUnits & 23,000 & 25,000 & 27,000 & 23,000 \\ \hline PriceperUnit & 40 & 40 & 40 & 40 \\ \hline BudgetedSalesinDollars & 920,000 & 1,000,000 & 1,080,000 & 920,000 \\ \hline \end{tabular} Production Budget \begin{tabular}{|l|l|l|l|} \hline Production Budget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedEndingInventory & 18,750 & 20,250 & 17,250 \\ \hline BudgetedSalesUnits & 23,000 & 25,000 & 27,000 \\ \hline LessBeginningInventory & 17,250 & 18,750 & 20,250 \\ \hline Totalunitstobeproducedintheperiod & 24,500 & 26,500 & 24,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{1}{c}{\begin{tabular}{c} Direct Materials \\ \multicolumn{1}{c}{ Budget } \end{tabular}} & \multicolumn{1}{c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 26,500 & 24,000 \\ \hline xmaterialsrequiredforeachunit(inpounds) & & & \\ \hline Totalbudgetedmaterialrequired & 73,500 & 3 & \\ \hline +Budgetedmaterialsendinginventory & 47,700 & 79,500 & 72,000 \\ \hline -Materialsbeginninginventory & 44,100 & 47,700 & \\ \hline Totalmaterialstobepurchases(inpounds) & 77,100 & 43,200 & \\ \hline Cost per pound & & & \\ \hline Totalmaterialstobepurchased(indollars) & 323,820 & 43,350 \\ \hline \end{tabular} Factory Overhead Budget \begin{tabular}{|l|l|l|l|} \hline FactoryOverheadBudget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 24,250 & 24,000 \\ \hline xVariableOverheadrate & 1.80 & 1.80 & 1.80 \\ \hline BudgetedVariableOverhead & 44,100 & 43,650 & 43,200 \\ \hline BudgetedFixedOverhead & 15,000 & 15,000 & 15,000 \\ \hline TotalBudgetedOverhead & 59,100 & 58,650 & 58,200 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline InterestonLongTermNotesPayable & 1,500 & 1,500 & 1,500 \\ \hline InterestonShortTermNotesPayable & & & \\ \hline Dividends & 80,000 & & \\ \hline CapitalExpenditures & & & 25,000 \\ \hline Total Payments & 785,225 & 721,245 & 538,395 \\ \hline Preliminary Cash & & 278,755 & 541,605 \\ \hline Cashborrowedorrepaidonshorttermnotes & & & \\ \hline \begin{tabular}{ll|l|l} Ending Cash \end{tabular} & & & \\ \hline \end{tabular} Sales Budget \begin{tabular}{|l|c|c|c|c|} \hline SalesBudget & July & August & September & October \\ \hline BudgetedSalesInUnits & 23,000 & 25,000 & 27,000 & 23,000 \\ \hline PriceperUnit & 40 & 40 & 40 & 40 \\ \hline BudgetedSalesinDollars & 920,000 & 1,000,000 & 1,080,000 & 920,000 \\ \hline \end{tabular} Production Budget \begin{tabular}{|l|l|l|l|} \hline Production Budget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedEndingInventory & 18,750 & 20,250 & 17,250 \\ \hline BudgetedSalesUnits & 23,000 & 25,000 & 27,000 \\ \hline LessBeginningInventory & 17,250 & 18,750 & 20,250 \\ \hline Totalunitstobeproducedintheperiod & 24,500 & 26,500 & 24,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{1}{c}{\begin{tabular}{c} Direct Materials \\ \multicolumn{1}{c}{ Budget } \end{tabular}} & \multicolumn{1}{c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 26,500 & 24,000 \\ \hline xmaterialsrequiredforeachunit(inpounds) & & & \\ \hline Totalbudgetedmaterialrequired & 73,500 & 3 & \\ \hline +Budgetedmaterialsendinginventory & 47,700 & 79,500 & 72,000 \\ \hline -Materialsbeginninginventory & 44,100 & 47,700 & \\ \hline Totalmaterialstobepurchases(inpounds) & 77,100 & 43,200 & \\ \hline Cost per pound & & & \\ \hline Totalmaterialstobepurchased(indollars) & 323,820 & 43,350 \\ \hline \end{tabular} Factory Overhead Budget \begin{tabular}{|l|l|l|l|} \hline FactoryOverheadBudget & \multicolumn{1}{|c|}{ July } & August & September \\ \hline BudgetedProductionUnits & 24,500 & 24,250 & 24,000 \\ \hline xVariableOverheadrate & 1.80 & 1.80 & 1.80 \\ \hline BudgetedVariableOverhead & 44,100 & 43,650 & 43,200 \\ \hline BudgetedFixedOverhead & 15,000 & 15,000 & 15,000 \\ \hline TotalBudgetedOverhead & 59,100 & 58,650 & 58,200 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started