Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create a budget based on the expenses you think the average family needs to get by in the Charlotte North Carolina area. Follow these

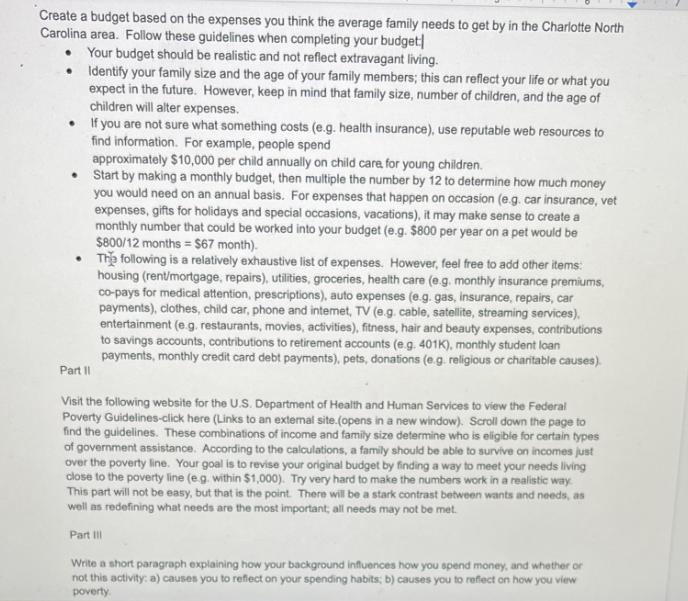

Create a budget based on the expenses you think the average family needs to get by in the Charlotte North Carolina area. Follow these guidelines when completing your budget: Your budget should be realistic and not reflect extravagant living. Identify your family size and the age of your family members; this can reflect your life or what you expect in the future. However, keep in mind that family size, number of children, and the age of children will alter expenses. Part II If you are not sure what something costs (e.g. health insurance), use reputable web resources to find information. For example, people spend approximately $10,000 per child annually on child care for young children. Start by making a monthly budget, then multiple the number by 12 to determine how much money you would need on an annual basis. For expenses that happen on occasion (e.g. car insurance, vet expenses, gifts for holidays and special occasions, vacations), it may make sense to create a monthly number that could be worked into your budget (e.g. $800 per year on a pet would be $800/12 months $67 month). The following is a relatively exhaustive list of expenses. However, feel free to add other items: housing (rent/mortgage, repairs), utilities, groceries, health care (e.g. monthly insurance premiums, co-pays for medical attention, prescriptions), auto expenses (e.g. gas, insurance, repairs, car payments), clothes, child car, phone and intemet, TV (e.g. cable, satellite, streaming services). entertainment (e.g. restaurants, movies, activities), fitness, hair and beauty expenses, contributions to savings accounts, contributions to retirement accounts (e.g. 401K), monthly student loan payments, monthly credit card debt payments), pets, donations (e.g. religious or charitable causes). Visit the following website for the U.S. Department of Health and Human Services to view the Federal Poverty Guidelines-click here (Links to an external site.(opens in a new window). Scroll down the page to find the guidelines. These combinations of income and family size determine who is eligible for certain types of government assistance. According to the calculations, a family should be able to survive on incomes just over the poverty line. Your goal is to revise your original budget by finding a way to meet your needs living close to the poverty line (e.g. within $1,000). Try very hard to make the numbers work in a realistic way. This part will not be easy, but that is the point. There will be a stark contrast between wants and needs, as well as redefining what needs are the most important; all needs may not be met. Part III Write a short paragraph explaining how your background influences how you spend money, and whether or not this activity: a) causes you to reflect on your spending habits; b) causes you to reflect on how you view poverty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started