Create a cash flow statement....

comoarative income statement and balance sheet provided, as well some extra information.

The following additional information is needed for the statement of cash flows:

1) You paid off the short term note payable on time.

2) You acquired a patent for $1,000 in cash.

3) You issued 30 shares of common stock as payment for $630 of equipment on February 1, 2023, and later sold 60 additional shares of common stock on September 1, 2023, for $22 per share in cash.

4) You sold equipment for $2,722 in cash. The equipment cost $4,000 and had a book value of $2.558

5)You purchased Available for Sale Securities for $800 in cash.

6)You purchased $300 of five-year bonds of another company for $285 and plan to hold these bonds until their due date in 2027.

7)You amortized the patents. Trademarks are not amortized (just like land is not depreciated).

8) You declared $650 in cash dividends on June 30, 2023, and an additional $710 on December 30, 2023.

9)Because the rent on your retail store continues to go up each year, you decided to start saving for your own building and deposited $1,200 into a saving account.

10) You recorded depreciation on the equipment.

11)You checked the remaining balance sheet accounts to make sure the changes from 2022 to 2023 have been fully explained.

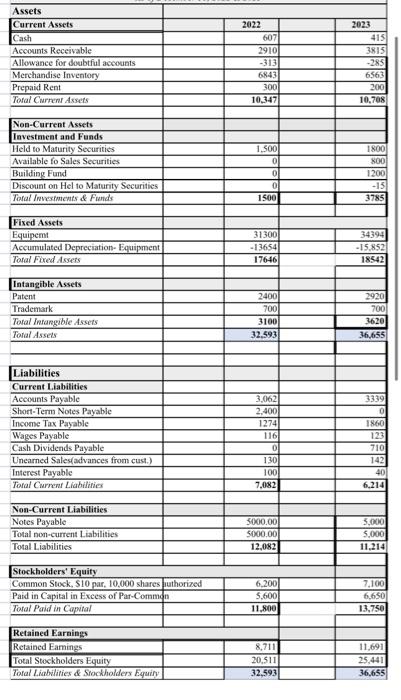

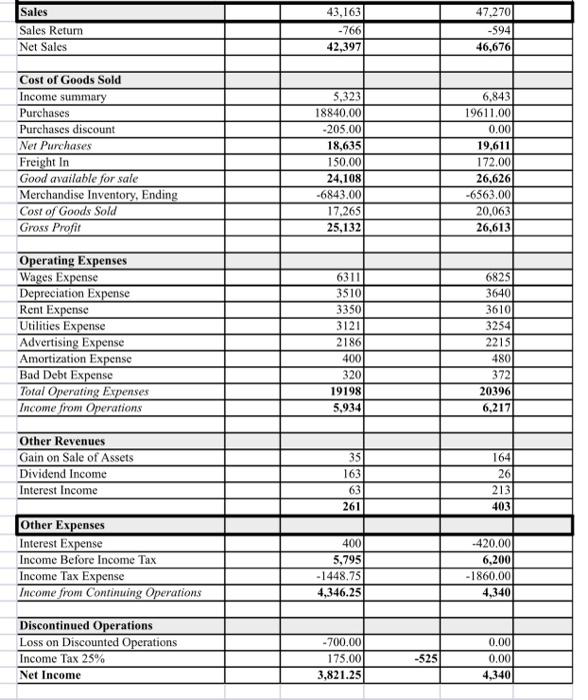

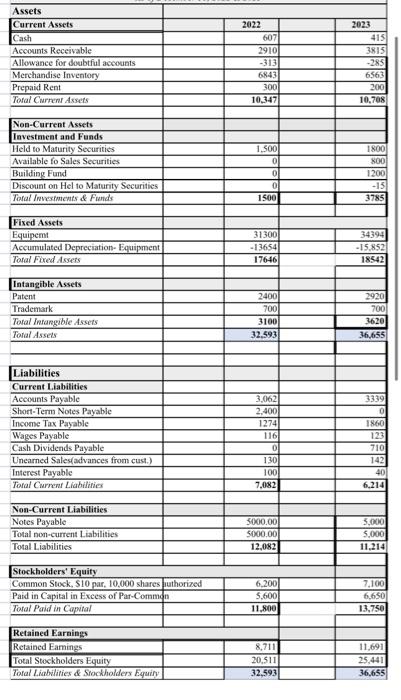

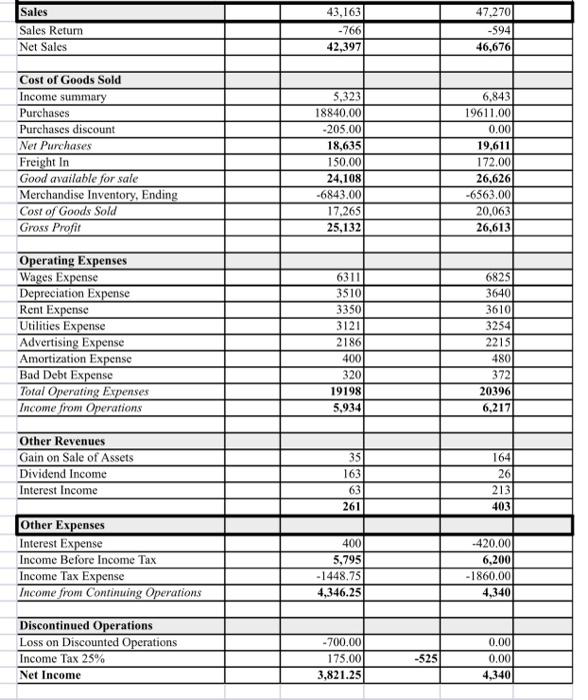

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ Assets } \\ \hline Current Assets & & 2022 & 2023 \\ \hline Cash & & 607 & 415 \\ \hline Accounts Receivable & & 2910 & 3815 \\ \hline Allowance for doubtful accounts & & -313 & -285 \\ \hline Merchandise Inventory & & 6843 & 6563 \\ \hline Prepaid Rent & & 300 & 200 \\ \hline Total Current Assets & & 10,347 & 10,708 \\ \hline \multicolumn{4}{|l|}{ Non-Current Assets } \\ \hline \multicolumn{4}{|l|}{ Investment and Funds } \\ \hline Held to Maturity Securities & & 1,500 & 1800 \\ \hline Available fo Sales Securities & & 0 & 800 \\ \hline Building Fund & & 0 & 1200 \\ \hline Discount on Hel to Maturity Securities & & 0 & -15 \\ \hline Tofal /mvesiments \& Frends & & 1500 & 3785 \\ \hline \multicolumn{4}{|l|}{ Fixed Assets } \\ \hline Equipemt & & 31300 & 34394 \\ \hline Accumulated Depreciation- Equipment & & -13654 & 15,852 \\ \hline Total Fived Assets & & 17646 & 18542 \\ \hline \multicolumn{4}{|l|}{ Intangible Assets } \\ \hline Patent & & 2400 & 2920 \\ \hline Trademark & & 700 & 700 \\ \hline Total hnangible Assets & & 3100 & 3620 \\ \hline Total Assets & & 32.593 & 36,655 \\ \hline & & & \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline \multicolumn{4}{|l|}{ Current Liabilities } \\ \hline Accounts Payable & & 3,062 & 3339 \\ \hline Shott-Term Notes Payable & & 2,400 & 0 \\ \hline Income Tax Payable & & 1274 & 1860 \\ \hline Wages Payable & & 116 & 123 \\ \hline Cash Dividends Payable & & 0 & 710 \\ \hline Unearned Sales(advances from cust.) & & 130 & 142 \\ \hline Interest Payable & & 100 & 40 \\ \hline Total Current Liabilities & & 7,082 & 6,214 \\ \hline \multicolumn{4}{|l|}{ Non-Current Liabilities } \\ \hline Notes Payable & & 5000.00 & 5,000 \\ \hline Total non-current Liabilities & & 5000.00 & 5,000 \\ \hline Total Liabilities & & 12,082 & 11.214 \\ \hline \multicolumn{4}{|l|}{ Stockholders' Equity } \\ \hline Common Stock, $10 par, 10,000 shares & Tiuthorized & 6,200 & 7,100 \\ \hline Paid in Capital in Excess of Par-Comm & qn & 5,600 & 6,650 \\ \hline Total Paid in Capital & & 11,800 & 13,750 \\ \hline \multicolumn{4}{|l|}{ Retained Earnings } \\ \hline Retained Eamings & & 8,711 & 11,691 \\ \hline Total Stockholders Equity & & 20,511 & 25,441 \\ \hline Tofal Liabilities \& Srockholders Equiry & & 32,593 & 36,655 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline Sales & & & 47,270 & \\ \hline Sales Return & -766 & & -594 & \\ \hline Net Sales & 42,397 & & 46,676 & \\ \hline \multicolumn{5}{|l|}{ Cost of Goods Sold } \\ \hline Income summary & 5,323 & & 6,843 & \\ \hline Purchases & 18840.00 & & 19611.00 & \\ \hline Purchases discount & 205,00 & & 0.00 & \\ \hline Net Purchases & 18,635 & & 19,611 & \\ \hline Freight In & 150.00 & & 172.00 & \\ \hline Good available for sale & 24,108 & & 26,626 & \\ \hline Merchandise Inventory, Ending & -6843.00 & & -6563.00 & \\ \hline Cost of Goods Sold & 17,265 & & 20,063 & \\ \hline Gross Profit & 25,132 & & 26,613 & \\ \hline \multicolumn{5}{|l|}{ Operating Expenses } \\ \hline Wages Expense & 6311 & & 6825 & \\ \hline Depreciation Expense & 3510 & & 3640 & \\ \hline Rent Expense & 3350 & & 3610 & \\ \hline Utilities Expense & 3121 & & 3254 & \\ \hline Advertising Expense & 2186 & & 2215 & \\ \hline Amortization Expense & 400 & & 480 & \\ \hline Bad Debt Expense & 320 & & 372 & \\ \hline Total Operating Expenses & 19198 & & 20396 & \\ \hline Income from Operations & 5,934 & & 6,217 & \\ \hline \multicolumn{5}{|l|}{ Other Revenues } \\ \hline Gain on Sale of Assets & 35 & & 164 & \\ \hline Dividend Income & 163 & & 26 & \\ \hline \multirow[t]{2}{*}{ Interest Income } & 63 & & 213 & \\ \hline & 261 & & 403 & \\ \hline \multicolumn{5}{|l|}{ Other Expenses } \\ \hline Interest Expense & 400 & & .420 .00 & \\ \hline Income Before Income Tax & 5,795 & & 6,200 & \\ \hline Income Tax Expense & 1448,75 & & -1860.00 & \\ \hline Income from Continuing Operations & 4,346.25 & & 4,340 & \\ \hline \multicolumn{5}{|l|}{ Discontinued Operations } \\ \hline Loss on Discounted Operations & 700,00 & & 0.00 & \\ \hline Income Tax 25\% & 175.00 & -525 & 0.00 & \\ \hline Net Income & 3,821.25 & & 4,340 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ Assets } \\ \hline Current Assets & & 2022 & 2023 \\ \hline Cash & & 607 & 415 \\ \hline Accounts Receivable & & 2910 & 3815 \\ \hline Allowance for doubtful accounts & & -313 & -285 \\ \hline Merchandise Inventory & & 6843 & 6563 \\ \hline Prepaid Rent & & 300 & 200 \\ \hline Total Current Assets & & 10,347 & 10,708 \\ \hline \multicolumn{4}{|l|}{ Non-Current Assets } \\ \hline \multicolumn{4}{|l|}{ Investment and Funds } \\ \hline Held to Maturity Securities & & 1,500 & 1800 \\ \hline Available fo Sales Securities & & 0 & 800 \\ \hline Building Fund & & 0 & 1200 \\ \hline Discount on Hel to Maturity Securities & & 0 & -15 \\ \hline Tofal /mvesiments \& Frends & & 1500 & 3785 \\ \hline \multicolumn{4}{|l|}{ Fixed Assets } \\ \hline Equipemt & & 31300 & 34394 \\ \hline Accumulated Depreciation- Equipment & & -13654 & 15,852 \\ \hline Total Fived Assets & & 17646 & 18542 \\ \hline \multicolumn{4}{|l|}{ Intangible Assets } \\ \hline Patent & & 2400 & 2920 \\ \hline Trademark & & 700 & 700 \\ \hline Total hnangible Assets & & 3100 & 3620 \\ \hline Total Assets & & 32.593 & 36,655 \\ \hline & & & \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline \multicolumn{4}{|l|}{ Current Liabilities } \\ \hline Accounts Payable & & 3,062 & 3339 \\ \hline Shott-Term Notes Payable & & 2,400 & 0 \\ \hline Income Tax Payable & & 1274 & 1860 \\ \hline Wages Payable & & 116 & 123 \\ \hline Cash Dividends Payable & & 0 & 710 \\ \hline Unearned Sales(advances from cust.) & & 130 & 142 \\ \hline Interest Payable & & 100 & 40 \\ \hline Total Current Liabilities & & 7,082 & 6,214 \\ \hline \multicolumn{4}{|l|}{ Non-Current Liabilities } \\ \hline Notes Payable & & 5000.00 & 5,000 \\ \hline Total non-current Liabilities & & 5000.00 & 5,000 \\ \hline Total Liabilities & & 12,082 & 11.214 \\ \hline \multicolumn{4}{|l|}{ Stockholders' Equity } \\ \hline Common Stock, $10 par, 10,000 shares & Tiuthorized & 6,200 & 7,100 \\ \hline Paid in Capital in Excess of Par-Comm & qn & 5,600 & 6,650 \\ \hline Total Paid in Capital & & 11,800 & 13,750 \\ \hline \multicolumn{4}{|l|}{ Retained Earnings } \\ \hline Retained Eamings & & 8,711 & 11,691 \\ \hline Total Stockholders Equity & & 20,511 & 25,441 \\ \hline Tofal Liabilities \& Srockholders Equiry & & 32,593 & 36,655 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline Sales & & & 47,270 & \\ \hline Sales Return & -766 & & -594 & \\ \hline Net Sales & 42,397 & & 46,676 & \\ \hline \multicolumn{5}{|l|}{ Cost of Goods Sold } \\ \hline Income summary & 5,323 & & 6,843 & \\ \hline Purchases & 18840.00 & & 19611.00 & \\ \hline Purchases discount & 205,00 & & 0.00 & \\ \hline Net Purchases & 18,635 & & 19,611 & \\ \hline Freight In & 150.00 & & 172.00 & \\ \hline Good available for sale & 24,108 & & 26,626 & \\ \hline Merchandise Inventory, Ending & -6843.00 & & -6563.00 & \\ \hline Cost of Goods Sold & 17,265 & & 20,063 & \\ \hline Gross Profit & 25,132 & & 26,613 & \\ \hline \multicolumn{5}{|l|}{ Operating Expenses } \\ \hline Wages Expense & 6311 & & 6825 & \\ \hline Depreciation Expense & 3510 & & 3640 & \\ \hline Rent Expense & 3350 & & 3610 & \\ \hline Utilities Expense & 3121 & & 3254 & \\ \hline Advertising Expense & 2186 & & 2215 & \\ \hline Amortization Expense & 400 & & 480 & \\ \hline Bad Debt Expense & 320 & & 372 & \\ \hline Total Operating Expenses & 19198 & & 20396 & \\ \hline Income from Operations & 5,934 & & 6,217 & \\ \hline \multicolumn{5}{|l|}{ Other Revenues } \\ \hline Gain on Sale of Assets & 35 & & 164 & \\ \hline Dividend Income & 163 & & 26 & \\ \hline \multirow[t]{2}{*}{ Interest Income } & 63 & & 213 & \\ \hline & 261 & & 403 & \\ \hline \multicolumn{5}{|l|}{ Other Expenses } \\ \hline Interest Expense & 400 & & .420 .00 & \\ \hline Income Before Income Tax & 5,795 & & 6,200 & \\ \hline Income Tax Expense & 1448,75 & & -1860.00 & \\ \hline Income from Continuing Operations & 4,346.25 & & 4,340 & \\ \hline \multicolumn{5}{|l|}{ Discontinued Operations } \\ \hline Loss on Discounted Operations & 700,00 & & 0.00 & \\ \hline Income Tax 25\% & 175.00 & -525 & 0.00 & \\ \hline Net Income & 3,821.25 & & 4,340 & \\ \hline \end{tabular}