Answered step by step

Verified Expert Solution

Question

1 Approved Answer

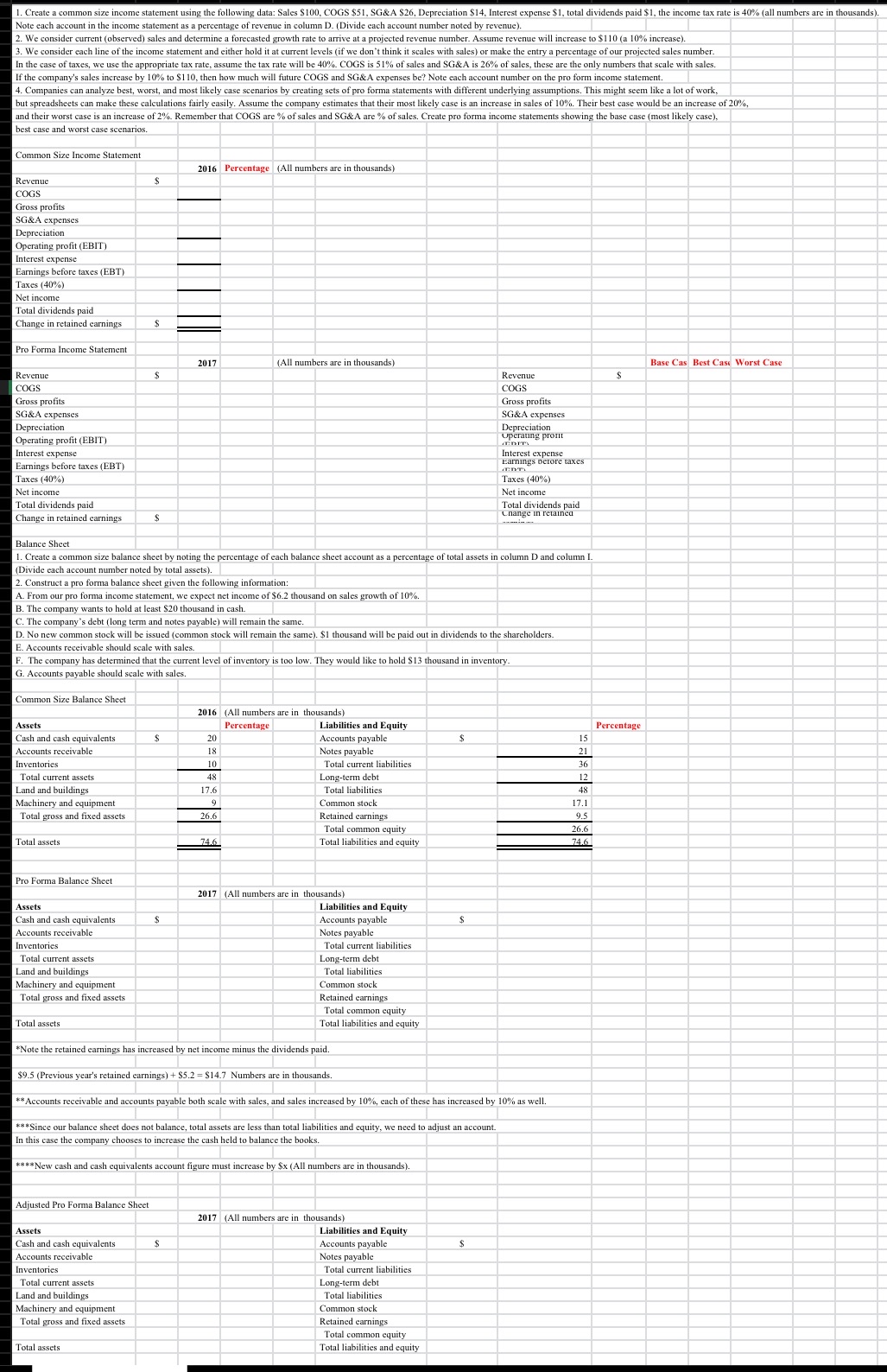

Create a common size income statement using the following data: Sales $ 1 0 0 , COGS $ 5 1 , S G & A

Create a common size income statement using the following data: Sales $ COGS $&$ Depreciation $ Interest expense $ total dividends paid $ the income tax rate is all numbers are in thousands

Note each account in the income statement as a percentage of revenue in column DDivide each account number noted by revenue

We consider current observed sales and determine a forecasted growth rate to arrive at a projected revenue number. Assume revenue will increase to $a increase

We consider each line of the income statement and either hold it at current levels if we don't think it scales with sales or make the entry a percentage of our projected sales number.

In the case of taxes, we use the appropriate tax rate, assume the tax rate will be COGS is of sales and SG&A is of sales, these are the only numbers that scale with sales.

If the company's sales increase by to $ then how much will future COGS and SG&A expenses be Note each account number on the pro form income statement.

Companies can analyze best, worst, and most likely case scenarios by creating sets of pro forma statements with different underlying assumptions. This might seem like a lot of work,

but spreadsheets can make these calculations fairly easily. Assume the company estimates that their most likely case is an increase in sales of Their best case would be an increase of

and their worst case is an increase of Remember that COGS are of sales and SG&A are of sales. Create pro forma income statements showing the base case most likely case

best case and worst case scenarios.

Common Size Income Statement

Create a common size balance sheet by noting the percentage of each balance sheet account as a percentage of total assets in column D and column I.

Divide each account number noted by total assets

Construct a pro forma balance sheet given the following information:

A From our pro forma income statement, we expect net income of $ thousand on sales growth of

B The company wants to hold at least $ thousand in cash.

C The company's debt long term and notes payable will remain the same.

D No new common stock will be issued common stock will remain the same $ thousand will be paid out in dividends to the shareholders.

E Accounts receivable should scale with sales.

F The company has determined that the current level of inventory is too low. They would like to hold $ thousand in inventory.

G Accounts payable should scale with sales.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started