Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CREATE A CONCLUSION AND RECOMMENDATION In a separate paragraph for each. See attached file for data RVRCOB Holdings Inc The RVRCOB Holdings is a conglomerate

CREATE A CONCLUSION AND RECOMMENDATION In a separate paragraph for each. See attached file for data

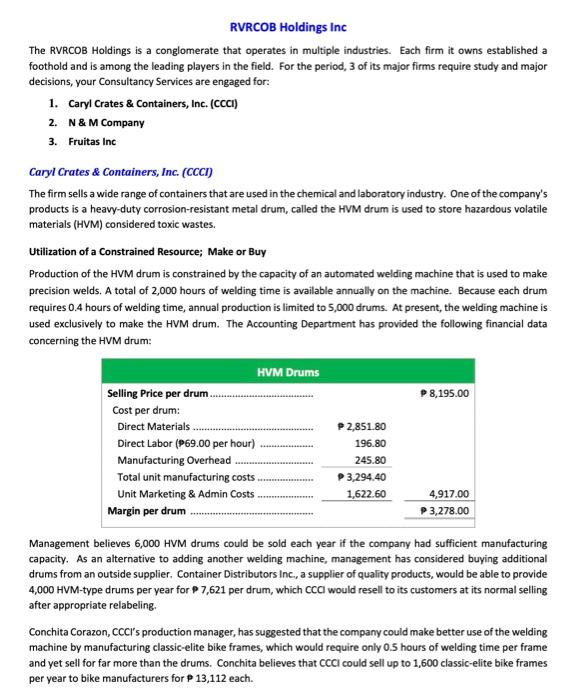

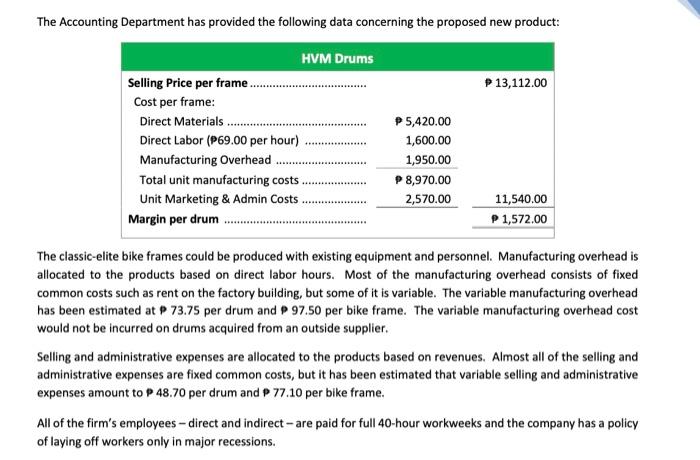

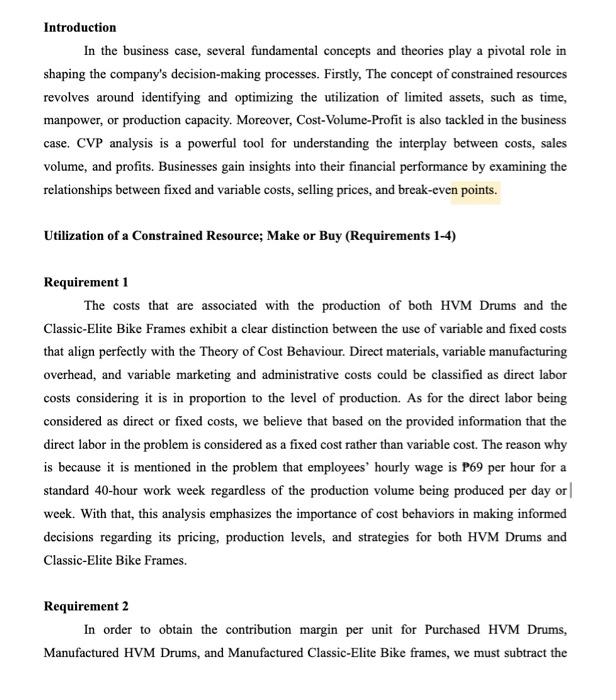

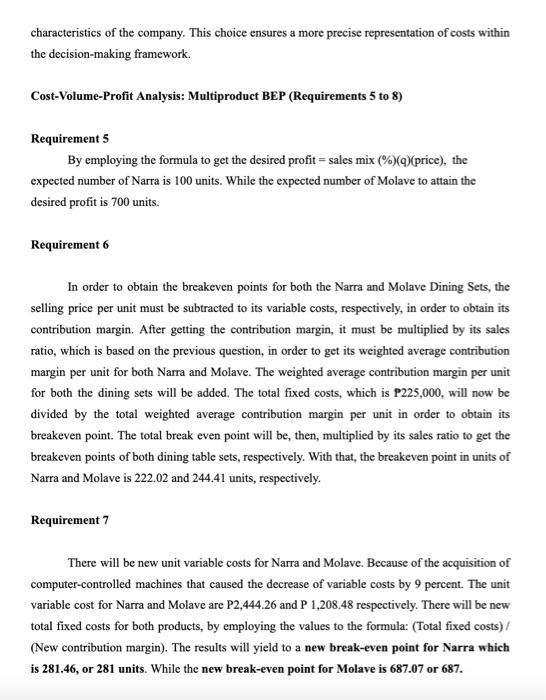

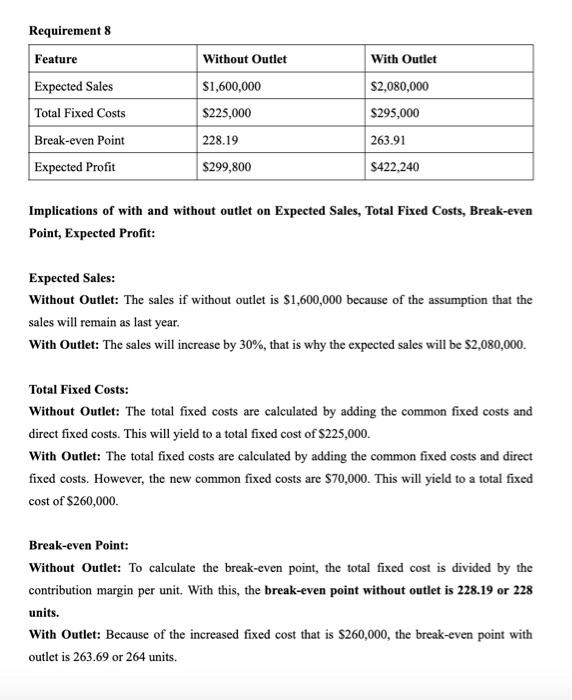

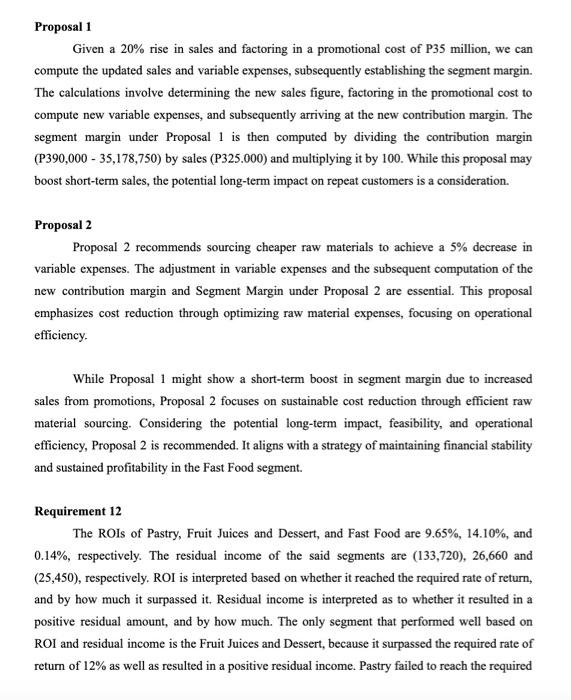

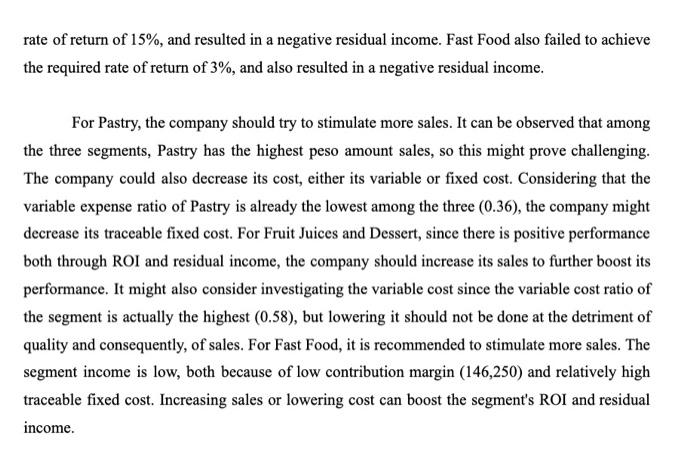

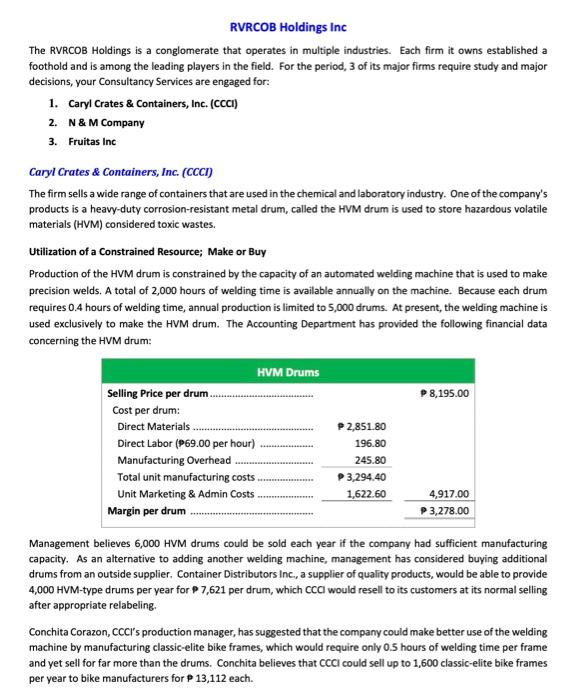

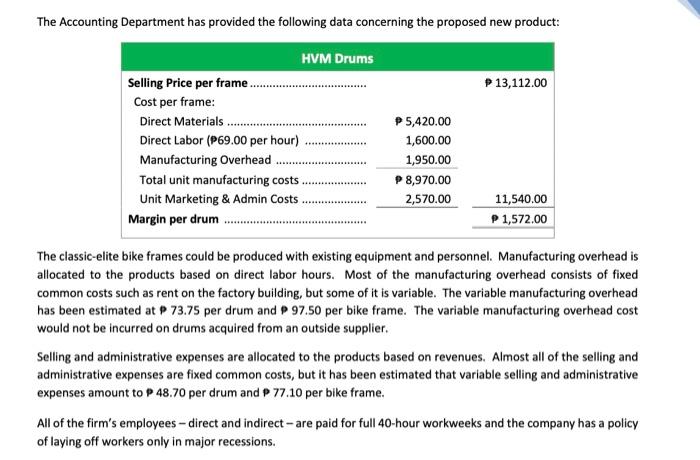

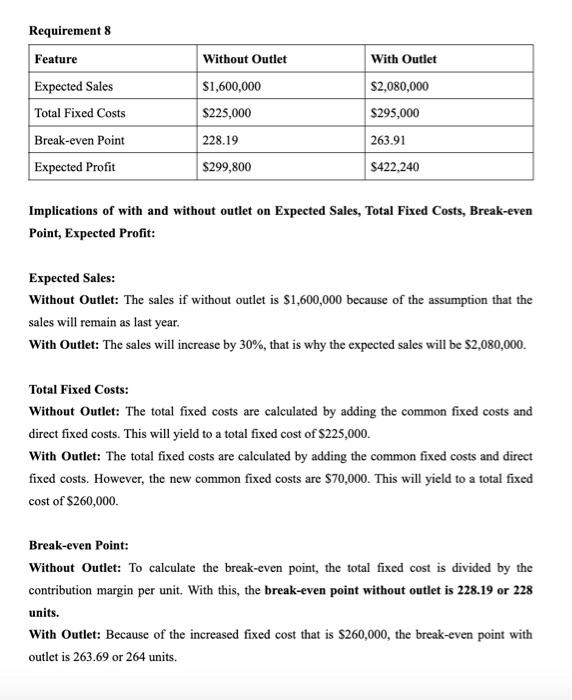

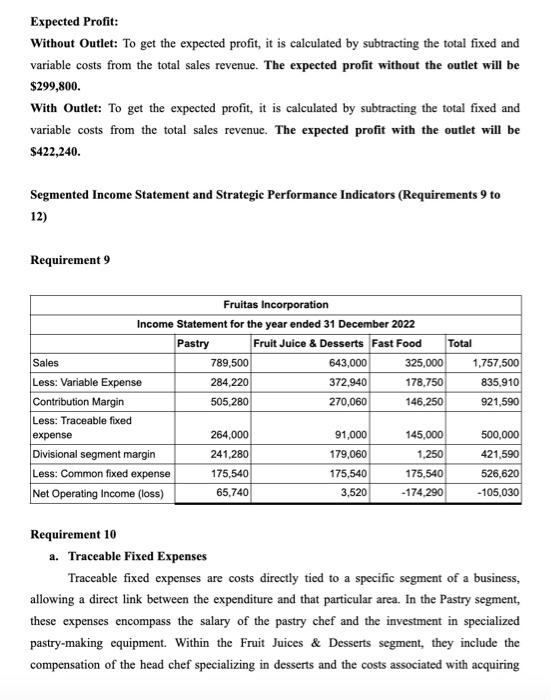

RVRCOB Holdings Inc The RVRCOB Holdings is a conglomerate that operates in multiple industries. Each firm it owns established a foothold and is among the leading players in the field. For the period, 3 of its major firms require study and major decisions, your Consultancy Services are engaged for: 1. Caryl Crates \& Containers, Inc. (CCCI) 2. N \& M Company 3. Fruitas Inc Caryl Crates \& Containers, Inc. (CCCI) The firm sells a wide range of containers that are used in the chemical and laboratory industry. One of the company's products is a heavy-duty corrosion-resistant metal drum, called the HVM drum is used to store hazardous volatile materials (HVM) considered toxic wastes. Utilization of a Constrained Resource; Make or Buy Production of the HVM drum is constrained by the capacity of an automated welding machine that is used to make precision welds. A total of 2,000 hours of welding time is available annually on the machine. Because each drum requires 0.4 hours of welding time, annual production is limited to 5,000 drums. At present, the welding machine is used exclusively to make the HVM drum. The Accounting Department has provided the following financial data concerning the HVM drum: Management believes 6,000 HVM drums could be sold each year if the company had sufficient manufacturing capacity. As an alternative to adding another welding machine, management has considered buying additional drums from an outside supplier. Container Distributors Inc, a supplier of quality products, would be able to provide 4,000 HVM-type drums per year for 7,621 per drum, which CCCl would resell to its customers at its normal selling after appropriate relabeling. Conchita Corazon, CCCl production manager, has suggested that the company could make better use of the welding machine by manufacturing classic-elite bike frames, which would require only 0.5 hours of welding time per frame and yet sell for far more than the drums. Conchita believes that cCCl could sell up to 1,600 classic-elite bike frames per year to bike manufacturers for P13,112 each. The Accounting Department has provided the following data concerning the proposed new product: The classic-elite bike frames could be produced with existing equipment and personnel. Manufacturing overhead is allocated to the products based on direct labor hours. Most of the manufacturing overhead consists of fixed common costs such as rent on the factory building, but some of it is variable. The variable manufacturing overhead has been estimated at P73.75 per drum and 997.50 per bike frame. The variable manufacturing overhead cost would not be incurred on drums acquired from an outside supplier. Selling and administrative expenses are allocated to the products based on revenues. Almost all of the selling and administrative expenses are fixed common costs, but it has been estimated that variable selling and administrative expenses amount to P48.70 per drum and P77.10 per bike frame. All of the firm's employees - direct and indirect - are paid for full 40-hour workweeks and the company has a policy of laying off workers only in major recessions. Introduction In the business case, several fundamental concepts and theories play a pivotal role in shaping the company's decision-making processes. Firstly, The concept of constrained resources revolves around identifying and optimizing the utilization of limited assets, such as time, manpower, or production capacity. Moreover, Cost-Volume-Profit is also tackled in the business case. CVP analysis is a powerful tool for understanding the interplay between costs, sales volume, and profits. Businesses gain insights into their financial performance by examining the relationships between fixed and variable costs, selling prices, and break-even points. Utilization of a Constrained Resource; Make or Buy (Requirements 1-4) Requirement 1 The costs that are associated with the production of both HVM Drums and the Classic-Elite Bike Frames exhibit a clear distinction between the use of variable and fixed costs that align perfectly with the Theory of Cost Behaviour. Direct materials, variable manufacturing overhead, and variable marketing and administrative costs could be classified as direct labor costs considering it is in proportion to the level of production. As for the direct labor being considered as direct or fixed costs, we believe that based on the provided information that the direct labor in the problem is considered as a fixed cost rather than variable cost. The reason why is because it is mentioned in the problem that employees' hourly wage is P69 per hour for a standard 40-hour work week regardless of the production volume being produced per day or week. With that, this analysis emphasizes the importance of cost behaviors in making informed decisions regarding its pricing, production levels, and strategies for both HVM Drums and Classic-Elite Bike Frames. Requirement 2 In order to obtain the contribution margin per unit for Purchased HVM Drums, Manufactured HVM Drums, and Manufactured Classic-Elite Bike frames, we must subtract the selling price of each mentioned to its variable costs, respectively. To begin with the Purchased HVM Drums, we must subtract the selling price to its variable costs, which is the purchase price and the variable marketing and administrative costs of it. With that, the contribution margin for the Purchased HVM Drums is P525.30. As for the Manufactured HVM Drums and Manufactured Classic-Elite Bike Frames, we must also subtract its selling price to its variable costs, which are the direct materials, the direct labor, the variable manufacturing overhead and the variable marketing and administrative costs, respectively. This comes out to P5,023.95 and P5,917.4 as their contribution margin, respectively. Requirement 3 In this scenario, Conchita Corazon Container Distributors Inc. (CCCl) faces a challenge due to the limitations of its welding machine. They produce HVM drums but are exploring options for a new product, classic-elite bike frames. The goal is to find the best plan that maximizes net operating income. Currently, the welding machine can produce 5,000HVM drums annually, yielding a margin of P3,278.00 per drum. Another option is to purchase 4,000 HVM drums from Container Distributors Inc. (CDI) at P7,621 each. Additionally, manufacturing bike frames is suggested, with a selling price of P13,112.00 and a margin of P1,572.00 per frame, requiring 0.5 hours of welding time. The decision involves considering variable overhead, selling/admin expenses, and assessing the welding machine's capacity. The optimal strategy should maximize contribution margin while staying within capacity constraints, potentially involving a combination of HVM drum production, purchasing drums, and manufacturing bike frames. To determine the increase in net operating income, a detailed analysis of costs, revenues, and capacity constraints is crucial for a strategic plan aligned with maximizing profitability. Requirement 4 Caryl Crates \& Containers, Inc. (CCCI) is currently confronted with a decision centered around the utilization of a constrained resource - specifically, an automated welding machine. The appropriate classification of direct labor as either variable or fixed is contingent upon the unique circumstances of Caryl Crates \& Containers, Inc. (CCCI). Nevertheless, opting to treat direct labor as a fixed cost for both products seems to better align with the operational characteristics of the company. This choice ensures a more precise representation of costs within the decision-making framework. Cost-Volume-Profit Analysis: Multiproduct BEP (Requirements 5 to 8) Requirement 5 By employing the formula to get the desired profit = sales mix (%)(q)( price ), the expected number of Narra is 100 units. While the expected number of Molave to attain the desired profit is 700 units. Requirement 6 In order to obtain the breakeven points for both the Narra and Molave Dining Sets, the selling price per unit must be subtracted to its variable costs, respectively, in order to obtain its contribution margin. After getting the contribution margin, it must be multiplied by its sales ratio, which is based on the previous question, in order to get its weighted average contribution margin per unit for both Narra and Molave. The weighted average contribution margin per unit for both the dining sets will be added. The total fixed costs, which is P225,000, will now be divided by the total weighted average contribution margin per unit in order to obtain its breakeven point. The total break even point will be, then, multiplied by its sales ratio to get the breakeven points of both dining table sets, respectively. With that, the breakeven point in units of Narra and Molave is 222.02 and 244.41 units, respectively. Requirement 7 There will be new unit variable costs for Narra and Molave. Because of the acquisition of computer-controlled machines that caused the decrease of variable costs by 9 percent. The unit variable cost for Narra and Molave are P2,444.26 and P 1,208.48 respectively. There will be new total fixed costs for both products, by employing the values to the formula: (Total fixed costs)/ (New contribution margin). The results will yield to a new break-even point for Narra which is 281.46, or 281 units. While the new break-even point for Molave is 687.07 or 687 . Requirement 8 Implications of with and without outlet on Expected Sales, Total Fixed Costs, Break-even Point, Expected Profit: Expected Sales: Without Outlet: The sales if without outlet is $1,600,000 because of the assumption that the sales will remain as last year. With Outlet: The sales will increase by 30%, that is why the expected sales will be $2,080,000. Total Fixed Costs: Without Outlet: The total fixed costs are calculated by adding the common fixed costs and direct fixed costs. This will yield to a total fixed cost of $225,000. With Outlet: The total fixed costs are calculated by adding the common fixed costs and direct fixed costs. However, the new common fixed costs are $70,000. This will yield to a total fixed cost of $260,000. Break-even Point: Without Outlet: To calculate the break-even point, the total fixed cost is divided by the contribution margin per unit. With this, the break-even point without outlet is 228.19 or 228 units. With Outlet: Because of the increased fixed cost that is $260,000, the break-even point with outlet is 263.69 or 264 units. Expected Profit: Without Outlet: To get the expected profit, it is calculated by subtracting the total fixed and variable costs from the total sales revenue. The expected profit without the outlet will be $299,800. With Outlet: To get the expected profit, it is calculated by subtracting the total fixed and variable costs from the total sales revenue. The expected profit with the outlet will be $422,240. Segmented Income Statement and Strategic Performance Indicators (Requirements 9 to 12) Requirement 9 Requirement 10 a. Traceable Fixed Expenses Traceable fixed expenses are costs directly tied to a specific segment of a business, allowing a direct link between the expenditure and that particular area. In the Pastry segment, these expenses encompass the salary of the pastry chef and the investment in specialized pastry-making equipment. Within the Fruit Juices \& Desserts segment, they include the compensation of the head chef specializing in desserts and the costs associated with acquiring specialized equipment for crafting fruit-based desserts. Similarly, in the Fast Food segment, traceable fixed expenses comprise the salary of the head chef oversecing fast food items and the specific equipment costs essential for efficient fast-food preparation. These expenses highlight the unique and segment-specific investments required for each area of the business. b. Common Fixed Expenses Common fixed expenses are those incurred for the general operation of the entire company and cannot be directly attributed to any specific segment. Examples include expenses such as rent for shared spaces that serve multiple segments, salaries of employees working across various areas like administrative staff, and general utilities necessary for overall business operations. Unlike traceable fixed expenses tied to specific segments, these costs contribute to the company's holistic functioning, benefiting the organization as a whole rather than being exclusive to any particular segment. c. Product Line Margin The product line margin is the difference between sales and variable expenses for each segment. Pastry: P789,500 (Sales) - P284,220 (Variable Expenses) = P505,280 Fruit Juices and Desserts: P643,000 (Sales) - P372,940 (Variable Expenses) = P270,060 Fast Food: P325,000 (Sales) - P178,750 (Variable Expenses) = P146,250 d. Company-Wide Net Operating Income The company-wide net operating income is the sum of the product line margins minus the common fixed expenses. Company-Wide Net Operating Income =(P505,280+P270,060+P146,250)P175,540 (Common Fixed Expenses) =P921,560P175,540=P746,050 Requirement 11 The current financial performance of Fruitas Inc.'s Fast Food segment reveals sales of P325,000 with variable expenses amounting to P178,750. This results in a contribution margin that forms the basis for calculating the existing segment margin. The traceable fixed expenses for the Fast Food segment stand at P145,000. Proposal 1 Given a 20% rise in sales and factoring in a promotional cost of P35 million, we can compute the updated sales and variable expenses, subsequently establishing the segment margin. The calculations involve determining the new sales figure, factoring in the promotional cost to compute new variable expenses, and subsequently arriving at the new contribution margin. The segment margin under Proposal 1 is then computed by dividing the contribution margin (P390,000 - 35,178,750) by sales ( P325.000) and multiplying it by 100 . While this proposal may boost short-term sales, the potential long-term impact on repeat customers is a consideration. Proposal 2 Proposal 2 recommends sourcing cheaper raw materials to achieve a 5% decrease in variable expenses. The adjustment in variable expenses and the subsequent computation of the new contribution margin and Segment Margin under Proposal 2 are essential. This proposal emphasizes cost reduction through optimizing raw material expenses, focusing on operational efficiency. While Proposal 1 might show a short-term boost in segment margin due to increased sales from promotions, Proposal 2 focuses on sustainable cost reduction through efficient raw material sourcing. Considering the potential long-term impact, feasibility, and operational efficiency, Proposal 2 is recommended. It aligns with a strategy of maintaining financial stability and sustained profitability in the Fast Food segment. Requirement 12 The ROIs of Pastry, Fruit Juices and Dessert, and Fast Food are 9.65\%, 14.10\%, and 0.14%, respectively. The residual income of the said segments are (133,720),26,660 and (25,450), respectively. ROI is interpreted based on whether it reached the required rate of return, and by how much it surpassed it. Residual income is interpreted as to whether it resulted in a positive residual amount, and by how much. The only segment that performed well based on ROI and residual income is the Fruit Juices and Dessert, because it surpassed the required rate of return of 12% as well as resulted in a positive residual income. Pastry failed to reach the required rate of return of 15%, and resulted in a negative residual income. Fast Food also failed to achieve the required rate of return of 3%, and also resulted in a negative residual income. For Pastry, the company should try to stimulate more sales. It can be observed that among the three segments, Pastry has the highest peso amount sales, so this might prove challenging. The company could also decrease its cost, either its variable or fixed cost. Considering that the variable expense ratio of Pastry is already the lowest among the three (0.36), the company might decrease its traceable fixed cost. For Fruit Juices and Dessert, since there is positive performance both through ROI and residual income, the company should increase its sales to further boost its performance. It might also consider investigating the variable cost since the variable cost ratio of the segment is actually the highest (0.58), but lowering it should not be done at the detriment of quality and consequently, of sales. For Fast Food, it is recommended to stimulate more sales. The segment income is low, both because of low contribution margin (146,250) and relatively high traceable fixed cost. Increasing sales or lowering cost can boost the segment's ROI and residual income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started