Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create a financial analysis that include the Net Present Value (NPV) or internal rate of return (IRR) Assumptions Regardless of the tool you choose, your

Create a financial analysis that include the Net Present Value (NPV) or internal rate of return (IRR)

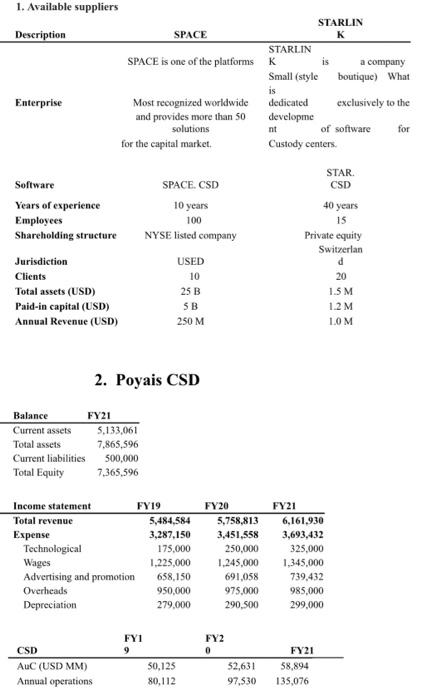

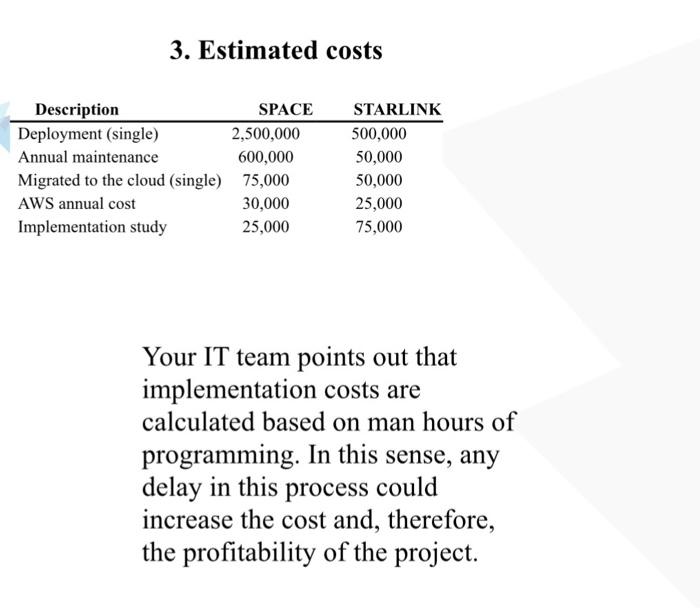

1. Available suppliers 2. Poyais CSD 3. Estimated costs Your IT team points out that implementation costs are calculated based on man hours of programming. In this sense, any delay in this process could increase the cost and, therefore, the profitability of the project Assumptions

Regardless of the tool you choose, your IT team estimates that it will be necessary to migrate custody software to the cloud. This is expected to reduce technology costs by $30,000 per year.

Prior to making a decision, it was instructed to carry out the implementation study of both tools; That is, this study must be paid regardless of the decision made by the company.

Your IT team estimates that each tool could be implemented in about 12 months.

Your sales team estimates that with the purchase of SPACE. CSD could increase revenue by 1.5% per year. On the other hand, it estimates a growth of 0.7% per year if STAR is purchased. CSD.

The company uses a straight-line depreciation system and estimates a useful life of 10 years for each software.

The annual maintenance of each software is adjusted based on an expected inflation of 2%.

It assumes a WACC of 10%.

ISR of 25%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started