Create a general journal the following:

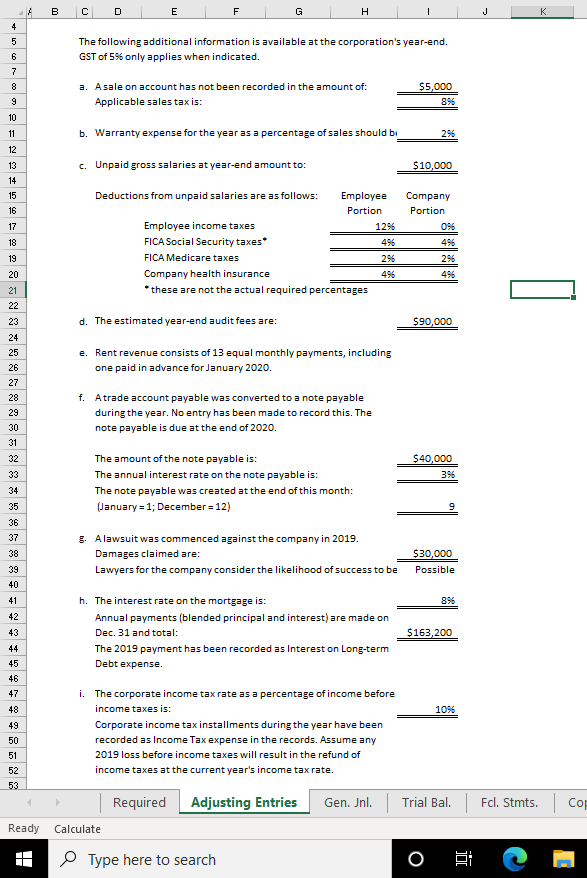

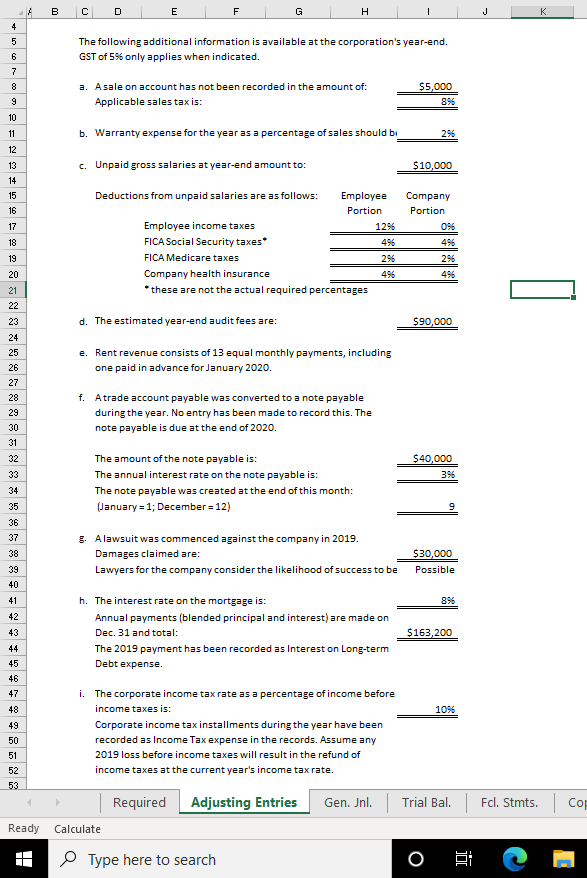

4 B D E F G H | J 4 5 6 7 The following additional information is available at the corporation's year-end. GST of 5% only applies when indicated. 8 a. A sale on account has not been recorded in the amount of: Applicable sales tax is: $5,000 896 9 10 11 b. Warranty expense for the year as a percentage of sales should by 296 c. Unpaid gross salaries at year-end amount to: $10,000 12 13 14 15 16 17 Deductions from unpaid salaries are as follows: Employee Portion Employee income taxes 1296 FICA Social Security taxes* 496 FICA Medicare taxes 296 Company health insurance 496 *these are not the actual required percentages Company Portion 096 496 296 496 18 19 20 21 22 d. The estimated year-end audit fees are: $90,000 23 24 25 e. Rent revenue consists of 13 equal monthly payments, including one paid in advance for January 2020. f. Atrade account payable was converted to a note payable during the year. No entry has been made to record this. The note payable is due at the end of 2020. $40,000 396 The amount of the note payable is: The annual interest rate on the note payable is: The note payable was created at the end of this month: (January = 1; December = 12) 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 3. Alawsuit was commenced against the company in 2019. Damages claimed are: Lawyers for the company consider the likelihood of success to be $30,000 Possible 896 h. The interest rate on the mortgage is: Annual payments (blended principal and interest) are made on Dec. 31 and total: The 2019 payment has been recorded as Interest on Long-term Debt expense. $ 163,200 48 1096 49 50 51 52 53 i. The corporate income tax rate as a percentage of income before income taxes is: Corporate income tax installments during the year have been recorded as Income Tax expense in the records. Assume any 2019 loss before income taxes will result in the refund of income taxes at the current year's income tax rate. Required Adjusting Entries Gen. Jnl. Trial Bal. Fcl. Stmts. COF Ready Calculate Type here to search gi 4 B D E F G H | J 4 5 6 7 The following additional information is available at the corporation's year-end. GST of 5% only applies when indicated. 8 a. A sale on account has not been recorded in the amount of: Applicable sales tax is: $5,000 896 9 10 11 b. Warranty expense for the year as a percentage of sales should by 296 c. Unpaid gross salaries at year-end amount to: $10,000 12 13 14 15 16 17 Deductions from unpaid salaries are as follows: Employee Portion Employee income taxes 1296 FICA Social Security taxes* 496 FICA Medicare taxes 296 Company health insurance 496 *these are not the actual required percentages Company Portion 096 496 296 496 18 19 20 21 22 d. The estimated year-end audit fees are: $90,000 23 24 25 e. Rent revenue consists of 13 equal monthly payments, including one paid in advance for January 2020. f. Atrade account payable was converted to a note payable during the year. No entry has been made to record this. The note payable is due at the end of 2020. $40,000 396 The amount of the note payable is: The annual interest rate on the note payable is: The note payable was created at the end of this month: (January = 1; December = 12) 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 3. Alawsuit was commenced against the company in 2019. Damages claimed are: Lawyers for the company consider the likelihood of success to be $30,000 Possible 896 h. The interest rate on the mortgage is: Annual payments (blended principal and interest) are made on Dec. 31 and total: The 2019 payment has been recorded as Interest on Long-term Debt expense. $ 163,200 48 1096 49 50 51 52 53 i. The corporate income tax rate as a percentage of income before income taxes is: Corporate income tax installments during the year have been recorded as Income Tax expense in the records. Assume any 2019 loss before income taxes will result in the refund of income taxes at the current year's income tax rate. Required Adjusting Entries Gen. Jnl. Trial Bal. Fcl. Stmts. COF Ready Calculate Type here to search gi