Create a horizontal and Vertical analysis based on the provided information below. Thank you so much for your help I really appreciate it!

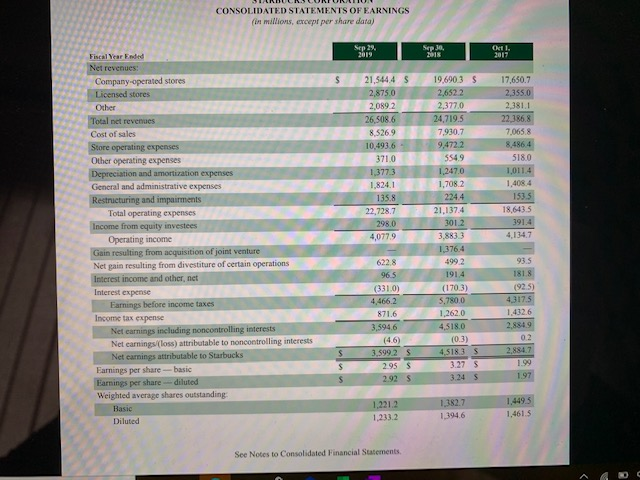

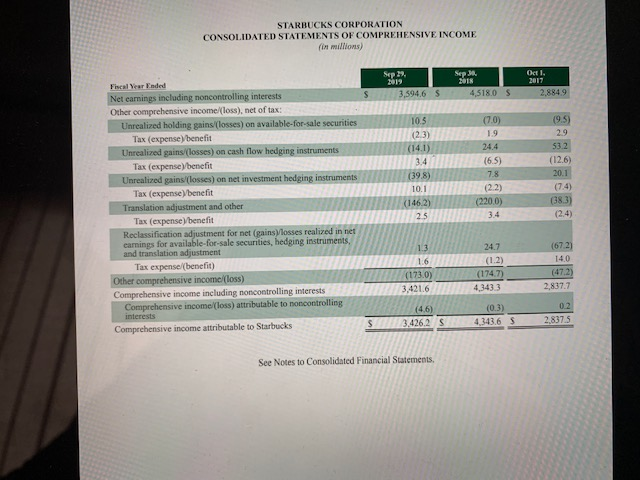

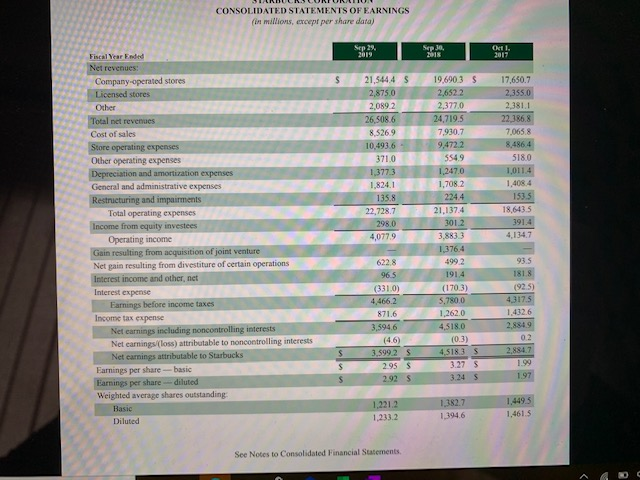

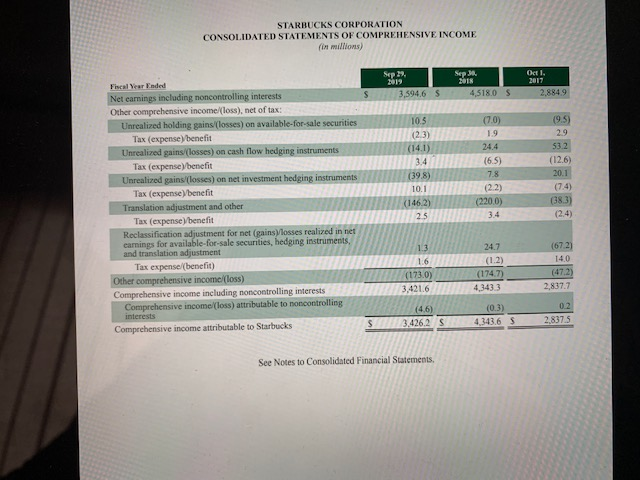

CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data) Sep 29, 2019 Sep 30, 2018 Chil 2017 $ Fiscal Year Ended Net revenues Company operated stores Licensed stores Other Total net revenues Cost of sales Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other net Interest expense Earnings before income taxes Income tax expense Net earnings including noncontrolling interests Net earnings (loss) attributable to noncontrolling interests Net camnings attributable to Starbucks Famnings per share-basic Earnings per share-diluted Weighted average shares outstanding Basic Diluted 21,544.4 $ 2,875.0 2,089 2 26,508 6 8,526,9 10.493.6 3710 1,377.3 1,824.1 135.8 22,728.7 298.0 4,077.9 19,690.3 $ 2,6522 2,377.0 24,719 5 7,930.7 9,4722 5549 1.247.0 1.7082 224.4 21.137.4 3012 3,8833 1,376,4 4992 1914 (1703) 5,7800 1.262.0 4,518.0 (0.3) 4.51835 3.27 $ 3.24 5 17.650.7 2,355.0 2,381.1 22.386.8 7.065.8 8.486.4 518.0 1,011.4 1,408,4 153.5 18.643.5 391.4 4.134.7 6228 96.5 (3310) 4,466.2 871.6 3,594.6 (4.6) 3,599.25 2.95$ 2.92 s 93.5 1818 (925) 4317.5 1.432.6 2.884.9 02 2,884.7 1.99 1.97 $ S $ 1.221.2 1,233.2 1.382.7 1,394,6 1,4493 1,4615 See Notes to Consolidated Financial Statements STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Sep. Sep 29 2019 3,594,6 S Okt 1. 2017 2,8849 $ 4,518,0 s Fiscal Year Faded Net earnings including noncontrolling interests Other comprehensive income/loss), net of tax: Unrealized holding gains (losses) on available for sale securities Tax (expense) benefit Unrealized gains/(losses) on cash flow hedging instruments Tax (expense)/benefit Unrealized gains (losses) on net investment hedging instruments Tax (expense) benefit Translation adjustment and other Tax (expense benefit Reclassification adjustment for net (gainslosses realized in net earnings for available for sale securities, hedging instruments, and translation adjustment Tax expense (benefit Other comprehensive income/loss) Comprehensive income including noncontrolling interests Comprehensive income (loss) attributable to noncontrolling interests Comprehensive income attributable to Starbucks 105 (23) (14.1) 3.4 (39.8) 10.1 (1462) 25 (7.0) 1.9 24.4 (65) 7.8 (2.2) (2200) 3.4 (9.5) 29 53.2 (12.6) 20.1 (74) (383) (2.4) 1.3 1.6 (173.0) 3,4216 247 (1.2) (1747) 4,343 3 (672) 14.0 (472) 2,837.7 02 (4.6) $3,426.2 S (0.3) 4.3436 S 2.837.5 See Notes to Consolidated Financial Statements