Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create a payoff-profit table for a Written Strangle on LUV stock. For the table, use spot prices in 6-months from 50 to 70 in increments

Create a payoff-profit table for a Written Strangle on LUV stock. For the table, use spot prices in 6-months from 50 to 70 in increments of 2.

Create a payoff-profit table for a Written Strangle on LUV stock. For the table, use spot prices in 6-months from 50 to 70 in increments of 2.

b. What is the maximum risk of this position?

c. What is the maximum reward of this position?

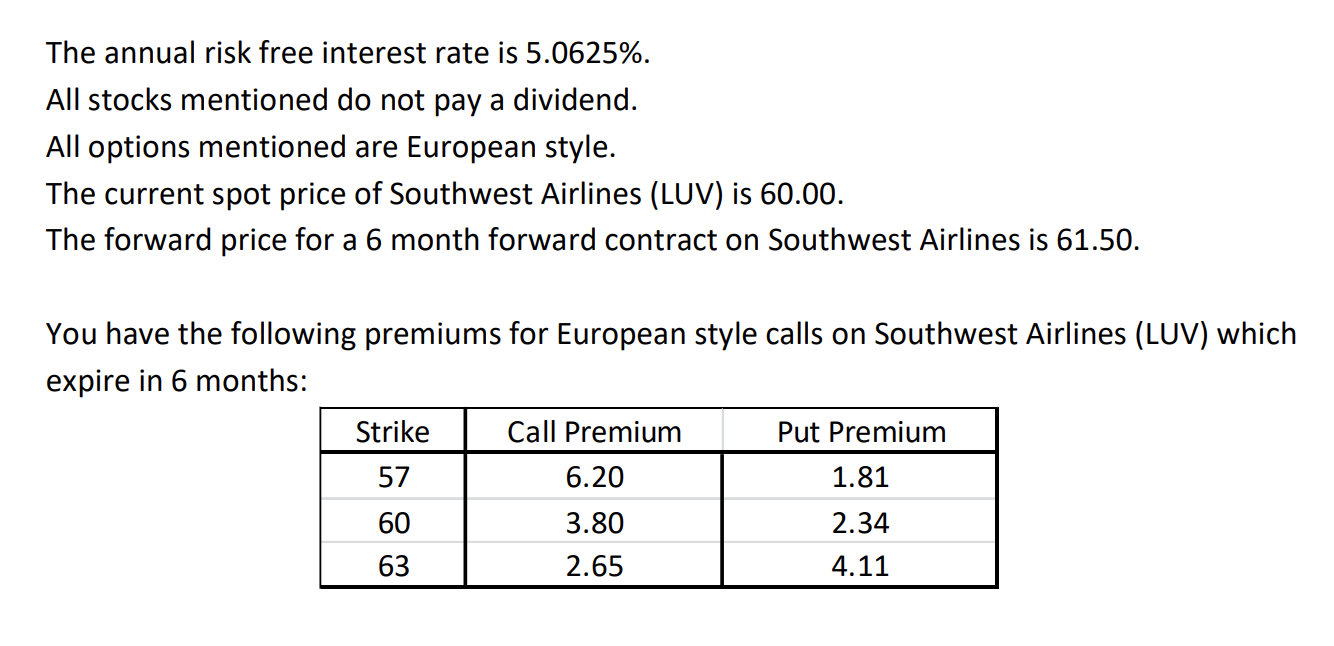

The annual risk free interest rate is 5.0625%. All stocks mentioned do not pay a dividend. All options mentioned are European style. The current spot price of Southwest Airlines (LUV) is 60.00. The forward price for a 6 month forward contract on Southwest Airlines is 61.50. You have the following premiums for European style calls on Southwest Airlines (LUV) which expire in 6 months: Strike Call Premium Put Premium 57 6.20 1.81 60 3.80 2.34 63 2.65 4.11 The annual risk free interest rate is 5.0625%. All stocks mentioned do not pay a dividend. All options mentioned are European style. The current spot price of Southwest Airlines (LUV) is 60.00. The forward price for a 6 month forward contract on Southwest Airlines is 61.50. You have the following premiums for European style calls on Southwest Airlines (LUV) which expire in 6 months: Strike Call Premium Put Premium 57 6.20 1.81 60 3.80 2.34 63 2.65 4.11Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started