Question

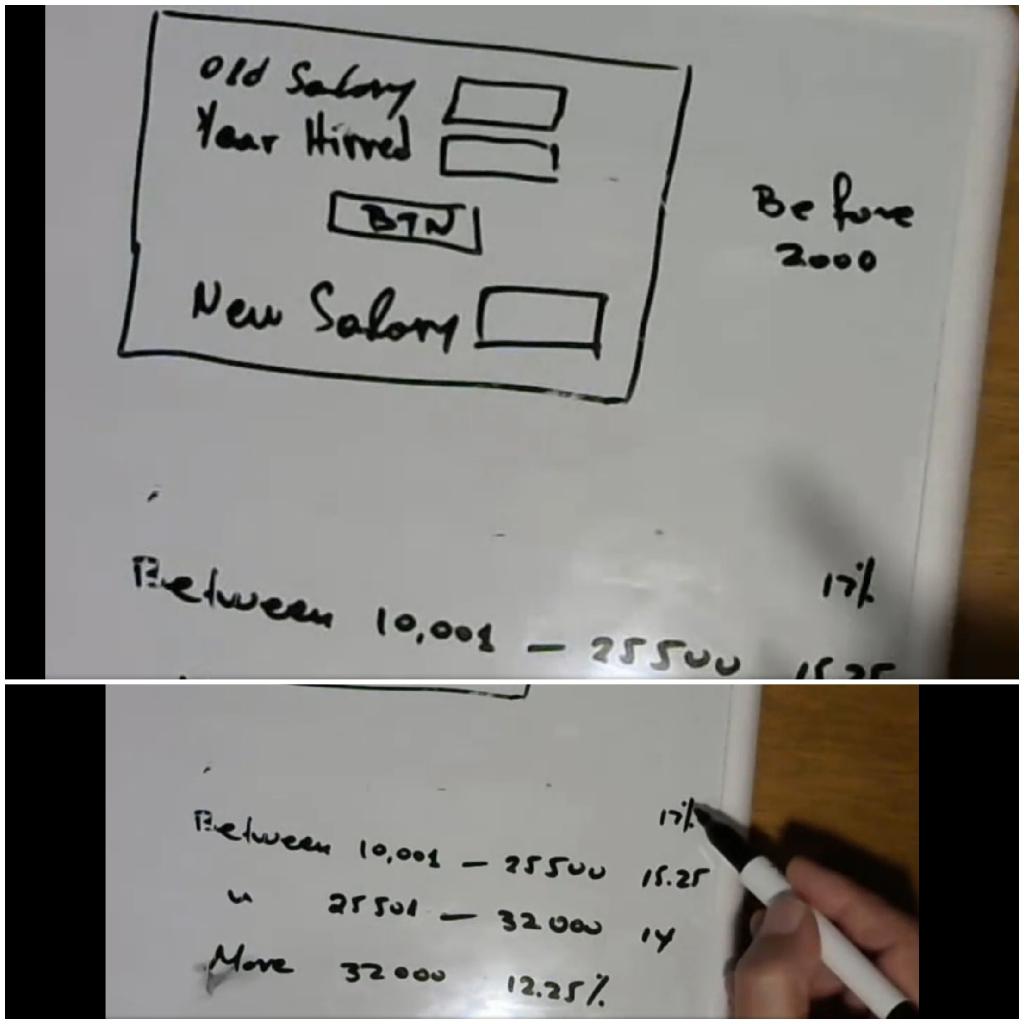

create a programming code in visual studio2017 the old salary but also the year you were hired if you were hired before 2000 if you

create a programming code in visual studio2017 the old salary but also the year you were hired if you were hired before 2000 if you were hired before 2000 the increase is 17 percent so if I was higher the same in my salary is between 25000 and 32,000 is 14% but if I if this is my salary and I was hired before the 2000 goes this number goes up by 1% so all these numbers may go up by 1% based on the year you were hired so if you were hired before the 2000 this numbers every one of these numbers should go up by 1% the interface we add an extra box for the record the year that the employee was hired if the employee was hired before 2000 so even employers here 1987 for example then his or her salary will go up Class 1 of this number spending on them value of salary so if that person was hired before 2000 and his salary for his salary is more than 32 that would be 13.25 so it will be plus 1% so that as well plus 1% here it is if last 1% of these numbers if you were hired prior to 2000

Year Hired Before 2.. New Salory Between 10,008 Between 10,001 - 25500 18.25 25 Sol - 3200 ry 12.257 More 32.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started