Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a company purchases employers liability insurance to insure against accidents in the workplace. The probability of an accident occurring is 0.02. The insurance

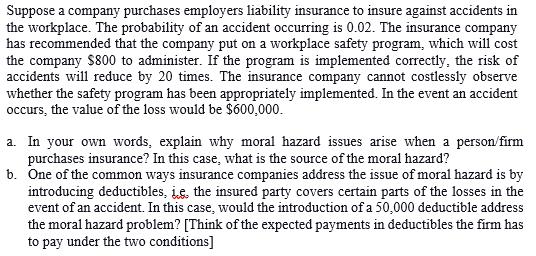

Suppose a company purchases employers liability insurance to insure against accidents in the workplace. The probability of an accident occurring is 0.02. The insurance company has recommended that the company put on a workplace safety program, which will cost the company $800 to administer. If the program is implemented correctly, the risk of accidents will reduce by 20 times. The insurance company cannot costlessly observe whether the safety program has been appropriately implemented. In the event an accident occurs, the value of the loss would be $600,000. a. In your own words, explain why moral hazard issues arise when a person/firm purchases insurance? In this case, what is the source of the moral hazard? b. One of the common ways insurance companies address the issue of moral hazard is by introducing deductibles, ie, the insured party covers certain parts of the losses in the event of an accident. In this case, would the introduction of a 50,000 deductible address the moral hazard problem? [Think of the expected payments in deductibles the firm has to pay under the two conditions]

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Moral hazard arises when a person or firm purchases insurance and is no longer as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started