Create a statement based on the informaton provided below using hystorical, trend, ratio data, and current/future economic projects as well as information from the companys MD&A to aid in preparing projections.

- Clearly state your assumptions in a text box at the bottom of each tab. Cite sources for assumptions based on research.

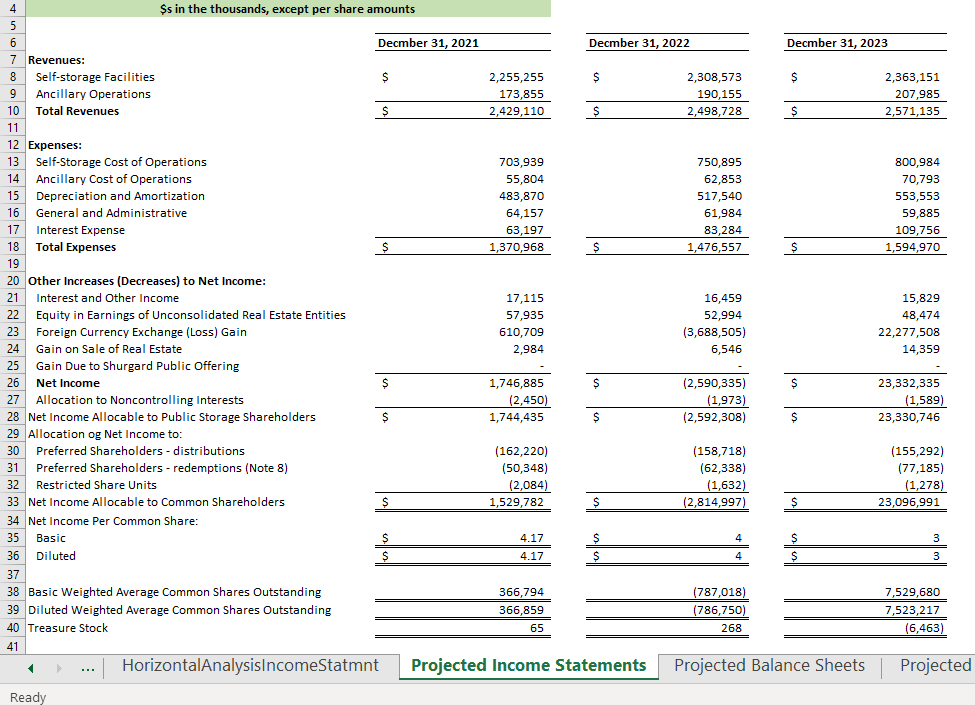

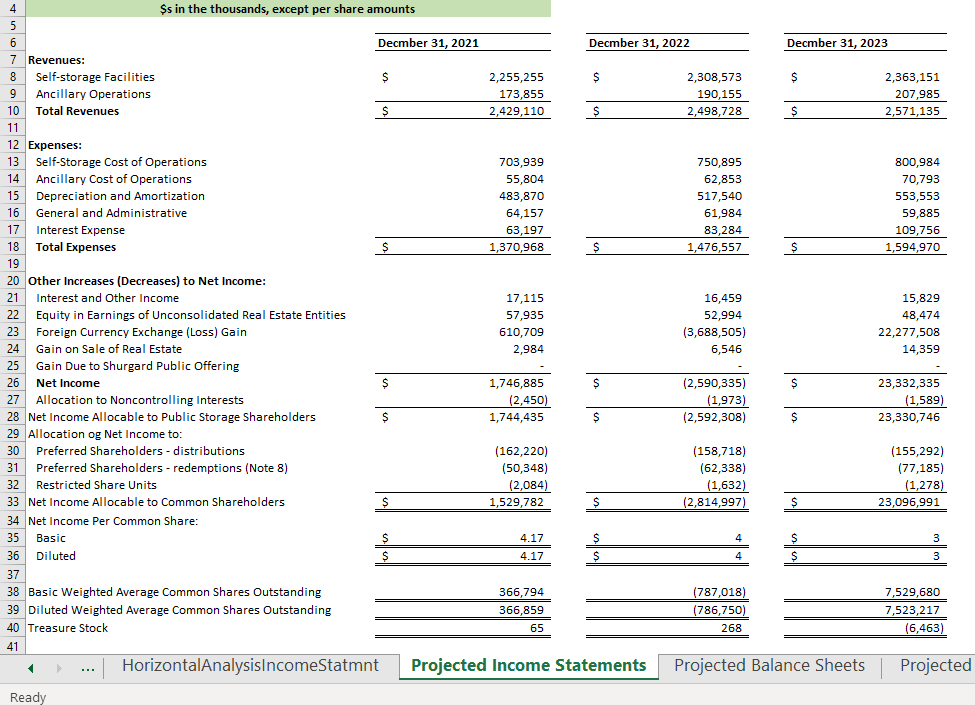

ITEM 7. Managements Discussion and Analysis of Financial Condition and Results of Operations Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A) should be read in conjunction with our financial statements and notes thereto. Critical Accounting Policies Our MD&A discusses our financial statements, which have been prepared in accordance with United States ("U.S.") generally accepted accounting principles ("GAAP"), and are affected by our judgments, assumptions and estimates. The notes to our December 31, 2018 financial statements, primarily Note 2, summarize our significant accounting policies. We believe the following are our critical accounting policies, because they have a material impact on the portrayal of our financial condition and results, and they require us to make judgments and estimates about matters that are inherently uncertain Income Tax Expense: We have elected to be treated as a REIT, as defined in the Internal Revenue Code of 1986, as amended (the "Code). As a REIT, we do not incur federal income tax on our REIT taxable income that is fully distributed each year (for this purpose, certain distributions paid in a subsequent year may be considered), and if we meet certain organizational and operational rules. We believe we have met these REIT requirements for all periods presented herein. Accordingly, we have recorded no federal income tax expense related to our REIT taxable income. Our evaluation that we have met the REIT requirements could be incorrect, because compliance with the tax rules requires factual determinations, and circumstances we have not identified could result in noncompliance with the tax requirements in current or prior years. For any taxable year that we fail to qualify as a REIT and for which applicable statutory relief provisions did not apply, we would be taxed at the regular corporate rates on all of our taxable income for at least that year and the ensuing four years, we could be subject to penalties and interest, and our net income would be materially different from the amounts estimated in our financial statements. In addition, certain of our consolidated corporate subsidiaries have elected to be treated as "taxable REIT subsidiaries" for federal income tax purposes, which are taxable as regular corporations and subject to certain limitations on intercompany transactions. If tax authorities determine that amounts paid by our taxable REIT subsidiaries to us are not reasonable compared to similar arrangements among unrelated parties, we could be subject to a 100% penalty tax on the excess payments. Such a penalty tax could have a material adverse impact on our net income. Impairment of Long-Lived Assets: The analysis of impairment of our long-lived assets involves identification of indicators of impairment, projections of future operating cash flows, and estimates of fair values, all of which require significant judgment and subjectivity. Others could come to materially different conclusions. In addition, we may not have identified all current facts and circumstances that may affect impairment. Any unidentified impairment loss, or change in conclusions, could have a material adverse impact on our net income. Accrual for Uncertain and Contingent Liabilities: We accrue for certain contingent and other liabilities that have significant uncertain elements, such as property taxes, workers compensation claims, tenant reinsurance claims, as well as other legal claims and disputes involving customers, employees, governmental agencies and other third parties. We estimate such liabilities based upon many factors such as assumptions of past and future trends and our evaluation of likely outcomes. However, the estimates of known liabilities could be incorrect or we may not be aware of all such liabilities, in which case our accrued liabilities and net income could be misstated. Accounting for Acquired Real Estate Facilities: We estimate the fair values of the land, buildings and intangible assets acquired for purposes of allocating the purchase price. Such estimates are based upon many assumptions and judgments, including (1) market rates of return and capitalization rates on real estate and intangible assets, (11) building and material cost levels, (111) comparisons of the acquired underlying land parcels to recent land 25 transactions, and (iv) future cash flows from the real estate and the existing tenant base. Others could come to materially different conclusions as to the estimated fair values, which would result in different depreciation and amortization expense, gains and losses on sale of real estate assets, and real estate and intangible assets. Overview Our self-storage operations generate most of our net income, and we believe that our earnings growth is most impacted by the level of organic growth in our existing self-storage portfolio. Accordingly, a significant portion of management's time is devoted to maximizing cash flows from our existino self-storage facilities Our self-storage operations generate most of our net income, and we believe that our earnings growth is most impacted by the level of organic growth in our existing self-storage portfolio. Accordingly, a significant portion of management's time is devoted to maximizing cash flows from our existing self-storage facilities. Most of our facilities compete with other well-managed and well-located competitors and we are subject to general economic conditions, particularly those that affect the spending habits of consumers and moving trends. We believe that our centralized information networks, national telephone and online reservation system, the brand name Public Storage," and our economies of scale enable us to meet such challenges effectively. In the last three years, there has been a marked increase in development of new self-storage facilities in many of the markets we operate in, due to the favorable economics of development which we have also taken advantage of. These newly developed facilities compete with many of the facilities we own, negatively impacting our occupancies, rental rates, and rental growth. This increase in supply has been most notable in Atlanta, Austin, Charlotte, Chicago, Dallas, Denver, Houston, New York, and Portland. We plan on growing organically as well as through the acquisition and development of new facilities and expanding our existing self-storage facilities. Since the beginning of 2013 through December 31, 2018, we acquired a total of 296 facilities with 20.6 million net rentable square feet from third parties for approximately $2.7 billion, and we opened newly developed and expanded self-storage space for a total cost of $1.2 billion, adding approximately 11.3 million net rentable square feet Subsequent to December 31, 2018, we acquired or were under contract to acquire (subject to customary closing conditions) 14 self-storage facilities for $102.4 million. We will continue to seek to acquire properties; however, there is significant competition to acquire existing facilities and there can be no assurance as to the level of facilities we may acquire. As of December 31, 2018, we had additional development and redevelopment projects to build approximately 5.2 million net rentable square feet at a total cost of approximately $607.4 million. We expect to continue to seek additional development projects; however, the level of such activity may be limited due to various constraints such as difficulty in finding available sites that meet our risk-adjusted yield expectations, as well as challenges in obtaining building permits for self-storage activities in certain municipalities. We believe that our development and redevelopment activities are beneficial to our business over the long run. However, in the short run, such activities dilute our earnings due to the three to four year period that it takes to fill up newly developed and redeveloped storage facilities and reach a stabilized level of cash flows offset by the cost of capital to fund the cost, combined with related overhead expenses flowing through general and administrative expense. We believe the level of dilution incurred in 2018 will continue at similar levels in 2019 and beyond, assuming realization of our current expectation of maintaining our current level of development for the foreseeable future. On July 13, 2018, we received a cash distribution from Shurgard Self Storage SA ("Shurgard Europe) totaling $145.4 million. On September 18, 2017, we completed a public offering of $1.0 billion in aggregate principal amount of unsecured notes in two equal tranches (collectively, the "U.S. Dollar Notes"), one maturing in September 2022 bearing interest at 2.370%, and another maturing in September 2027 bearing interest at 3.094%. This was our first public offering of debt, which should also serve to facilitate future offerings. 26 On October 15, 2018, Shurgard Europe completed an initial global offering (the "Offering) of its common shares, and its shares commenced trading on Euronext Brussels under the "SHUR symbol. In the Offering, Shurgard Europe issued 25.0 million of its common shares to third parties at a price of 23 per share, for 575 million in gross proceeds. The gross proceeds were used to repay short-term borrowings, invest in real estate assets, and for other corporate purposes. Our equity interest, comprised of a direct and indirect pro-rata ownership interest in 31.3 million shares, decreased from 49% to 35.2% as a result of the Offering. While we did not sell any of our shares in the Offering, we did record a gain on disposition in 2018 of $151.6 million, as if we had sold a proportionate share of our investment in Shurgard Europe. See Investment in Shurgard Europe" below for more information. On October 18, 2018, we sold our property in West London to Shurgard Europe for $42.1 million and recorded a related gain on sale of real estate of approximately $31.5 million. As of December 31, 2018, our capital resources over the next year are expected to be approximately $1.1 billion which exceeds our current planned capital needs over the next year of approximately $711.4 million. Our capital resources include: (1) $361.2 million of cash as of December 31, 2018 (11) $483.8 million of available borrowing capacity on our revolving line of credit, and (111) approximately $200 million to $250 million of expected retained operating cash flow for the next twelve months. Retained operating cash flow represents our expected cash flow provided by operating activities, less shareholder distributions and capital expenditures to maintain our real estate facilities. Our planned capital needs over the next year consist of (1) $322.1 million of remaining spend on our current development pipeline, (11) $102.4 million in property acquisitions currently under contract, (111) $285.0 million for the redemption of our Series Y Preferred Shares on March 28, 2019, and (iv) $1.9 million in principal repayments on existing debt. Our capital needs may increase over the next year as we expect to add projects to our development pipeline and acquire additional properties. In addition to other investment activities, we may also redeem outstanding preferred securities or repurchase shares of our common stock in the future. December 31, 2023 $ 2,363,151 207,985 2,571,135 $ 800,984 70,793 553,553 59,885 109,756 1,594,970 $ 4 $s in the thousands, except per share amounts 5 6 Decmber 31, 2021 Decmber 31, 2022 7 Revenues: 8 Self-storage Facilities $ 2,255,255 $ 2,308,573 9 Ancillary Operations 173,855 190,155 10 Total Revenues $ 2,429,110 $ 2,498,728 11 12 Expenses: 13 Self-Storage Cost of Operations 703,939 750,895 14 Ancillary Cost of Operations 55,804 62,853 15 Depreciation and Amortization 483,870 517,540 16 General and Administrative 64,157 61,984 17 Interest Expense 63,197 83,284 18 Total Expenses $ 1,370,968 $ 1,476,557 19 20 Other Increases (Decreases) to Net Income: 21 Interest and Other Income 17,115 16,459 22 Equity in Earnings of Unconsolidated Real Estate Entities 57,935 52,994 23 Foreign Currency Exchange (Loss) Gain 610,709 (3,688,505) 24 Gain on Sale of Real Estate 2,984 6,546 25 Gain Due to Shurgard Public Offering 26 Net Income $ 1,746,885 $ (2,590,335) 27 Allocation to Noncontrolling Interests (2,450) (1,973) 28 Net Income Allocable to Public Storage Shareholders $ 1,744,435 $ (2,592,308) 29 Allocation og Net Income to: 30 Preferred Shareholders - distributions (162,220) (158,718) 31 Preferred Shareholders - redemptions (Note 8) (50,348) (62,338) 32 Restricted Share Units (2,084) (1,632) 33 Net Income Allocable to Common Shareholders $ 1,529,782 $ (2,814,997) 34 Net Income Per Common Share: 35 Basic $ 4.17 $ 4 36 Diluted $ 4.17 $ 37 38 Basic Weighted Average Common Shares Outstanding 366,794 (787,018) 39 Diluted Weighted Average Common Shares Outstanding 366,859 (786,750) 40 Treasure Stock 65 268 41 HorizontalAnalysisIncomeStatmnt Projected Income Statements 15,829 48,474 22,277,508 14,359 $ 23,332,335 (1,589) 23,330,746 (155,292) (77,185) (1,278) 23,096,991 $ 3 S $ 4 3 7,529,680 7,523,217 (6,463) Projected Balance Sheets Projected Ready ITEM 7. Managements Discussion and Analysis of Financial Condition and Results of Operations Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A) should be read in conjunction with our financial statements and notes thereto. Critical Accounting Policies Our MD&A discusses our financial statements, which have been prepared in accordance with United States ("U.S.") generally accepted accounting principles ("GAAP"), and are affected by our judgments, assumptions and estimates. The notes to our December 31, 2018 financial statements, primarily Note 2, summarize our significant accounting policies. We believe the following are our critical accounting policies, because they have a material impact on the portrayal of our financial condition and results, and they require us to make judgments and estimates about matters that are inherently uncertain Income Tax Expense: We have elected to be treated as a REIT, as defined in the Internal Revenue Code of 1986, as amended (the "Code). As a REIT, we do not incur federal income tax on our REIT taxable income that is fully distributed each year (for this purpose, certain distributions paid in a subsequent year may be considered), and if we meet certain organizational and operational rules. We believe we have met these REIT requirements for all periods presented herein. Accordingly, we have recorded no federal income tax expense related to our REIT taxable income. Our evaluation that we have met the REIT requirements could be incorrect, because compliance with the tax rules requires factual determinations, and circumstances we have not identified could result in noncompliance with the tax requirements in current or prior years. For any taxable year that we fail to qualify as a REIT and for which applicable statutory relief provisions did not apply, we would be taxed at the regular corporate rates on all of our taxable income for at least that year and the ensuing four years, we could be subject to penalties and interest, and our net income would be materially different from the amounts estimated in our financial statements. In addition, certain of our consolidated corporate subsidiaries have elected to be treated as "taxable REIT subsidiaries" for federal income tax purposes, which are taxable as regular corporations and subject to certain limitations on intercompany transactions. If tax authorities determine that amounts paid by our taxable REIT subsidiaries to us are not reasonable compared to similar arrangements among unrelated parties, we could be subject to a 100% penalty tax on the excess payments. Such a penalty tax could have a material adverse impact on our net income. Impairment of Long-Lived Assets: The analysis of impairment of our long-lived assets involves identification of indicators of impairment, projections of future operating cash flows, and estimates of fair values, all of which require significant judgment and subjectivity. Others could come to materially different conclusions. In addition, we may not have identified all current facts and circumstances that may affect impairment. Any unidentified impairment loss, or change in conclusions, could have a material adverse impact on our net income. Accrual for Uncertain and Contingent Liabilities: We accrue for certain contingent and other liabilities that have significant uncertain elements, such as property taxes, workers compensation claims, tenant reinsurance claims, as well as other legal claims and disputes involving customers, employees, governmental agencies and other third parties. We estimate such liabilities based upon many factors such as assumptions of past and future trends and our evaluation of likely outcomes. However, the estimates of known liabilities could be incorrect or we may not be aware of all such liabilities, in which case our accrued liabilities and net income could be misstated. Accounting for Acquired Real Estate Facilities: We estimate the fair values of the land, buildings and intangible assets acquired for purposes of allocating the purchase price. Such estimates are based upon many assumptions and judgments, including (1) market rates of return and capitalization rates on real estate and intangible assets, (11) building and material cost levels, (111) comparisons of the acquired underlying land parcels to recent land 25 transactions, and (iv) future cash flows from the real estate and the existing tenant base. Others could come to materially different conclusions as to the estimated fair values, which would result in different depreciation and amortization expense, gains and losses on sale of real estate assets, and real estate and intangible assets. Overview Our self-storage operations generate most of our net income, and we believe that our earnings growth is most impacted by the level of organic growth in our existing self-storage portfolio. Accordingly, a significant portion of management's time is devoted to maximizing cash flows from our existino self-storage facilities Our self-storage operations generate most of our net income, and we believe that our earnings growth is most impacted by the level of organic growth in our existing self-storage portfolio. Accordingly, a significant portion of management's time is devoted to maximizing cash flows from our existing self-storage facilities. Most of our facilities compete with other well-managed and well-located competitors and we are subject to general economic conditions, particularly those that affect the spending habits of consumers and moving trends. We believe that our centralized information networks, national telephone and online reservation system, the brand name Public Storage," and our economies of scale enable us to meet such challenges effectively. In the last three years, there has been a marked increase in development of new self-storage facilities in many of the markets we operate in, due to the favorable economics of development which we have also taken advantage of. These newly developed facilities compete with many of the facilities we own, negatively impacting our occupancies, rental rates, and rental growth. This increase in supply has been most notable in Atlanta, Austin, Charlotte, Chicago, Dallas, Denver, Houston, New York, and Portland. We plan on growing organically as well as through the acquisition and development of new facilities and expanding our existing self-storage facilities. Since the beginning of 2013 through December 31, 2018, we acquired a total of 296 facilities with 20.6 million net rentable square feet from third parties for approximately $2.7 billion, and we opened newly developed and expanded self-storage space for a total cost of $1.2 billion, adding approximately 11.3 million net rentable square feet Subsequent to December 31, 2018, we acquired or were under contract to acquire (subject to customary closing conditions) 14 self-storage facilities for $102.4 million. We will continue to seek to acquire properties; however, there is significant competition to acquire existing facilities and there can be no assurance as to the level of facilities we may acquire. As of December 31, 2018, we had additional development and redevelopment projects to build approximately 5.2 million net rentable square feet at a total cost of approximately $607.4 million. We expect to continue to seek additional development projects; however, the level of such activity may be limited due to various constraints such as difficulty in finding available sites that meet our risk-adjusted yield expectations, as well as challenges in obtaining building permits for self-storage activities in certain municipalities. We believe that our development and redevelopment activities are beneficial to our business over the long run. However, in the short run, such activities dilute our earnings due to the three to four year period that it takes to fill up newly developed and redeveloped storage facilities and reach a stabilized level of cash flows offset by the cost of capital to fund the cost, combined with related overhead expenses flowing through general and administrative expense. We believe the level of dilution incurred in 2018 will continue at similar levels in 2019 and beyond, assuming realization of our current expectation of maintaining our current level of development for the foreseeable future. On July 13, 2018, we received a cash distribution from Shurgard Self Storage SA ("Shurgard Europe) totaling $145.4 million. On September 18, 2017, we completed a public offering of $1.0 billion in aggregate principal amount of unsecured notes in two equal tranches (collectively, the "U.S. Dollar Notes"), one maturing in September 2022 bearing interest at 2.370%, and another maturing in September 2027 bearing interest at 3.094%. This was our first public offering of debt, which should also serve to facilitate future offerings. 26 On October 15, 2018, Shurgard Europe completed an initial global offering (the "Offering) of its common shares, and its shares commenced trading on Euronext Brussels under the "SHUR symbol. In the Offering, Shurgard Europe issued 25.0 million of its common shares to third parties at a price of 23 per share, for 575 million in gross proceeds. The gross proceeds were used to repay short-term borrowings, invest in real estate assets, and for other corporate purposes. Our equity interest, comprised of a direct and indirect pro-rata ownership interest in 31.3 million shares, decreased from 49% to 35.2% as a result of the Offering. While we did not sell any of our shares in the Offering, we did record a gain on disposition in 2018 of $151.6 million, as if we had sold a proportionate share of our investment in Shurgard Europe. See Investment in Shurgard Europe" below for more information. On October 18, 2018, we sold our property in West London to Shurgard Europe for $42.1 million and recorded a related gain on sale of real estate of approximately $31.5 million. As of December 31, 2018, our capital resources over the next year are expected to be approximately $1.1 billion which exceeds our current planned capital needs over the next year of approximately $711.4 million. Our capital resources include: (1) $361.2 million of cash as of December 31, 2018 (11) $483.8 million of available borrowing capacity on our revolving line of credit, and (111) approximately $200 million to $250 million of expected retained operating cash flow for the next twelve months. Retained operating cash flow represents our expected cash flow provided by operating activities, less shareholder distributions and capital expenditures to maintain our real estate facilities. Our planned capital needs over the next year consist of (1) $322.1 million of remaining spend on our current development pipeline, (11) $102.4 million in property acquisitions currently under contract, (111) $285.0 million for the redemption of our Series Y Preferred Shares on March 28, 2019, and (iv) $1.9 million in principal repayments on existing debt. Our capital needs may increase over the next year as we expect to add projects to our development pipeline and acquire additional properties. In addition to other investment activities, we may also redeem outstanding preferred securities or repurchase shares of our common stock in the future. December 31, 2023 $ 2,363,151 207,985 2,571,135 $ 800,984 70,793 553,553 59,885 109,756 1,594,970 $ 4 $s in the thousands, except per share amounts 5 6 Decmber 31, 2021 Decmber 31, 2022 7 Revenues: 8 Self-storage Facilities $ 2,255,255 $ 2,308,573 9 Ancillary Operations 173,855 190,155 10 Total Revenues $ 2,429,110 $ 2,498,728 11 12 Expenses: 13 Self-Storage Cost of Operations 703,939 750,895 14 Ancillary Cost of Operations 55,804 62,853 15 Depreciation and Amortization 483,870 517,540 16 General and Administrative 64,157 61,984 17 Interest Expense 63,197 83,284 18 Total Expenses $ 1,370,968 $ 1,476,557 19 20 Other Increases (Decreases) to Net Income: 21 Interest and Other Income 17,115 16,459 22 Equity in Earnings of Unconsolidated Real Estate Entities 57,935 52,994 23 Foreign Currency Exchange (Loss) Gain 610,709 (3,688,505) 24 Gain on Sale of Real Estate 2,984 6,546 25 Gain Due to Shurgard Public Offering 26 Net Income $ 1,746,885 $ (2,590,335) 27 Allocation to Noncontrolling Interests (2,450) (1,973) 28 Net Income Allocable to Public Storage Shareholders $ 1,744,435 $ (2,592,308) 29 Allocation og Net Income to: 30 Preferred Shareholders - distributions (162,220) (158,718) 31 Preferred Shareholders - redemptions (Note 8) (50,348) (62,338) 32 Restricted Share Units (2,084) (1,632) 33 Net Income Allocable to Common Shareholders $ 1,529,782 $ (2,814,997) 34 Net Income Per Common Share: 35 Basic $ 4.17 $ 4 36 Diluted $ 4.17 $ 37 38 Basic Weighted Average Common Shares Outstanding 366,794 (787,018) 39 Diluted Weighted Average Common Shares Outstanding 366,859 (786,750) 40 Treasure Stock 65 268 41 HorizontalAnalysisIncomeStatmnt Projected Income Statements 15,829 48,474 22,277,508 14,359 $ 23,332,335 (1,589) 23,330,746 (155,292) (77,185) (1,278) 23,096,991 $ 3 S $ 4 3 7,529,680 7,523,217 (6,463) Projected Balance Sheets Projected Ready