Create a Statement of Cash Flows using the indirect method

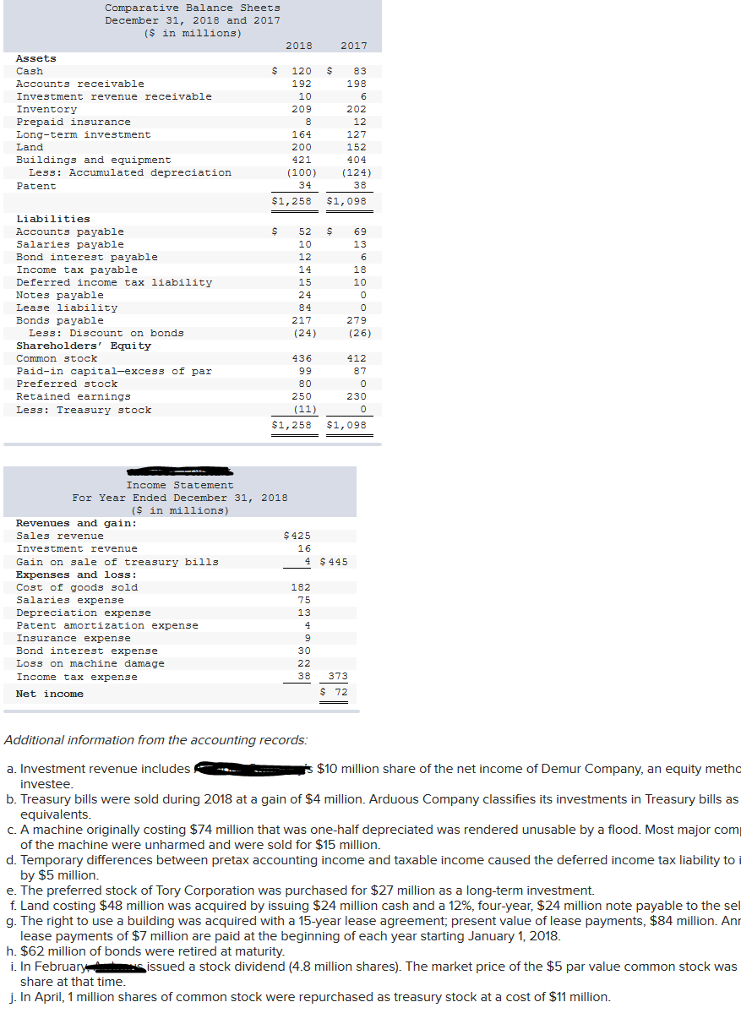

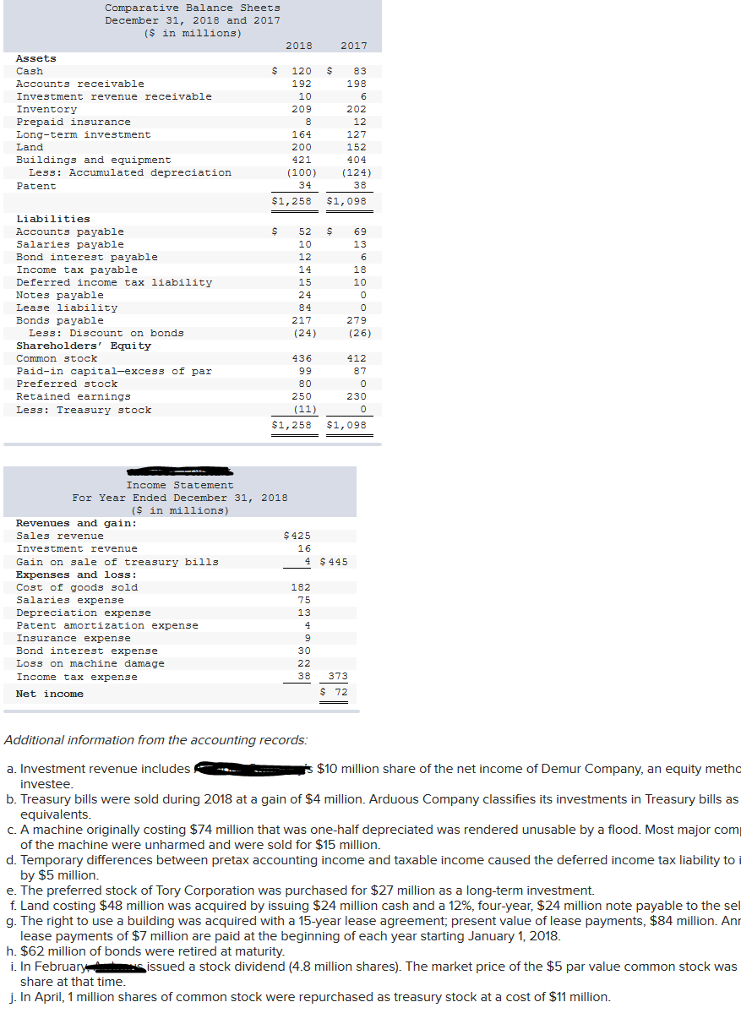

Comparative Balance Sheets December 31, 2018 and 2017 (s in millions) 2018 2017 Assets Cash Accounts receivable Investment revenue receivable Inventory Prepaid insurance Long-term investment Land Buildings and equipment S 120 83 198 192 209 202 12 164 200 421 152 404 Less: Accumulated depreciation Patent (100) (124) $1,258 $1,098 $ 52 69 Liabilities Accounts payable Salaries payable Bond interest payable Income tax payable Deferred income tax 1iability Notes payable Lease liability Bonds payable 12 217 (24) 279 (26) Less: Discount on bonds Sharcholders' Equity Common stock Paid-in capital-excess of par Preferred stock Retained earnings Less: Treasury stock 436 412 80 250 230 $1,258 $1,098 Income Statement For Year Ended December 31, 2018 (s in millions) Revenues and gain: Sales revenue Investment revenue Gain on sale of treasury bills Expenses and loss: Cost of goods sold Salaries expense Depreciation expense Patent amortization expense Insurance expense Bond interest expense Loss on machine damage Income tax expense Net income S 425 4 $445 182 38 373 S 72 Additional information from the accounting records: a. Investment revenue includes $10 million share of the net income of Demur Company, an equity metho b. Treasury bills were sold during 2018 at a gain of $4 million. Arduous Company classifies its investments in Treasury bills as C. A machine originally costing $74 million that was one-half depreciated was rendered unusable by a flood. Most major com d. Temporary differences between pretax accounting income and taxable income caused the deferred income tax liability to i e. The preferred stock of Tory Corporation was purchased for $27 million as a long-term investment. g. The right to use a building was acquired with a 15-year lease agreement, present value of lease payments, $84 million. Anr h. $62 million of bonds were retired at maturity. investee equivalents. of the machine were unharmed and were sold for $15 million. by $5 million. Land costing $48 million was acquired by issuing $24 million cash and a 12%, four-year, $24 million note payable to the sel lease payments of $7 million are paid at the beginning of each year starting January 1, 2018. i. In Februaryissued a stock dividend (4.8 million shares). The market price of the $5 par value common stock was share at that time j. In April, 1 million shares of common stock were repurchased as treasury stock at a cost of $11 million