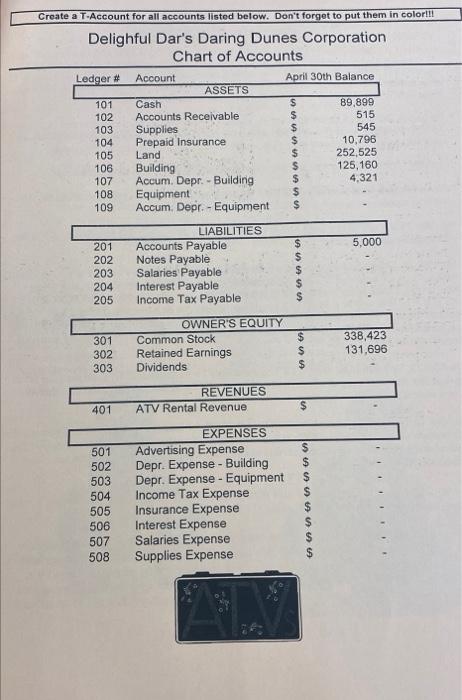

Create a T-Account for all accounts listed below. Don't forget to put them in colorlll Delighful Dar's Daring Dunes Corporation Chart of Accounts Ledger # Account April 30th Balance ASSETS 101 Cash $ 89,899 102 Accounts Receivable $ 515 103 Supplies $ 545 104 Prepaid Insurance 10,796 105 Land $ 252,525 106 Building $ 125,160 107 Accum. Depr. - Building $ 4.321 108 Equipment $ 109 Accum Depr.- Equipment $ 5,000 $ $ 201 202 203 204 205 LIABILITIES Accounts Payable Notes Payable Salaries Payable Interest Payable Income Tax Payable $ $ 301 302 303 OWNER'S EQUITY Common Stock Retained Earnings Dividends $ $ $ 338,423 131,696 REVENUES ATV Rental Revenue 401 $ 501 $ EXPENSES Advertising Expense Depr. Expense - Building Depr. Expense - Equipment Income Tax Expense Insurance Expense Interest Expense Salaries Expense Supplies Expense 502 503 504 505 506 507 508 one on $ 1. 2. Delightful Dar's Darin Dunes Transactions On May 1, Delightful Dar bought some new ATV's from Jack Cat's ATV's Last month she sold all of her ATV's because they were wom out. She purchased a total of 34 ATV's for $160,003. She paid $33.333 in cash and put the remaining balance on account. All balances on account must be fully paid within 10 months. The ATV's have an expected life of 3.5 years and a salvage value of $19.555. They will be depreciated using the straight-line method. On May 3. Delightful Dar drives in the big bucks!! Thirty-nine people decided to rent those new ATV's. Dar charges her clients $33.95 an hour to rent the ATV's. A total of 80 rental hours was recorded on this day (60 hours were paid in cash and the rest was put on client accounts). On May 5, Delightful Dar decided to buy the land next to her business for $56,789 cash. On May 9, Delightful Dar realized that she needed some extra supplies. She purchased $3.210 worth of supplies on account from Dirt Cheap Office Products clients paid cash for a change!! On May 13, Delightful Dar rents ATV's to her clients for 88 hours at $34.50 an hour. All of her 3. 4. 5. 8. 6. On May 16, Delightful Dar went to the bank and talked to Macy Money about a loan. Jack, from Jack Cat's ATV's needed $72,000 of the balance due from Dar. Therefore, Dar got a 4-year loan from the bank in the amount of $72,000 to pay off some of her balance from Jack Cat's ATV's. The loan will be paid off in 8 equal installments due on November 16 and May 16" for each of the next 4 years. Macy will charge 14.4% interest on the loan. Interest will be paid with each installment. (Note: there are two transactions occurring here, first recognize the loan and then pay your liability) 7. On May 18, Delightful Dar rents ATV's to her clients for 92 hours at $34.75 an hour (Dar loves to raise her prices on a regular basis!!). Her clients paid for 52 hours in cash and the other 40 hours were added to client accounts. On May 19, Delightful Dar paid Bailey's Bulletin $681 for informative flyers. The flyers contain information about Dar's new ATV's and are expected to increase Dar's rental revenues by 52% next month!! Dar is old school and prefers to advertise using flyers. Dar expenses this immediately. On May 21, Delightful Dar received cash from some of her clients who had put their ATV rental fees on account. She received a total of $1,111 from client accounts. 10. On May 23, Delightful Dar decided to hire Macy Money and Builey from Bailey's Bulletin to work part-time over the next few weeks. She thought they would be good for fit for her business since they seem to know her well. Their duties will include assisting people to their ATV's, distributing flags, and cooler checks (no soft drinks allowed, beer/wine only!!). It is expected that they will work a total of 48 hours during the rest of this month at a rate of $15.75 an hour. 9. 11. On May 24, Delightful Dar found out that a couple of her clients had trouble with the ATV's they rented on May 13th, but didn't say anything at the time of rental. Therefore, Dar decided to refund them for a total of 6 hours. She wrote out and mailed the check today. 12. On May 25, Delightful Dar records rental revenue from the ATV's of $1,580. Eighty percent of that was paid in cash at the time of rental. The rest was added to customer accounts. 13. On May 28, Delightful Dar decides to pay dividends in the amount of $444. 14. On May 30, Delightful Dar pays Macy & Bailey a total of 5777 cash for their excellent work. Adjustments On May 31, you notice the following: a) You have used up one months worth of insurance (On March 1. Dar purchased a 6-month insurance policy for $16,194) b) You need to recognize interest accumulated on the note payable c) You need to recognize depreciation on the building. You bought the building on February 15, last year. It has an expected life of 35 years and you use straight-line depreciation d) You have accrued salaries of $945 e) You need to recognize depreciation on the ATV's 1) You have only $1,239 worth of supplies on hand g) You need to recognize/accrue federal income taxes of $41. The Accounting Cycle 1/2) Analyze & Journalize transactions 6) Prepare an adjusted trial balance 3) Post to ledger accounts 7) Prepare the financial statements 4) Prepare a trial balance 8) Journalize and post closing entries 5) Journalize and post adjusting entries 9) Prepare a post-closing trial balance 00 18N OLO Have Fun & Good Luck!! Delightful Dar (also known as Professor G) needs your help! She really dislikes accounting, unlike you!! For unknown reasons, Dar seems to think marketing is better. Last week, she heard a rumor that you are an accounting genius. She rushed backed to her office, picked up the phone, and called you in for an interview. After learning how much better you thought accounting was than marketing, she hired you immediately! Congratulations on your new job!!! Dar has asked you to do the following: Colored Journal Entries from steps 2, 5, and 8 of the accounting cycle Colored Ledger Accounts (T-Accounts) from steps 3, 5, and 8 of the accounting cycle A Completed Worksheet in color for steps 4, 5, and 6 of the accounting cycle Colored Financial Statements. This should include a statement of operations, a statement of retained earnings, and a classified statement of financial position A post-closing trial balance in color . . . Additional things to consider: Only 1 T-Account needs to be created for each account. See Chart of Accounts. Please Note: Dar has been in business for a while, therefore, your Ledger accounts (T-Accounts) may already have balances in them. When doing journal entries, remember that debits come before credits and that both must equal. Remember, each time you post to the ledger account, you should put the reference number in your general journal. Assume the year is 2022 for your transactions and financial statements. na natnraraetinate it will only make things harder on you!! Create a T-Account for all accounts listed below. Don't forget to put them in colorlll Delighful Dar's Daring Dunes Corporation Chart of Accounts Ledger # Account April 30th Balance ASSETS 101 Cash $ 89,899 102 Accounts Receivable $ 515 103 Supplies $ 545 104 Prepaid Insurance 10,796 105 Land $ 252,525 106 Building $ 125,160 107 Accum. Depr. - Building $ 4.321 108 Equipment $ 109 Accum Depr.- Equipment $ 5,000 $ $ 201 202 203 204 205 LIABILITIES Accounts Payable Notes Payable Salaries Payable Interest Payable Income Tax Payable $ $ 301 302 303 OWNER'S EQUITY Common Stock Retained Earnings Dividends $ $ $ 338,423 131,696 REVENUES ATV Rental Revenue 401 $ 501 $ EXPENSES Advertising Expense Depr. Expense - Building Depr. Expense - Equipment Income Tax Expense Insurance Expense Interest Expense Salaries Expense Supplies Expense 502 503 504 505 506 507 508 one on $ 1. 2. Delightful Dar's Darin Dunes Transactions On May 1, Delightful Dar bought some new ATV's from Jack Cat's ATV's Last month she sold all of her ATV's because they were wom out. She purchased a total of 34 ATV's for $160,003. She paid $33.333 in cash and put the remaining balance on account. All balances on account must be fully paid within 10 months. The ATV's have an expected life of 3.5 years and a salvage value of $19.555. They will be depreciated using the straight-line method. On May 3. Delightful Dar drives in the big bucks!! Thirty-nine people decided to rent those new ATV's. Dar charges her clients $33.95 an hour to rent the ATV's. A total of 80 rental hours was recorded on this day (60 hours were paid in cash and the rest was put on client accounts). On May 5, Delightful Dar decided to buy the land next to her business for $56,789 cash. On May 9, Delightful Dar realized that she needed some extra supplies. She purchased $3.210 worth of supplies on account from Dirt Cheap Office Products clients paid cash for a change!! On May 13, Delightful Dar rents ATV's to her clients for 88 hours at $34.50 an hour. All of her 3. 4. 5. 8. 6. On May 16, Delightful Dar went to the bank and talked to Macy Money about a loan. Jack, from Jack Cat's ATV's needed $72,000 of the balance due from Dar. Therefore, Dar got a 4-year loan from the bank in the amount of $72,000 to pay off some of her balance from Jack Cat's ATV's. The loan will be paid off in 8 equal installments due on November 16 and May 16" for each of the next 4 years. Macy will charge 14.4% interest on the loan. Interest will be paid with each installment. (Note: there are two transactions occurring here, first recognize the loan and then pay your liability) 7. On May 18, Delightful Dar rents ATV's to her clients for 92 hours at $34.75 an hour (Dar loves to raise her prices on a regular basis!!). Her clients paid for 52 hours in cash and the other 40 hours were added to client accounts. On May 19, Delightful Dar paid Bailey's Bulletin $681 for informative flyers. The flyers contain information about Dar's new ATV's and are expected to increase Dar's rental revenues by 52% next month!! Dar is old school and prefers to advertise using flyers. Dar expenses this immediately. On May 21, Delightful Dar received cash from some of her clients who had put their ATV rental fees on account. She received a total of $1,111 from client accounts. 10. On May 23, Delightful Dar decided to hire Macy Money and Builey from Bailey's Bulletin to work part-time over the next few weeks. She thought they would be good for fit for her business since they seem to know her well. Their duties will include assisting people to their ATV's, distributing flags, and cooler checks (no soft drinks allowed, beer/wine only!!). It is expected that they will work a total of 48 hours during the rest of this month at a rate of $15.75 an hour. 9. 11. On May 24, Delightful Dar found out that a couple of her clients had trouble with the ATV's they rented on May 13th, but didn't say anything at the time of rental. Therefore, Dar decided to refund them for a total of 6 hours. She wrote out and mailed the check today. 12. On May 25, Delightful Dar records rental revenue from the ATV's of $1,580. Eighty percent of that was paid in cash at the time of rental. The rest was added to customer accounts. 13. On May 28, Delightful Dar decides to pay dividends in the amount of $444. 14. On May 30, Delightful Dar pays Macy & Bailey a total of 5777 cash for their excellent work. Adjustments On May 31, you notice the following: a) You have used up one months worth of insurance (On March 1. Dar purchased a 6-month insurance policy for $16,194) b) You need to recognize interest accumulated on the note payable c) You need to recognize depreciation on the building. You bought the building on February 15, last year. It has an expected life of 35 years and you use straight-line depreciation d) You have accrued salaries of $945 e) You need to recognize depreciation on the ATV's 1) You have only $1,239 worth of supplies on hand g) You need to recognize/accrue federal income taxes of $41. The Accounting Cycle 1/2) Analyze & Journalize transactions 6) Prepare an adjusted trial balance 3) Post to ledger accounts 7) Prepare the financial statements 4) Prepare a trial balance 8) Journalize and post closing entries 5) Journalize and post adjusting entries 9) Prepare a post-closing trial balance 00 18N OLO Have Fun & Good Luck!! Delightful Dar (also known as Professor G) needs your help! She really dislikes accounting, unlike you!! For unknown reasons, Dar seems to think marketing is better. Last week, she heard a rumor that you are an accounting genius. She rushed backed to her office, picked up the phone, and called you in for an interview. After learning how much better you thought accounting was than marketing, she hired you immediately! Congratulations on your new job!!! Dar has asked you to do the following: Colored Journal Entries from steps 2, 5, and 8 of the accounting cycle Colored Ledger Accounts (T-Accounts) from steps 3, 5, and 8 of the accounting cycle A Completed Worksheet in color for steps 4, 5, and 6 of the accounting cycle Colored Financial Statements. This should include a statement of operations, a statement of retained earnings, and a classified statement of financial position A post-closing trial balance in color . . . Additional things to consider: Only 1 T-Account needs to be created for each account. See Chart of Accounts. Please Note: Dar has been in business for a while, therefore, your Ledger accounts (T-Accounts) may already have balances in them. When doing journal entries, remember that debits come before credits and that both must equal. Remember, each time you post to the ledger account, you should put the reference number in your general journal. Assume the year is 2022 for your transactions and financial statements. na natnraraetinate it will only make things harder on you