Answered step by step

Verified Expert Solution

Question

1 Approved Answer

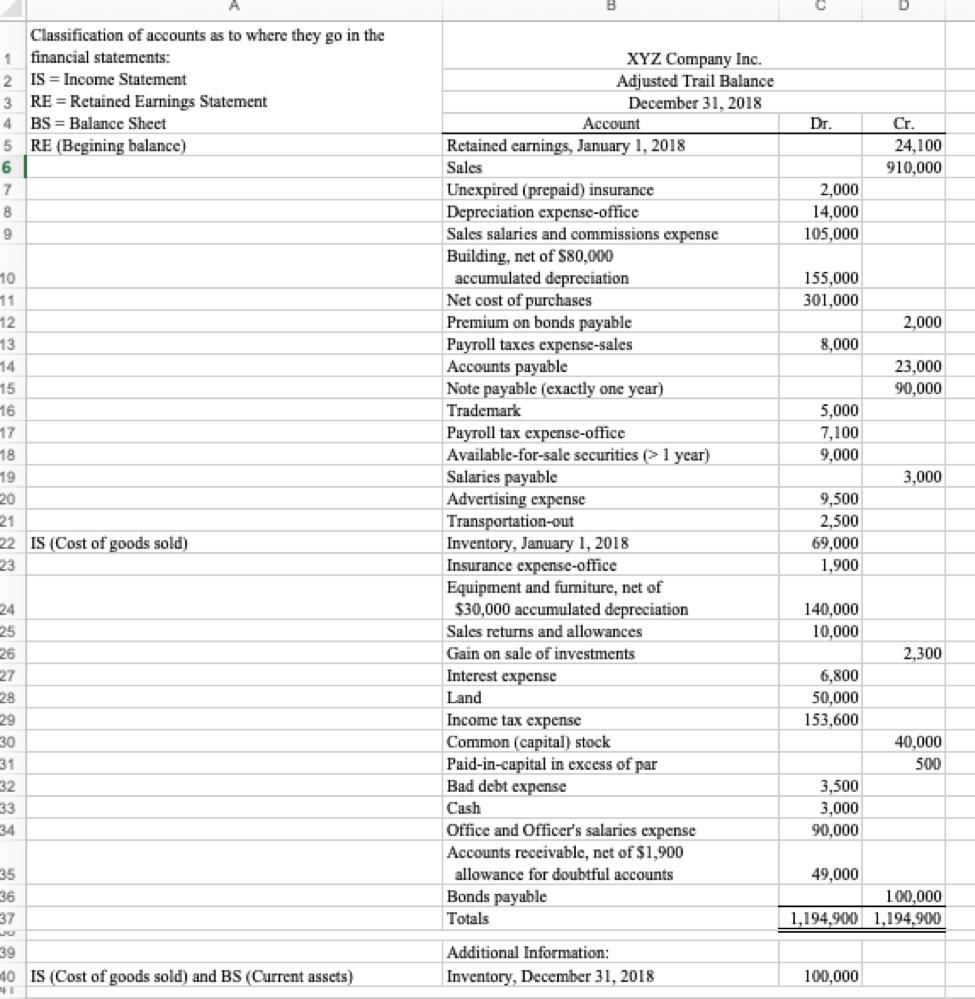

Create an individual Income Statement, Retained Earning, and Balance Sheet. Classification of accounts as to where they go in the 1 financial statements: 2 IS

Create an individual Income Statement, Retained Earning, and Balance Sheet.

Classification of accounts as to where they go in the 1 financial statements: 2 IS = Income Statement 3 RE=Retained Earnings Statement 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 IS (Cost of goods sold) 23 24 25 26 27 28 30 31 32 33 34 BS Balance Sheet RE (Begining balance) 35 36 37 39 40 IS (Cost of goods sold) and BS (Current assets) 41 Account Retained earnings, January 1, 2018 Sales XYZ Company Inc. Adjusted Trail Balance December 31, 2018 Unexpired (prepaid) insurance Depreciation expense-office Sales salaries and commissions expense Building, net of $80,000 accumulated depreciation Net cost of purchases Premium on bonds payable Payroll taxes expense-sales Accounts payable Note payable (exactly one year) Trademark Payroll tax expense-office Available-for-sale securities (> 1 year) Salaries payable Advertising expense Transportation-out Inventory, January 1, 2018 Insurance expense-office Equipment and furniture, net of $30,000 accumulated depreciation Sales returns and allowances Gain on sale of investments Interest expense Land Income tax expense Common (capital) stock Paid-in-capital in excess of par Bad debt expense Cash Office and Officer's salaries expense Accounts receivable, net of $1,900 allowance for doubtful accou Bonds payable Totals Additional Information: Inventory, December 31, 2018 Dr. 2,000 14,000 105,000 155,000 301,000 8,000 5,000 7,100 9,000 9,500 2,500 69,000 1,900 140,000 10,000 6,800 50,000 153,600 3,500 3,000 90,000 49,000 Cr. 24,100 910,000 100,000 2,000 23,000 90,000 3,000 2,300 40,000 500 100,000 1,194,900 1,194,900 Classification of accounts as to where they go in the 1 financial statements: 2 IS = Income Statement 3 RE=Retained Earnings Statement 4 BS = Balance Sheet 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 IS (Cost of goods sold) 23 24 25 26 27 28 30 31 32 33 34 RE (Begining balance) 35 36 37 39 40 IS (Cost of goods sold) and BS (Current assets) 41 Account Retained earnings, January 1, 2018 Sales XYZ Company Inc. Adjusted Trail Balance December 31, 2018 Unexpired (prepaid) insurance Depreciation expense-office Sales salaries and commissions expense Building, net of $80,000 accumulated depreciation Net cost of purchases Premium on bonds payable Payroll taxes expense-sales Accounts payable Note payable (exactly one year) Trademark Payroll tax expense-office Available-for-sale securities (> 1 year) Salaries payable Advertising expense Transportation-out Inventory, January 1, 2018 Insurance expense-office Equipment and furniture, net of $30,000 accumulated depreciation Sales returns and allowances Gain on sale of investments Interest expense Land Income tax expense Common (capital) stock Paid-in-capital in excess of par Bad debt expense Cash Office and Officer's salaries expense Accounts receivable, net of $1,900 allowance for doubtful accou Bonds payable Totals Additional Information: Inventory, December 31, 2018 Dr. 2,000 14,000 105,000 155,000 301,000 8,000 5,000 7,100 9,000 9,500 2,500 69,000 1,900 140,000 10,000 6,800 50,000 153,600 3,500 3,000 90,000 49,000 Cr. 24,100 910,000 100,000 2,000 23,000 90,000 3,000 2,300 40,000 500 100,000 1,194,900 1,194,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the individual Income Statement IS Retained Earnings Statement RE and Balance Sheet BS fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started