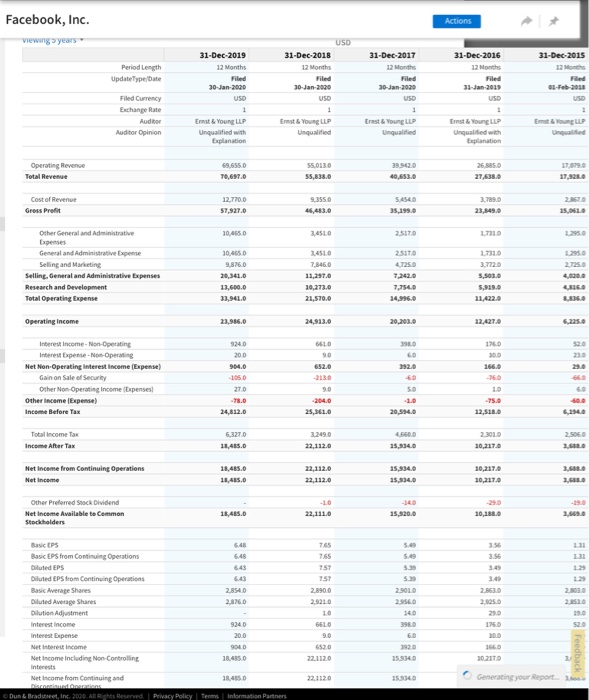

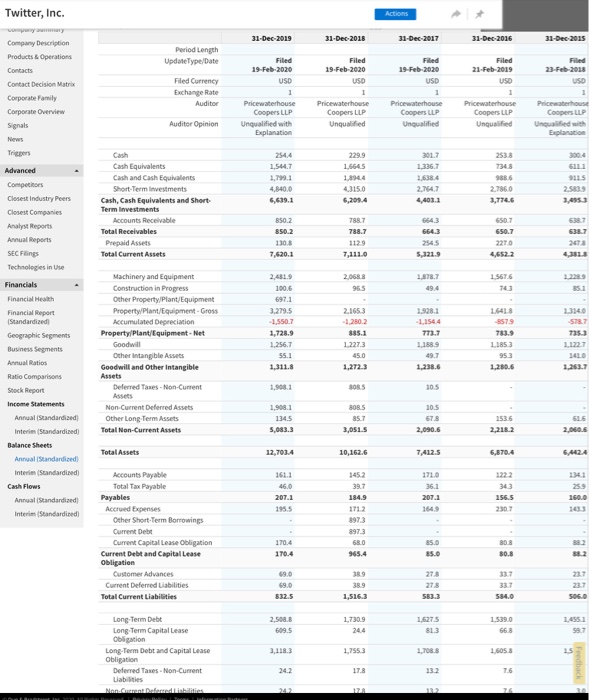

Create Common Size Analysis (i.e., vertical financial analysis) for Facebook and Twitter

This should be a providing an Income Statement Common Size Analysis (CSA) for Facebook and one key competitor Twitter for the past 5 years.

Create Trending Analysis (i.e., horizontal financial analysis): This should be a providing an Income Statement Trending Analysis for Facebook and key competitor Twitter for the past 5 years.

Facebook, Inc. Actions viewing years Period Length UpdateType/Date 31-Dec-2015 12 Months Filed USD 31-Dec-2018 12 Months Filed 30-Jan-2020 USD 1 Ernst & Young LLP Unqualified 31-Dec-2019 12 Months Filed 30-Jan-2020 USD 1 Ernst & Young LLP Unqualified with Explanation 31-Dec-2016 12 Months Filed 31-Jan-2019 USD Filed Currency Exchange Rate Auditor Auditor Opinion 31-Dec-2017 12 Months Filed 30-Jan-2020 USD 1 Ernst & Young LUP Unqualified Ernst & Young LUP Unqualified with Explanation Em Young WP Une Operating Revenue Total Revenue 69.6550 70,697,0 55,093.0 55,838,0 40,653.0 27,638. Cost of Revenue Gross Profit 12.770.0 57,927.0 9,355.0 46,483.0 5.4540 35,1990 2.8570 15.05 23.04. Other General and Administrative 10.4550 3,4510 2517 1.710 123.0 2.7250 General and Administrative Expense Seling and Marketing Selling. General and Administrative Expenses Research and Development Total Operating Expense 10.455.0 9,876.0 20,341.0 11,600.0 33,941.0 24510 7.8460 11,297,0 10,273.0 21,570.0 2.5170 4.725.0 7,2420 7,7540 24,996.0 1.7310 3.772.0 5,503 5,919.0 11,422.0 460 3.836.0 Operating Income 23,986.0 24,913.0 20,203.0 12.427 6225.0 9240 6610 170 200 210 392.0 166.0 Interest Income Non-Operating Interest Expense - Non-Operating Net Non-Operating interest Income (Expense) Gain on Sale of Security Other NonOperating Income penses Other income Expense) Income Before Tax 652.0 -2130 CO -1050 27.0 -78.0 24,812.0 10 -75.0 12,518.0 25,361.0 20,594.0 6,2540 Total Income Tax Income After Tax 2.5060 6.3270 18,485.0 46600 15,3340 23010 30,210 22,112.0 Net Income from Continuing Operations Net Income 18.455.0 11,455.0 22,112,0 22,112.0 15,934.0 15,934.0 10,217. 10,217.0 2. Other Preferred Stock Dividend Net Income Available to Common Stockholders -10 22,1110 18,485.0 15,920.0 10,1880 3,66 3.56 3.56 131 6.43 6.43 2.854D 2,876.0 765 765 7.ST 7.57 2.100 2.9210 10 6610 9.0 5. 5.39 5.39 2010 2.9560 2.863.0 Basic EPS Basic EPS from Continuing Operations Diluted EPS Diluted EPS from Continuing Operations Basic Average Shares Diluted Average Shares Dilution Adjustment Interest income Interest Expense Net interest income Net Income Including Non-Controlling Interests Net Income from Continuing and 2:03 2151 10 3980 520 9240 200 9040 18.435.0 29.0 1760 JOTO 160 102110 22.1120 15.9040 Feedback 18.450 22.112.0 15.04.0 Generating your Report 1 Dun & Bradstree, Inc. 2020. AlRights Reserved. Privacy Policy Terms Information Partners Facebook, Inc. Actions USD 31-Dec-2019 31-Dec-2018 31-Dec-2017 31-Dec-2016 31-Dec-2015 Period Fed 30-2020 30-Jan-2020 Filed Currency 31-Jan-2019 USD USD 1 1 Auditor USD 1 Emut & Young LLP Ungulfed with Explanation Loung LLP Unte mung LLP Ungud 1. 7306D 5.60 Company Summary Company Description Products & Operations Contacts Contact Decision Matrix Corporate Family Corporate Overview Signals SWOT News Tris Advanced Competitors Closest industry Peers Closest Companies Analyst Reports Annual Reports SEC filings Technologies in Use 4 TO 14.30 19.00 25,7160 1. 2010 NOT 13.01 14 2006.D 41,1140 41,711 29,448. Cash Even Cash and Cashes Short Term investments Cash, Cash qahvalents and short Term Investments Accounts receivable Total Receivables Prepaid Total Current Assets 2TD 9.5180 9,5180 NO 2.500 2,599.0 TSD 1,990 5320 3,8320 1.600 48,563. 3441 21.6520 Land and improvements Buildings and improvements Machinery and Equipment Construction in Progress 78 4D CD 2220 TO 31.2060 BERITO 10,000 11120 11.05. 58.16 S.S. 1.00 SO TO 1.1.0 31.3.0 2500 NO 183310 4. 1. Other Property Planet Property Gross Accumulated Depreciation Property Planet Goodwill Otherapie Geodwill and other intet Other Long Terme Total Non-Current Assets 31.750 S.GR 11.06 2460 21 22 TO 19.03 2.70 67.1510 12210 14 20.105. 2.15 15,961.0 .. 25. 46,8540 12 30,00 Total Arts 14,524 64,163. 45,402.0 1960 Financials Financial Health Financial Report Standardized Geographic Segments Business Segments Annual Ratios Ratio Comparisons Stock Report Income Statements Annual (Standardized Interim (Standardized Balance Sheets Annual Standardized Interim (Standardid Cash Flows Annual Standard Interim (Standardized) 3000 MO 2118 Accounts Payable Total Ple Other Payables Payables Apes Create Line of Credit 1,810 HD 1990 2010 ZTTO 500D DO 2010 70 2010 1,0770 2010 Current Capitale Obligation Current Debt and Capital Lasse ligation Customer Advance Current Deferred Liabilities Other Comestabilities Total Current Liabilities SOOD 3470 90.0 LTD 7,017.0 15.053.0 3.760 2. 1.325.0 . 40 101 BOTS 500 Long Term Capitolion Long-Term Debt and Caption Derved Toes on- Cente NonCurver Defende Trade and Other Payables. Non Current Other Long Termine Total on Current Liabilities NO 1,055 1900 LAST, 2,12 3,264.0 Total Liabilities 32,122.0 1.3.2010 10.177. 5,7676 Retained amnings en beter 41.5810 33.000 21.6 55.000 4550 Galins Low Notecting -T00D Generating your Report und deine Privacy policy Paners Facebook, Inc. Actions 21. 49000 2,100 2273 Land and improvements Building and Machinery and ment Construction Pro LOTO 11.220 TO 30,000 31120 7, 3000 1. 29000 1500 1,80 3310 40 31.513.0 TRS 55.46.0 10.30 24,633.0 3,881. Other Property Property Mantes Accumulated Depreciation Property Plant/quipment - Net Cardas Other intangibles Goodwill and Other interes Omargom Total Non-Current Assets 18.735.0 13.10 182210 LD 20.305 2240 212920 25.995. 20.45 29.09. 2.150 67,851.0 4. 35. 21. Analyst Reports Annual Reports SEC Filings Technologies in Use Financials Financial Health Financial Report Standardized Geographic Segments Business Segments Annual Ratios Ratio Comparisons Stock Report Income Statements Annual Standardized Interim (standardized Balance Sheets Annual (Standardized) Interim (Standardized Cash Flows Annual (Standardized Interim (Standardized) Total 133.0 97,34 14.500 34,99 Accounts Payable Total Tax Payable 1360 0940 60 2.0T3.0 2178 20 737 Payable 1. 1,5510 2000 Current Notes Payable Line of Credit 5000 2770 2770 1000 1.OTTO 20 200 Current Captain Current Debt and Capital Lease lotion Customer Me Current Defend Us Other Comestibilities Total Current Liabilities 2010 LOTTO 200 1,081 2.175.0 35,053 7,027.0 5340 300 GTD Long lon Capital Lease Obligation Long-Term Debt Caption Deferred on Cuneste Non Current Deferred Trade and Other Payables Monument Other Lang Total Non-Current ST 2.6L 2.AL 1.050 17,20.0 6.100 SALTO 2.2.0 Total Liabilities 120 13.2010 10 5.767. 55.620 21,670 2010 2220 D 4550 30 Additional Paid Capital Gains Lowest lecting the Stockholders' Equity Total Equity 101,0540 7440 10 4.LT Total Liabilities and Shareholders' Equity 233, 97,334 14.40 64. 22 03.0 M0 84,8270 591 24 Netangibles Working Capital Invested Capital Capital Options Totale Total Captain Common Stackovity Total Com Share Outstanding Treasury Shares 1.450 51.1720 10.30 10140 30.000 SOLO 01.0540 2.6520 MO 42 14.1270 2.000 24 4 2. 1520 2.5 2. Tangle Book Value Employees 11.50 440 27500 1200 25.105 asport Actions Twitter, Inc. OneStop 1,805 Conta 1,715 Report Collapse All Core Company Summary Company Description Products & Operations Contacts Contact Decision Matrix Corporate Family Corporate Overview Signals News Except for share items millions and perhatitlinancials Millions Annual Income (Standardized) Viewing 5 years USD 31-Dec-2019 31-Dec-2018 31-Dec-2017 31-Dec-2016 Period Length 12 Months 12 Months 12 Months 12 Months UpdateType Date Filled Filed Filed Filed 19-Feb-2020 19-Feb-2020 19-Feb-2020 21-Feb-2019 Filed Currency USD USD USD Exchange Rate 1 1 1 Auditor Pricewaterhouse Pricewaterhouse Pricewaterhouse Pricewaterhouse Coopers LLP Coopers LLP Coopers LLP Coopers LLP Auditor Opinion Unqualified with Unqualified Unqualified Unqualified Explanation USD 31-Dec-2015 12 Months Filed 23-Feb-2018 USD 1 Pricewaterhouse Coopers LLP Unqualified with Explanation Operating Revenue Total Revenue 30424 3,0424 2.44 2.443.3 2.529.6 2,529.6 2,218.0 2,218.0 TO Cost of Revenue Gross Profit 965.0 2,0774 8612 1.582.1 932.2 1,597.4 729.3 1,458.8 Advanced Competitors Closest Industry Peers Closest Companies Analyst Reports Annual Reports SEC Filings Technologies in Use 2988 283.9 293.3 260.7 3533 283.9 293.3 260.7 Other General and Administrative Expenses General and Administrative Expense Selling and Marketing Selling, General and Administrative Expenses Research and Development Total Operating Expense 9138 1,2726 771.4 1,070.2 717.4 1,001.3 871.5 1,1122 1,251.1 806.6 553.9 1,624.0 542.0 1,543.3 713.5 1,964.6 1,9388 Operating Income 366.4 38.7 IST. 1112 243 100.0 98.2 1052 -50.9 Interest Income Non-Operating Interest Expense-Non-Operating Net Non-Operating Interest Income (Expense) Other Non-Operating income Expenses Other Income (Expense) Income Before Tax 8.4 -733 2.1 Financials Financial Health Financial Report (Standarded Geographic Segments Business Serents Annual Ratios Ratio Comparisons Stock Report Income Statements Annual (Standardized Interim Standardized Balance Sheets Annual (Standardized Interim Standard Cash Flows Annual (Standardized Interim Standardized 14.9 14.9 30.1 423.5 - 95.4 440.8 -2,095.5 16.0 Total Income Tax Income After Tax 126 -103.1 -12.3 -521.0 1,205.6 1,465.7 1,205.6 -108.1 -456.9 -521.0 Net Income from Continuing Operations Net Income 1,205.6 -108.1 456.9 -5210 1,465.7 1,205.6 -100.1 -456.9 Net Income Available to Common Stockholders 150 -0.15 190 190 -0.65 -0.65 150 0.15 Basic EPS Basic EPS from Continuing Operations Diluted EPS Diluted EPS from Continuing Operations Chines 5 S Feedback 157 156 0.15 015 -0.65 -0.65 136 743 7127 7171 2624 Twitter, Inc. Actions 31-Dec-2019 31-Dec-2018 31-Dec-2017 31-Dec-2016 31-Dec-2015 Filed 19-Feb-2020 Filed 19-Feb-2020 USD Period Length UpdateType/Date Filed Currency Exchange Rate Auditor Filed 21-Feb-2019 USD Filed 23-Feb-2018 USD Company Description Products & Operations Contacts Contact Decision Matrix Corporate Family Corporate Overview Signals News Triggers USD Filed 19-Feb-2020 USD 1 Pricewaterhouse Coopers LLP Unqualified with Explanation 1 Pricewaterhouse Coopers LLP Unqualified Pricewaterhouse Coopers LLP Unqualified Pricewaterhouse Coopers LLP Unqualified Pricewaterhouse Coopers LLP Uncualified with Explanation Auditor Opinion 301.7 1.336.7 2538 7343 229.9 1,6645 1894 4.315.0 6,209.4 300.4 6111 925 1,541.7 1,799.1 4.840.0 6,639.1 2.7360 3,7746 Advanced Competitors Closest Industry Peers Closest Companies Analyst Reports Annual Reports SEC Filing Technologies in Use Cash Cash Equivalents Cash and Cash Equivalents Short Term Investments Cash, Cash Equivalents and Short- Term Investments Accounts Receivable Total Receivables Prepaid Assets Total Current Assets 788.7 638.7 664.3 850.2 850. 130.8 7,620.1 1129 7,111.0 2210 4,6522 5,321.9 4,113 1.8787 1225 2.0683 965 1.5676 70 - Machinery and Equipment Construction in Progress Other Property/Plant/Equipment Property Plant/Equipment Gross Accumulated Depreciation Property/Plant/Equipment - Net Goodwill Other intangible Assets Goodwill and other intangible Deferred Taxes - Non-Current Assets Non-Current Deferred Assets Other Long-Term Assets Total Non-Current Assets 100.6 697.1 22795 -1.550.7 1,728.9 1.256.7 55.1 1,311.8 2.165.3 -1.2802 885.1 1.227.3 45.0 1,2723 1.928.1 1,154.4 773.7 1.188.9 49.7 1.238.6 1.648 2579 783.9 11853 953 1,280.6 13140 STAT 7353 1.122.7 1410 1,908.1 3085 Financials Financial Health Financial Report Standardized Geographic Segments Business Segments Annual Ratios Ratio Comparisons Stock Report Income Statements Annual Standardized Interim (Standardized Balance Sheets Annual Standardized Interim (Standardized Cash Flows Annual Standardized Interim Standardized 10.5 10.5 1,908.1 134,5 5,083.3 8085 85.7 3,051.5 ELS 153.6 2,218.2 2,090.6 2,060.6 Total Assets 12,703.4 10,162.6 7,412.5 6,870.4 6.442.4 161.1 46.0 207.1 195.5 1710 36.1 207.3 343 156.5 259 1600 Accounts Payable Total Tax Payable Payables Accrued Expenses Other Short-Term Borrowings Current Debt Current Capital Lease Obligation Current Debt and Capital Lease Obligation Customer Advances Current Deferred Liabilities Total Current Liabilities 145.2 39.7 184.9 1712 8973 8973 680 965.4 170.4 170.4 85. 85.0 80.8 80.8 88.2 69.0 69,0 389 389 1,5163 278 27.8 33.7 33.7 584.0 207 237 5060 2,508.8 609.5 1,730.9 244 1.627.5 81.3 1.539.0 668 1,4551 59.7 Long-Term Debt Long-Term Capital Lease Obligation Long-Term Debt and Capital Lease Obligation Deferred Taxes - Non-Current Labilities 3,118.3 1,7553 1,708.8 1.6058 25 17.8 7.6 Twitter, Inc. Actions Other Long Term Assets Total Non-Current Assets 1345 5,083.3 857 3,051.5 67.8 2,090.6 153.6 2.218.2 61.6 2,060.6 Total Assets 12,7034 10.1026 7,412.5 6,870.4 6,442.4 Annual Standardid Interim Standardized Balance Sheets Annual Standardized Interim Standardized Cash Flows Annual (Standardized Interim Standardized 1611 1710 1222 34.3 156.5 230.7 1141 25.9 160.0 1433 207.1 207.1 195.5 1549 1712 1973 Accounts Payable Total Tax Payable Payables Accrued Expenses Other Short Term Borrowings Current Debt Current Capital Lease Obligation Current Debt and Capital Lease Obligation Customer Advances Current Deferred Liabilities Total Current Liabilities 38.2 1704 170.4 85.0 85.0 80.8 80.8 965.4 33.7 23. 27.8 27.8 58.3 23.7 S06.0 3325 1,516.3 584.0 2.3.3 G09.5 1.6275 31.3 1,539.0 66.8 1,455.1 59.7 24 3.1133 1.7088 1,605.8 1.514.8 Long Term Debt Long-Term Capital Lease Obligation Long-Term Debt and Capital Lease Obligation Deferred Taxes - Non Current Liabilities Non-Current Deferred Liabilities Other Long Term Liabilities Total Non-Current Liabilities 242 173 13:2 7.6 3.0 202 201 3,166.5 675 1.1407 50.0 1,782.0 7.6 68.0 1.681.4 3.0 S06 1,568.4 Total Liabilities 2,165. 2.265.4 2,0744 00 116 0.0 0.0 -2.671.7 0.0 0.0 -2.5504 0.0 OUD -2,093.5 Common Stock Capital Stock Retained Earnings (Accumulated Deficit Additional Paid In Capital Gains Losses) Not Affecting Retained Earnings Stockholders' Equity Total Equity 6,507.1 8.7633 -7015 7,750.5 -31.6 7,224.5 -693 653 3,7014 8.7044 6.805.6 6.805.6 5,0472 5,0472 4,604.9 4,604.9 4,368.0 4,368.0 12,703.4 10,166 7,412.5 6,870.4 Total Liabilities and Shareholders Equity 6,4424 553 306 4.738.5 6,7876 6.674. 1663 Net Tangible Assets Working Capital Invested Capital Capital Lease Obligations Total Debt Net Debt Total Capitalization Common Stock Equity Total Common Shares Outstanding Shares Issued Tangible Book Value Employees 3.3243 4,0682 61439 147.7 1,666.7 550.4 6,143.9 4,604.9 721.6 7216 3,1043 3,875.8 5.823.1 147.5 1,600.0 543.6 5,823.1 4,368.0 7338 3.288T 709. 112132 8.7044 7796 7726 6941 30.6 7643 7643 5.5333 6,674.7 5.0472 7469 7469 3086 3.372 6941 3.104.3 3 4,500 3,583 & Feedback Ped by Dune, 2000 Facebook, Inc. Actions viewing years Period Length UpdateType/Date 31-Dec-2015 12 Months Filed USD 31-Dec-2018 12 Months Filed 30-Jan-2020 USD 1 Ernst & Young LLP Unqualified 31-Dec-2019 12 Months Filed 30-Jan-2020 USD 1 Ernst & Young LLP Unqualified with Explanation 31-Dec-2016 12 Months Filed 31-Jan-2019 USD Filed Currency Exchange Rate Auditor Auditor Opinion 31-Dec-2017 12 Months Filed 30-Jan-2020 USD 1 Ernst & Young LUP Unqualified Ernst & Young LUP Unqualified with Explanation Em Young WP Une Operating Revenue Total Revenue 69.6550 70,697,0 55,093.0 55,838,0 40,653.0 27,638. Cost of Revenue Gross Profit 12.770.0 57,927.0 9,355.0 46,483.0 5.4540 35,1990 2.8570 15.05 23.04. Other General and Administrative 10.4550 3,4510 2517 1.710 123.0 2.7250 General and Administrative Expense Seling and Marketing Selling. General and Administrative Expenses Research and Development Total Operating Expense 10.455.0 9,876.0 20,341.0 11,600.0 33,941.0 24510 7.8460 11,297,0 10,273.0 21,570.0 2.5170 4.725.0 7,2420 7,7540 24,996.0 1.7310 3.772.0 5,503 5,919.0 11,422.0 460 3.836.0 Operating Income 23,986.0 24,913.0 20,203.0 12.427 6225.0 9240 6610 170 200 210 392.0 166.0 Interest Income Non-Operating Interest Expense - Non-Operating Net Non-Operating interest Income (Expense) Gain on Sale of Security Other NonOperating Income penses Other income Expense) Income Before Tax 652.0 -2130 CO -1050 27.0 -78.0 24,812.0 10 -75.0 12,518.0 25,361.0 20,594.0 6,2540 Total Income Tax Income After Tax 2.5060 6.3270 18,485.0 46600 15,3340 23010 30,210 22,112.0 Net Income from Continuing Operations Net Income 18.455.0 11,455.0 22,112,0 22,112.0 15,934.0 15,934.0 10,217. 10,217.0 2. Other Preferred Stock Dividend Net Income Available to Common Stockholders -10 22,1110 18,485.0 15,920.0 10,1880 3,66 3.56 3.56 131 6.43 6.43 2.854D 2,876.0 765 765 7.ST 7.57 2.100 2.9210 10 6610 9.0 5. 5.39 5.39 2010 2.9560 2.863.0 Basic EPS Basic EPS from Continuing Operations Diluted EPS Diluted EPS from Continuing Operations Basic Average Shares Diluted Average Shares Dilution Adjustment Interest income Interest Expense Net interest income Net Income Including Non-Controlling Interests Net Income from Continuing and 2:03 2151 10 3980 520 9240 200 9040 18.435.0 29.0 1760 JOTO 160 102110 22.1120 15.9040 Feedback 18.450 22.112.0 15.04.0 Generating your Report 1 Dun & Bradstree, Inc. 2020. AlRights Reserved. Privacy Policy Terms Information Partners Facebook, Inc. Actions USD 31-Dec-2019 31-Dec-2018 31-Dec-2017 31-Dec-2016 31-Dec-2015 Period Fed 30-2020 30-Jan-2020 Filed Currency 31-Jan-2019 USD USD 1 1 Auditor USD 1 Emut & Young LLP Ungulfed with Explanation Loung LLP Unte mung LLP Ungud 1. 7306D 5.60 Company Summary Company Description Products & Operations Contacts Contact Decision Matrix Corporate Family Corporate Overview Signals SWOT News Tris Advanced Competitors Closest industry Peers Closest Companies Analyst Reports Annual Reports SEC filings Technologies in Use 4 TO 14.30 19.00 25,7160 1. 2010 NOT 13.01 14 2006.D 41,1140 41,711 29,448. Cash Even Cash and Cashes Short Term investments Cash, Cash qahvalents and short Term Investments Accounts receivable Total Receivables Prepaid Total Current Assets 2TD 9.5180 9,5180 NO 2.500 2,599.0 TSD 1,990 5320 3,8320 1.600 48,563. 3441 21.6520 Land and improvements Buildings and improvements Machinery and Equipment Construction in Progress 78 4D CD 2220 TO 31.2060 BERITO 10,000 11120 11.05. 58.16 S.S. 1.00 SO TO 1.1.0 31.3.0 2500 NO 183310 4. 1. Other Property Planet Property Gross Accumulated Depreciation Property Planet Goodwill Otherapie Geodwill and other intet Other Long Terme Total Non-Current Assets 31.750 S.GR 11.06 2460 21 22 TO 19.03 2.70 67.1510 12210 14 20.105. 2.15 15,961.0 .. 25. 46,8540 12 30,00 Total Arts 14,524 64,163. 45,402.0 1960 Financials Financial Health Financial Report Standardized Geographic Segments Business Segments Annual Ratios Ratio Comparisons Stock Report Income Statements Annual (Standardized Interim (Standardized Balance Sheets Annual Standardized Interim (Standardid Cash Flows Annual Standard Interim (Standardized) 3000 MO 2118 Accounts Payable Total Ple Other Payables Payables Apes Create Line of Credit 1,810 HD 1990 2010 ZTTO 500D DO 2010 70 2010 1,0770 2010 Current Capitale Obligation Current Debt and Capital Lasse ligation Customer Advance Current Deferred Liabilities Other Comestabilities Total Current Liabilities SOOD 3470 90.0 LTD 7,017.0 15.053.0 3.760 2. 1.325.0 . 40 101 BOTS 500 Long Term Capitolion Long-Term Debt and Caption Derved Toes on- Cente NonCurver Defende Trade and Other Payables. Non Current Other Long Termine Total on Current Liabilities NO 1,055 1900 LAST, 2,12 3,264.0 Total Liabilities 32,122.0 1.3.2010 10.177. 5,7676 Retained amnings en beter 41.5810 33.000 21.6 55.000 4550 Galins Low Notecting -T00D Generating your Report und deine Privacy policy Paners Facebook, Inc. Actions 21. 49000 2,100 2273 Land and improvements Building and Machinery and ment Construction Pro LOTO 11.220 TO 30,000 31120 7, 3000 1. 29000 1500 1,80 3310 40 31.513.0 TRS 55.46.0 10.30 24,633.0 3,881. Other Property Property Mantes Accumulated Depreciation Property Plant/quipment - Net Cardas Other intangibles Goodwill and Other interes Omargom Total Non-Current Assets 18.735.0 13.10 182210 LD 20.305 2240 212920 25.995. 20.45 29.09. 2.150 67,851.0 4. 35. 21. Analyst Reports Annual Reports SEC Filings Technologies in Use Financials Financial Health Financial Report Standardized Geographic Segments Business Segments Annual Ratios Ratio Comparisons Stock Report Income Statements Annual Standardized Interim (standardized Balance Sheets Annual (Standardized) Interim (Standardized Cash Flows Annual (Standardized Interim (Standardized) Total 133.0 97,34 14.500 34,99 Accounts Payable Total Tax Payable 1360 0940 60 2.0T3.0 2178 20 737 Payable 1. 1,5510 2000 Current Notes Payable Line of Credit 5000 2770 2770 1000 1.OTTO 20 200 Current Captain Current Debt and Capital Lease lotion Customer Me Current Defend Us Other Comestibilities Total Current Liabilities 2010 LOTTO 200 1,081 2.175.0 35,053 7,027.0 5340 300 GTD Long lon Capital Lease Obligation Long-Term Debt Caption Deferred on Cuneste Non Current Deferred Trade and Other Payables Monument Other Lang Total Non-Current ST 2.6L 2.AL 1.050 17,20.0 6.100 SALTO 2.2.0 Total Liabilities 120 13.2010 10 5.767. 55.620 21,670 2010 2220 D 4550 30 Additional Paid Capital Gains Lowest lecting the Stockholders' Equity Total Equity 101,0540 7440 10 4.LT Total Liabilities and Shareholders' Equity 233, 97,334 14.40 64. 22 03.0 M0 84,8270 591 24 Netangibles Working Capital Invested Capital Capital Options Totale Total Captain Common Stackovity Total Com Share Outstanding Treasury Shares 1.450 51.1720 10.30 10140 30.000 SOLO 01.0540 2.6520 MO 42 14.1270 2.000 24 4 2. 1520 2.5 2. Tangle Book Value Employees 11.50 440 27500 1200 25.105 asport Actions Twitter, Inc. OneStop 1,805 Conta 1,715 Report Collapse All Core Company Summary Company Description Products & Operations Contacts Contact Decision Matrix Corporate Family Corporate Overview Signals News Except for share items millions and perhatitlinancials Millions Annual Income (Standardized) Viewing 5 years USD 31-Dec-2019 31-Dec-2018 31-Dec-2017 31-Dec-2016 Period Length 12 Months 12 Months 12 Months 12 Months UpdateType Date Filled Filed Filed Filed 19-Feb-2020 19-Feb-2020 19-Feb-2020 21-Feb-2019 Filed Currency USD USD USD Exchange Rate 1 1 1 Auditor Pricewaterhouse Pricewaterhouse Pricewaterhouse Pricewaterhouse Coopers LLP Coopers LLP Coopers LLP Coopers LLP Auditor Opinion Unqualified with Unqualified Unqualified Unqualified Explanation USD 31-Dec-2015 12 Months Filed 23-Feb-2018 USD 1 Pricewaterhouse Coopers LLP Unqualified with Explanation Operating Revenue Total Revenue 30424 3,0424 2.44 2.443.3 2.529.6 2,529.6 2,218.0 2,218.0 TO Cost of Revenue Gross Profit 965.0 2,0774 8612 1.582.1 932.2 1,597.4 729.3 1,458.8 Advanced Competitors Closest Industry Peers Closest Companies Analyst Reports Annual Reports SEC Filings Technologies in Use 2988 283.9 293.3 260.7 3533 283.9 293.3 260.7 Other General and Administrative Expenses General and Administrative Expense Selling and Marketing Selling, General and Administrative Expenses Research and Development Total Operating Expense 9138 1,2726 771.4 1,070.2 717.4 1,001.3 871.5 1,1122 1,251.1 806.6 553.9 1,624.0 542.0 1,543.3 713.5 1,964.6 1,9388 Operating Income 366.4 38.7 IST. 1112 243 100.0 98.2 1052 -50.9 Interest Income Non-Operating Interest Expense-Non-Operating Net Non-Operating Interest Income (Expense) Other Non-Operating income Expenses Other Income (Expense) Income Before Tax 8.4 -733 2.1 Financials Financial Health Financial Report (Standarded Geographic Segments Business Serents Annual Ratios Ratio Comparisons Stock Report Income Statements Annual (Standardized Interim Standardized Balance Sheets Annual (Standardized Interim Standard Cash Flows Annual (Standardized Interim Standardized 14.9 14.9 30.1 423.5 - 95.4 440.8 -2,095.5 16.0 Total Income Tax Income After Tax 126 -103.1 -12.3 -521.0 1,205.6 1,465.7 1,205.6 -108.1 -456.9 -521.0 Net Income from Continuing Operations Net Income 1,205.6 -108.1 456.9 -5210 1,465.7 1,205.6 -100.1 -456.9 Net Income Available to Common Stockholders 150 -0.15 190 190 -0.65 -0.65 150 0.15 Basic EPS Basic EPS from Continuing Operations Diluted EPS Diluted EPS from Continuing Operations Chines 5 S Feedback 157 156 0.15 015 -0.65 -0.65 136 743 7127 7171 2624 Twitter, Inc. Actions 31-Dec-2019 31-Dec-2018 31-Dec-2017 31-Dec-2016 31-Dec-2015 Filed 19-Feb-2020 Filed 19-Feb-2020 USD Period Length UpdateType/Date Filed Currency Exchange Rate Auditor Filed 21-Feb-2019 USD Filed 23-Feb-2018 USD Company Description Products & Operations Contacts Contact Decision Matrix Corporate Family Corporate Overview Signals News Triggers USD Filed 19-Feb-2020 USD 1 Pricewaterhouse Coopers LLP Unqualified with Explanation 1 Pricewaterhouse Coopers LLP Unqualified Pricewaterhouse Coopers LLP Unqualified Pricewaterhouse Coopers LLP Unqualified Pricewaterhouse Coopers LLP Uncualified with Explanation Auditor Opinion 301.7 1.336.7 2538 7343 229.9 1,6645 1894 4.315.0 6,209.4 300.4 6111 925 1,541.7 1,799.1 4.840.0 6,639.1 2.7360 3,7746 Advanced Competitors Closest Industry Peers Closest Companies Analyst Reports Annual Reports SEC Filing Technologies in Use Cash Cash Equivalents Cash and Cash Equivalents Short Term Investments Cash, Cash Equivalents and Short- Term Investments Accounts Receivable Total Receivables Prepaid Assets Total Current Assets 788.7 638.7 664.3 850.2 850. 130.8 7,620.1 1129 7,111.0 2210 4,6522 5,321.9 4,113 1.8787 1225 2.0683 965 1.5676 70 - Machinery and Equipment Construction in Progress Other Property/Plant/Equipment Property Plant/Equipment Gross Accumulated Depreciation Property/Plant/Equipment - Net Goodwill Other intangible Assets Goodwill and other intangible Deferred Taxes - Non-Current Assets Non-Current Deferred Assets Other Long-Term Assets Total Non-Current Assets 100.6 697.1 22795 -1.550.7 1,728.9 1.256.7 55.1 1,311.8 2.165.3 -1.2802 885.1 1.227.3 45.0 1,2723 1.928.1 1,154.4 773.7 1.188.9 49.7 1.238.6 1.648 2579 783.9 11853 953 1,280.6 13140 STAT 7353 1.122.7 1410 1,908.1 3085 Financials Financial Health Financial Report Standardized Geographic Segments Business Segments Annual Ratios Ratio Comparisons Stock Report Income Statements Annual Standardized Interim (Standardized Balance Sheets Annual Standardized Interim (Standardized Cash Flows Annual Standardized Interim Standardized 10.5 10.5 1,908.1 134,5 5,083.3 8085 85.7 3,051.5 ELS 153.6 2,218.2 2,090.6 2,060.6 Total Assets 12,703.4 10,162.6 7,412.5 6,870.4 6.442.4 161.1 46.0 207.1 195.5 1710 36.1 207.3 343 156.5 259 1600 Accounts Payable Total Tax Payable Payables Accrued Expenses Other Short-Term Borrowings Current Debt Current Capital Lease Obligation Current Debt and Capital Lease Obligation Customer Advances Current Deferred Liabilities Total Current Liabilities 145.2 39.7 184.9 1712 8973 8973 680 965.4 170.4 170.4 85. 85.0 80.8 80.8 88.2 69.0 69,0 389 389 1,5163 278 27.8 33.7 33.7 584.0 207 237 5060 2,508.8 609.5 1,730.9 244 1.627.5 81.3 1.539.0 668 1,4551 59.7 Long-Term Debt Long-Term Capital Lease Obligation Long-Term Debt and Capital Lease Obligation Deferred Taxes - Non-Current Labilities 3,118.3 1,7553 1,708.8 1.6058 25 17.8 7.6 Twitter, Inc. Actions Other Long Term Assets Total Non-Current Assets 1345 5,083.3 857 3,051.5 67.8 2,090.6 153.6 2.218.2 61.6 2,060.6 Total Assets 12,7034 10.1026 7,412.5 6,870.4 6,442.4 Annual Standardid Interim Standardized Balance Sheets Annual Standardized Interim Standardized Cash Flows Annual (Standardized Interim Standardized 1611 1710 1222 34.3 156.5 230.7 1141 25.9 160.0 1433 207.1 207.1 195.5 1549 1712 1973 Accounts Payable Total Tax Payable Payables Accrued Expenses Other Short Term Borrowings Current Debt Current Capital Lease Obligation Current Debt and Capital Lease Obligation Customer Advances Current Deferred Liabilities Total Current Liabilities 38.2 1704 170.4 85.0 85.0 80.8 80.8 965.4 33.7 23. 27.8 27.8 58.3 23.7 S06.0 3325 1,516.3 584.0 2.3.3 G09.5 1.6275 31.3 1,539.0 66.8 1,455.1 59.7 24 3.1133 1.7088 1,605.8 1.514.8 Long Term Debt Long-Term Capital Lease Obligation Long-Term Debt and Capital Lease Obligation Deferred Taxes - Non Current Liabilities Non-Current Deferred Liabilities Other Long Term Liabilities Total Non-Current Liabilities 242 173 13:2 7.6 3.0 202 201 3,166.5 675 1.1407 50.0 1,782.0 7.6 68.0 1.681.4 3.0 S06 1,568.4 Total Liabilities 2,165. 2.265.4 2,0744 00 116 0.0 0.0 -2.671.7 0.0 0.0 -2.5504 0.0 OUD -2,093.5 Common Stock Capital Stock Retained Earnings (Accumulated Deficit Additional Paid In Capital Gains Losses) Not Affecting Retained Earnings Stockholders' Equity Total Equity 6,507.1 8.7633 -7015 7,750.5 -31.6 7,224.5 -693 653 3,7014 8.7044 6.805.6 6.805.6 5,0472 5,0472 4,604.9 4,604.9 4,368.0 4,368.0 12,703.4 10,166 7,412.5 6,870.4 Total Liabilities and Shareholders Equity 6,4424 553 306 4.738.5 6,7876 6.674. 1663 Net Tangible Assets Working Capital Invested Capital Capital Lease Obligations Total Debt Net Debt Total Capitalization Common Stock Equity Total Common Shares Outstanding Shares Issued Tangible Book Value Employees 3.3243 4,0682 61439 147.7 1,666.7 550.4 6,143.9 4,604.9 721.6 7216 3,1043 3,875.8 5.823.1 147.5 1,600.0 543.6 5,823.1 4,368.0 7338 3.288T 709. 112132 8.7044 7796 7726 6941 30.6 7643 7643 5.5333 6,674.7 5.0472 7469 7469 3086 3.372 6941 3.104.3 3 4,500 3,583 & Feedback Ped by Dune, 2000