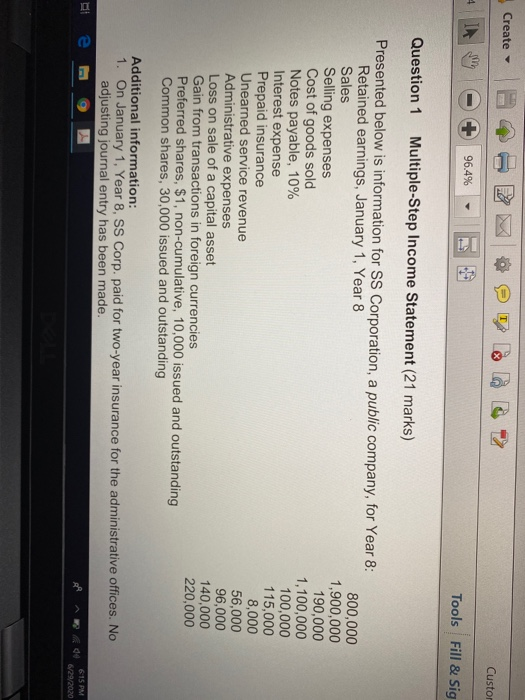

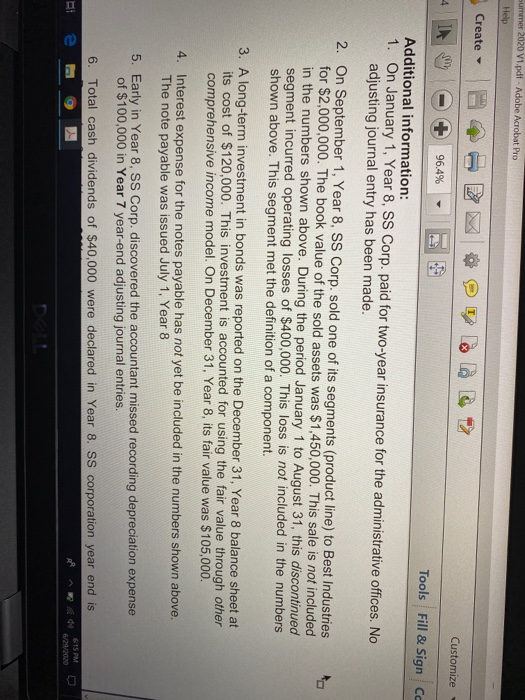

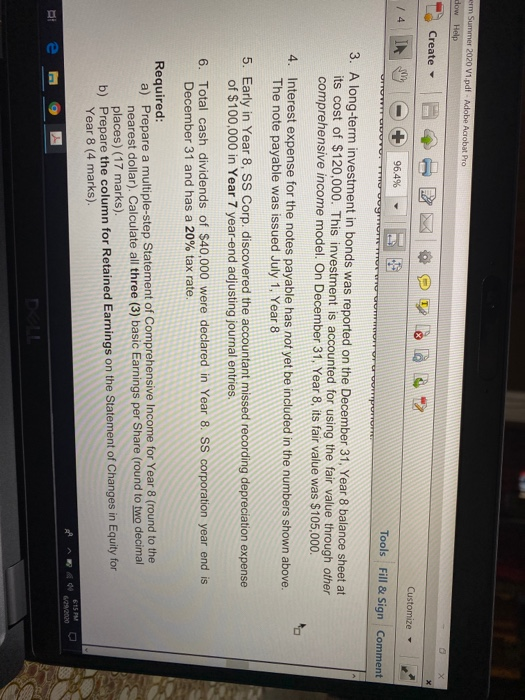

Create - Custor 4 96.4% 11 Tools Fill & Sig Question 1 Multiple-Step Income Statement (21 marks) Presented below is information for SS Corporation, a public company, for Year 8: Retained earnings, January 1, Year 8 800,000 Sales 1,900,000 Selling expenses 190,000 Cost of goods sold 1,100,000 Notes payable, 10% 100,000 Interest expense 115,000 Prepaid insurance 8,000 Unearned service revenue 56,000 Administrative expenses 96,000 Loss on sale of a capital asset 140,000 Gain from transactions in foreign currencies 220,000 Preferred shares, $1, non-cumulative, 10,000 issued and outstanding Common shares, 30,000 issued and outstanding Additional information: 1. On January 1, Year 8, SS Corp. paid for two-year insurance for the administrative offices. No adjusting journal entry has been made. E de 6:15 PM 6/29/2020 Summer 2020 V1.pdf - Adobe Acrobat Pro Help Create - Customize 4 IN 96.4% Tools Fill & Sign Cc Additional information: 1. On January 1, Year 8, SS Corp. paid for two-year insurance for the administrative offices. No adjusting journal entry has been made. 2. On September 1, Year 8, SS Corp. sold one of its segments (product line) to Best Industries for $2,000,000. The book value of the sold assets was $1,450,000. This sale is not included in the numbers shown above. During the period January 1 to August 31, this discontinued segment incurred operating losses of $400,000. This loss is not included in the numbers shown above. This segment met the definition of a component. 3. A long-term investment in bonds was reported on the December 31, Year 8 balance sheet at its cost of $120,000. This investment is accounted for using the fair value through other comprehensive income model. On December 31, Year 8, its fair value was $105,000. 4. Interest expense for the notes payable has not yet be included in the numbers shown above. The note payable was issued July 1, Year 8 5. Early in Year 8, SS Corp. discovered the accountant missed recording depreciation expense of $100,000 in Year 7 year-end adjusting journal entries. 6. Total cash dividends of $40,000 were declared in Year 8. SS corporation year end is RI e E 615 PM 6/29/2020 erm Summer 2020 V1.pdf - Adobe Acrobat Pro dow Help X Create Customize / 4 96.4% To oogmer UTTUWT Uwoy Tools Fill & Sign Comment 3. A long-term investment in bonds was reported on the December 31, Year 8 balance sheet at its cost of $120,000. This investment is accounted for using the fair value through other comprehensive income model. On December 31, Year 8, its fair value was $105,000. 4. Interest expense for the notes payable has not yet be included in the numbers shown above. The note payable was issued July 1, Year 8 5. Early in Year 8, SS Corp. discovered the accountant missed recording depreciation expense of $100,000 in Year 7 year-end adjusting journal entries, 6. Total cash dividends of $40,000 were declared in Year 8. SS corporation year end is December 31 and has a 20% tax rate. Required: a) Prepare a multiple-step Statement of Comprehensive Income for Year 8 (round to the nearest dollar). Calculate all three (3) basic Earnings per Share (round to two decimal places) (17 marks). b) Prepare the column for Retained Earnings on the Statement of Changes in Equity for Year 8 (4 marks) 615 PM BI Dell Create - Custor 4 96.4% 11 Tools Fill & Sig Question 1 Multiple-Step Income Statement (21 marks) Presented below is information for SS Corporation, a public company, for Year 8: Retained earnings, January 1, Year 8 800,000 Sales 1,900,000 Selling expenses 190,000 Cost of goods sold 1,100,000 Notes payable, 10% 100,000 Interest expense 115,000 Prepaid insurance 8,000 Unearned service revenue 56,000 Administrative expenses 96,000 Loss on sale of a capital asset 140,000 Gain from transactions in foreign currencies 220,000 Preferred shares, $1, non-cumulative, 10,000 issued and outstanding Common shares, 30,000 issued and outstanding Additional information: 1. On January 1, Year 8, SS Corp. paid for two-year insurance for the administrative offices. No adjusting journal entry has been made. E de 6:15 PM 6/29/2020 Summer 2020 V1.pdf - Adobe Acrobat Pro Help Create - Customize 4 IN 96.4% Tools Fill & Sign Cc Additional information: 1. On January 1, Year 8, SS Corp. paid for two-year insurance for the administrative offices. No adjusting journal entry has been made. 2. On September 1, Year 8, SS Corp. sold one of its segments (product line) to Best Industries for $2,000,000. The book value of the sold assets was $1,450,000. This sale is not included in the numbers shown above. During the period January 1 to August 31, this discontinued segment incurred operating losses of $400,000. This loss is not included in the numbers shown above. This segment met the definition of a component. 3. A long-term investment in bonds was reported on the December 31, Year 8 balance sheet at its cost of $120,000. This investment is accounted for using the fair value through other comprehensive income model. On December 31, Year 8, its fair value was $105,000. 4. Interest expense for the notes payable has not yet be included in the numbers shown above. The note payable was issued July 1, Year 8 5. Early in Year 8, SS Corp. discovered the accountant missed recording depreciation expense of $100,000 in Year 7 year-end adjusting journal entries. 6. Total cash dividends of $40,000 were declared in Year 8. SS corporation year end is RI e E 615 PM 6/29/2020 erm Summer 2020 V1.pdf - Adobe Acrobat Pro dow Help X Create Customize / 4 96.4% To oogmer UTTUWT Uwoy Tools Fill & Sign Comment 3. A long-term investment in bonds was reported on the December 31, Year 8 balance sheet at its cost of $120,000. This investment is accounted for using the fair value through other comprehensive income model. On December 31, Year 8, its fair value was $105,000. 4. Interest expense for the notes payable has not yet be included in the numbers shown above. The note payable was issued July 1, Year 8 5. Early in Year 8, SS Corp. discovered the accountant missed recording depreciation expense of $100,000 in Year 7 year-end adjusting journal entries, 6. Total cash dividends of $40,000 were declared in Year 8. SS corporation year end is December 31 and has a 20% tax rate. Required: a) Prepare a multiple-step Statement of Comprehensive Income for Year 8 (round to the nearest dollar). Calculate all three (3) basic Earnings per Share (round to two decimal places) (17 marks). b) Prepare the column for Retained Earnings on the Statement of Changes in Equity for Year 8 (4 marks) 615 PM BI Dell