Answered step by step

Verified Expert Solution

Question

1 Approved Answer

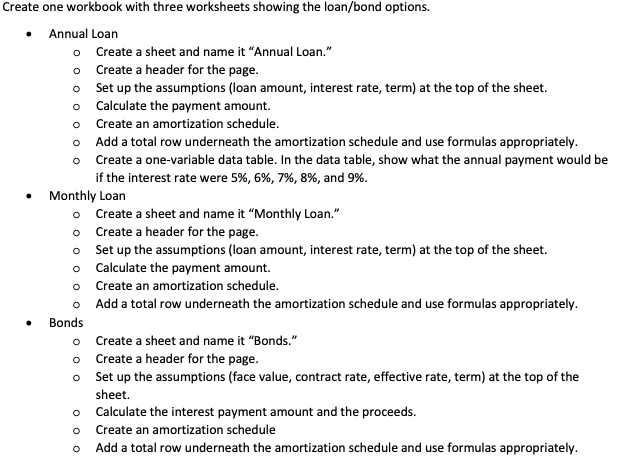

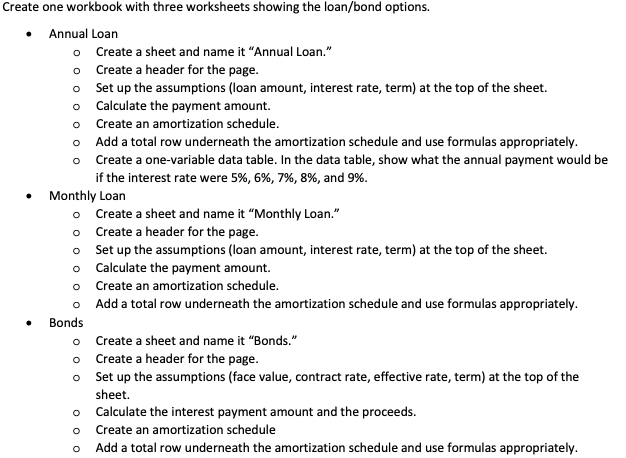

Create one workbook with three worksheets showing the loan / bond options. Annual Loan Create a sheet and name it Annual Loan. Create a header

Create one workbook with three worksheets showing the loanbond options.

Annual Loan

Create a sheet and name it "Annual Loan."

Create a header for the page.

Set up the assumptions loan amount, interest rate, term at the top of the sheet.

Calculate the payment amount.

Create an amortization schedule.

Add a total row underneath the amortization schedule and use formulas appropriately.

Create a onevariable data table. In the data table, show what the annual payment would be

if the interest rate were and

Monthly Loan

Create a sheet and name it "Monthly Loan."

Create a header for the page.

Set up the assumptions loan amount, interest rate, term at the top of the sheet.

Calculate the payment amount.

Create an amortization schedule.

Add a total row underneath the amortization schedule and use formulas appropriately.

Bonds

Create a sheet and name it "Bonds."

Create a header for the page.

Set up the assumptions face value, contract rate, effective rate, term at the top of the

sheet.

Calculate the interest payment amount and the proceeds.

Create an amortization schedule

Add a total row underneath the amortization schedule and use formulas appropriately.You are still working with Angela Zithern at Ye Olde Sweets. Angela needs to purchase some more equipment, so she is considering borrowing some money. Angela has two options: she can get a loan from the bank or sell some bonds in the market.

The bank is offering a $ loan with a year term and interest rate of Angela has the option of either paying monthly or annually. All payments will be made at the end of the period.

Angela also has the option of selling bonds. The bonds would be $ face value with a contract rate of The market rate right now is The interest will be paid annually with the principal due in years.

Angela also asks you what would happen if the interest rate changes. You say, Ill get you the schedules and then show you what happens if the rate changes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started