Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create Pro-Forma Financial Statements (I/S, B/S and Statement of Cash Flows) with deltas out 3 years and analysis Each year must have 2 columns: 1

- Create Pro-Forma Financial Statements (I/S, B/S and Statement of Cash Flows) with deltas out 3 years and analysis

Each year must have 2 columns: 1 with your strategy and 1 without your strategy.- Include Pro-Forma ratios for the first year out with deltas contrasting from the most current year’s ratios.

Use the data below:

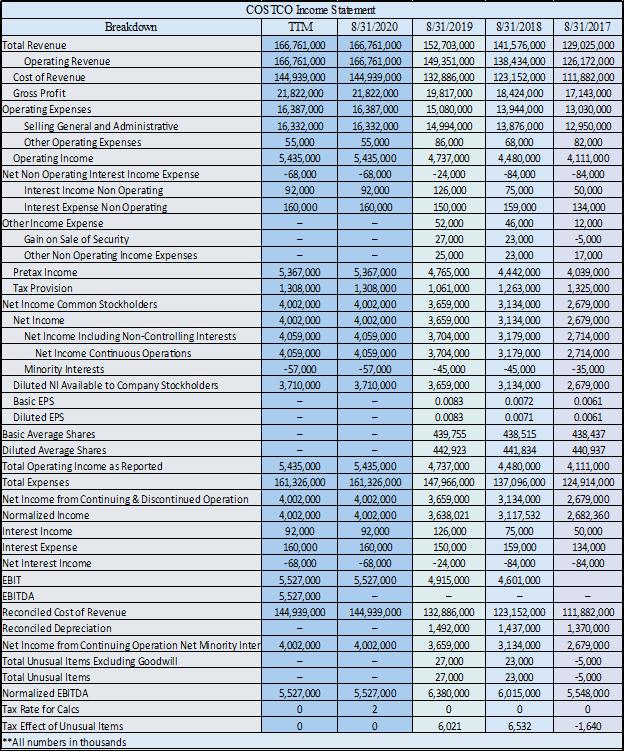

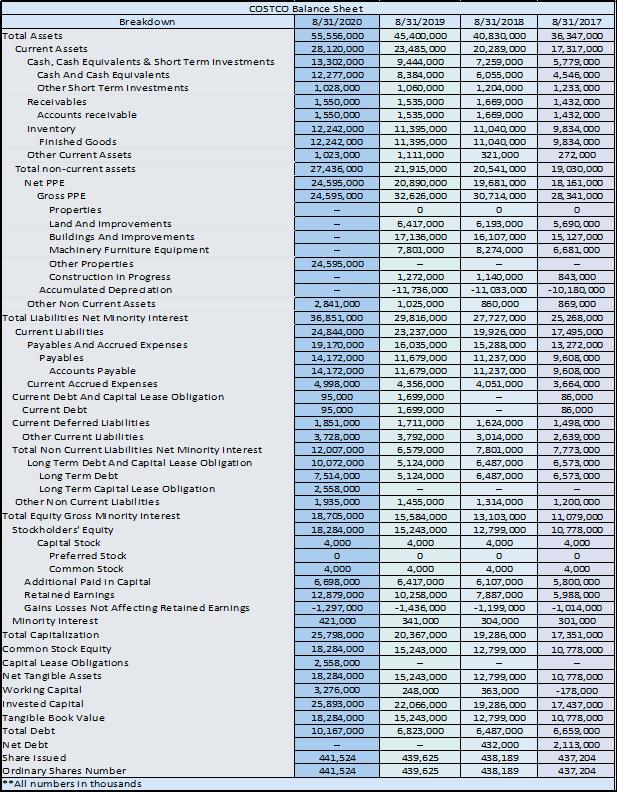

Total Revenue Operating Revenue Cost of Revenue Gross Profit Operating Expenses Selling General and Administrative Other Operating Expenses Operating Income Breakdown Net Non Operating Interest Income Expense Interest Income Non Operating Interest Expense Non Operating Other Income Expense Gain on Sale of Security Other Non Operating Income Expenses Pretax Income Tax Provision Net Income Common Stockholders Net Income Net Income Including Non-Controlling Interests Net Income Continuous Operations Minority Interests Diluted NI Available to Company Stockholders Basic EPS Diluted EPS Basic Average Shares Diluted Average Shares Total Operating Income as Reported Total Expenses Interest Income Interest Expense Net Income from Continuing & Discontinued Operation Normalized Income Net Interest Income EBIT EBITDA Reconciled Cost of Revenue Reconciled Depreciation Normalized EBITDA Tax Rate for Calcs COSTCO Income Statement TIM 8/31/2020 8/31/2019 8/31/2018 8/31/2017 166,761,000 166,761,000 152,703,000 141,576,000 129,025,000 166,761,000 166,761,000 149,351,000 138,434,000 126,172,000 144,939,000 144,939,000 132,886,000 123,152,000 21,822,000 21,822,000 19,817,000 18,424,000 17,143,000 111,882,000 16,387,000 16,387,000 15,080,000 13,944,000 13,030,000 16,332,000 14,994,000 13,876,000 12,950,000 55,000 86,000 68,000 82,000 5,435,000 4,737,000 4,480,000 4,111,000 -68,000 -24,000 -84,000 -84,000 92,000 126,000 75,000 50,000 160,000 150,000 159,000 134,000 52,000 46,000 12,000 27,000 23,000 -5,000 25,000 23,000 17,000 4,765,000 4,442,000 4,039,000 1,061,000 1,263,000 1,325,000 3,659,000 3,134,000 2,679,000 3,659,000 3,134,000 2,679,000 3,704,000 3,179,000 2,714,000 Net Income from Continuing Operation Net Minority Inter Total Unusual Items Excluding Goodwill Total Unusual Items Tax Effect of Unusual Items **All numbers in thousands 16,332,000 55,000 5,435,000 -68,000 92,000 160,000 5,367,000 1,308,000 4,002,000 4,002,000 4,059,000 4,059,000 -57,000 3,710,000 5,435,000 161,326,000 4,002,000 4,002,000 92,000 160,000 -68,000 5,527,000 5,527,000 144,939,000 - 4,002,000 5,527,000 0 0 5,367,000 1,308,000 4,002,000 4,002,000 4,059,000 4,059,000 -57,000 3,710,000 144,999,000 4,002,000 3,704,000 3,179,000 -45,000 -45,000 5,435,000 161,326,000 4,002,000 4,002,000 92,000 160,000 150,000 -68,000 -24,000 5,527,000 4,915,000 5,527,000 2 0 3,659,000 0.0083 0.0083 439,755 442,923 4,737,000 147,966,000 3,659,000 3,638,021 126,000 3,134,000 0.0072 0.0071 6,380,000 0 6,021 438,515 441,834 4,480,000 4,111,000 137,096,000 124,914,000 3,134,000 3,117,532 75,000 159,000 -84,000 4,601,000 132,886,000 123,152,000 1,492,000 1,437,000 3,659,000 3,134,000 27,000 23,000 27,000 23,000 6,015,000 0 6,532 2,714,000 -35,000 2,679,000 0.0061 0.0061 438,437 440,937 2,679,000 2,682,360 50,000 134,000 -84,000 111,882,000 1,370,000 2,679,000 -5,000 -5,000 5,548,000 0 -1,640

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer ProForma Financial Statements IS BS and Statement of Cash Flows with deltas out three years and analysis Each year must have two columns one with your strategy and one without your strategy Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started