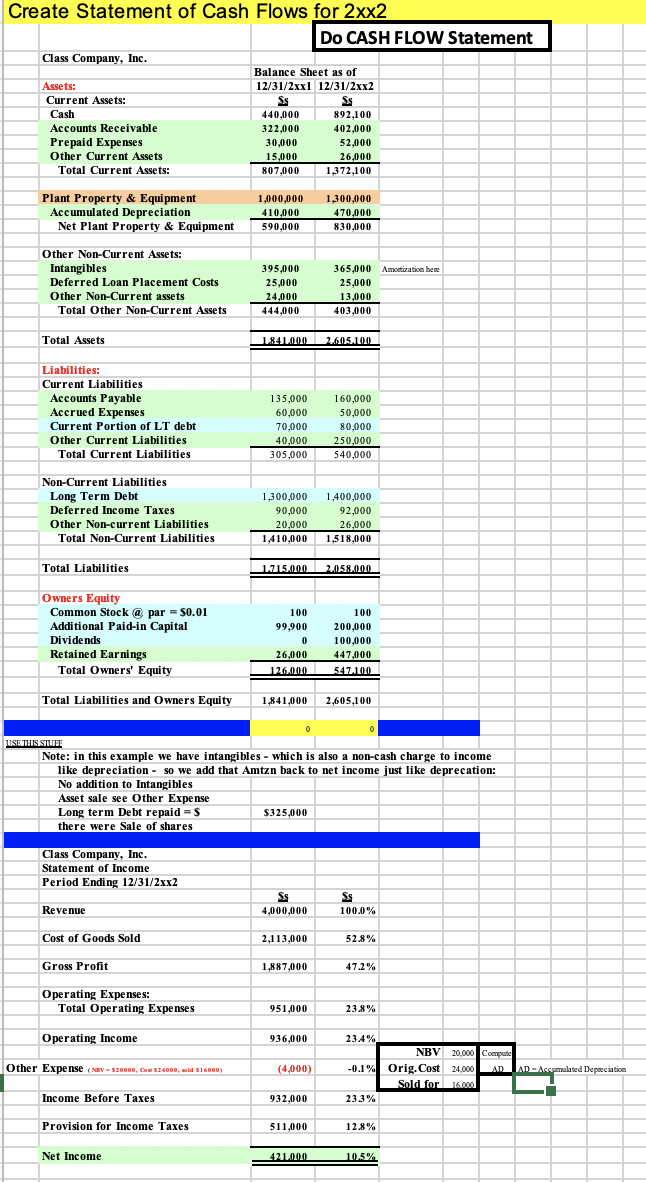

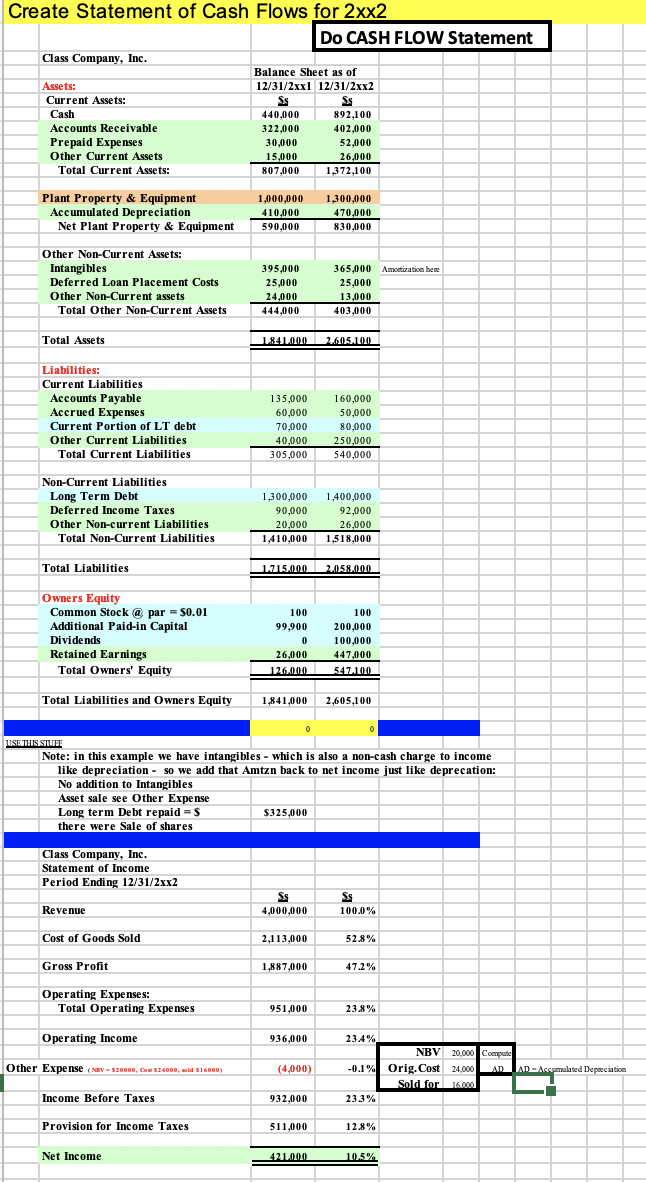

Create Statement of Cash Flows for 2xx2 Do CASH FLOW Statement Class Company, Inc. SS Assets: Current Assets: Cash Accounts Receivable Prepaid Expenses Other Current Assets Total Current Assets: Balance Sheet as of 12/31/2xxl 12/31/2xx2 Ss 440,000 892,100 322,000 402,000 30,000 52,000 15,000 26.000 807,000 1,372,100 Plant Property & Equipment Accumulated Depreciation Net Plant Property & Equipment 1,000,000 410,000 590,000 1,300,000 470,000 830,000 Amortization here Other Non-Current Assets: Intangibles Deferred Loan Placement Costs Other Non-Current assets Total Other Non-Current Assets 395,000 25,000 24,000 444,000 365,000 25,000 13,000 403,000 Total Assets 1841.000 2.605.100 Liabilities: Current Liabilities Accounts Payable Accrued Expenses Current Portion of LT debt Other Current Liabilities Total Current Liabilities 135,000 60,000 70,000 40,000 305,000 160,000 50,000 80,000 250,000 540,000 Non-Current Liabilities Long Term Debt Deferred Income Taxes Other Non-current Liabilities Total Non-Current Liabilities 1,300,000 90,000 20,000 1,410,000 1,400,000 92,000 26,000 1,518,000 Total Liabilities 1715.000 2.058.000 100 Owners Equity Common Stock @ par = $0.01 Additional Paid-in Capital Dividends Retained Earnings Total Owners' Equity 100 99,900 0 26.000 126.000 200,000 100,000 447 000 547.100 Total Liabilities and Owners Equity 1,841,000 2,605,100 USE THIS SIUFF Note: in this example we have intangibles - which is also a non-cash charge to income like depreciation - so we add that Amtzn back to net income just like deprecation: No addition to Intangibles Asset sale see Other Expense Long term Debt repaid = $ $325,000 there were Sale of shares Class Company, Inc. Statement of Income Period Ending 12/31/2xx2 SS 4,000,000 SS 100.0% Revenue Cost of Goods Sold 2,113,000 52.8% Gross Profit 1,887,000 47.2% Operating Expenses: Total Operating Expenses 951,000 23.8% Operating Income 936,000 23.4% Other Expense (NBV - 520000, 524000, 516000) (4,000) -0.1% NBV Orig. Cost Sold for 20,000 Compute 24,000 AD LAD - Accumulated Depreciation 16.00 Income Before Taxes 932,000 23.3% Provision for Income Taxes 511,000 12.8% Net Income 421000 10.5%