Answered step by step

Verified Expert Solution

Question

1 Approved Answer

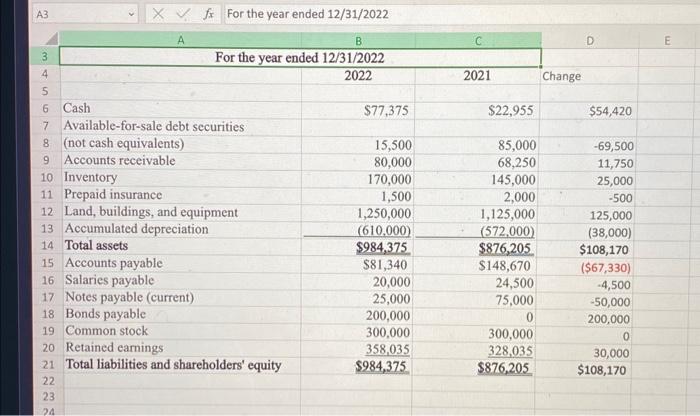

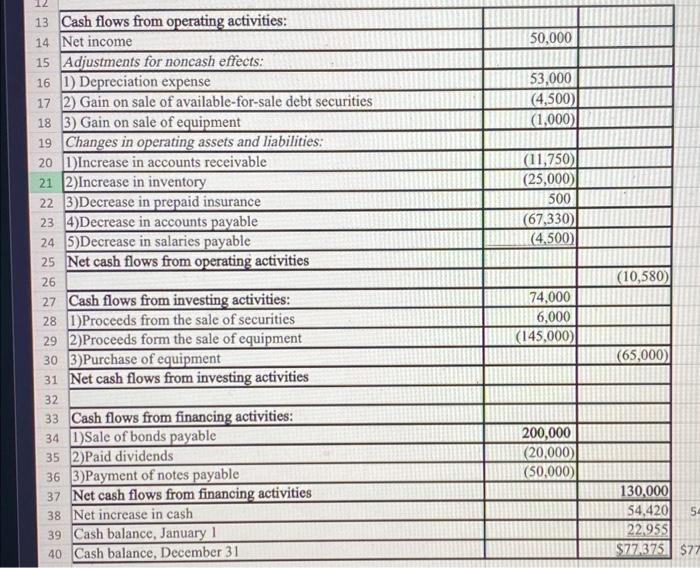

create t accounts, showing how to estimate the depreciation expense for 2021. create a t accounts, showing how to reconcile the retained earnings account. A3

create t accounts, showing how to estimate the depreciation expense for 2021. create a t accounts, showing how to reconcile the retained earnings account.

A3 For the year ended 12/31/2022 \begin{tabular}{|c|c|c|c|c|} \hline 2 & A & B & C & D \\ \hline 3 & \multicolumn{3}{|c|}{ For the year ended 12/31/2022} & \\ \hline 4 & & 2022 & 2021 & Change \\ \hline 5 & . & & & \\ \hline 6 & Cash & $77,375 & $22,955 & $54,420 \\ \hline 7 & Available-for-sale debt securities & & & \\ \hline 8 & (not cash equivalents) & 15,500 & 85,000 & 69,500 \\ \hline 9 & Accounts receivable & 80,000 & 68,250 & 11,750 \\ \hline 10 & Inventory & 170,000 & 145,000 & 25,000 \\ \hline 11 & Prepaid insurance & 1,500 & 2,000 & -500 \\ \hline 12 & Land, buildings, and equipment & 1,250,000 & 1,125,000 & 125,000 \\ \hline 13 & Accumulated depreciation & (610,000) & (572.000) & (38,000) \\ \hline 14 & Total assets & $984,375 & $876,205 & $108,170 \\ \hline 15 & Accounts payable & $81,340 & $148,670 & ($67,330) \\ \hline 16 & Salaries payable & 20,000 & 24,500 & 4,500 \\ \hline 17 & Notes payable (current) & 25,000 & 75,000 & 50,000 \\ \hline 18 & Bonds payable & 200,000 & 0 & 200,000 \\ \hline 19 & Common stock & 300,000 & 300,000 & 0 \\ \hline 20 & Retained earnings & 358,035 & 328,035 & 30,000 \\ \hline 21 & Total liabilities and shareholders' equity & $984,375 & $876,205 & $108,170 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Cash flows from operating activities: & \\ \hline Net income & 50,000 & \\ \hline Adjustments for noncash effects: & & \\ \hline 1) Depreciation expense & 53,000 & \\ \hline 2) Gain on sale of available-for-sale debt securities & (4,500) & \\ \hline 3) Gain on sale of equipment & (1,000) & \\ \hline Changes in operating assets and liabilities: & (11,750) & \\ \hline 1)Increase in accounts receivable & (25,000) & \\ \hline 2)Increase in inventory & 500 & \\ \hline 3)Decrease in prepaid insurance & (67,330) & \\ \hline 4)Decrease in accounts payable & (4,500) & \\ \hline 5)Decrease in salaries payable & & \\ \hline Net cash flows from operating activities & & \\ \hline & (10,580) \\ \hline Cash flows from investing activities: & 6,000 & \\ \hline 1)Proceeds from the sale of securities & (145,000) & \\ \hline 2)Proceeds form the sale of equipment & & \\ \hline 3)Purchase of equipment & & \\ \hline Net cash flows from investing activities & & \\ \hline & & \\ \hline Cash flows from financing activities: & (20,000) \\ \hline 1) Sale of bonds payable & (50,000) & \\ \hline 2)Paid dividends & & \\ \hline 3)Payment of notes payable & & \\ \hline Net cash flows from financing activities & & \\ \hline Net increase in cash & & \\ \hline Cash balance, January 1 & & \\ \hline Cash balance, December 31 & & \\ \hline \end{tabular} A3 For the year ended 12/31/2022 \begin{tabular}{|c|c|c|c|c|} \hline 2 & A & B & C & D \\ \hline 3 & \multicolumn{3}{|c|}{ For the year ended 12/31/2022} & \\ \hline 4 & & 2022 & 2021 & Change \\ \hline 5 & . & & & \\ \hline 6 & Cash & $77,375 & $22,955 & $54,420 \\ \hline 7 & Available-for-sale debt securities & & & \\ \hline 8 & (not cash equivalents) & 15,500 & 85,000 & 69,500 \\ \hline 9 & Accounts receivable & 80,000 & 68,250 & 11,750 \\ \hline 10 & Inventory & 170,000 & 145,000 & 25,000 \\ \hline 11 & Prepaid insurance & 1,500 & 2,000 & -500 \\ \hline 12 & Land, buildings, and equipment & 1,250,000 & 1,125,000 & 125,000 \\ \hline 13 & Accumulated depreciation & (610,000) & (572.000) & (38,000) \\ \hline 14 & Total assets & $984,375 & $876,205 & $108,170 \\ \hline 15 & Accounts payable & $81,340 & $148,670 & ($67,330) \\ \hline 16 & Salaries payable & 20,000 & 24,500 & 4,500 \\ \hline 17 & Notes payable (current) & 25,000 & 75,000 & 50,000 \\ \hline 18 & Bonds payable & 200,000 & 0 & 200,000 \\ \hline 19 & Common stock & 300,000 & 300,000 & 0 \\ \hline 20 & Retained earnings & 358,035 & 328,035 & 30,000 \\ \hline 21 & Total liabilities and shareholders' equity & $984,375 & $876,205 & $108,170 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Cash flows from operating activities: & \\ \hline Net income & 50,000 & \\ \hline Adjustments for noncash effects: & & \\ \hline 1) Depreciation expense & 53,000 & \\ \hline 2) Gain on sale of available-for-sale debt securities & (4,500) & \\ \hline 3) Gain on sale of equipment & (1,000) & \\ \hline Changes in operating assets and liabilities: & (11,750) & \\ \hline 1)Increase in accounts receivable & (25,000) & \\ \hline 2)Increase in inventory & 500 & \\ \hline 3)Decrease in prepaid insurance & (67,330) & \\ \hline 4)Decrease in accounts payable & (4,500) & \\ \hline 5)Decrease in salaries payable & & \\ \hline Net cash flows from operating activities & & \\ \hline & (10,580) \\ \hline Cash flows from investing activities: & 6,000 & \\ \hline 1)Proceeds from the sale of securities & (145,000) & \\ \hline 2)Proceeds form the sale of equipment & & \\ \hline 3)Purchase of equipment & & \\ \hline Net cash flows from investing activities & & \\ \hline & & \\ \hline Cash flows from financing activities: & (20,000) \\ \hline 1) Sale of bonds payable & (50,000) & \\ \hline 2)Paid dividends & & \\ \hline 3)Payment of notes payable & & \\ \hline Net cash flows from financing activities & & \\ \hline Net increase in cash & & \\ \hline Cash balance, January 1 & & \\ \hline Cash balance, December 31 & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started