Answered step by step

Verified Expert Solution

Question

1 Approved Answer

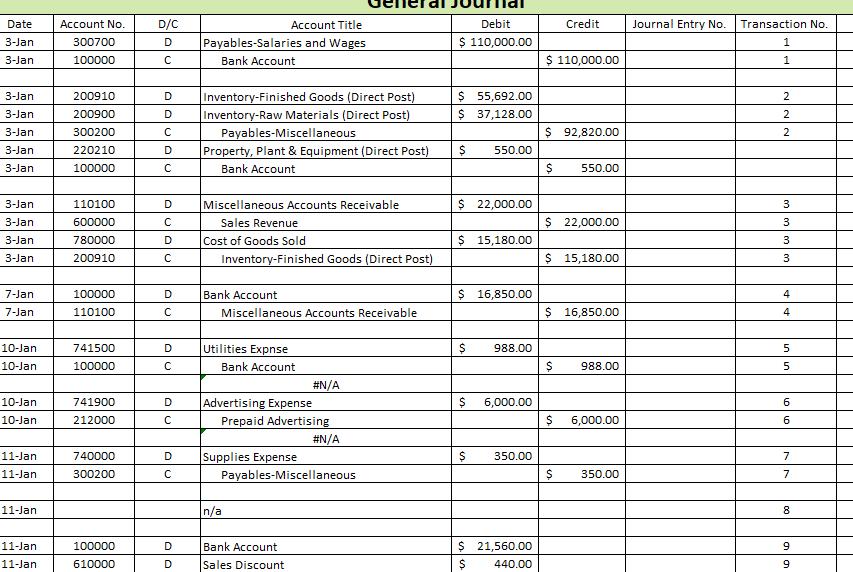

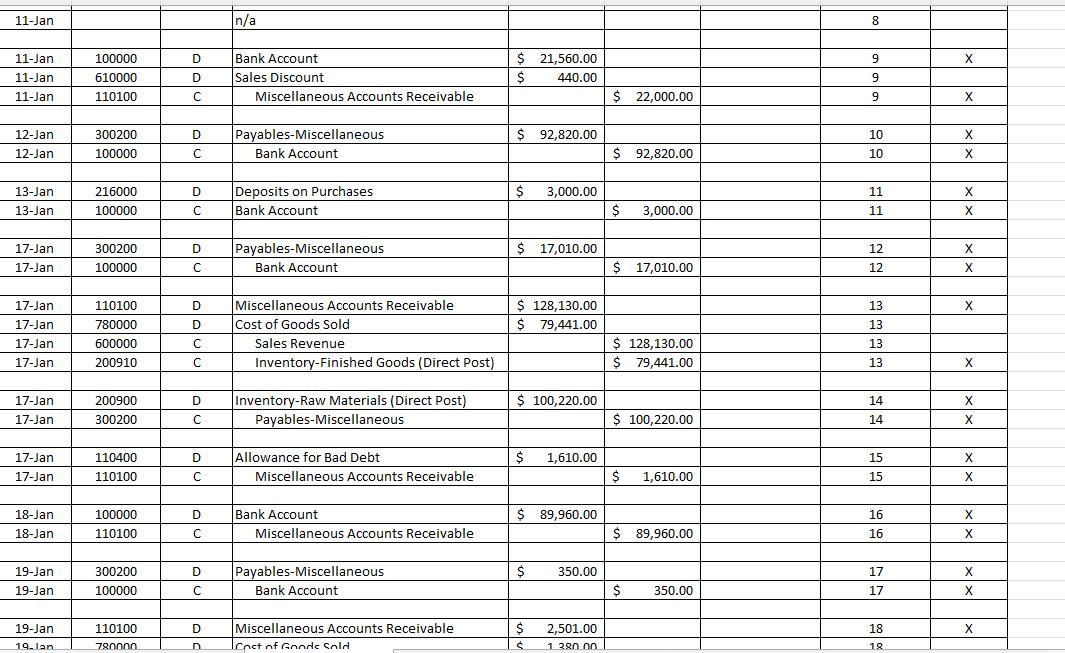

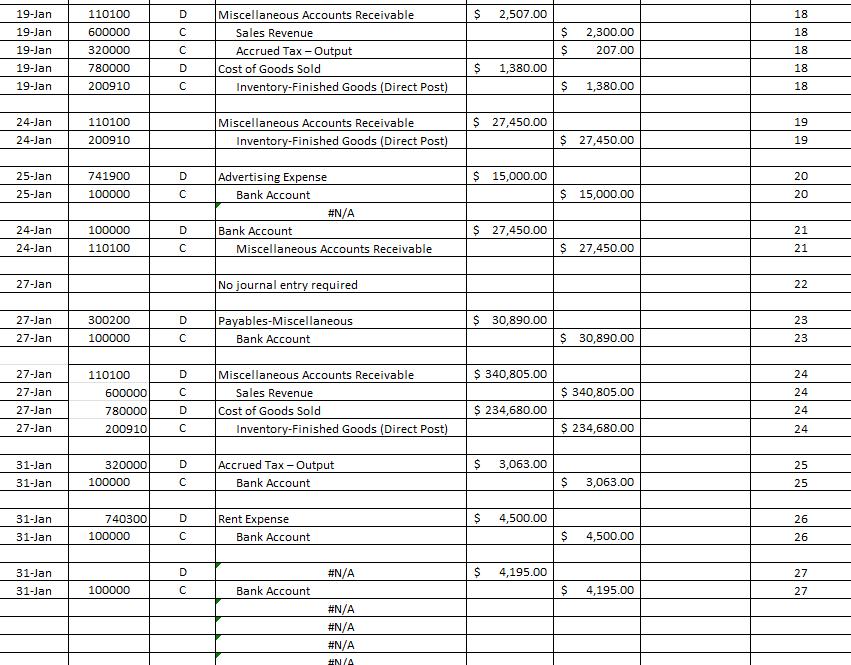

create the end of period worksheet and balance sheet . can you please create the end of period journal entry this is the format she

create the end of period worksheet and balance sheet .

can you please create the end of period

can you please create the end of period

journal entry

this is the format she wants for eop

this is the format she wants for eop

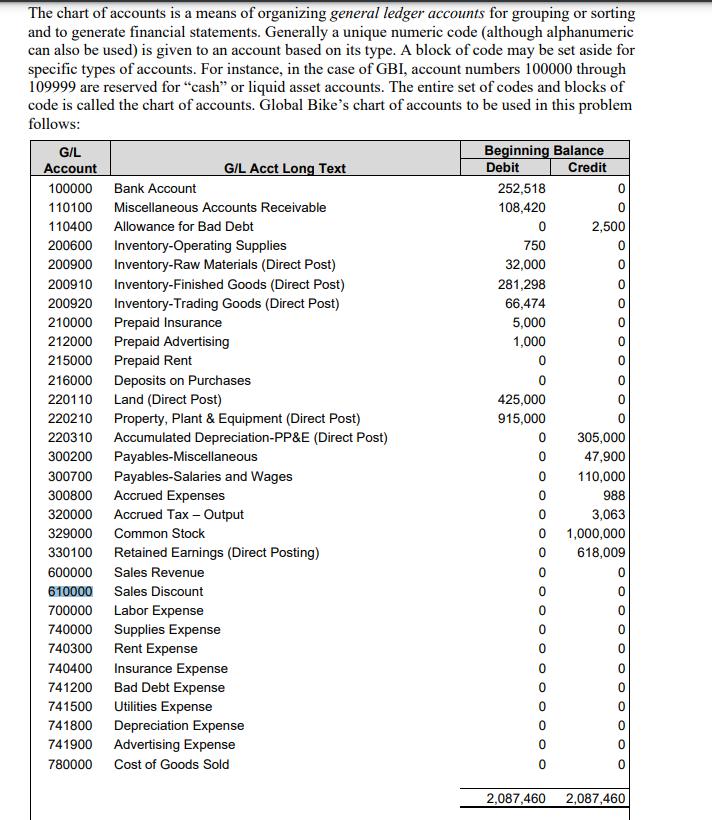

The chart of accounts is a means of organizing general ledger accounts for grouping or sorting and to generate financial statements. Generally a unique numeric code (although alphanumeric can also be used) is given to an account based on its type. A block of code may be set aside for specific types of accounts. For instance, in the case of GBI, account numbers 100000 through 109999 are reserved for "cash" or liquid asset accounts. The entire set of codes and blocks of code is called the chart of accounts. Global Bike's chart of accounts to be used in this problem follows: G/L Account 100000 Bank Account 110100 Miscellaneous Accounts Receivable 110400 Allowance for Bad Debt 200600 Inventory-Operating Supplies 200910 200900 Inventory-Raw Materials (Direct Post) Inventory-Finished Goods (Direct Post) Inventory-Trading Goods (Direct Post) Prepaid Insurance 200920 210000 212000 Prepaid Advertising 215000 Prepaid Rent 216000 Deposits on Purchases 220110 Land (Direct Post) 220210 Property, Plant & Equipment (Direct Post) 220310 Accumulated Depreciation-PP&E (Direct Post) 300200 300700 300800 320000 329000 330100 740400 741200 741500 741800 741900 780000 G/L Acct Long Text Payables-Miscellaneous Payables-Salaries and Wages Accrued Expenses Accrued Tax - Output 600000 Sales Revenue 610000 Sales Discount 700000 Labor Expense 740000 Supplies Expense 740300 Rent Expense Common Stock Retained Earnings (Direct Posting) Insurance Expense Bad Debt Expense Utilities Expense Depreciation Expense Advertising Expense Cost of Goods Sold Beginning Balance Debit Credit 252,518 108,420 0 750 32,000 281,298 66,474 5,000 1,000 0 0 425,000 915,000 0 0 0 0 0 0 0 0 0 0 0 0 0 OOO 0 0 0 0 0 2,087,460 0 0 2,500 0 0 0 0 0 305,000 47,900 110,000 988 3,063 1,000,000 618,009 0 O O o OO 0 2,087,460

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Introduction The turnover rate among fast food workers is a multifaceted aspect influenced by various factors Understanding the rate at which employee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started