Answered step by step

Verified Expert Solution

Question

1 Approved Answer

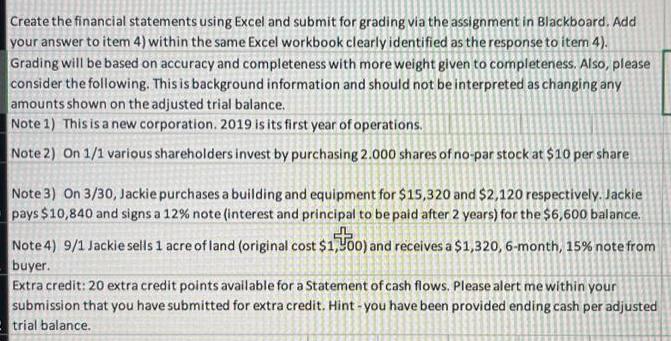

Create the financial statements using Excel and submit for grading via the assignment in Blackboard. Add your answer to item 4) within the same

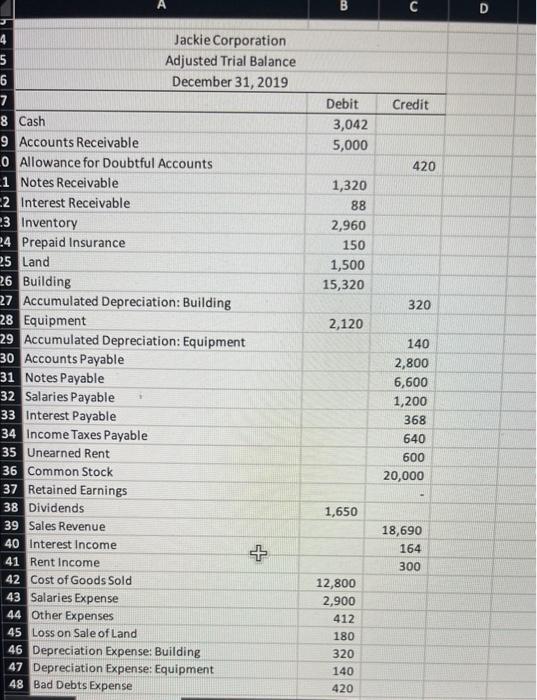

Create the financial statements using Excel and submit for grading via the assignment in Blackboard. Add your answer to item 4) within the same Excel workbook clearly identified as the response to item 4). Grading will be based on accuracy and completeness with more weight given to completeness. Also, please consider the following. This is background information and should not be interpreted as changing any amounts shown on the adjusted trial balance. Note 1) This is a new corporation. 2019 is its first year of operations. Note 2) On 1/1 various shareholders invest by purchasing 2.000 shares of no-par stock at $10 per share Note 3) On 3/30, Jackie purchases a building and equipment for $15,320 and $2,120 respectively. Jackie pays $10,840 and signs a 12% note (interest and principal to be paid after 2 years) for the $6,600 balance. Note 4) 9/1 Jackie sells 1 acre of land (original cost $1,400) and receives a $1,320, 6-month, 15% note from buyer. Extra credit: 20 extra credit points available for a Statement of cash flows. Please alert me within your submission that you have submitted for extra credit. Hint - you have been provided ending cash per adjusted trial balance. 5 6 7 8 Cash 9 Accounts Receivable 0 Allowance for Doubtful Accounts 1 Notes Receivable 22 Interest Receivable 3 Inventory 24 Prepaid Insurance 25 Land 26 Building 27 Accumulated Depreciation: Building Jackie Corporation Adjusted Trial Balance December 31, 2019 28 Equipment 29 Accumulated Depreciation: Equipment 30 Accounts Payable 31 Notes Payable 32 Salaries Payable 33 Interest Payable 34 Income Taxes Payable 35 Unearned Rent 36 Common Stock 37 Retained Earnings 38 Dividends 39 Sales Revenue 40 Interest Income 41 Rent Income 42 Cost of Goods Sold 43 Salaries Expense 44 Other Expenses 45 Loss on Sale of Land 46 Depreciation Expense: Building 47 Depreciation Expense: Equipment 48 Bad Debts Expense 52 B Debit 3,042 5,000 1,320 88 2,960 150 1,500 15,320 2,120 1,650 12,800 2,900 412 180 320 140 420 Credit 420 320 140 2,800 6,600 1,200 368 640 600 20,000 . 18,690 164 300 23 Inventory 24 Prepaid Insurance 25 Land 26 Building 27 Accumulated Depreciation: Building 28 Equipment 29 Accumulated Depreciation: Equipment 30 Accounts Payable 31 Notes Payable 32 Salaries Payable 33 Interest Payable 34 Income Taxes Payable 35 Unearned Rent 36 Common Stock 37 Retained Earnings 38 Dividends 39 Sales Revenue 40 Interest Income - 41 Rent Income 42 Cost of Goods Sold 43 Salaries Expense 44 Other Expenses 45 Loss on Sale of Land 46 Depreciation Expense: Building 47 Depreciation Expense: Equipment 48 Bad Debts Expense 49 Insurance Expense 50 Interest Expense 51 Income Tax Expense 52 Totals 53 54 Fr + 2,960 150 1,500 15,320 2,120 1,650 12,800 2,900 412 180 320 140 420 340 680 900 52,242 320 140 2,800 6,600 1,200 368 640 600 20,000 18,690 164 300 52,242

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Step 14 Income Statement Income Statement Sales Revenue 18690 Interest Income 164 Rent Income 300 TOTAL REVENUE 19154 Cost of Goods sold 12800 Salaries expense 2900 Other expense 412 Loss on sale of l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started