Answered step by step

Verified Expert Solution

Question

1 Approved Answer

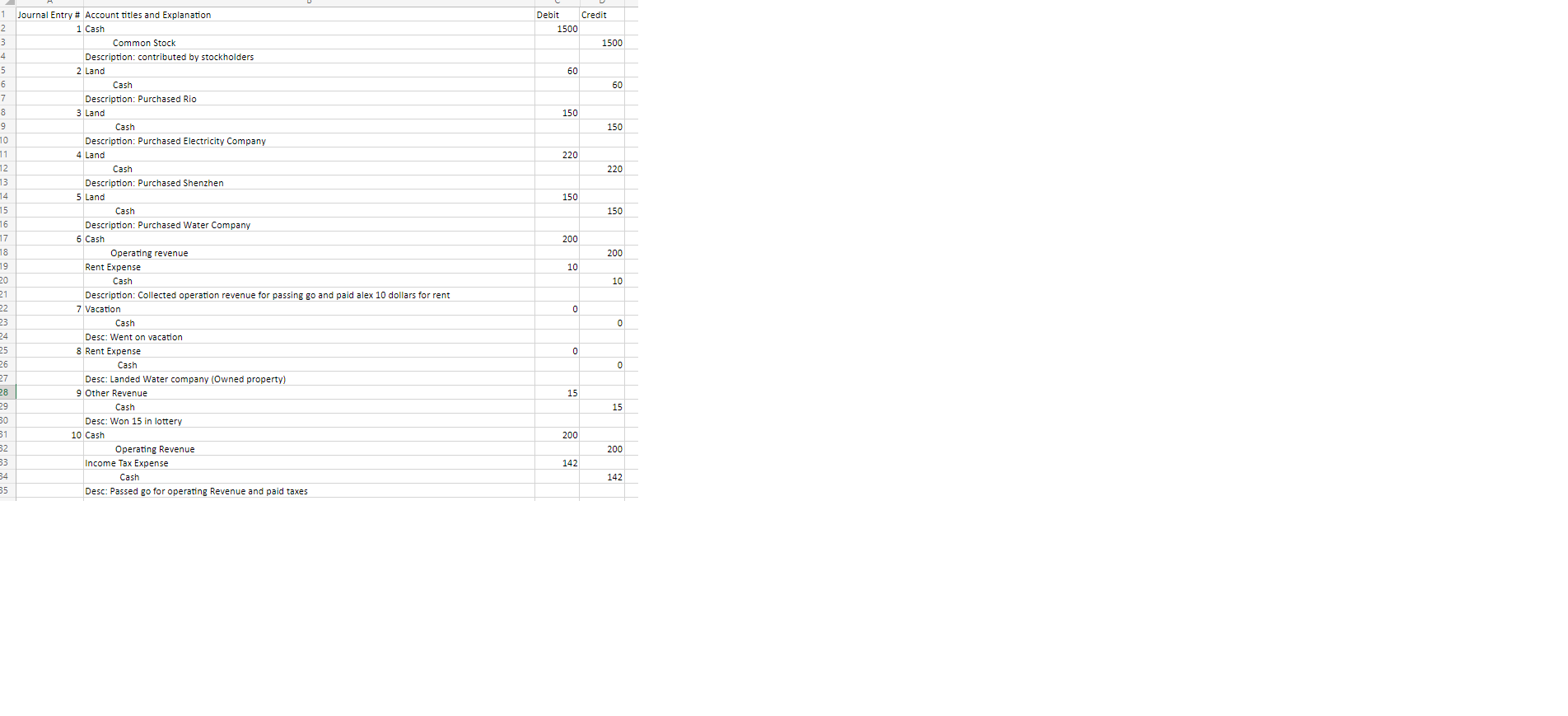

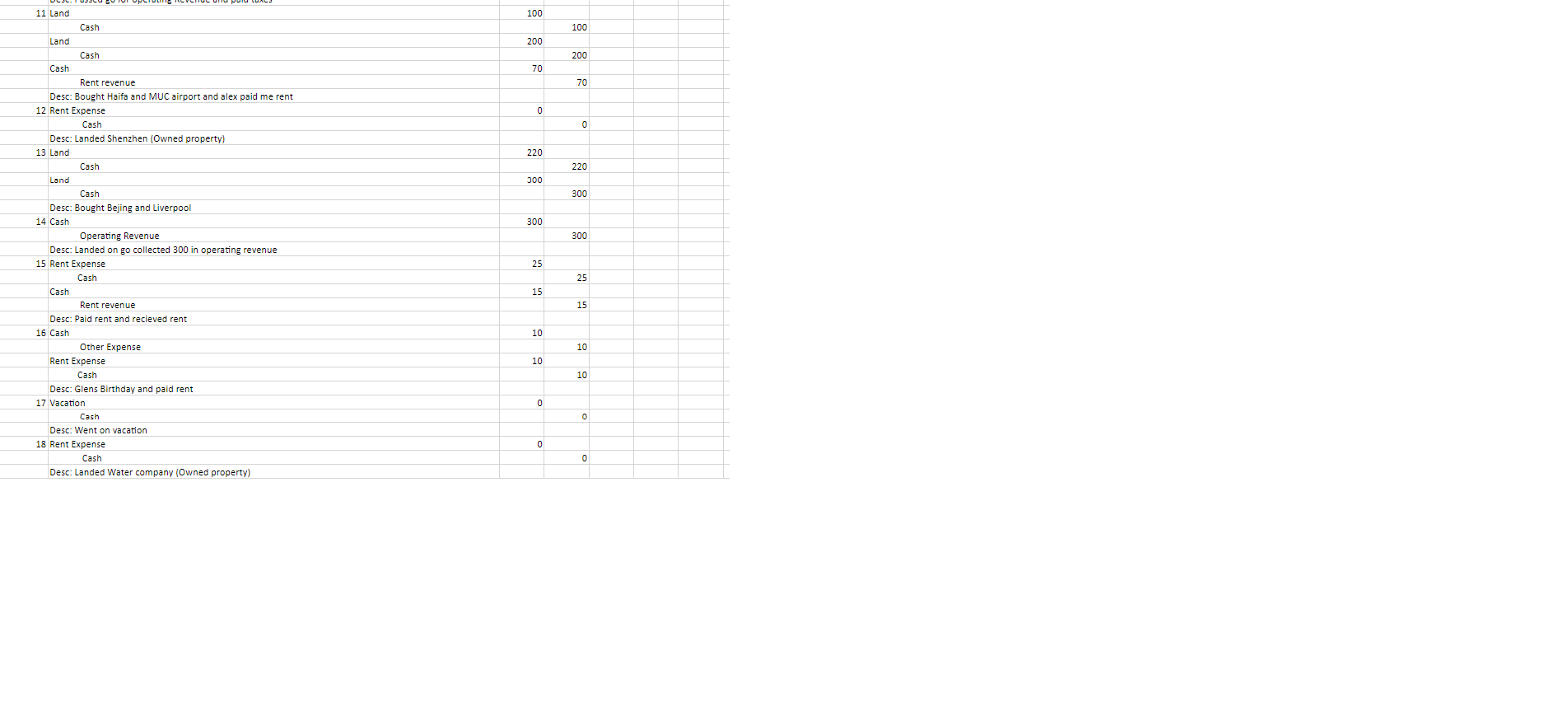

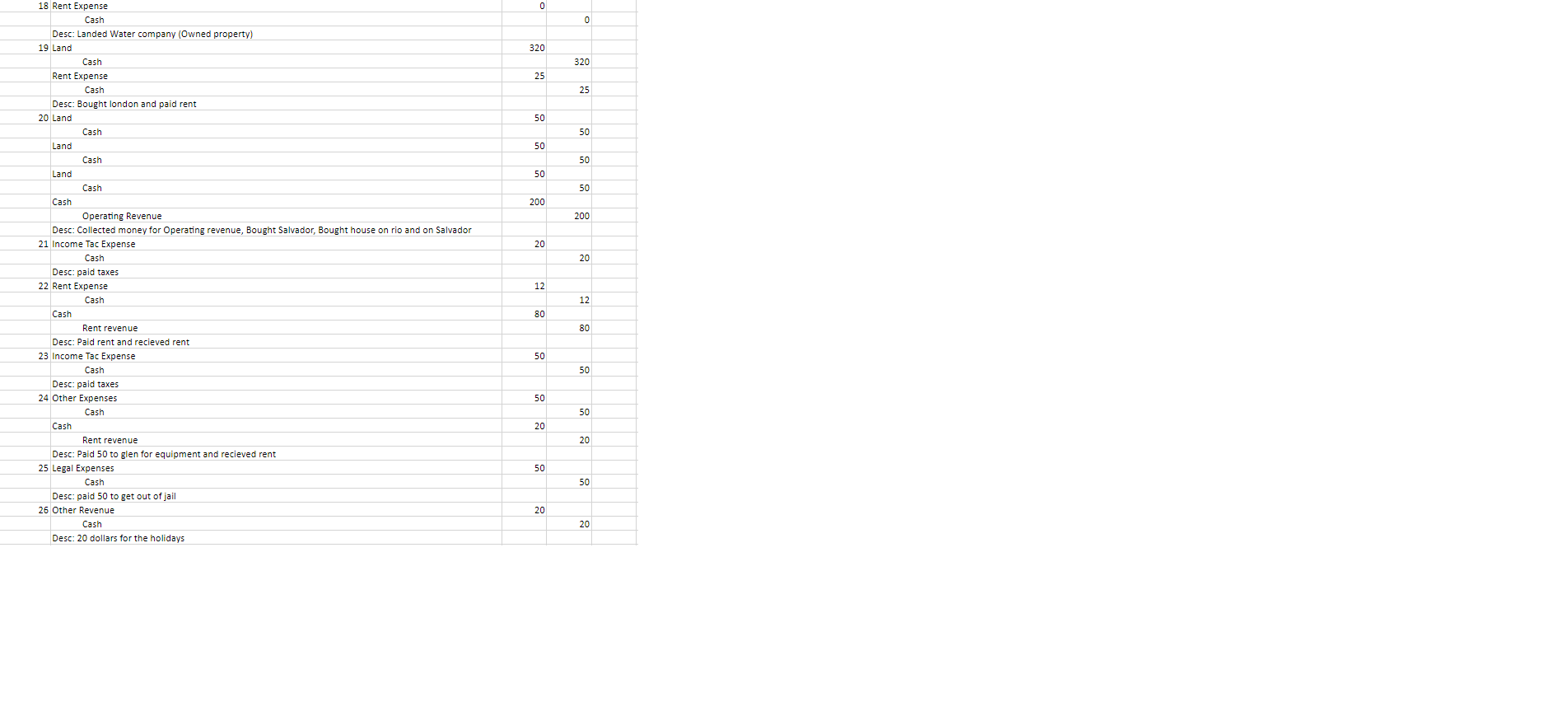

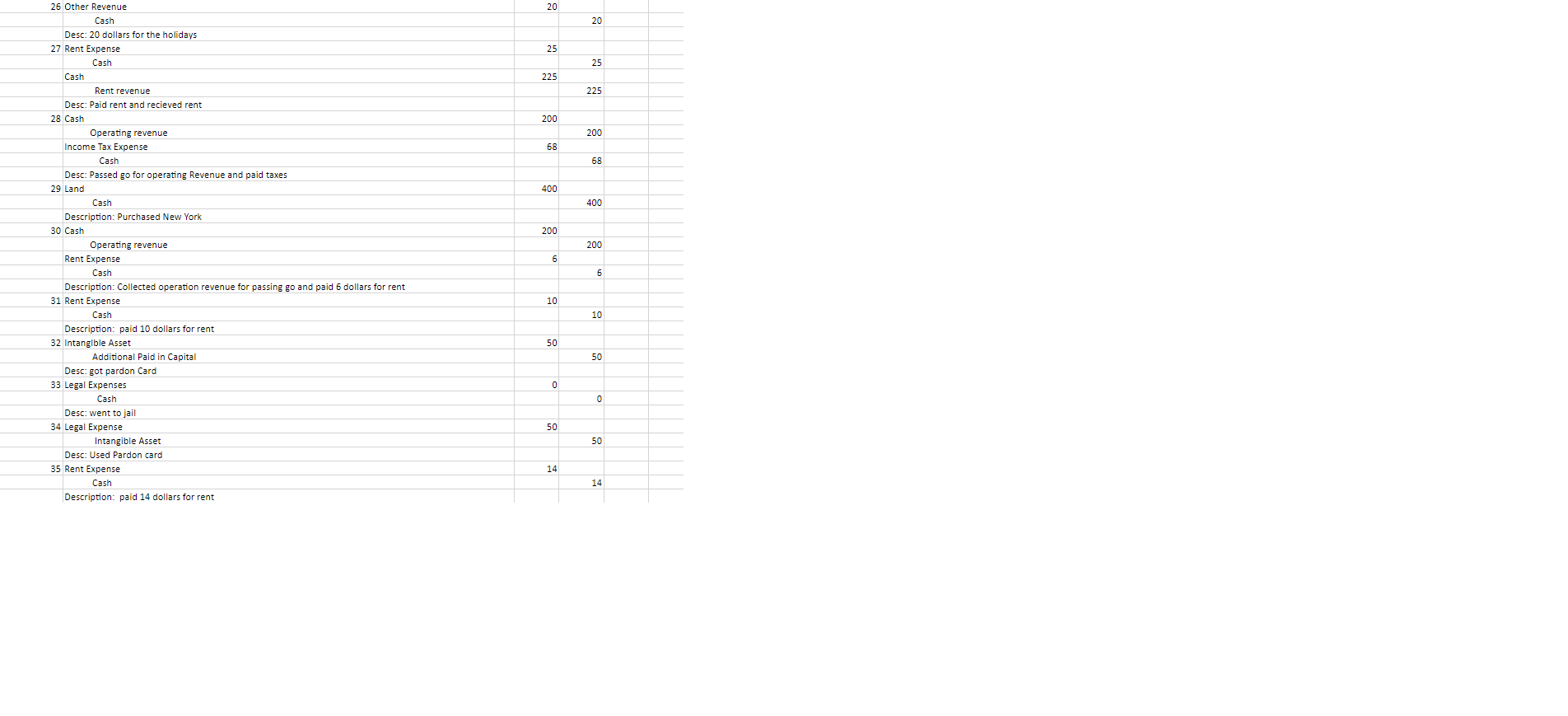

Create the T- Accounts, A trial Balance, Income Statement, and Stockholder's Equity with the information provided above. 18 Rent Expense Cash Desc: Landed Water company

Create the T- Accounts, A trial Balance, Income Statement, and Stockholder's Equity with the information provided above.

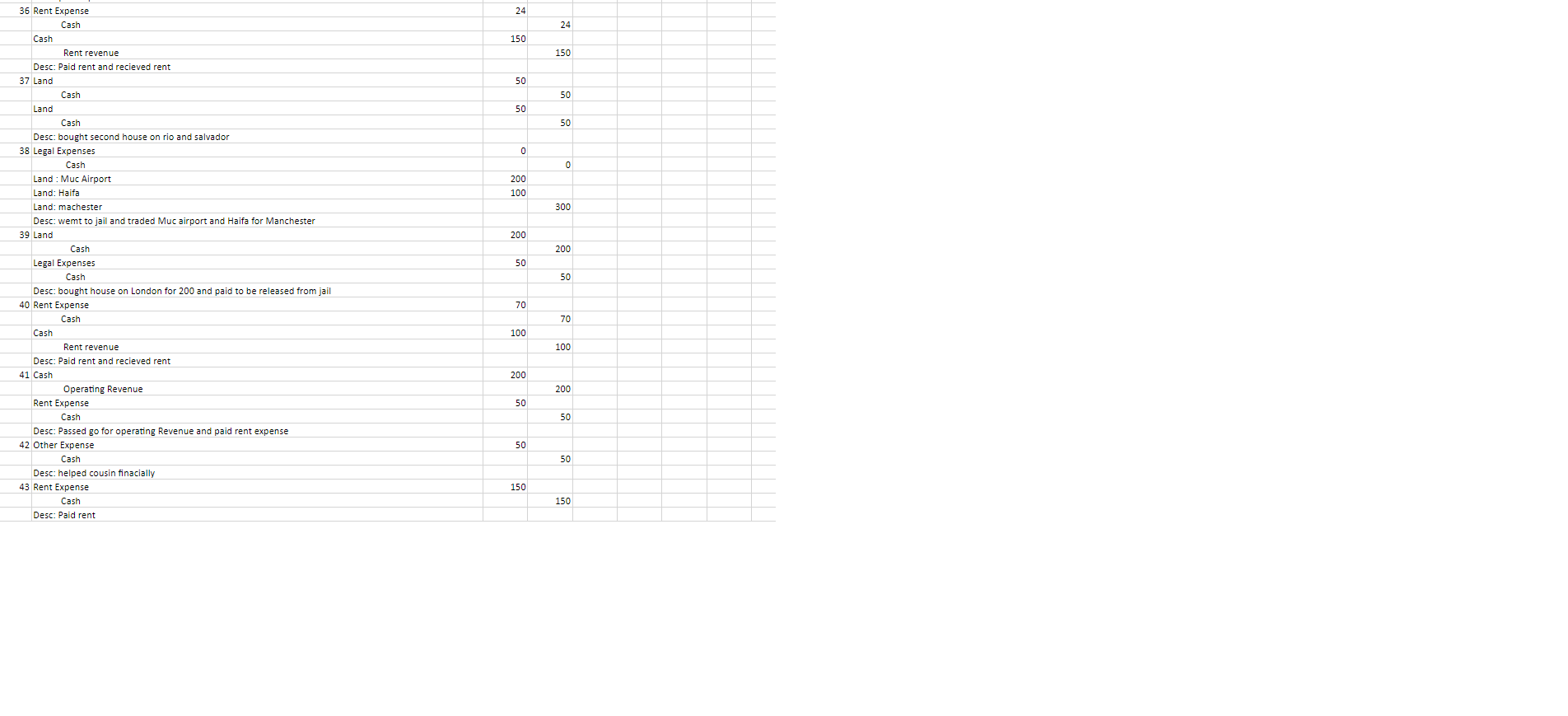

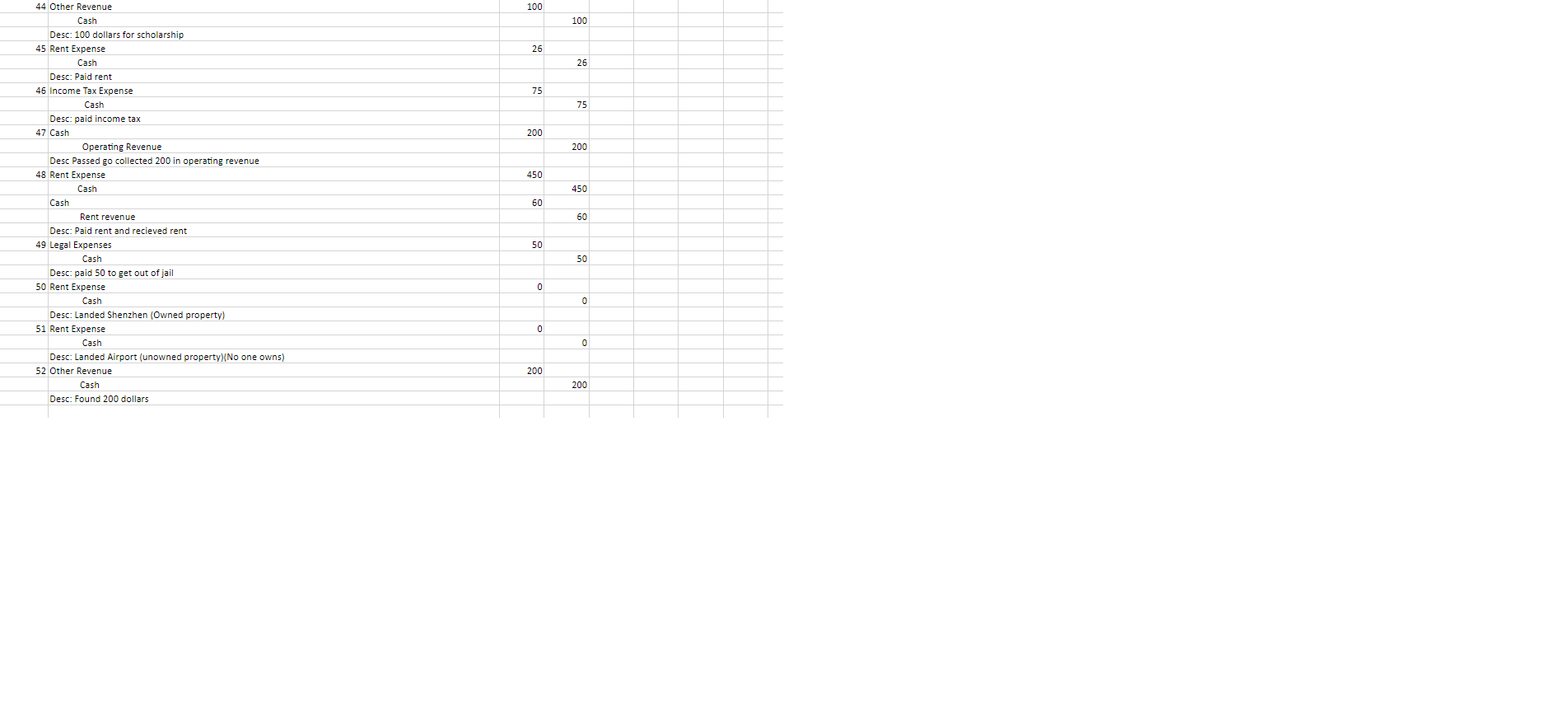

18 Rent Expense Cash Desc: Landed Water company (Owned property) 19 Land Rent Expense Cash Desc: Bought london and paid rent 20 Land Land Land Cash Operating Revenue 21 income Tac Expense Desc: paid taxes 22 Rent Expense Cash Rent revenue Desc: Paid rent and recieved rent 23 Income Tac Expense 240 24 Other Expens Cash Paid 50 to glen for equipment and recieved rent Cash 26 Other Revenue Cash Desc: 20 dollars for the holidays 26 Other Revenue Cash Desc: 20 dollars for the holidays 27 Rent Expense Cash Cash Desc: Paid rent and recieved rent 28 Cash Income Tax Expense Desc: Passed go for operating Revenue and paid taxes 29 Land Description: Purchased New York 30 Cash Operating revenue Casens Description: Collected operation revenue for passing go and paid 6 dollars for rent 31 Rent Expense Description: 32 Intanglble Asset Desc: got pardon Card 33 Legal Expenses Desc: went to 34 Legal Expense Intangible Asset Desc: Used Pardon card Cash Cash Description: paid 14 dollars for rent 20 20 25 25 225 225 200 200 68 68 400 400 200 200 6 6 10 10 50 50 \begin{tabular}{ll} \hline 0 & \\ \hline \end{tabular} 50 50 14 14 44 Other Revenue Cash Desc: 100 dollars for scholarship 45 Rent Expense Cash Desc: Paid rent 46 Income Tax Expense Desc: paid income tax 47 Cash Operating Revenue Desc Passed go collected 200 in operating revenue 48 Rent Expense Cash Rent revenue Desc: Paid rent and recieved rent 49 Legal Expenses 50 Rent Expense Cash Desc: Landed Shenzhen (Owned property) 51 Rent Expense Cash Desc: Landed Airport (unowned property)(No one owns) 52 Other Revenue Cash Desc: Found 200 dollars 100 100 26 26 75 75 200 200 450 450 60 50 50 0 0 200 200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started