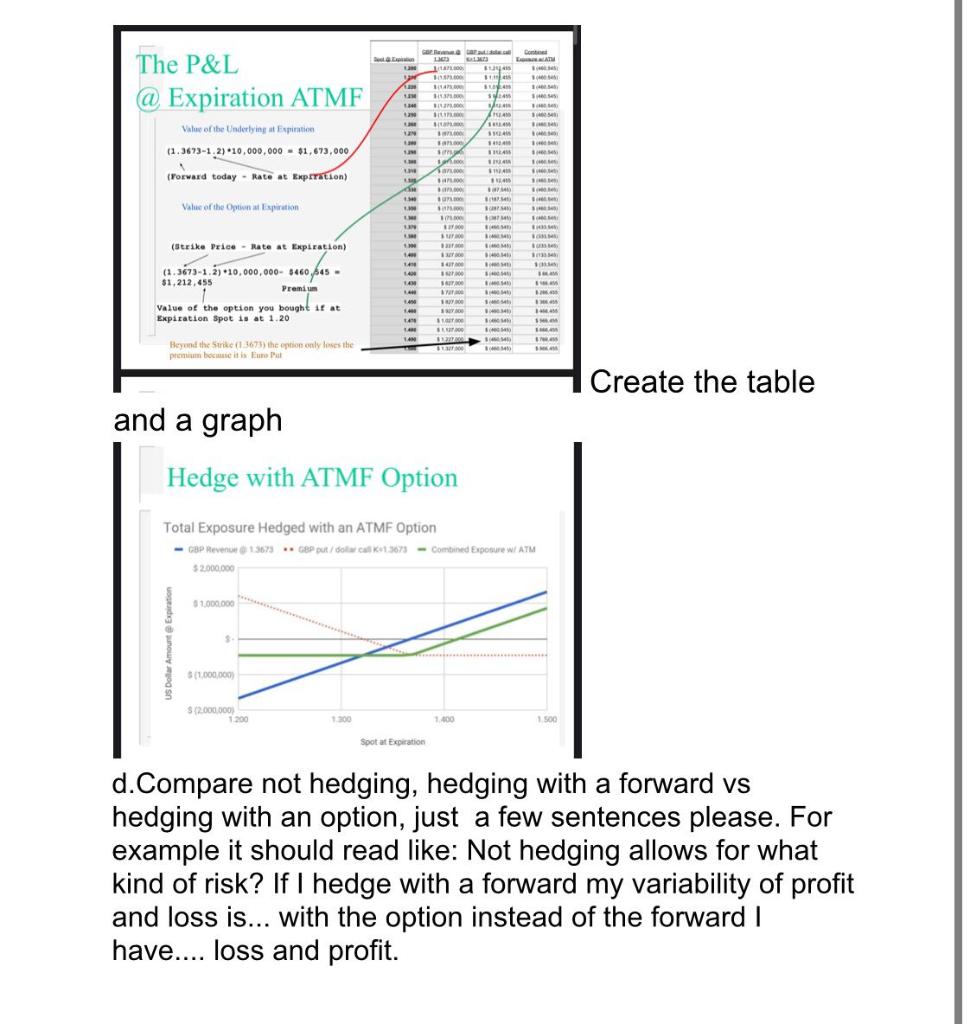

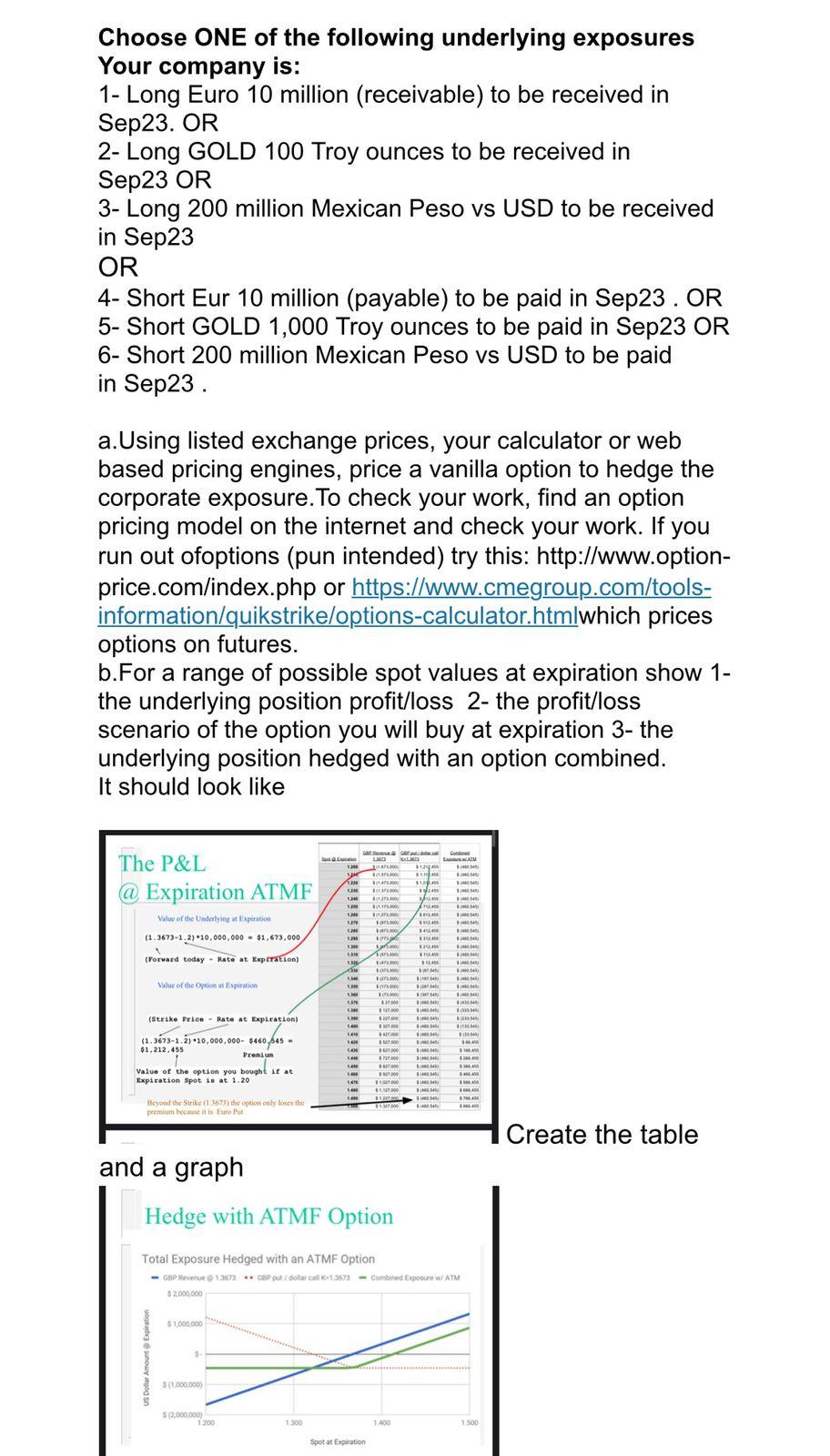

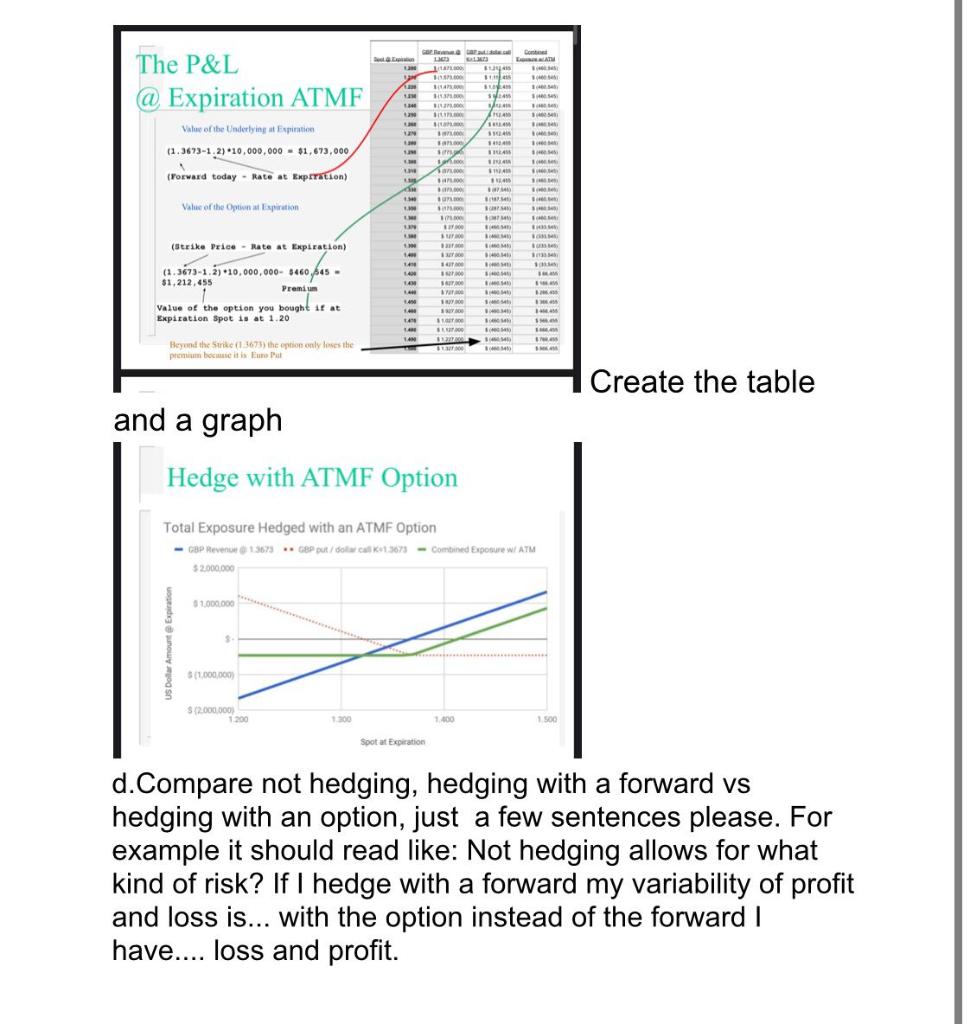

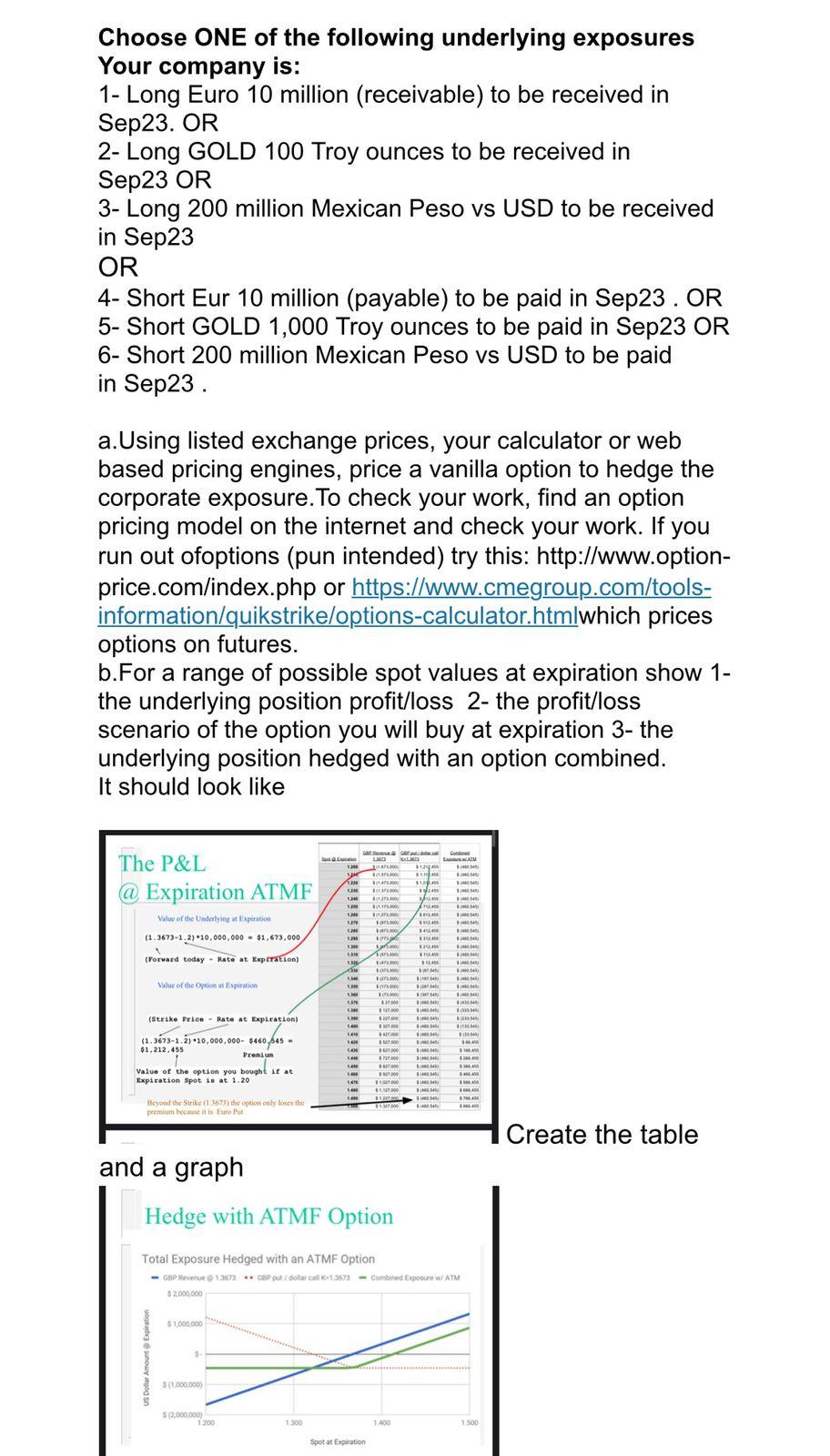

Create the table and a graph Hedge with ATMF Option d.Compare not hedging, hedging with a forward vs hedging with an option, just a few sentences please. For example it should read like: Not hedging allows for what kind of risk? If I hedge with a forward my variability of profit and loss is... with the option instead of the forward I have.... loss and profit. Choose ONE of the following underlying exposures Your company is: 1- Long Euro 10 million (receivable) to be received in Sep23. OR 2- Long GOLD 100 Troy ounces to be received in Sep23 OR 3- Long 200 million Mexican Peso vs USD to be received in Sep23 OR 4- Short Eur 10 million (payable) to be paid in Sep23 . OR 5- Short GOLD 1,000 Troy ounces to be paid in Sep23 OR 6- Short 200 million Mexican Peso vs USD to be paid in Sep23. a.Using listed exchange prices, your calculator or web based pricing engines, price a vanilla option to hedge the corporate exposure. To check your work, find an option pricing model on the internet and check your work. If you run out ofoptions (pun intended) try this: http://www.optionprice.com/index.php or https://www.cmegroup.com/toolsinformation/quikstrike/options-calculator.htmlwhich prices options on futures. b.For a range of possible spot values at expiration show 1the underlying position profit/loss 2 - the profit/loss scenario of the option you will buy at expiration 3- the underlying position hedged with an option combined. It should look like and a graph - Create the table Create the table and a graph Hedge with ATMF Option d.Compare not hedging, hedging with a forward vs hedging with an option, just a few sentences please. For example it should read like: Not hedging allows for what kind of risk? If I hedge with a forward my variability of profit and loss is... with the option instead of the forward I have.... loss and profit. Choose ONE of the following underlying exposures Your company is: 1- Long Euro 10 million (receivable) to be received in Sep23. OR 2- Long GOLD 100 Troy ounces to be received in Sep23 OR 3- Long 200 million Mexican Peso vs USD to be received in Sep23 OR 4- Short Eur 10 million (payable) to be paid in Sep23 . OR 5- Short GOLD 1,000 Troy ounces to be paid in Sep23 OR 6- Short 200 million Mexican Peso vs USD to be paid in Sep23. a.Using listed exchange prices, your calculator or web based pricing engines, price a vanilla option to hedge the corporate exposure. To check your work, find an option pricing model on the internet and check your work. If you run out ofoptions (pun intended) try this: http://www.optionprice.com/index.php or https://www.cmegroup.com/toolsinformation/quikstrike/options-calculator.htmlwhich prices options on futures. b.For a range of possible spot values at expiration show 1the underlying position profit/loss 2 - the profit/loss scenario of the option you will buy at expiration 3- the underlying position hedged with an option combined. It should look like and a graph - Create the table