Answered step by step

Verified Expert Solution

Question

1 Approved Answer

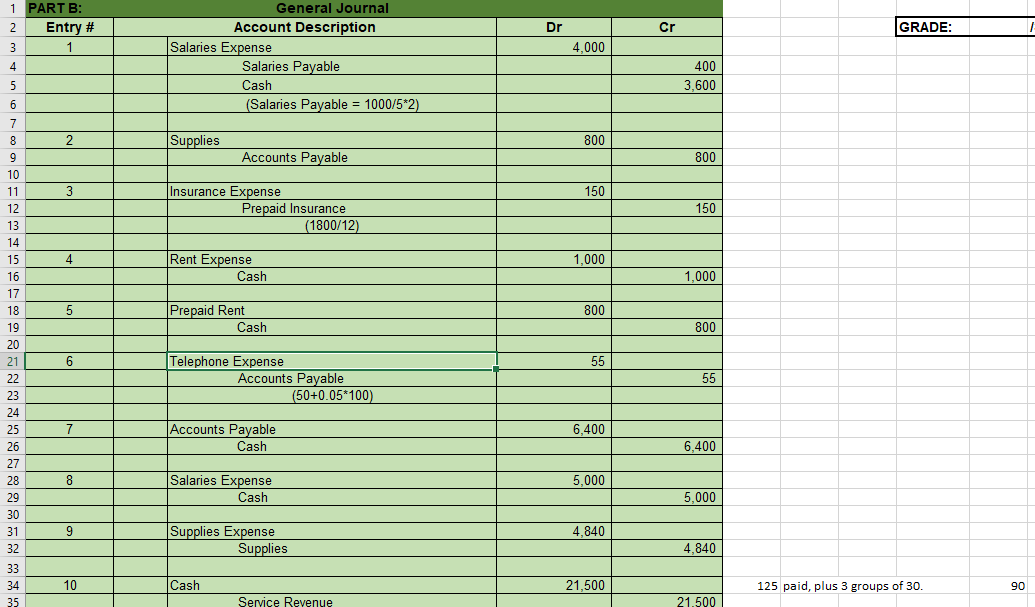

Create your Income Statement Create your Statement of Retained Earnings Create your Statement of Financial Position Dr Cr GRADE: 1 PART B: 2 Entry #

Create your Income Statement

Create your Statement of Retained Earnings

Create your Statement of Financial Position

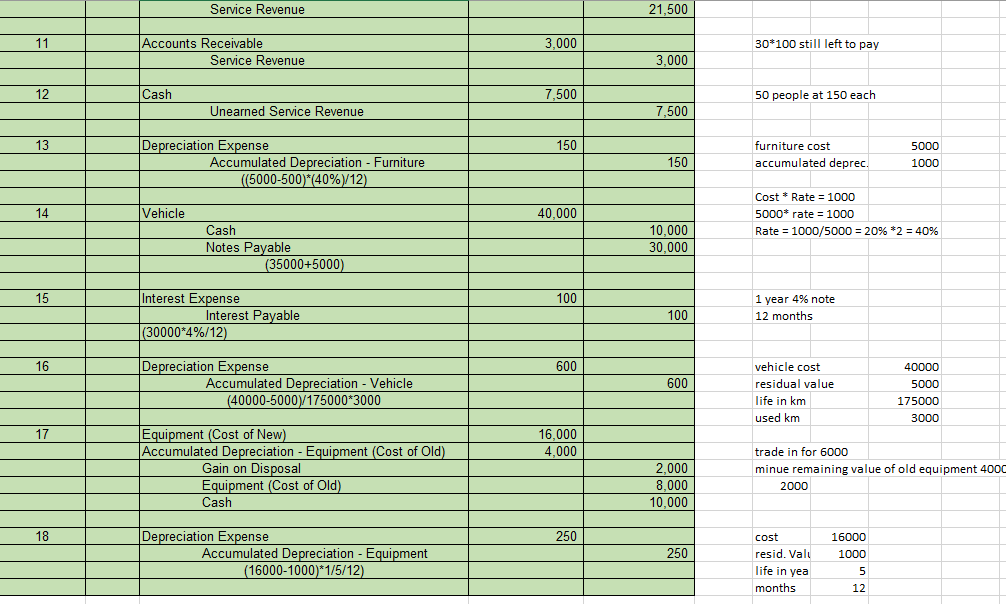

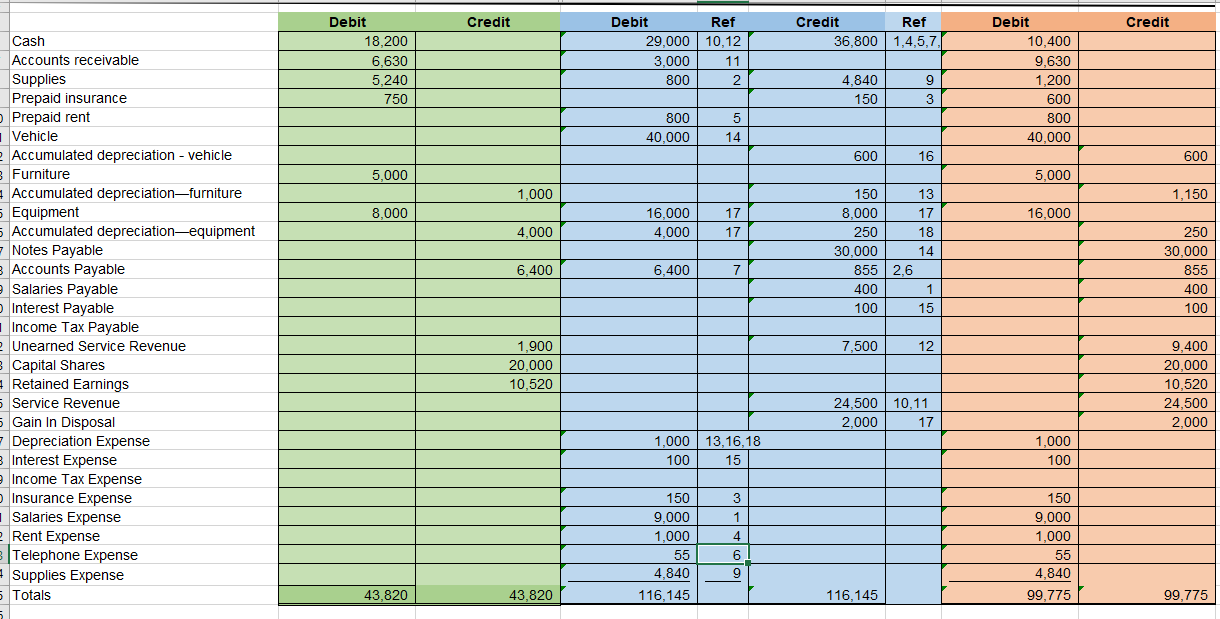

Dr Cr GRADE: 1 PART B: 2 Entry # 3 3 1 1 4 4,000 General Journal Account Description Salaries Expense Salaries Payable Cash (Salaries Payable = 1000/5*2) 400 3,600 5 6 2 Supplies 800 Accounts Payable 800 3 150 Insurance Expense Prepaid Insurance (1800/12) 150 4 1,000 Rent Expense Cash 1,000 5 800 Prepaid Rent Cash 800 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 6 55 Telephone Expense Accounts Payable (50+0.05*100) 55 7 6,400 Accounts Payable Cash 6,400 8 5,000 Salaries Expense Cash 5,000 9 4,840 Supplies Expense Supplies 4,840 10 Cash 21,500 125 paid, plus 3 groups of 30. 90 Service Revenue 21.500 Service Revenue 21,500 11 3,000 30*100 still left to pay Accounts Receivable Service Revenue 3,000 12 Cash 7.500 50 people at 150 each Unearned Service Revenue 7,500 13 150 Depreciation Expense Accumulated Depreciation - Furniture ((5000-500)*(40%/12) furniture cost accumulated deprec. 5000 1000 150 14 Vehicle 40,000 Cost * Rate = 1000 5000* rate = 1000 Rate = 1000/5000 = 20% *2 = 40% = Cash Notes Payable (35000+5000) 10,000 30.000 15 100 Interest Expense Interest Payable (30000*4%/12) 1 year 4% note 12 months 100 16 600 Depreciation Expense Accumulated Depreciation - Vehicle (40000-5000/175000*3000 600 vehicle cost residual value life in km used km 40000 5000 175000 3000 17 16.000 4,000 Equipment (Cost of New) Accumulated Depreciation - Equipment (Cost of Old) Gain on Disposal Equipment (Cost of Old) Cash 2,000 8,000 10,000 trade in for 6000 minue remaining value of old equipment 4000 2000 18 250 Depreciation Expense Accumulated Depreciation - Equipment (16000-1000)*1/5/12) 250 cost resid. Val 16000 1000 5 12 life in yea months Credit Credit Debit 18,200 6,630 Credit Ref 36,800 1,4,5,7, Debit 29,000 3,000 800 Ref 10,12 11 2 5,240 9 4,840 150 Debit 10,400 9.630 1,200 600 800 40,000 750 3 800 40,000 5 14 600 16 600 5,000 5,000 1,000 1,150 8,000 16,000 16,000 4,000 17 17 4,000 150 13 8,000 17 250 18 30,000 14 855 2,6 400 1 100 15 6.400 6.400 7 250 30.000 855 400 100 Cash Accounts receivable Supplies Prepaid insurance Prepaid rent 1 Vehicle Accumulated depreciation - vehicle 3 Furniture Accumulated depreciationfurniture Equipment Accumulated depreciation-equipment - Notes Payable Accounts Payable Salaries Payable Interest Payable Income Tax Payable Unearned Service Revenue 3 Capital Shares Retained Earnings Service Revenue Gain In Disposal - Depreciation Expense B Interest Expense Income Tax Expense Insurance Expense Salaries Expense Rent Expense 3. Telephone Expense - Supplies Expense Totals 7,500 12 1,900 20,000 10,520 9,400 20,000 10,520 24,500 2,000 24,500 10,11 2,000 17 1,000 13,16,18 100 15 1.000 100 150 9,000 1,000 55 4,840 116,145 3 1 4 6 9 150 9,000 1,000 55 4,840 99,775 43,820 43,820 116,145 99,775 1 PART D: FINANCIAL STATEMENTS 2 3 Create your Income Statement here. 4 5 GRADE: /5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Create your Statement of Retained Earnings here GRADE: 12 Create your Statement of Financial Position here GRADE: /10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started