Answered step by step

Verified Expert Solution

Question

1 Approved Answer

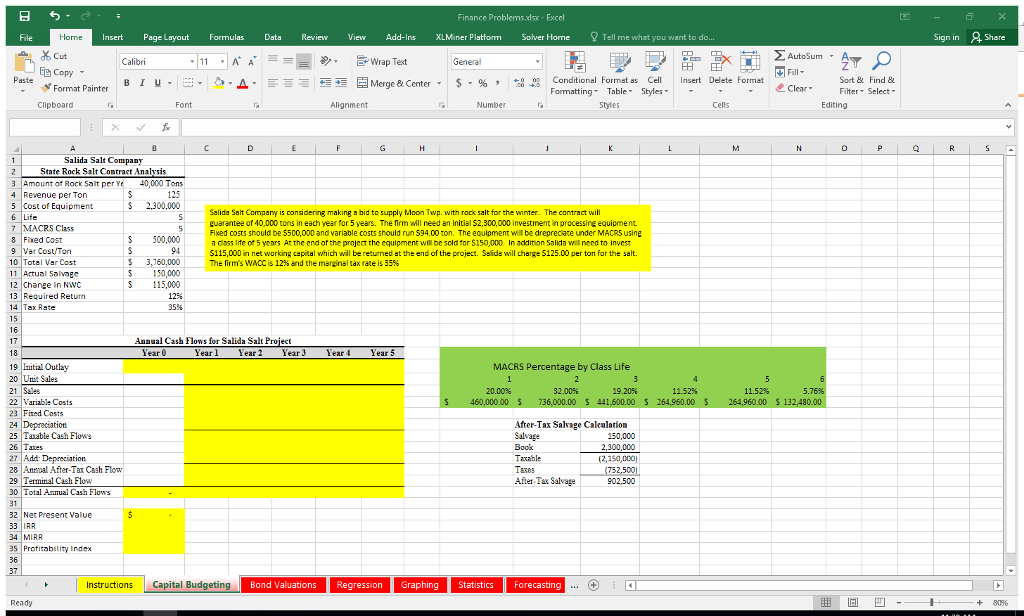

Creating Cash flows with MACRS Finance Problemsdsr-Excel Insert Page LayoutFormulas DataRevieViAdd-Ins XLMiner Platform Solver Home Tell me what you want to do.. Cut Copy AutoSum

Creating Cash flows with MACRS

Finance Problemsdsr-Excel Insert Page LayoutFormulas DataRevieViAdd-Ins XLMiner Platform Solver Home Tell me what you want to do.. Cut Copy AutoSum Calibri Fill ClerSot&Find 8 Clearier Select Paste j-0. ? . Fommittin al Fombleas Shell. B 1 u E E EA Merge & Certer , $ , % , .?: Insert Delete Format Clipboard Font Cells Salida Salt Company State Rock Salt Contract Analvsis 40,000 Tons Amount of Rock Salt perY 4 Revenue per Ton 5 Cost of Equipment 6 Life 7 MACRS Class 8 Fixed Cost 9 Var Cost/Ton 10 Total Var Cost 2,300,000 Salt Company is considering making ? bid to supply Moon Twp. with rock salt for the winter. The contract guarantee of 40,000 tons in eah year for 5 years. The firm will need an initial $2,300,000 investment in processing equipment. Fixed costs should be 5500,000 and variable costs should run $94.00 ton. The equipment Will be drepreciate under MACRS using ? d355 lite of 5 years At the end of the project the equipment wil be sold for $150,000 In addition Salida wil need to invest 5115,000 in net working capital which will be returmed at the end of the project. Salids will charge 5125.00 per ton for the salt. 5 500,000 3,760,000 $150,000 115,000 12% 35% firm's WACC is 12% and the marginal tax rate is 35% Actual Salvog 12 Chanee in NWC 13 Required Retun 14 Tax Rate 16 I Annual Cash Flows for Salida Salt Project 18 MACRS Percentage by Class Life 19 Itial Outlay 20 Uni Sales 21 Salas 22 Variable Costs 23 Fined Costs 24 Depreciation 25 Tanable Cash Flows 26 Tanes 27 Add Depreciation 20.00% 19.20% 11.52% 11.52% After-Tax Salvage Calealation 150,000 2,300,000 (2,150,000 Book Taxable Tanes After Tax Salvage Anmal After-Tar Cash Flow 29 Terminal Cash Flow 30 Total Anmual Cash Flows 902.500 32 Net Present Value 33 IRR 34 MIRR 35 Protitability Index 36 Instructions Capital Budgeting Valuations Bond Valuations Regression Graphing StatisticsForecasting ReadyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started