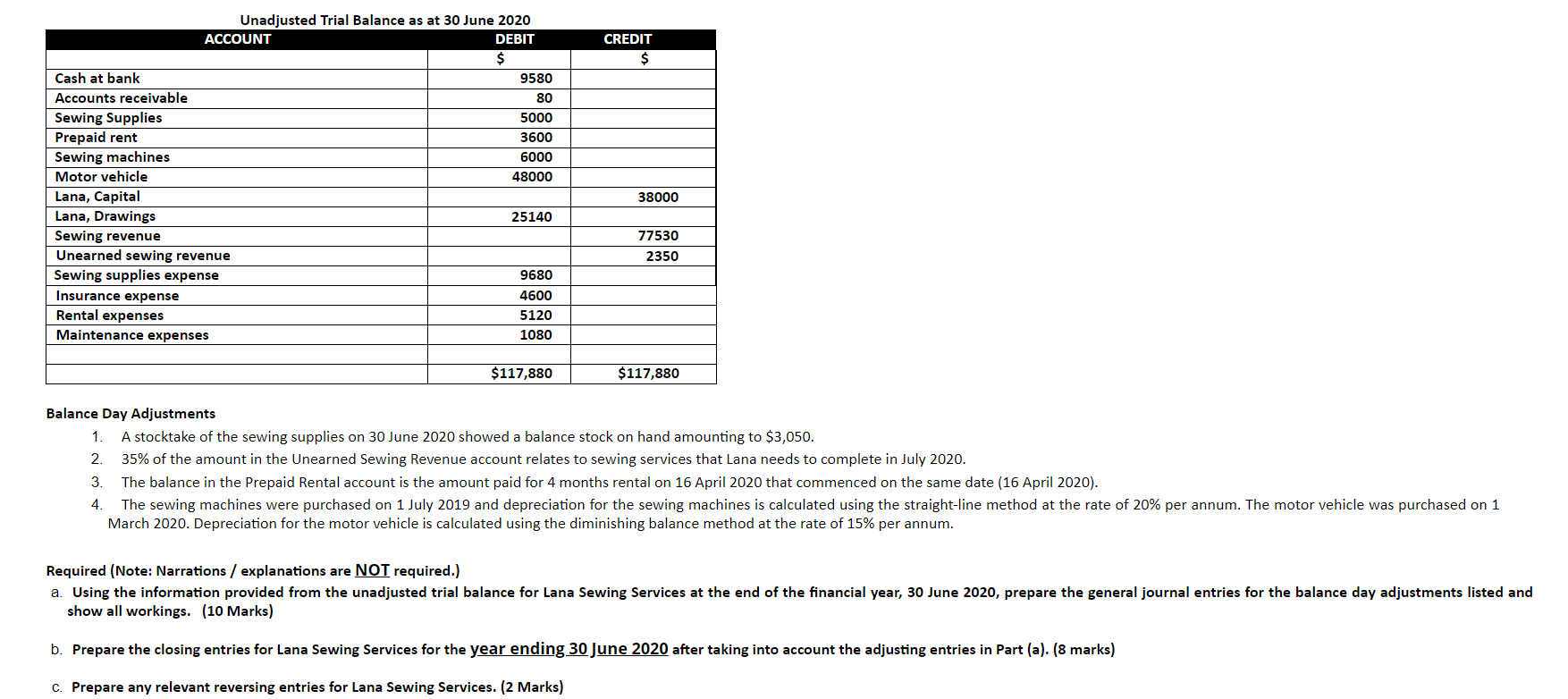

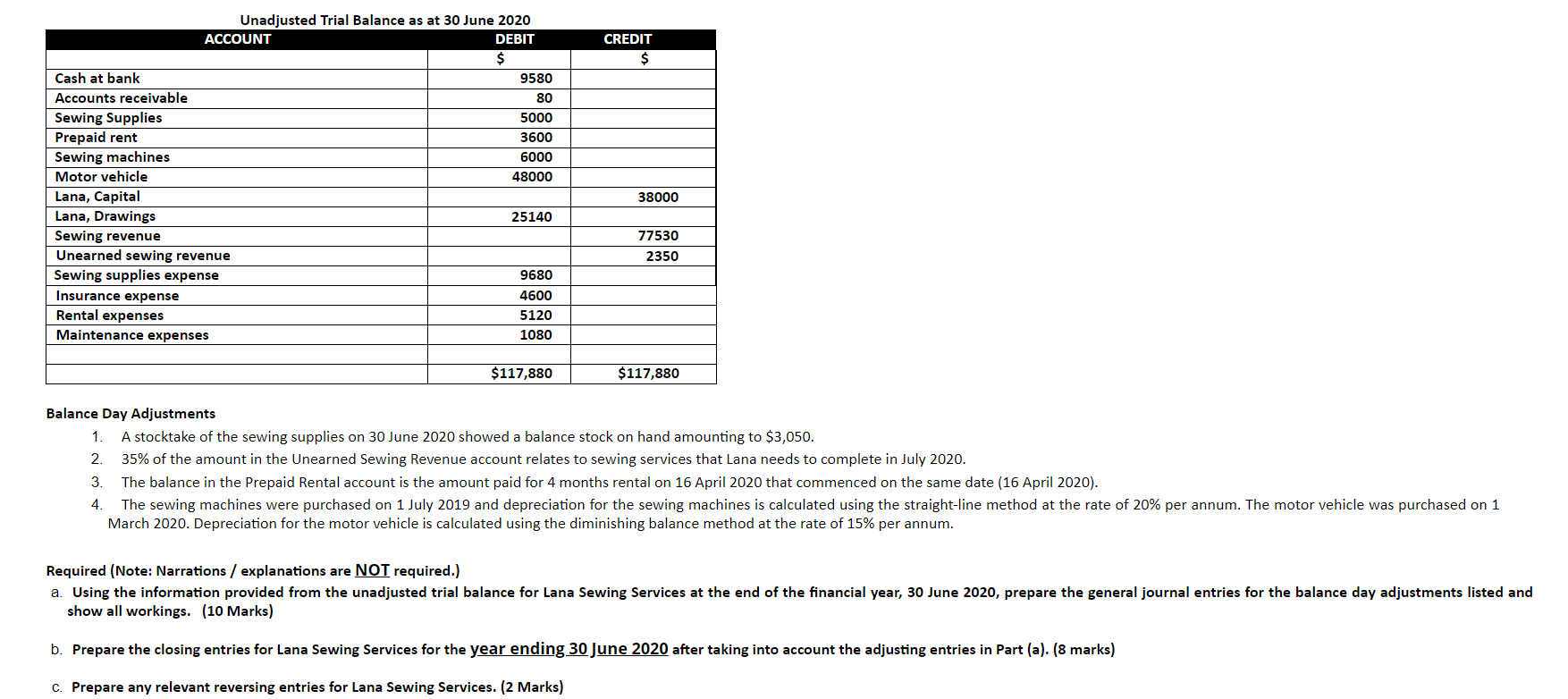

CREDIT $ 6000 Unadjusted Trial Balance as at 30 June 2020 ACCOUNT DEBIT $ Cash at bank 9580 Accounts receivable 80 Sewing Supplies 5000 Prepaid rent 3600 Sewing machines Motor vehicle 48000 Lana, Capital Lana, Drawings 25140 Sewing revenue Unearned sewing revenue Sewing supplies expense 9680 Insurance expense 4600 Rental expenses 5120 Maintenance expenses 1080 38000 77530 2350 $117,880 $117,880 alance Day Adjustments 1. A stocktake of the sewing supplies on 30 June 2020 showed a balance stock on hand amounting to $3,050. 2. 35% of the amount in the Unearned Sewing Revenue account relates to sewing services that Lana needs to complete in July 2020. 3 The balance in the Prepaid Rental account is the amount paid for 4 months rental on 16 April 2020 that commenced on the same date (16 April 2020). 4 The sewing machines were purchased on 1 July 2019 and depreciation for the sewing machines is calculated using the straight-line method at the rate of 20% per annum. The motor vehicle was purchased on 1 March 2020. Depreciation for the motor vehicle is calculated using the diminishing balance method at the rate of 15% per annum. Required (Note: Narrations / explanations are NOT required.) a. Using the information provided from the unadjusted trial balance for Lana Sewing Services at the end of the financial year, 30 June 2020, prepare the general journal entries for the balance day adjustments listed and show all workings. (10 Marks) b. Prepare the closing entries for Lana Sewing Services for the year ending 30 June 2020 after taking into account the adjusting entries in Part (a). (8 marks) c. Prepare any relevant reversing entries for Lana Sewing Services. (2 Marks) CREDIT $ 6000 Unadjusted Trial Balance as at 30 June 2020 ACCOUNT DEBIT $ Cash at bank 9580 Accounts receivable 80 Sewing Supplies 5000 Prepaid rent 3600 Sewing machines Motor vehicle 48000 Lana, Capital Lana, Drawings 25140 Sewing revenue Unearned sewing revenue Sewing supplies expense 9680 Insurance expense 4600 Rental expenses 5120 Maintenance expenses 1080 38000 77530 2350 $117,880 $117,880 alance Day Adjustments 1. A stocktake of the sewing supplies on 30 June 2020 showed a balance stock on hand amounting to $3,050. 2. 35% of the amount in the Unearned Sewing Revenue account relates to sewing services that Lana needs to complete in July 2020. 3 The balance in the Prepaid Rental account is the amount paid for 4 months rental on 16 April 2020 that commenced on the same date (16 April 2020). 4 The sewing machines were purchased on 1 July 2019 and depreciation for the sewing machines is calculated using the straight-line method at the rate of 20% per annum. The motor vehicle was purchased on 1 March 2020. Depreciation for the motor vehicle is calculated using the diminishing balance method at the rate of 15% per annum. Required (Note: Narrations / explanations are NOT required.) a. Using the information provided from the unadjusted trial balance for Lana Sewing Services at the end of the financial year, 30 June 2020, prepare the general journal entries for the balance day adjustments listed and show all workings. (10 Marks) b. Prepare the closing entries for Lana Sewing Services for the year ending 30 June 2020 after taking into account the adjusting entries in Part (a). (8 marks) c. Prepare any relevant reversing entries for Lana Sewing Services. (2 Marks)