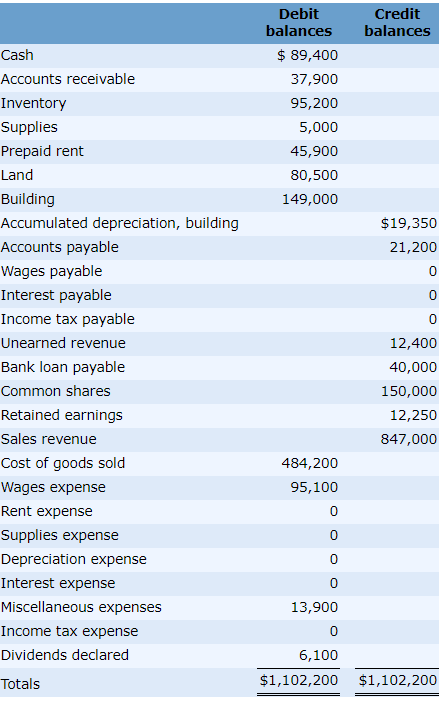

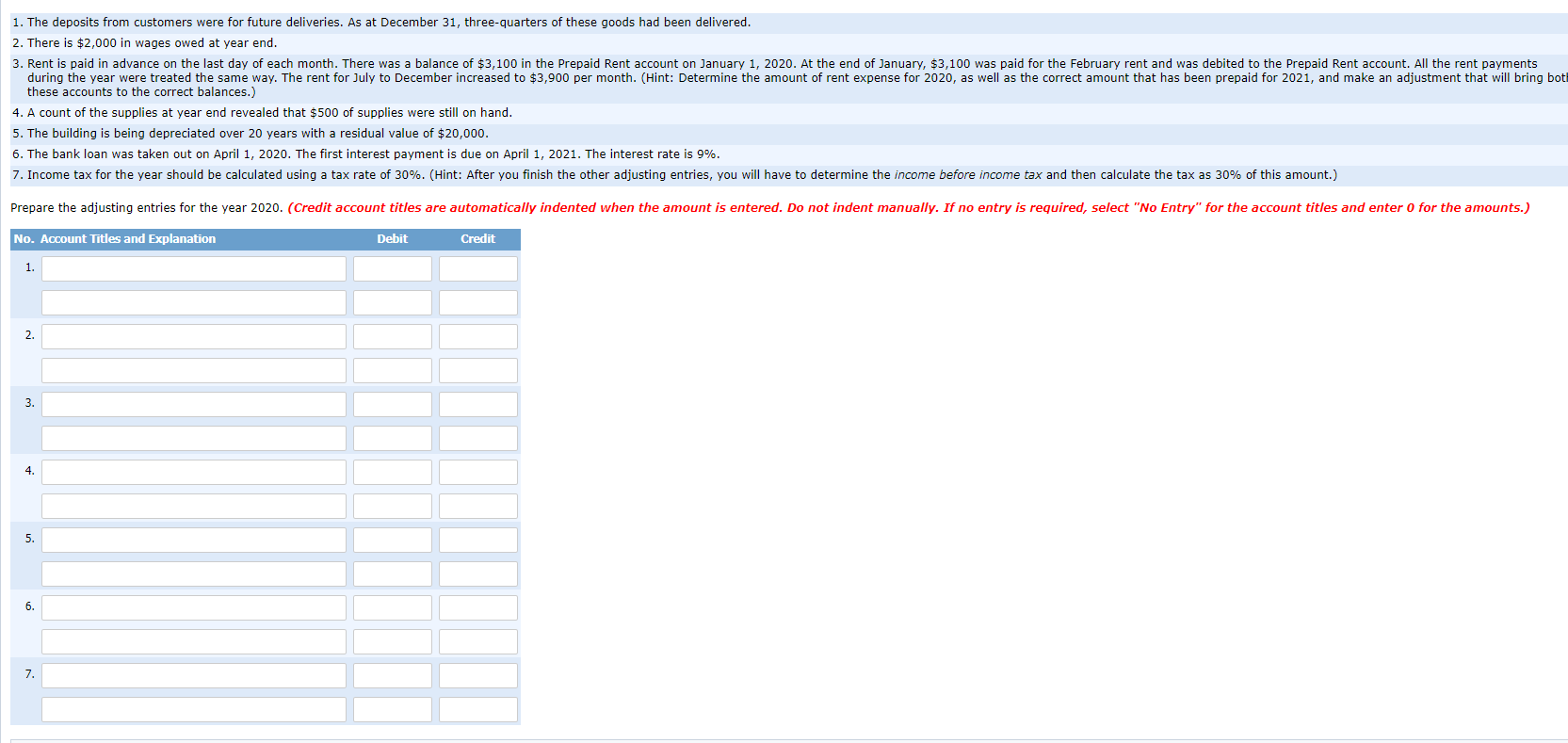

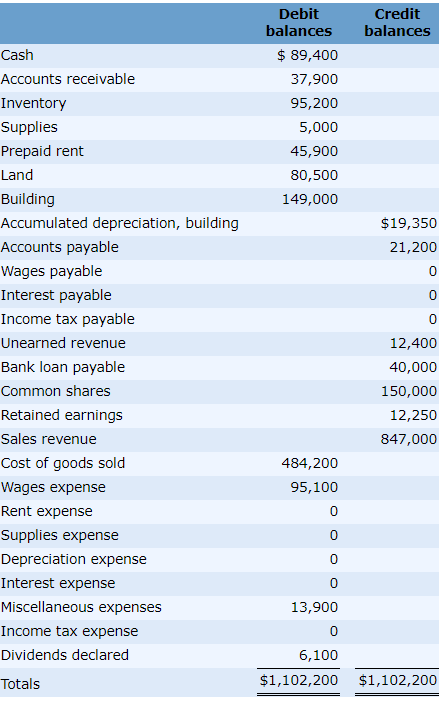

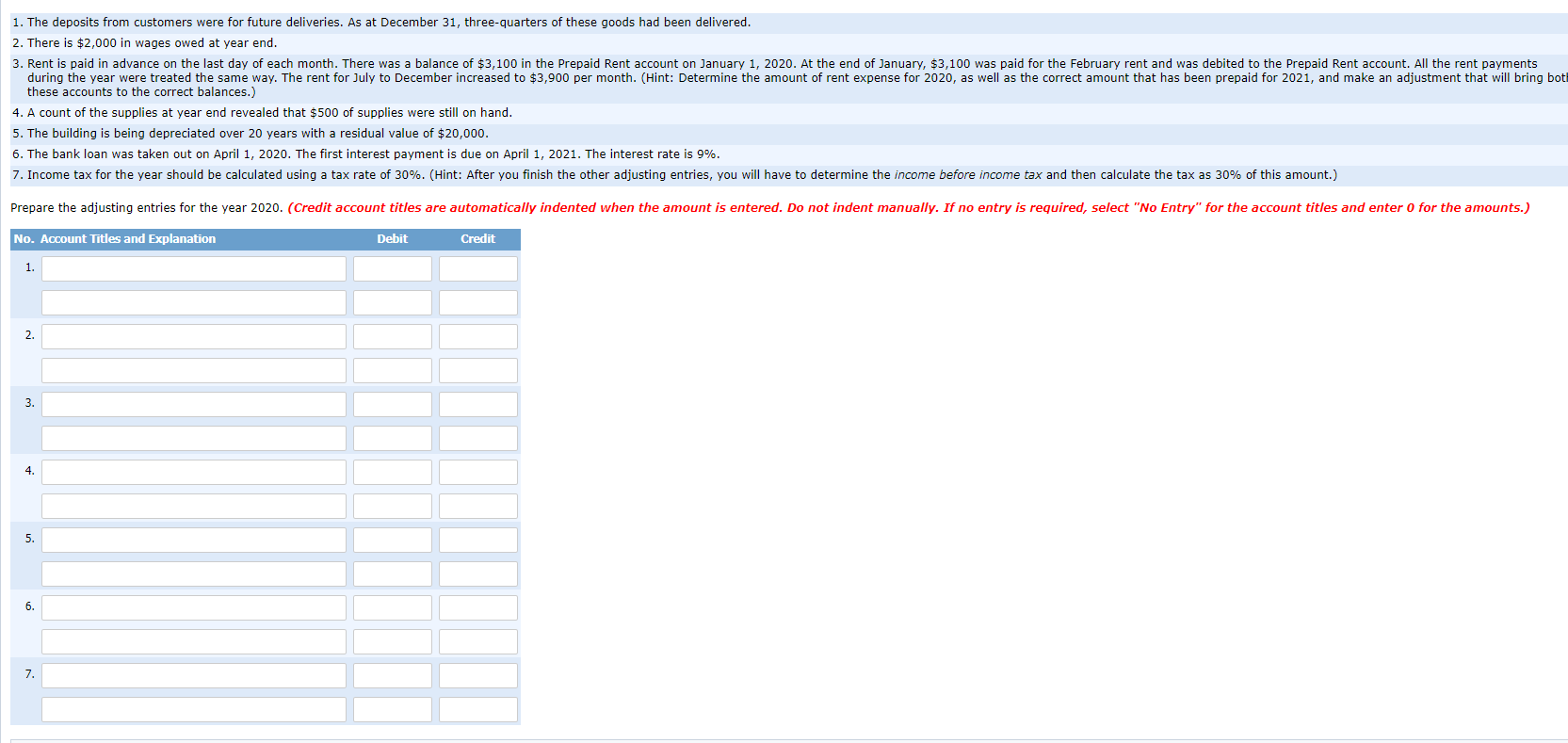

Credit balances Debit balances $ 89,400 37,900 95,200 5,000 45,900 80,500 149,000 $19,350 21,200 0 0 Cash Accounts receivable Inventory Supplies Prepaid rent Land Building Accumulated depreciation, building Accounts payable Wages payable Interest payable Income tax payable Unearned revenue Bank loan payable Common shares Retained earnings Sales revenue Cost of goods sold Wages expense Rent expense Supplies expense Depreciation expense Interest expense Miscellaneous expenses Income tax expense Dividends declared Totals 12,400 40,000 150,000 12,250 847,000 484,200 95,100 13,900 6,100 $1,102,200 $1,102,200 1. The deposits from customers were for future deliveries. As at December 31, three-quarters of these goods had been delivered. 2. There is $2,000 in wages owed at year end. 3. Rent is paid in advance on the last day of each month. There was a balance of $3,100 in the Prepaid Rent account on January 1, 2020. At the end of January, $3,100 was paid for the February rent and was debited to the Prepaid Rent account. All the rent payments during the year were treated the same way. The rent for July to December increased to $3,900 per month. (Hint: Determine the amount of rent expense for 2020, as well as the correct amount that has been prepaid for 2021, and make an adjustment that will bring bot these accounts to the correct balances.) 4. A count of the supplies at year end revealed that $500 of supplies were still on hand. 5. The building is being depreciated over 20 years with a residual value of $20,000. 6. The bank loan was taken out on April 1, 2020. The first interest payment is due on April 1, 2021. The interest rate is 9%. 7. Income tax for the year should be calculated using a tax rate of 30%. (Hint: After you finish the other adjusting entries, you will have to determine the income before income tax and then calculate the tax as 30% of this amount.) Prepare the adjusting entries for the year 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit