Answered step by step

Verified Expert Solution

Question

1 Approved Answer

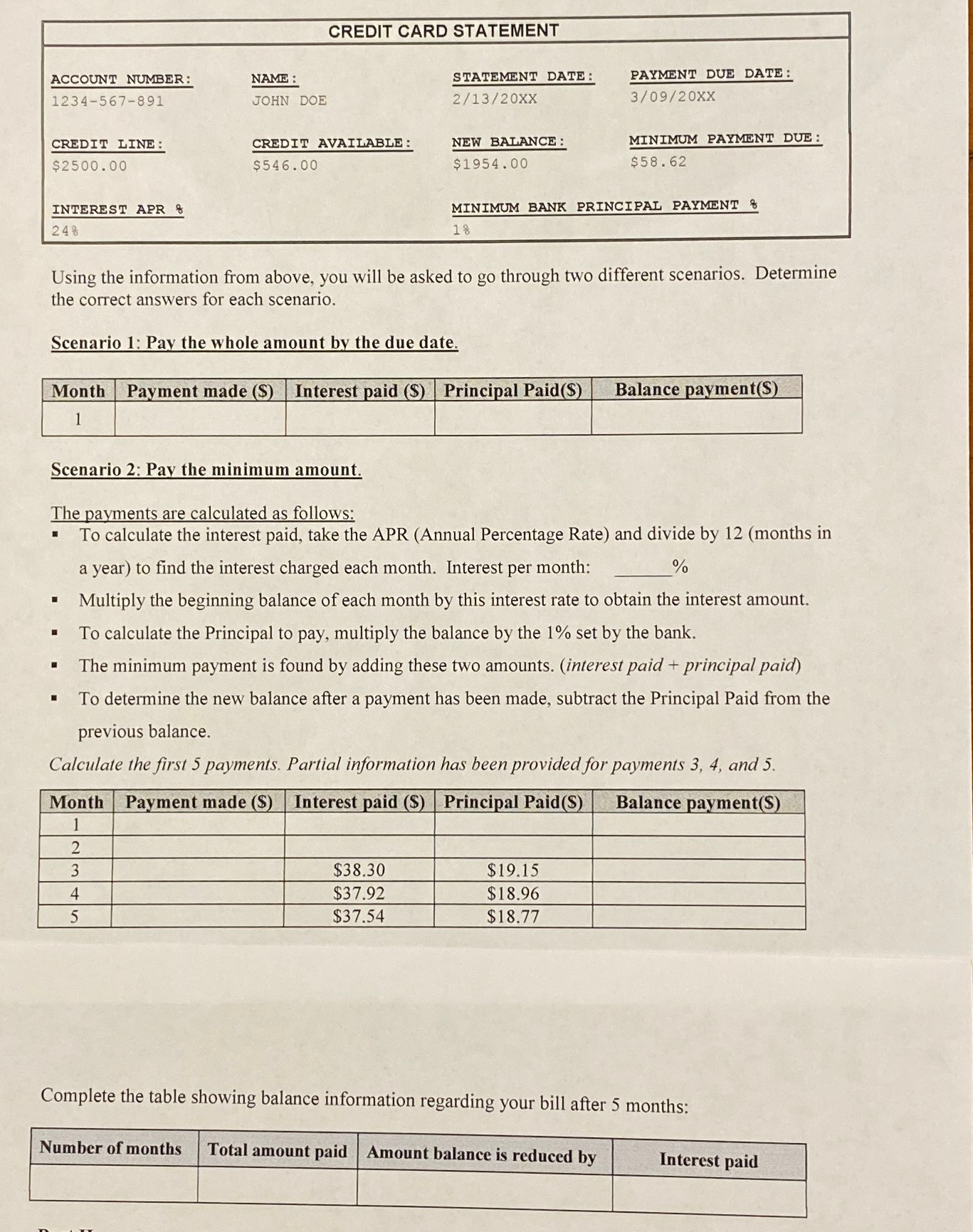

CREDIT CARD STATEMENT ACCOUNT NUMBER: 1234-567-891 NAME: JOHN DOE STATEMENT DATE: 2/13/20XX PAYMENT DUE DATE: 3/09/20XX CREDIT LINE: $2500.00 CREDIT AVAILABLE: $546.00 NEW BALANCE:

CREDIT CARD STATEMENT ACCOUNT NUMBER: 1234-567-891 NAME: JOHN DOE STATEMENT DATE: 2/13/20XX PAYMENT DUE DATE: 3/09/20XX CREDIT LINE: $2500.00 CREDIT AVAILABLE: $546.00 NEW BALANCE: $1954.00 MINIMUM PAYMENT DUE: $58.62 INTEREST APR 8 24% MINIMUM BANK PRINCIPAL PAYMENT % 1% Using the information from above, you will be asked to go through two different scenarios. Determine the correct answers for each scenario. Scenario 1: Pay the whole amount by the due date. Month 1 Payment made (S) Interest paid (S) Principal Paid($) Balance payment(S) Scenario 2: Pay the minimum amount. The payments are calculated as follows: % To calculate the interest paid, take the APR (Annual Percentage Rate) and divide by 12 (months in a year) to find the interest charged each month. Interest per month: Multiply the beginning balance of each month by this interest rate to obtain the interest amount. To calculate the Principal to pay, multiply the balance by the 1% set by the bank. The minimum payment is found by adding these two amounts. (interest paid + principal paid) To determine the new balance after a payment has been made, subtract the Principal Paid from the previous balance. Calculate the first 5 payments. Partial information has been provided for payments 3, 4, and 5. Month Payment made (S) Interest paid (S) Principal Paid (S) Balance payment(S) 1 2 3 4 5 $38.30 $19.15 $37.92 $18.96 $37.54 $18.77 Complete the table showing balance information regarding your bill after 5 months: Number of months Total amount paid Amount balance is reduced by Interest paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the table showing the balance information after 5 months for Scenario 1 paying the whole amount by the due date we can use the provided in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started