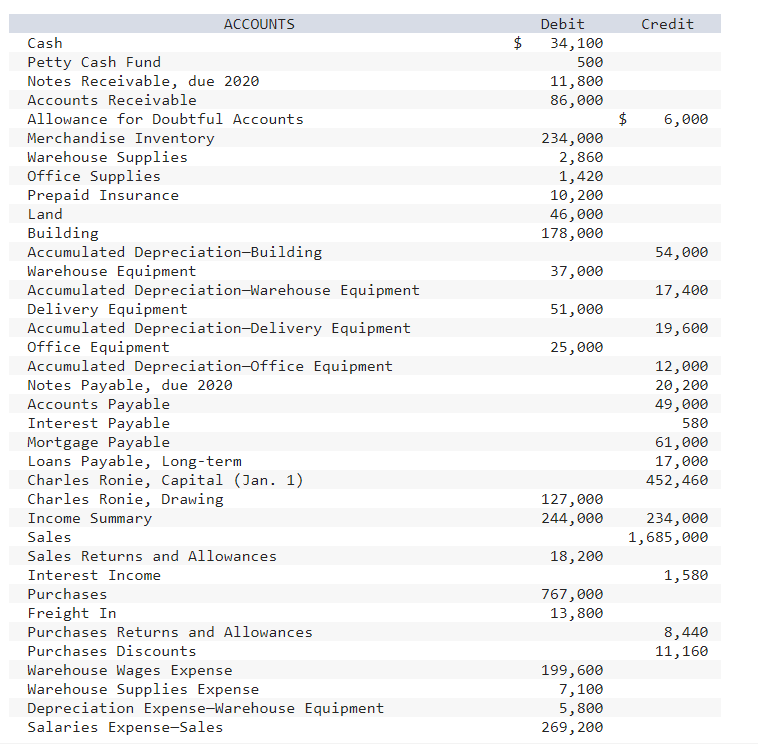

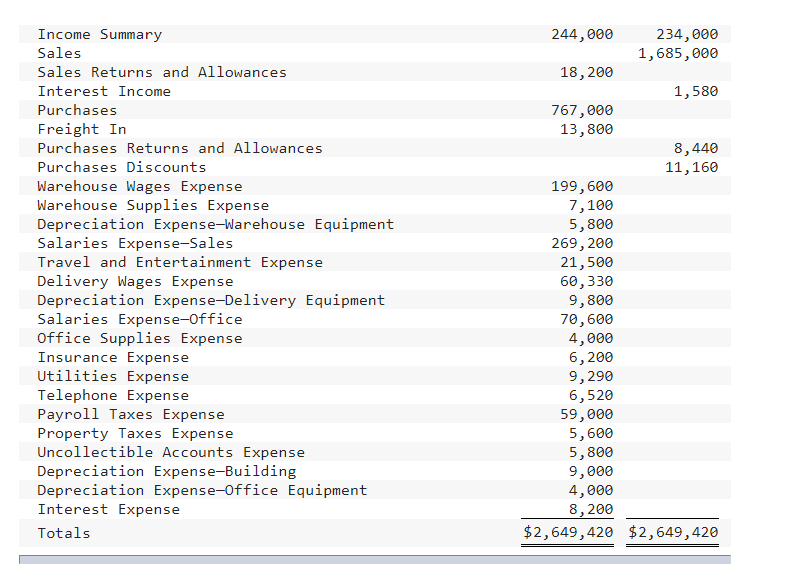

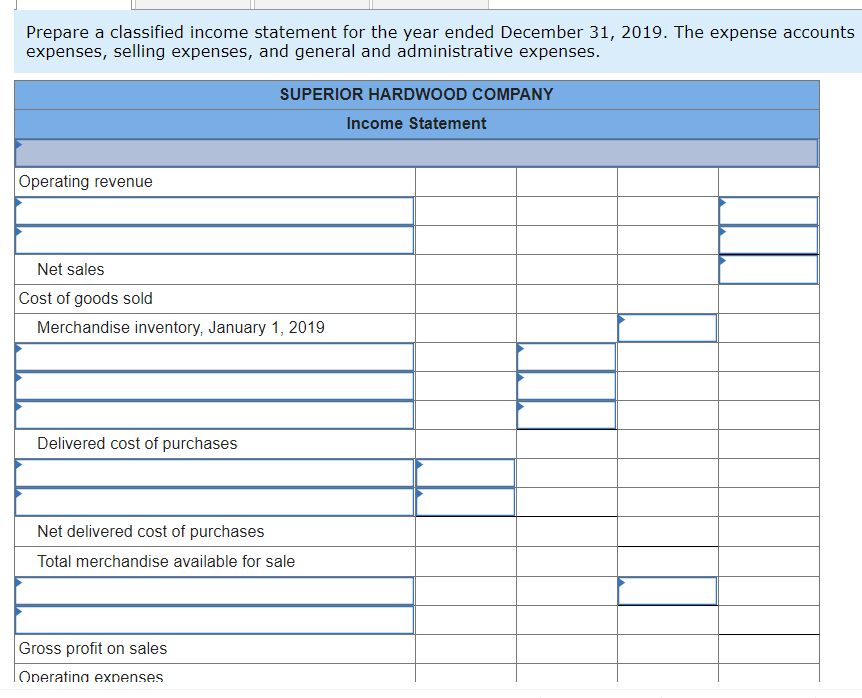

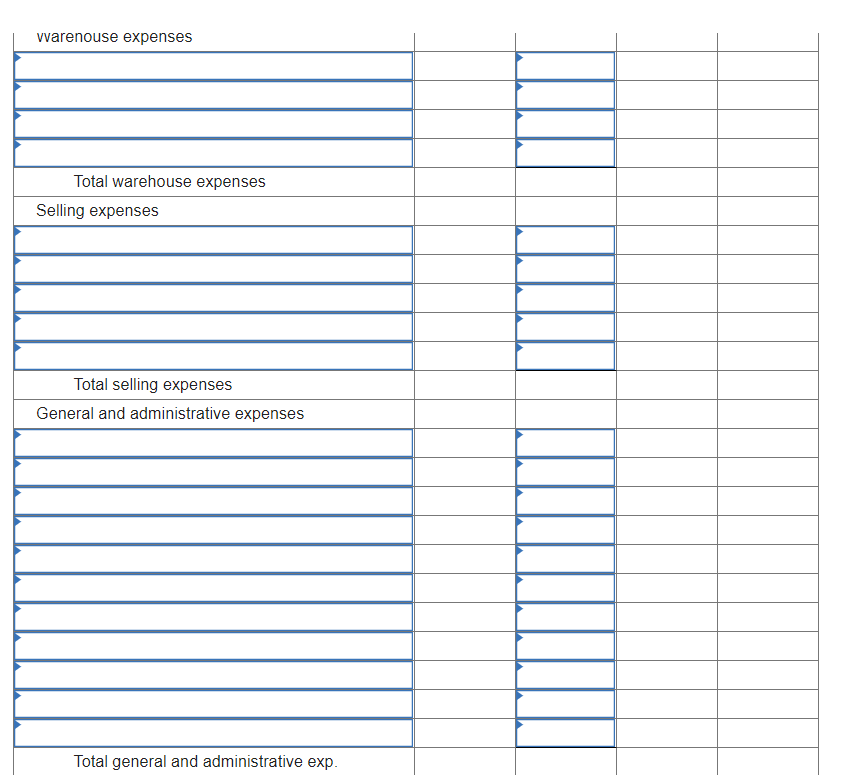

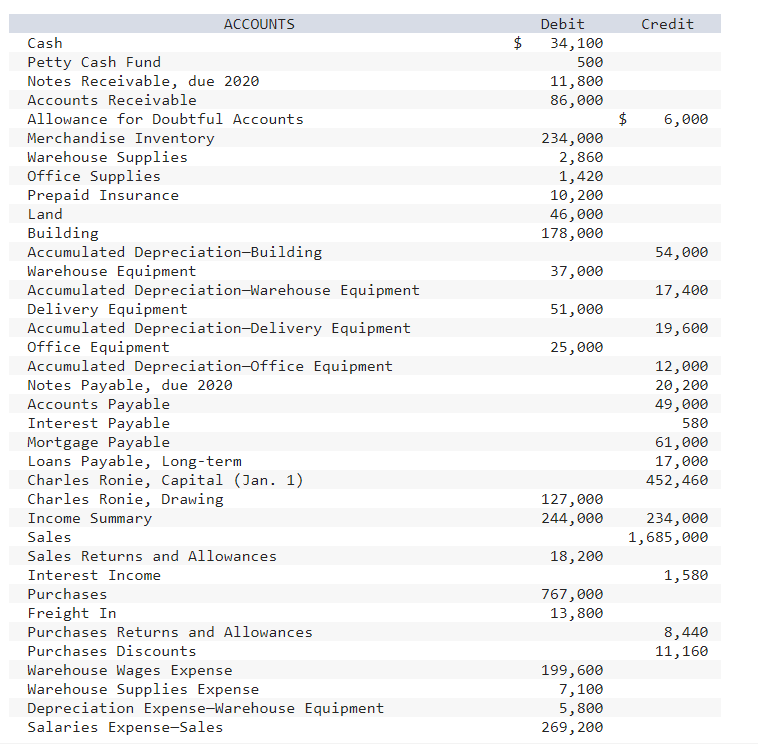

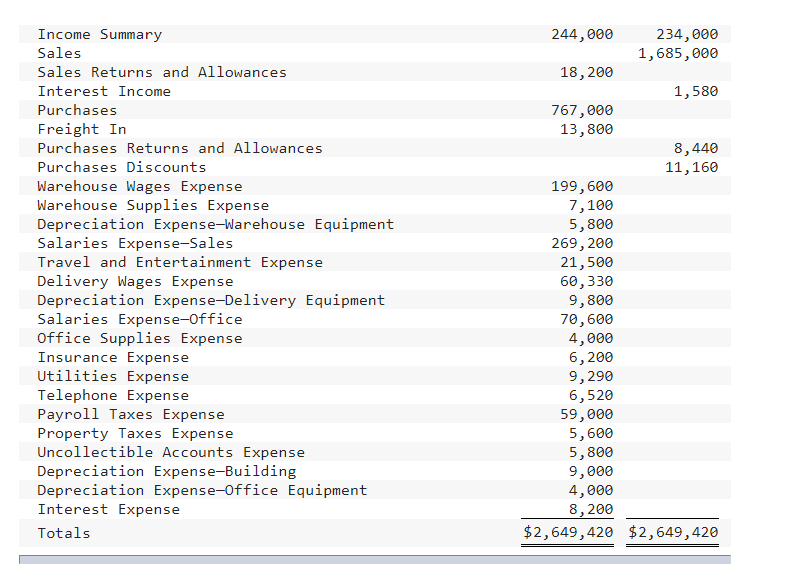

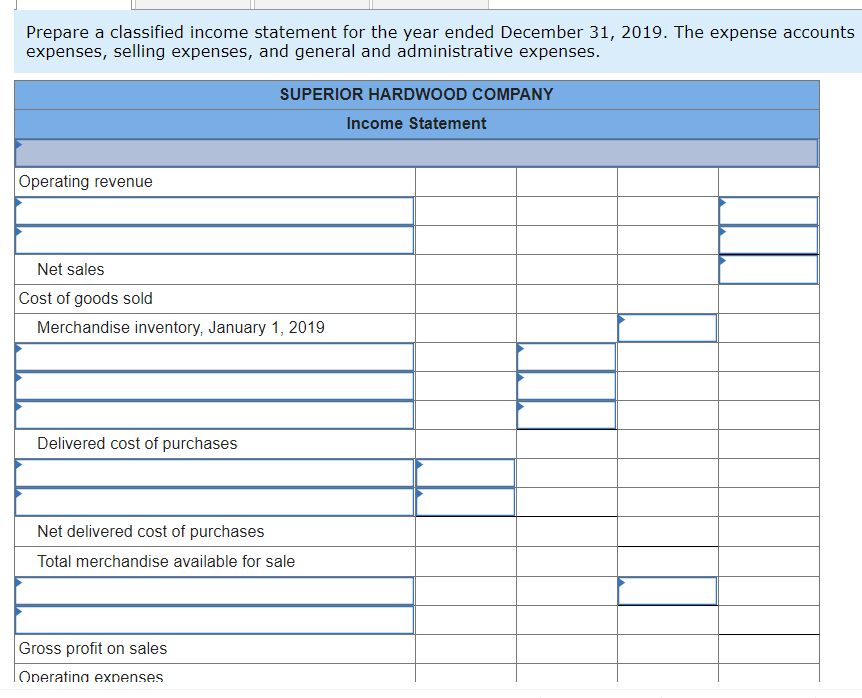

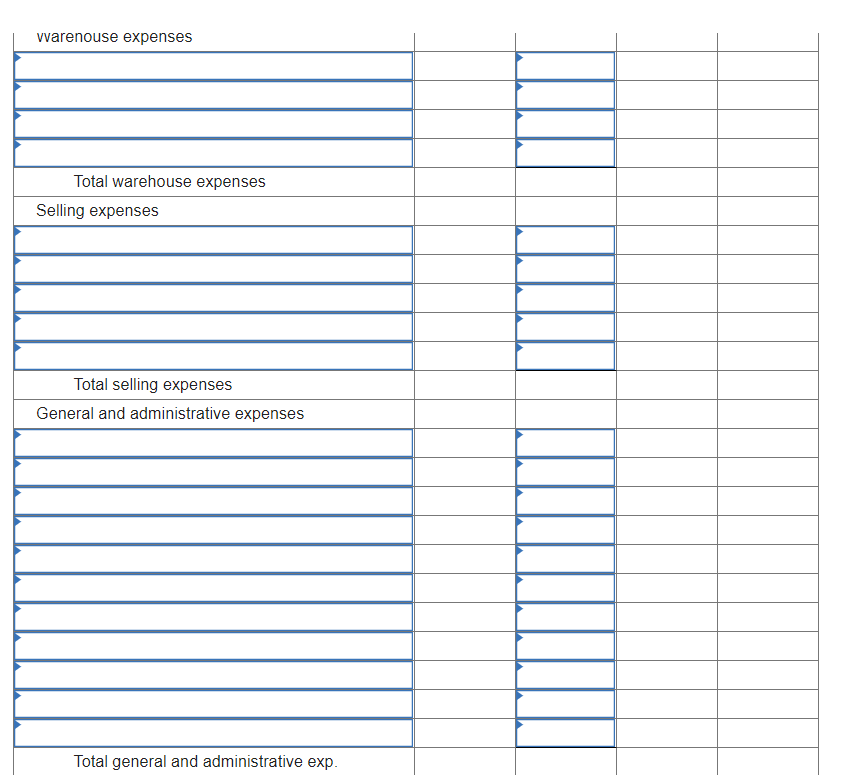

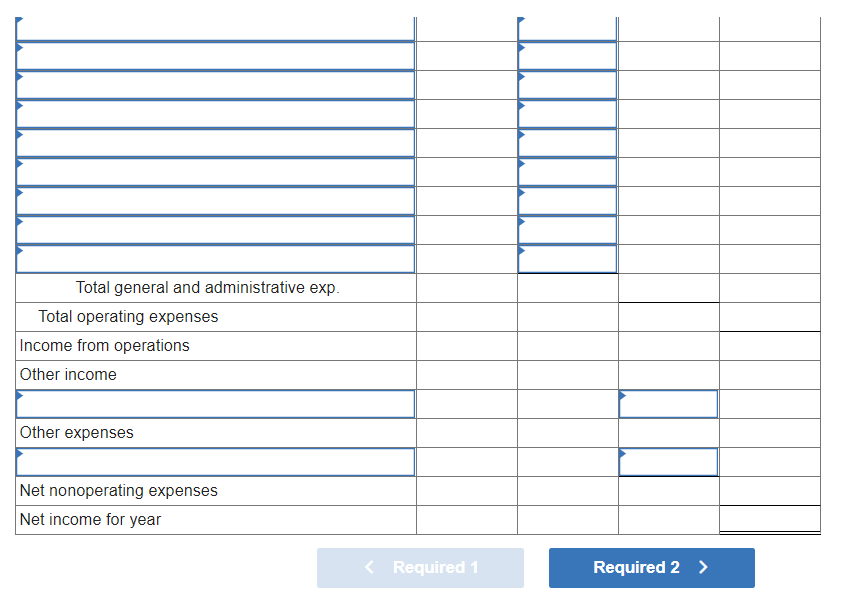

Credit $ Debit 34,100 500 11,800 86,000 $ 6,000 234,000 2,860 1,420 10,200 46,000 178,000 54,000 37,000 17,400 51,000 19,600 25,000 ACCOUNTS Cash Petty Cash Fund Notes Receivable, due 2020 Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Warehouse Supplies Office Supplies Prepaid Insurance Land Building Accumulated Depreciation-Building Warehouse Equipment Accumulated Depreciation-Warehouse Equipment Delivery Equipment Accumulated Depreciation-Delivery Equipment Office Equipment Accumulated Depreciation-office Equipment Notes Payable, due 2020 Accounts Payable Interest Payable Mortgage Payable Loans Payable, Long-term Charles Ronie, Capital (Jan. 1) Charles Ronie, Drawing Income Summary Sales Sales Returns and Allowances Interest Income Purchases Freight In Purchases Returns and Allowances Purchases Discounts Warehouse Wages Expense Warehouse Supplies Expense Depreciation Expense-Warehouse Equipment Salaries Expense-Sales 12,000 20,200 49,000 580 61,000 17,000 452,460 127,000 244,000 234,000 1,685,000 18,200 1,580 767,000 13,800 8,440 11,160 199,600 7,100 5,800 269, 200 Income Summary Sales Sales Returns and Allowances Interest Income Purchases Freight In Purchases Returns and Allowances Purchases Discounts Warehouse Wages Expense Warehouse Supplies Expense Depreciation Expense-Warehouse Equipment Salaries Expense-Sales Travel and Entertainment Expense Delivery Wages Expense Depreciation Expense-Delivery Equipment Salaries Expense-Office Office Supplies Expense Insurance Expense Utilities Expense Telephone Expense Payroll Taxes Expense Property Taxes Expense Uncollectible Accounts Expense Depreciation Expense-Building Depreciation Expense-Office Equipment Interest Expense Totals 244,000 234,000 1,685,000 18,200 1,580 767,000 13,800 8,440 11,160 199,600 7,100 5,800 269, 200 21,500 60,330 9,800 70,600 4,000 6,200 9,290 6,520 59,000 5,600 5,800 9,000 4,000 8,200 $2,649,420 $2,649,420 Prepare a classified income statement for the year ended December 31, 2019. The expense accounts expenses, selling expenses, and general and administrative expenses. SUPERIOR HARDWOOD COMPANY Income Statement Operating revenue Net sales Cost of goods sold Merchandise inventory, January 1, 2019 Delivered cost of purchases Net delivered cost of purchases Total merchandise available for sale Gross profit on sales Operating expenses vvarenouse expenses Total warehouse expenses Selling expenses Total selling expenses General and administrative expenses Total general and administrative exp. Total general and administrative exp. Total operating expenses Income from operations Other income Other expenses Net nonoperating expenses Net income for year