Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Credit evaluation of the customer involves the following 5 stages 1. Gathering credit information of the customer through: a. financial statements of a firm, b

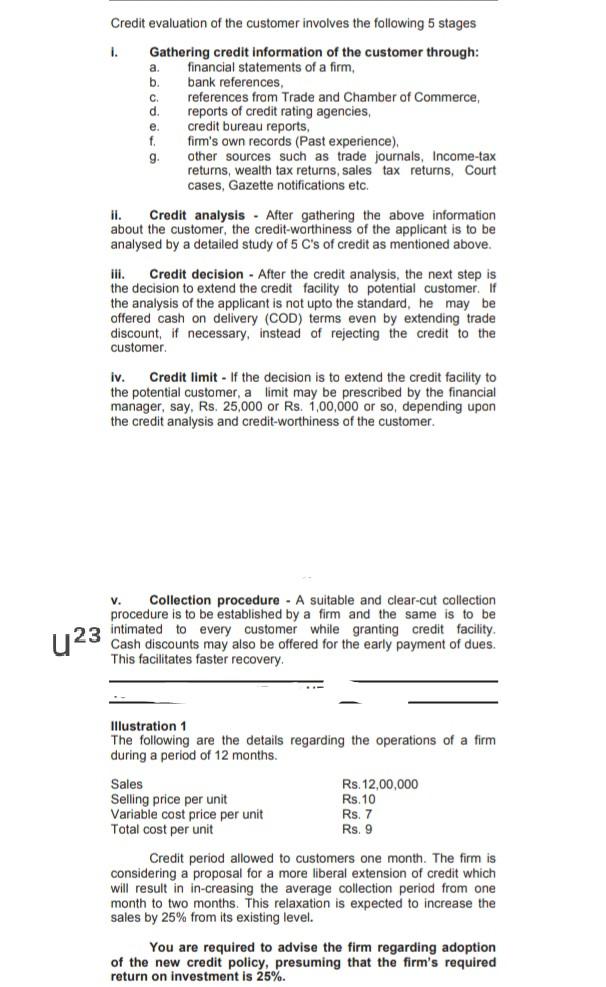

Credit evaluation of the customer involves the following 5 stages 1. Gathering credit information of the customer through: a. financial statements of a firm, b bank references, c. references from Trade and Chamber of Commerce, d. reports of credit rating agencies, e. credit bureau reports, f. firm's own records (Past experience), g other sources such as trade journals, Income-tax returns, wealth tax returns, sales tax returns. Court cases, Gazette notifications etc. il. Credit analysis. After gathering the above information about the customer, the credit-worthiness of the applicant is to be analysed by a detailed study of 5 C's of credit as mentioned above. iii. Credit decision - After the credit analysis, the next step is the decision to extend the credit facility potential customer. If the analysis of the applicant is not upto the standard, he may be offered cash on delivery (COD) terms even by extending trade discount, if necessary, instead of rejecting the credit to the customer iv. Credit limit - If the decision is to extend the credit facility to the potential customer, a limit may be prescribed by the financial manager, say, Rs. 25,000 or Rs. 1,00,000 or so, depending upon the credit analysis and credit-worthiness of the customer. u23 v. Collection procedure - A suitable and clear-cut collection procedure is to be established by a firm and the same is to be intimated to every customer while granting credit facility, Cash discounts may also be offered for the early payment of dues. This facilitates faster recovery, Illustration 1 The following are the details regarding the operations of a firm during a period of 12 months. Sales Selling price per unit Variable cost price per unit Total cost per unit Rs. 12,00,000 Rs. 10 Rs. 7 Rs. 9 Credit period allowed to customers one month. The firm is considering a proposal for a more liberal extension of credit which will result in increasing the average collection period from one month to two months. This relaxation is expected to increase the sales by 25% from its existing level. You are required to advise the firm regarding adoption of the new credit policy, presuming that the firm's required return on investment 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started