Answered step by step

Verified Expert Solution

Question

1 Approved Answer

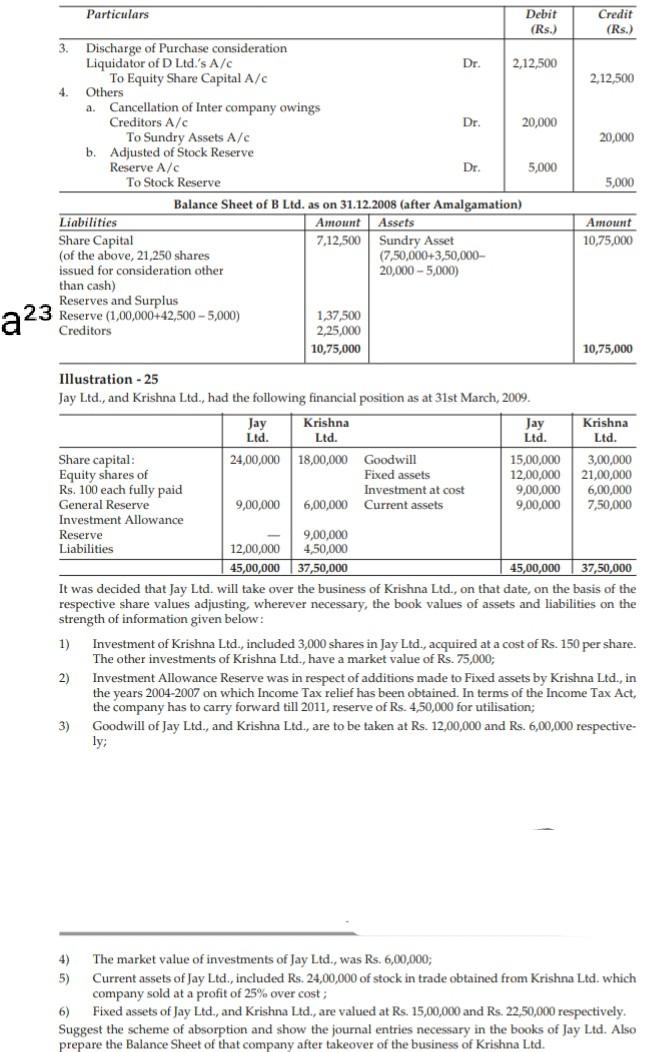

Credit (Rs.) 212500 20,000 Particulars Debit (Rs.) 3. Discharge of Purchase consideration Liquidator of D Ltd.'s A/C Dr. 2.12.500 To Equity Share Capital A/c 4

Credit (Rs.) 212500 20,000 Particulars Debit (Rs.) 3. Discharge of Purchase consideration Liquidator of D Ltd.'s A/C Dr. 2.12.500 To Equity Share Capital A/c 4 Others a. Cancellation of Inter company owings Creditors A/C Dr. 20,000 To Sundry Assets A/C b. Adjusted of Stock Reserve Reserve A/C Dr. 5,000 To Stock Reserve Balance Sheet of B Ltd. as on 31.12.2008 (after Amalgamation) Liabilities Amount Assets Share Capital 7,12,500 Sundry Asset (of the above, 21,250 shares (7,50,000+3,50,000- issued for consideration other 20,000 - 5,000) than cash) Reserves and Surplus Reserve (1,00,000+42,500 -5,000) 1,37,500 Creditors 2,25,000 10,75,000 5,000 Amount 10,75,000 a23 10,75,000 Illustration - 25 Jay Ltd., and Krishna Ltd., had the following financial position as at 31st March, 2009. Jay Krishna Jay Krishna Ltd. Ltd. Ltd. Ltd. Share capital: 24,00,000 18,00,000 Goodwill 15,00,000 3,00,000 Equity shares of Fixed assets 12,00,000 21,00,000 Rs. 100 each fully paid Investment at cost 9,00,000 6,00,000 General Reserve 9,00,000 6,00,000 Current assets 9,00,000 7,50,000 Investment Allowance Reserve 9,00,000 Liabilities 12,00,000 4,50,000 45,00,000 37,50,000 45,00,000 37,50,000 It was decided that Jay Ltd. will take over the business of Krishna Ltd., on that date, on the basis of the respective share values adjusting, wherever necessary, the book values of assets and liabilities on the strength of information given below: 1) Investment of Krishna Ltd., included 3,000 shares in Jay Ltd., acquired at a cost of Rs. 150 per share. The other investments of Krishna Ltd., have a market value of Rs. 75,000; 2) Investment Allowance Reserve was in respect of additions made to Fixed assets by Krishna Ltd., in the years 2004-2007 on which Income Tax relief has been obtained. In terms of the Income Tax Act, the company has to carry forward till 2011, reserve of Rs. 4,50,000 for utilisation; 3) Goodwill of Jay Ltd., and Krishna Ltd., are to be taken at Rs. 12,00,000 and Rs. 6,00,000 respective- ly; 4) The market value of investments of Jay Ltd., was Rs. 6,00,000; 5) Current assets of Jay Ltd., included Rs. 24,00,000 of stock in trade obtained from Krishna Ltd. which company sold at a profit of 25% over cost; 6) Fixed assets of Jay Ltd., and Krishna Ltd., are valued at Rs. 15,00,000 and Rs. 22,50,000 respectively. Suggest the scheme of absorption and show the journal entries necessary in the books of Jay Ltd. Also prepare the Balance Sheet of that company after takeover of the business of Krishna Ltd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started