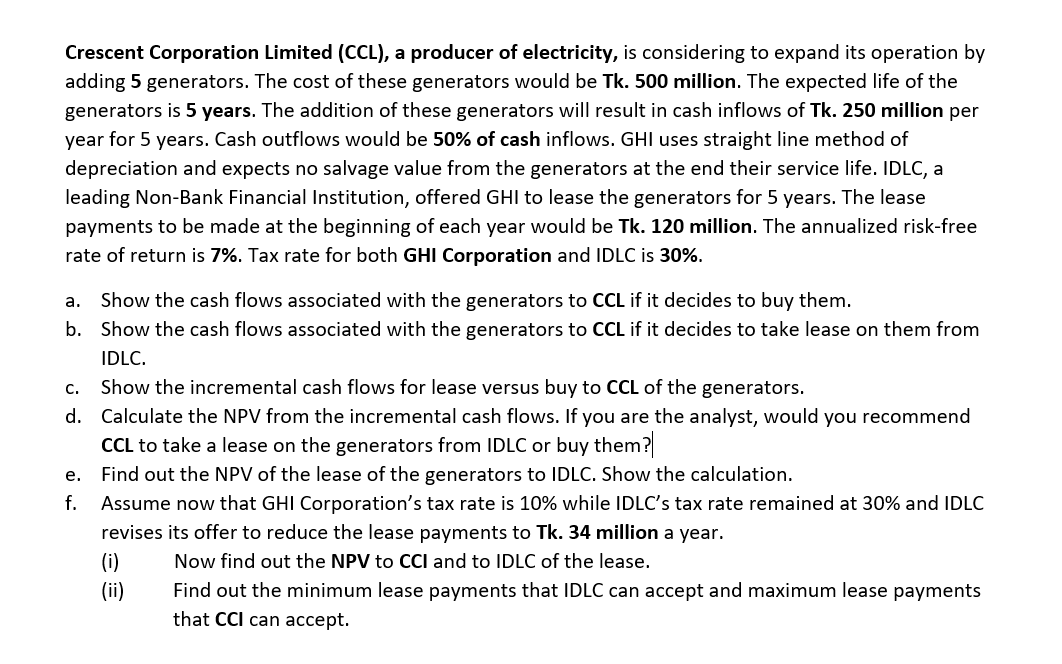

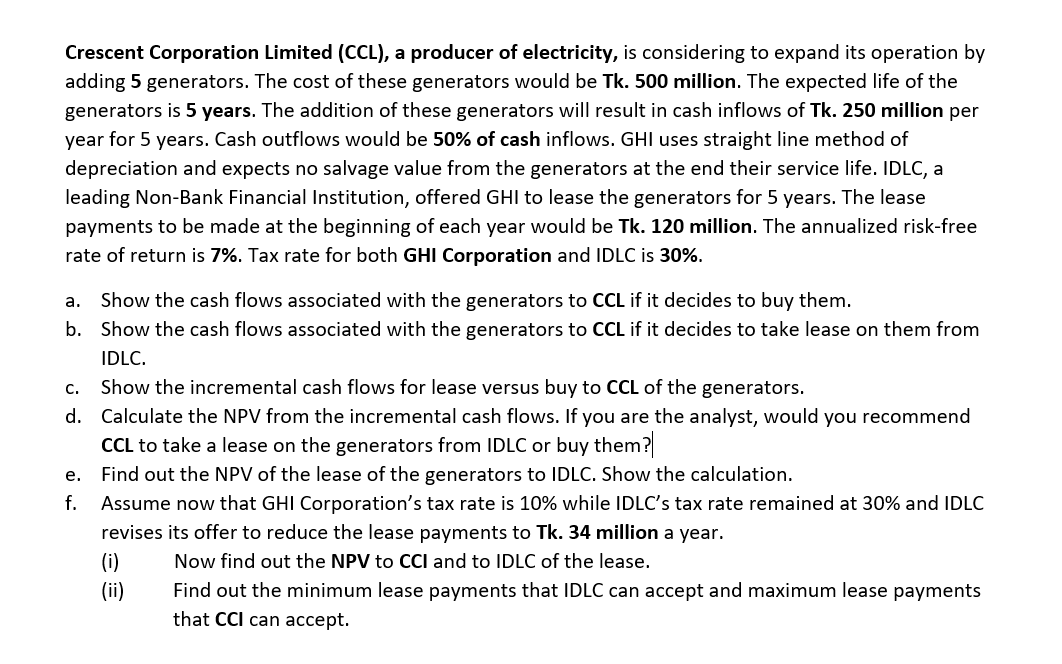

Crescent Corporation Limited (CCL), a producer of electricity, is considering to expand its operation by adding 5 generators. The cost of these generators would be Tk. 500 million. The expected life of the generators is 5 years. The addition of these generators will result in cash inflows of Tk. 250 million per year for 5 years. Cash outflows would be 50% of cash inflows. GHI uses straight line method of depreciation and expects no salvage value from the generators at the end their service life. IDLC, a leading Non-Bank Financial Institution, offered GHI to lease the generators for 5 years. The lease payments to be made at the beginning of each year would be Tk. 120 million. The annualized risk-free rate of return is 7%. Tax rate for both GHI Corporation and IDLC is 30%. a. Show the cash flows associated with the generators to CCL if it decides to buy them. b. Show the cash flows associated with the generators to CCL if it decides to take lease on them from IDLC. C. Show the incremental cash flows for lease versus buy to CCL of the generators. d. Calculate the NPV from the incremental cash flows. If you are the analyst, would you recommend CCL to take a lease on the generators from IDLC or buy them? Find out the NPV of the lease of the generators to IDLC. Show the calculation. f. Assume now that GHI Corporation's tax rate is 10% while IDLC's tax rate remained at 30% and IDLC revises its offer to reduce the lease payments to Tk. 34 million a year. (i) Now find out the NPV to CCI and to IDLC of the lease. (ii) Find out the minimum lease payments that IDLC can accept and maximum lease payments that CCI can accept. e. Crescent Corporation Limited (CCL), a producer of electricity, is considering to expand its operation by adding 5 generators. The cost of these generators would be Tk. 500 million. The expected life of the generators is 5 years. The addition of these generators will result in cash inflows of Tk. 250 million per year for 5 years. Cash outflows would be 50% of cash inflows. GHI uses straight line method of depreciation and expects no salvage value from the generators at the end their service life. IDLC, a leading Non-Bank Financial Institution, offered GHI to lease the generators for 5 years. The lease payments to be made at the beginning of each year would be Tk. 120 million. The annualized risk-free rate of return is 7%. Tax rate for both GHI Corporation and IDLC is 30%. a. Show the cash flows associated with the generators to CCL if it decides to buy them. b. Show the cash flows associated with the generators to CCL if it decides to take lease on them from IDLC. C. Show the incremental cash flows for lease versus buy to CCL of the generators. d. Calculate the NPV from the incremental cash flows. If you are the analyst, would you recommend CCL to take a lease on the generators from IDLC or buy them? Find out the NPV of the lease of the generators to IDLC. Show the calculation. f. Assume now that GHI Corporation's tax rate is 10% while IDLC's tax rate remained at 30% and IDLC revises its offer to reduce the lease payments to Tk. 34 million a year. (i) Now find out the NPV to CCI and to IDLC of the lease. (ii) Find out the minimum lease payments that IDLC can accept and maximum lease payments that CCI can accept. e