Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crescent Ltd. owns a factory in Queensland that makes electric switches. During 2020, due to increased competition from Winlectric Switches with improved battery life,

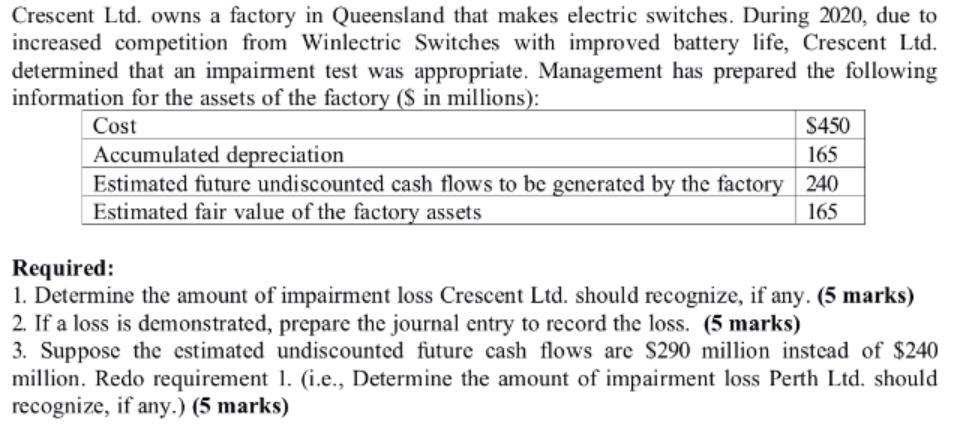

Crescent Ltd. owns a factory in Queensland that makes electric switches. During 2020, due to increased competition from Winlectric Switches with improved battery life, Crescent Ltd. determined that an impairment test was appropriate. Management has prepared the following information for the assets of the factory ($ in millions): Cost S450 Accumulated depreciation Estimated future undiscounted cash flows to be generated by the factory 240 Estimated fair value of the factory assets 165 165 Required: 1. Determine the amount of impairment loss Crescent Ltd. should recognize, if any. (5 marks) 2. If a loss is demonstrated, prepare the journal entry to record the loss. (5 marks) 3. Suppose the estimated undiscounted future cash flows are S290 million instead of $240 million. Redo requirement 1. (i.e., Determine the amount of impairment loss Perth Ltd. should recognize, if any.) (5 marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation iThe first step in the impairment test is to determine whether the assets are rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started