Question

Crime Control Co. accounts for a substantial part of its alarm system sales under the sales-type (capitalized) lease method. Under this method the company computes

Crime Control Co. accounts for a substantial part of its alarm system sales under the sales-type (capitalized) lease method. Under this method the company computes the present value of the total receipts it expects to get (over periods as long as eight years) from a lease and records this present value amount as sales in the first year of the lease. Justification for this accounting is that the 8-year lease extends over more than 75% of the 10-year useful life of the equipment. While the sales-type lease method is used for financial reporting, for tax purposes the company reports revenues only when received. Because first-year expenses of a lease are particularly large, the company reports substantial tax losses on these leases.

Required:

a. Critics maintain the sales-type lease method “front loads” income and that reported earnings may not be received in cash for several years. Comment on this criticism.

b. Will financial reporting income be improved from the company’s tax benefit?

c. The company insistsit can achieve earnings result in similar to those achieved by the the sales-type lease method by selling the lease receivables to third-party lessors or financial institutions. Comment on this assertion

Exercise 6-9

An analyst must be familiar with the concepts involved in determining income. The amount of in- come reported for a company depends on the recognition of revenues and expenses for a given time period. In certain cases, costs are recognized as expenses at the time of product sale; in other situations, guidelines are applied in capitalizing costs and recognizing them as expenses in future periods.

Required: a. Explain the rationale for recognizing costs as expenses at the time of product sale.

b. What is the rationale underlying the appropriateness of treating costs as expenses of a period instead of assigning the costs to an asset? Explain.

c. Under what circumstances is it appropriate to treat a cost of a an asset instead of as an expense? Explain.

d. Certain expenses are assigned to specific accounting periods on the basis of systematic and rational allocation of asset cost. Explain the underlying rationale for recognizing expenses on this basis.

e. Identify the conditions necessary to treat a cost a loss.

Problem 6-3

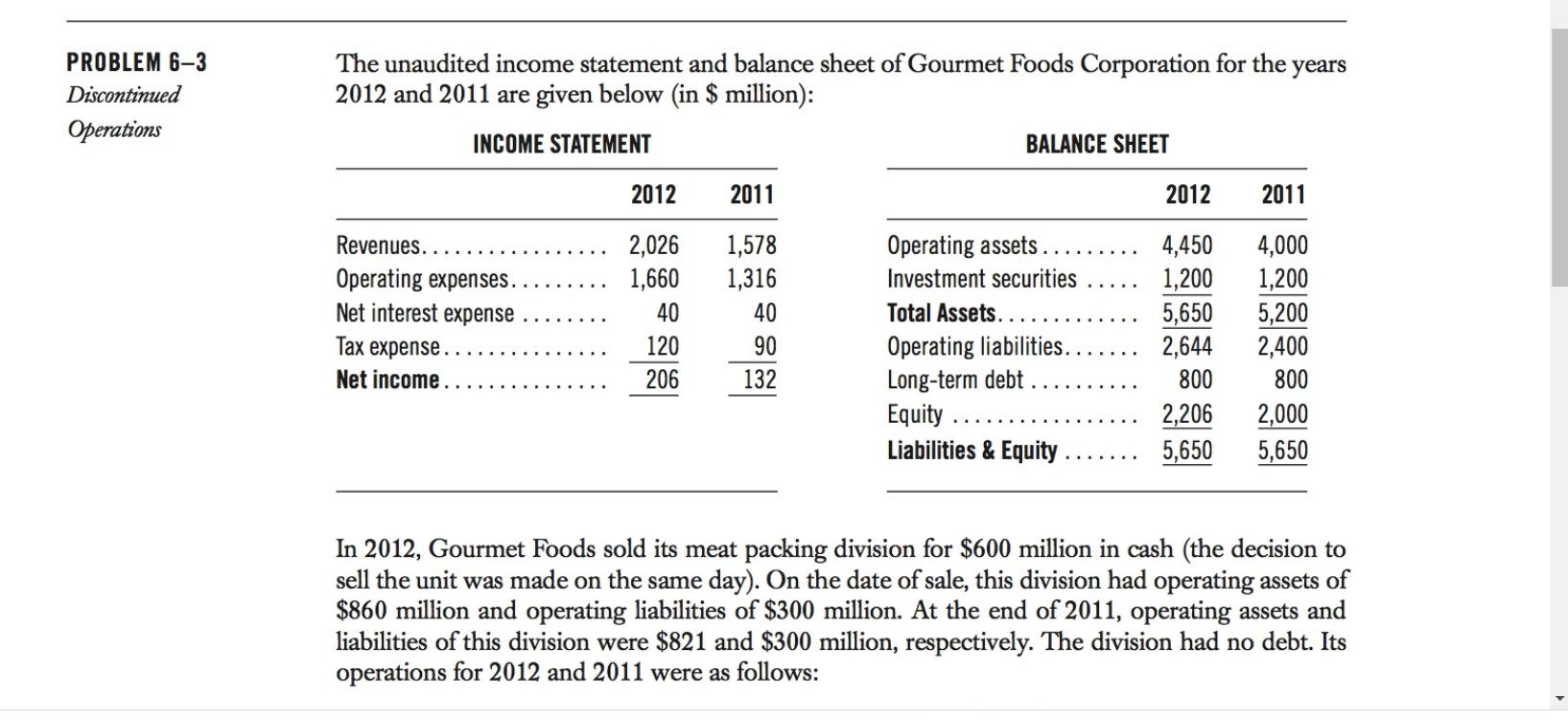

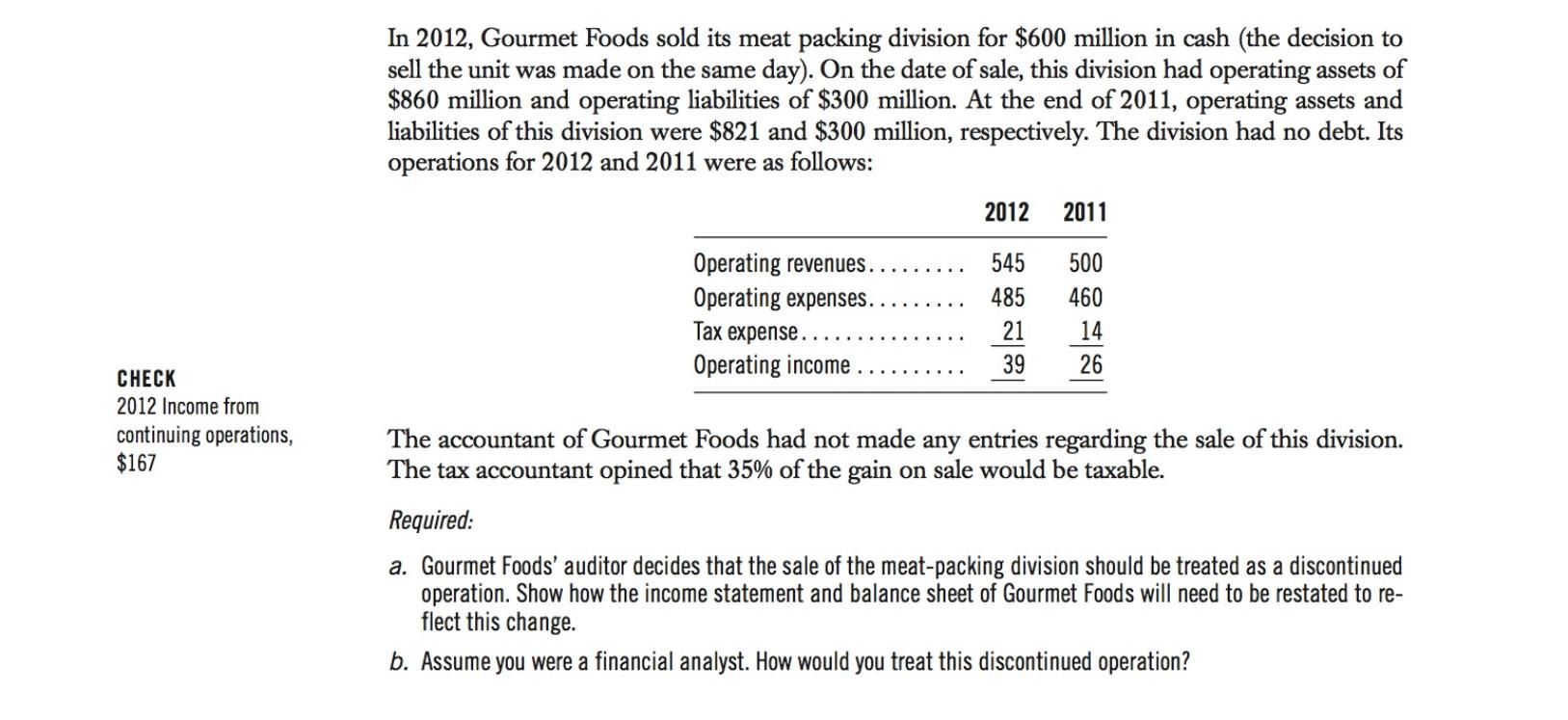

PROBLEM 6-3 Discontinued Operations The unaudited income statement and balance sheet of Gourmet Foods Corporation for the 2012 and 2011 are given below (in $ million): years INCOME STATEMENT Revenues. Operating expenses. Net interest expense Tax expense.. Net income. 2012 2,026 1,660 40 120 206 2011 1,578 1,316 40 90 132 BALANCE SHEET Operating assets.. Investment securities Total Assets.. Operating liabilities. Long-term debt Equity. Liabilities & Equity 2012 4,450 1,200 5,650 2,644 800 2,206 5,650 2011 4,000 1,200 5,200 2,400 800 2,000 5,650 In 2012, Gourmet Foods sold its meat packing division for $600 million in cash (the decision to sell the unit was made on the same day). On the date of sale, this division had operating assets of $860 million and operating liabilities of $300 million. At the end of 2011, operating assets and liabilities of this division were $821 and $300 million, respectively. The division had no debt. Its operations for 2012 and 2011 were as follows: CHECK 2012 Income from continuing operations, $167 In 2012, Gourmet Foods sold its meat packing division for $600 million in cash (the decision to sell the unit was made on the same day). On the date of sale, this division had operating assets of $860 million and operating liabilities of $300 million. At the end of 2011, operating assets and liabilities of this division were $821 and $300 million, respectively. The division had no debt. Its operations for 2012 and 2011 were as follows: Operating revenues. Operating expenses. Tax expense..... Operating income. 2012 2011 | 545 500 485 460 21 14 39 26 The accountant of Gourmet Foods had not made any entries regarding the sale of this division. The tax accountant opined that 35% of the gain on sale would be taxable. Required: a. Gourmet Foods auditor decides that the sale of the meat-packing division should be treated as a discontinued operation. Show how the income statement and balance sheet of Gourmet Foods will need to be restated to re- flect this change. b. Assume you were a financial analyst. How would you treat this discontinued operation?

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Exercise 67 Required Critics maintain the salestype lease method front loads income and that reported earnings may not be received in cash for several years Comment on this criticism Yes both companie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

627b3cfc89f24_101687.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started