Answered step by step

Verified Expert Solution

Question

1 Approved Answer

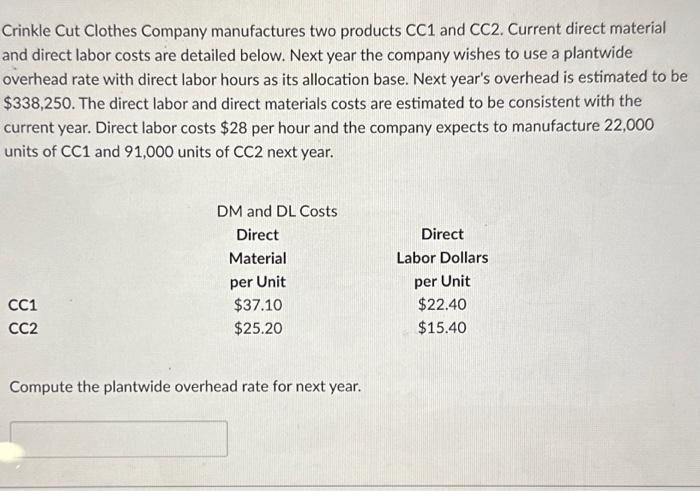

Crinkle Cut Clothes Company manufactures two products CC1 and CC2. Current direct material and direct labor costs are detailed below. Next year the company

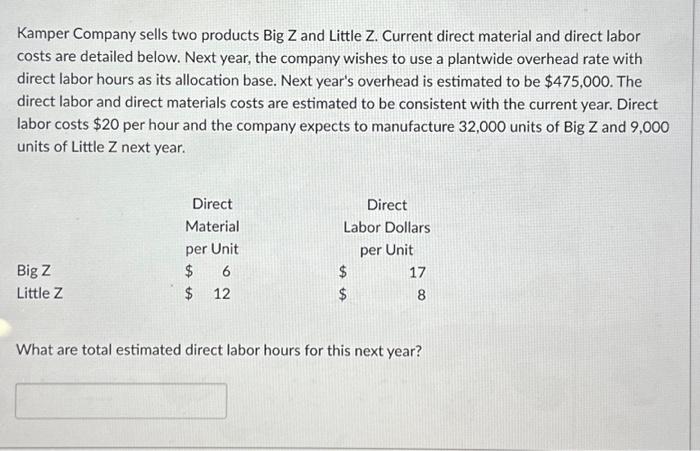

Crinkle Cut Clothes Company manufactures two products CC1 and CC2. Current direct material and direct labor costs are detailed below. Next year the company wishes to use a plantwide overhead rate with direct labor hours as its allocation base. Next year's overhead is estimated to be $338,250. The direct labor and direct materials costs are estimated to be consistent with the current year. Direct labor costs $28 per hour and the company expects to manufacture 22,000 units of CC1 and 91,000 units of CC2 next year. CC1 CC2 ODM and DL Costs Direct Material per Unit $37.10 $25.20 Compute the plantwide overhead rate for next year. Direct Labor Dollars per Unit $22.40 $15.40 Kamper Company sells two products Big Z and Little Z. Current direct material and direct labor costs are detailed below. Next year, the company wishes to use a plantwide overhead rate with direct labor hours as its allocation base. Next year's overhead is estimated to be $475,000. The direct labor and direct materials costs are estimated to be consistent with the current year. Direct labor costs $20 per hour and the company expects to manufacture 32,000 units of Big Z and 9,000 units of Little Z next year. Direct Direct Material Labor Dollars per Unit per Unit Big Z $ 6 $ 17 Little Z $ 12 $ 8 What are total estimated direct labor hours for this next year?

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Crinkle Cut Clothes Company Plantwide Overhead Rate Given Estimated Overhead Cost Next Year 338250 Direct Labor Cost per Hour 28 To Find Plantw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e3de733153_959237.pdf

180 KBs PDF File

663e3de733153_959237.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started