Question

Crisis Inc., is a startup company formed 4 years ago. The current capital structure consists of 11M common shares (ordinary shares) owned by the founder,

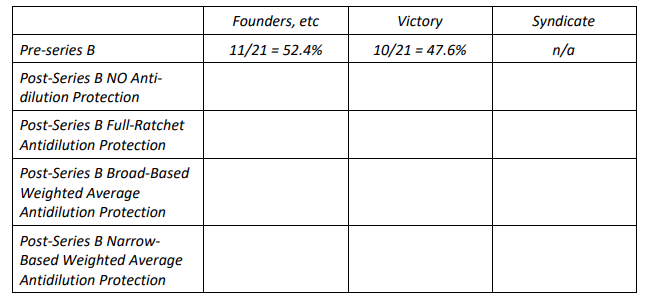

Crisis Inc., is a startup company formed 4 years ago. The current capital structure consists of 11M common shares (ordinary shares) owned by the founder, employees and family members, and 10M convertible preferred stock (series A) owned by Victory LP a VC firm. The convertible preferred stock was sold to Victory for $6 per share when the VC invested in Crisis Inc. The series A can be converted to ordinary stock on a 1:1 basis.

Crisis has had a poor year of operations they have had problems with prototype development and manufacturing issues. Crisis needs to raise additional capital of $30M by issuing series B convertible preferred stock (series B) to a new syndicate of VCs. Due to the operational problems, this will be a down round the series B will be sold for $4 per share. The series B can be converted to ordinary stock on a 1:1 basis.

Complete the following table (show any workings below):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started