Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Critical Thinking Assignment #4 On August 31st, 2021, the bank statement of Jill's Auto Shop arrived from Local Bank. Additionally, you have gathered the

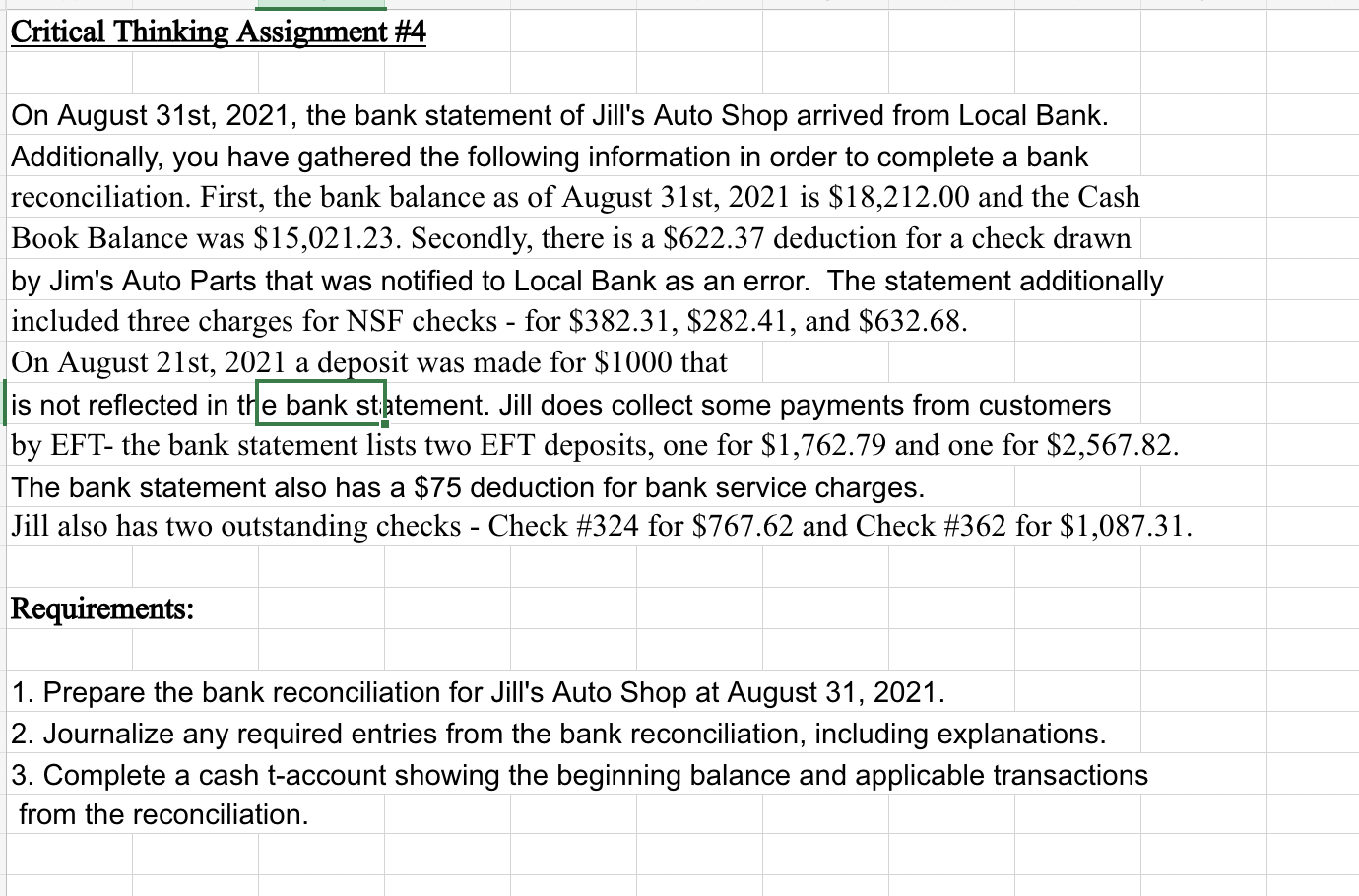

Critical Thinking Assignment #4 On August 31st, 2021, the bank statement of Jill's Auto Shop arrived from Local Bank. Additionally, you have gathered the following information in order to complete a bank reconciliation. First, the bank balance as of August 31st, 2021 is $18,212.00 and the Cash Book Balance was $15,021.23. Secondly, there is a $622.37 deduction for a check drawn by Jim's Auto Parts that was notified to Local Bank as an error. The statement additionally included three charges for NSF checks - for $382.31, $282.41, and $632.68. On August 21st, 2021 a deposit was made for $1000 that is not reflected in the bank statement. Jill does collect some payments from customers by EFT- the bank statement lists two EFT deposits, one for $1,762.79 and one for $2,567.82. The bank statement also has a $75 deduction for bank service charges. Jill also has two outstanding checks - Check #324 for $767.62 and Check #362 for $1,087.31. Requirements: 1. Prepare the bank reconciliation for Jill's Auto Shop at August 31, 2021. 2. Journalize any required entries from the bank reconciliation, including explanations. 3. Complete a cash t-account showing the beginning balance and applicable transactions from the reconciliation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Bank Reconciliation Jills Auto Shop Bank Reconciliation August 31 2021 Bank Statement Book Balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started