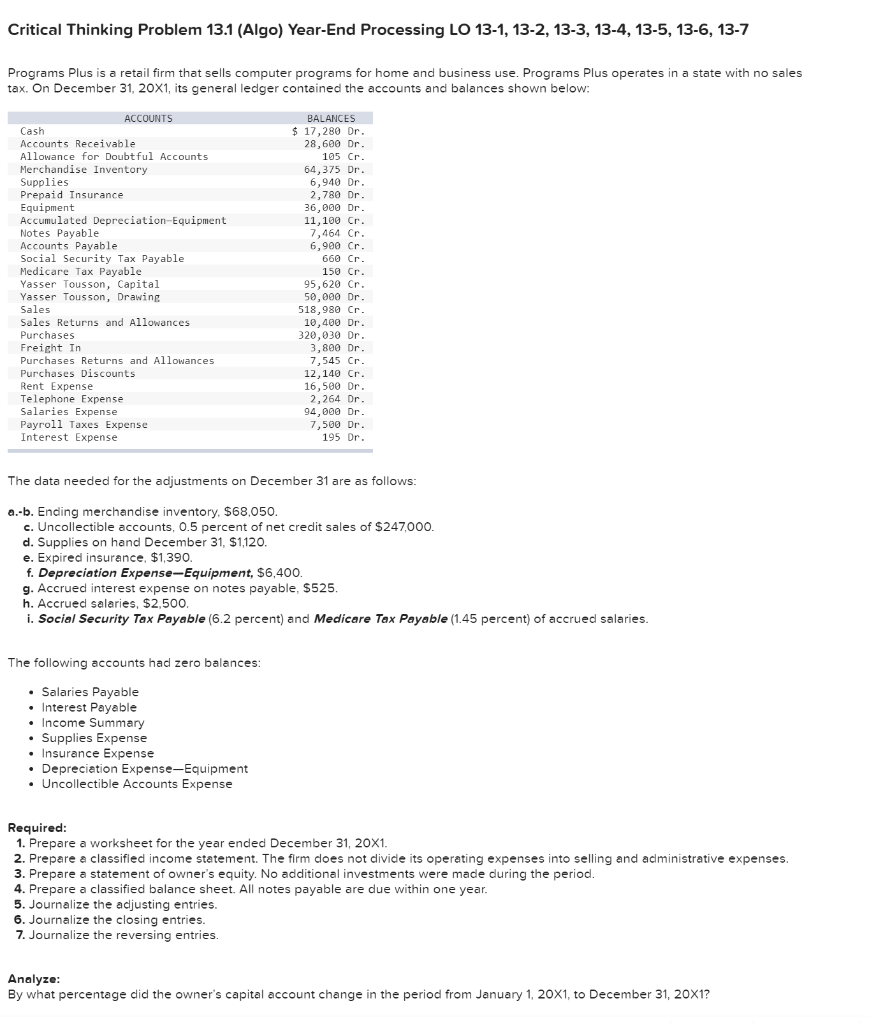

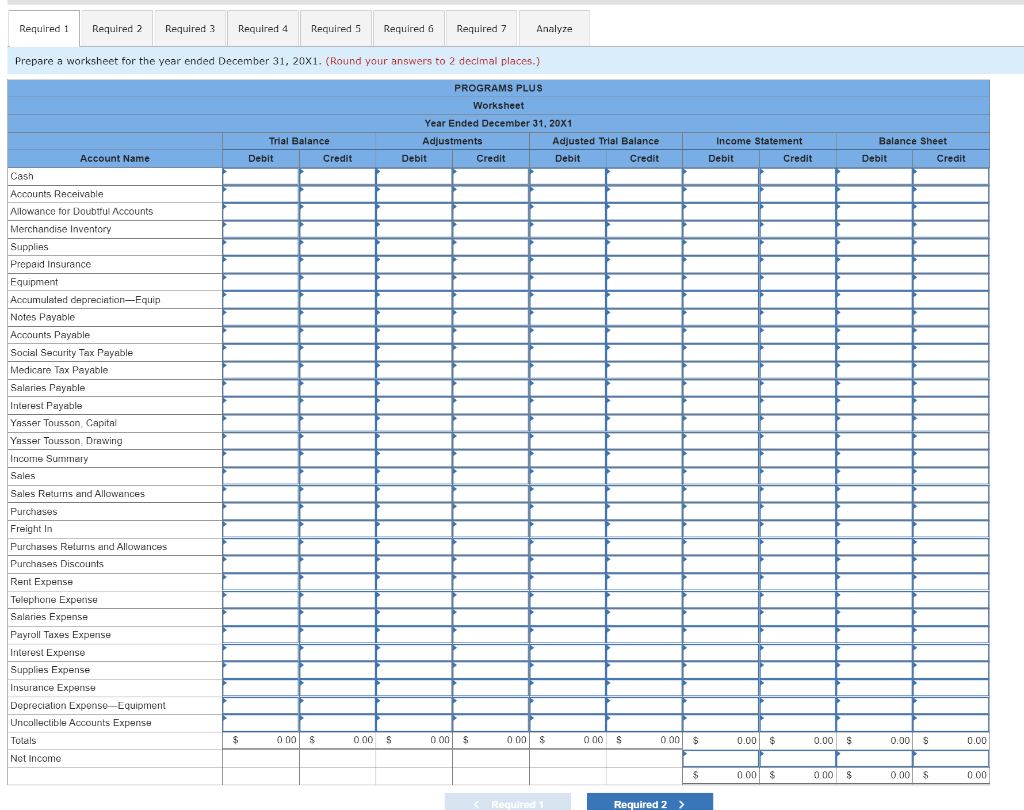

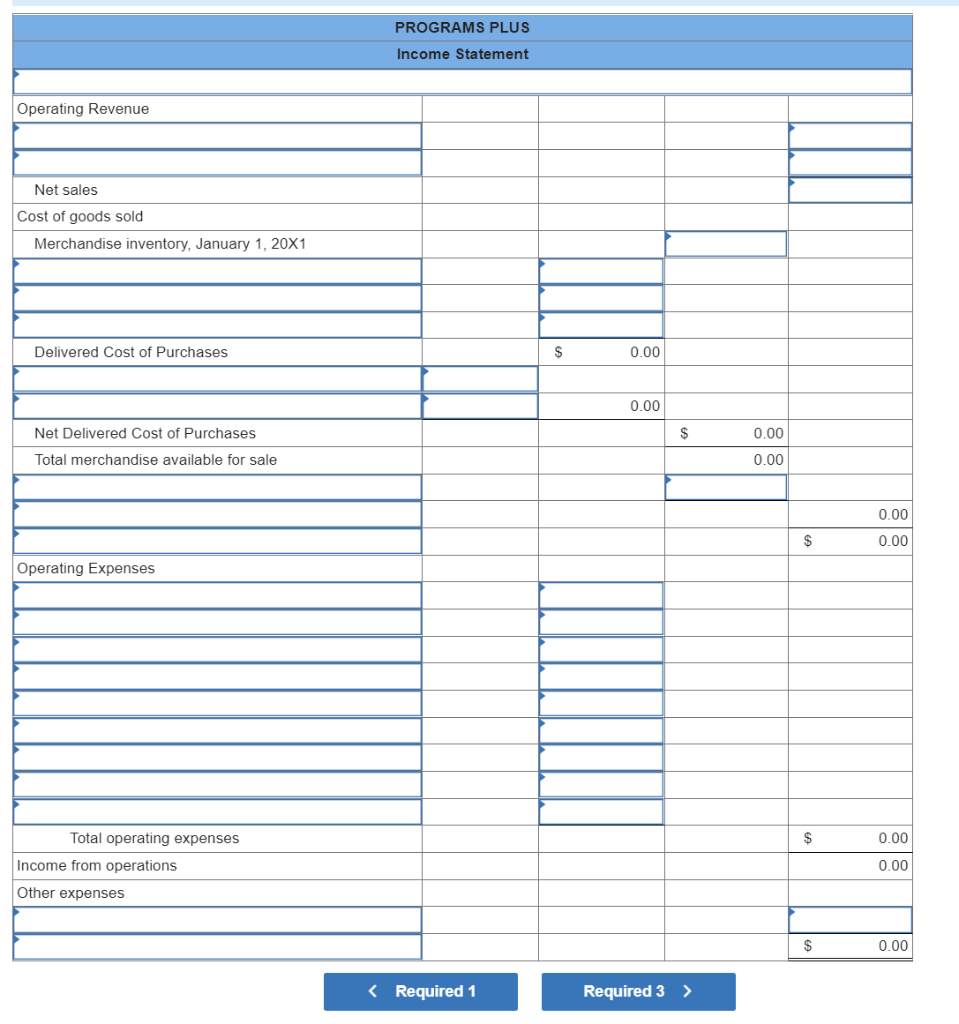

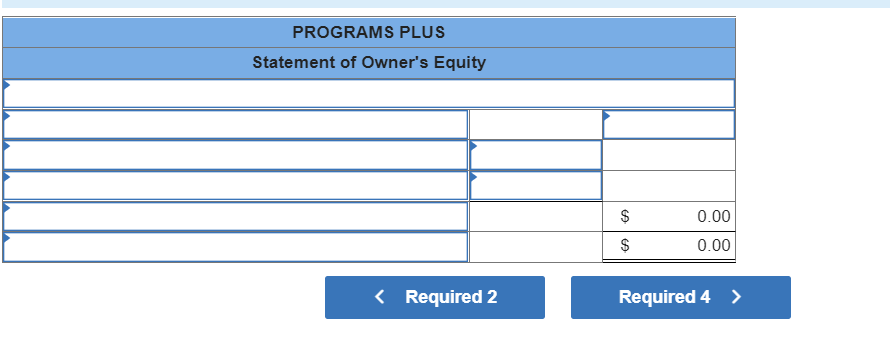

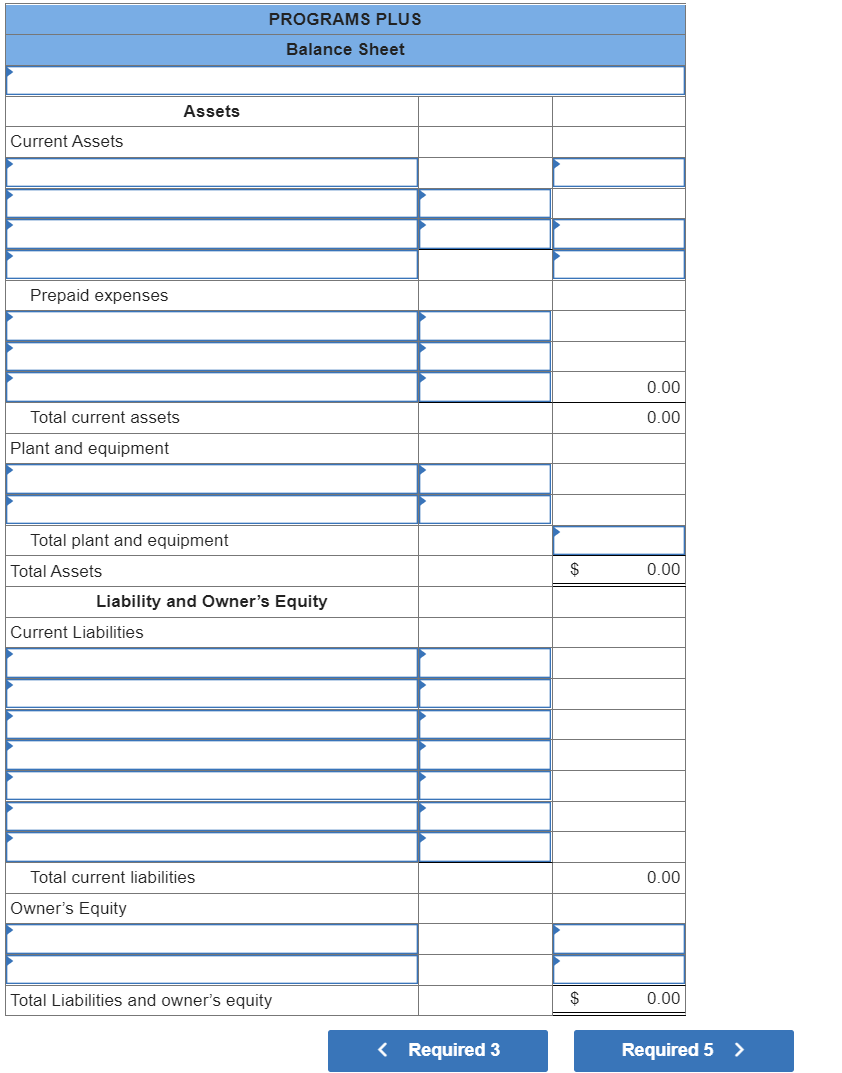

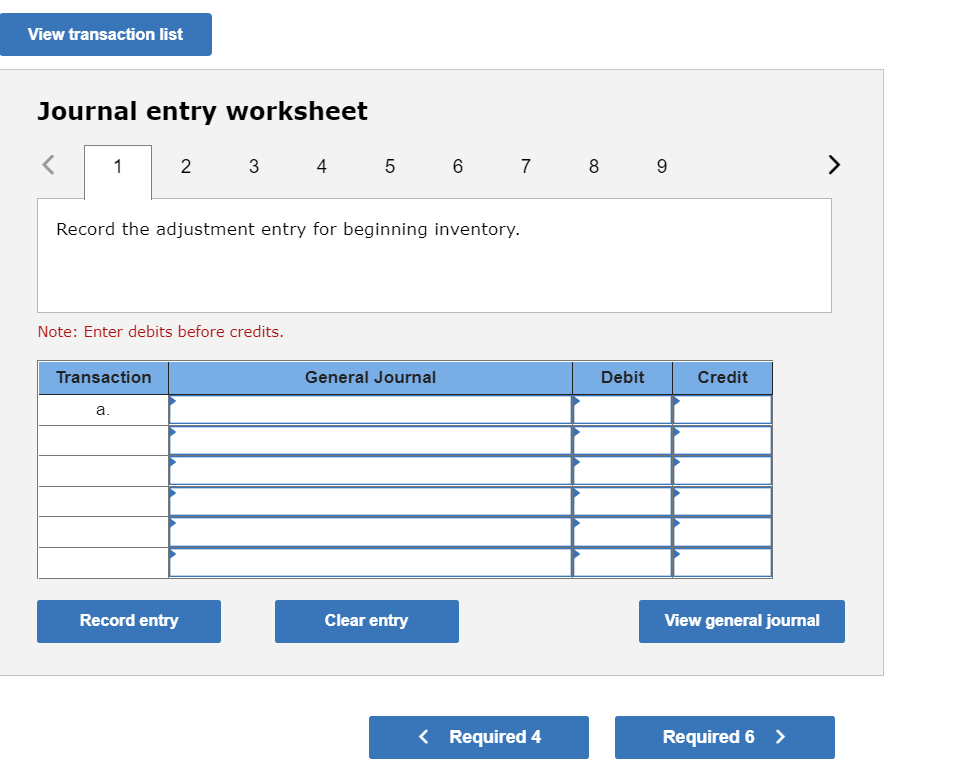

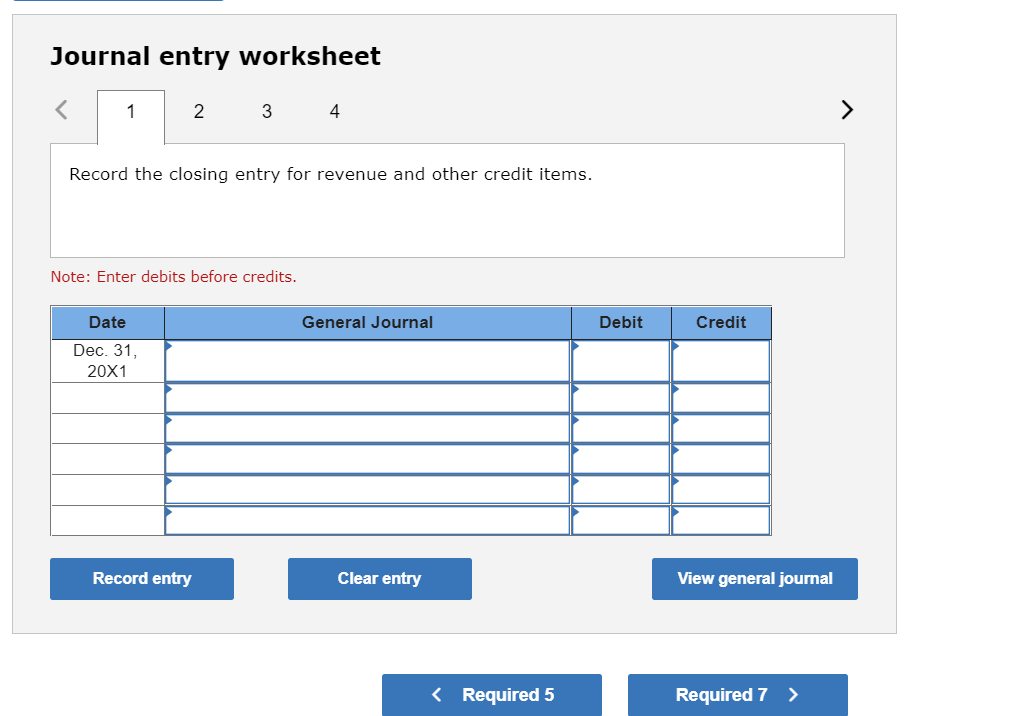

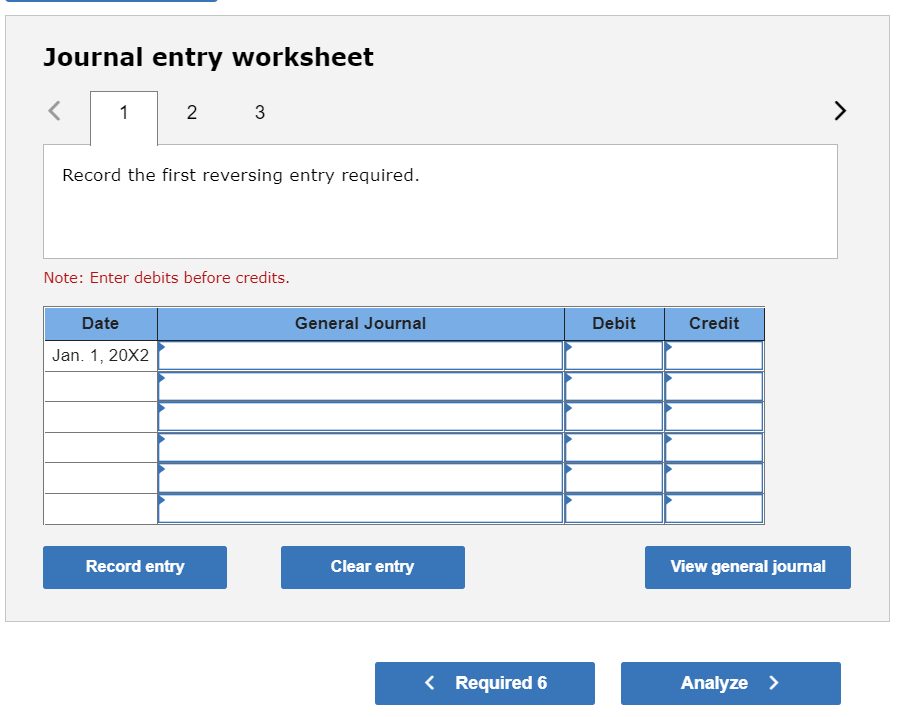

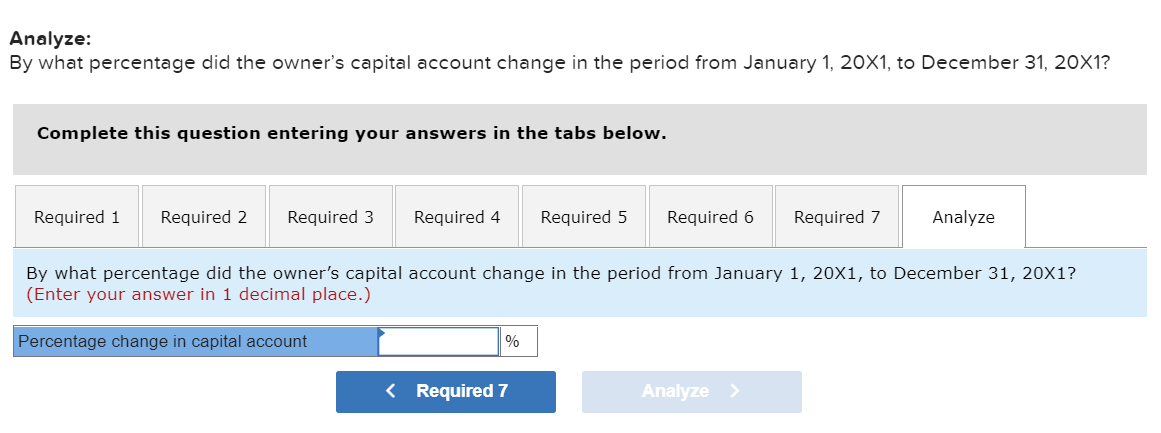

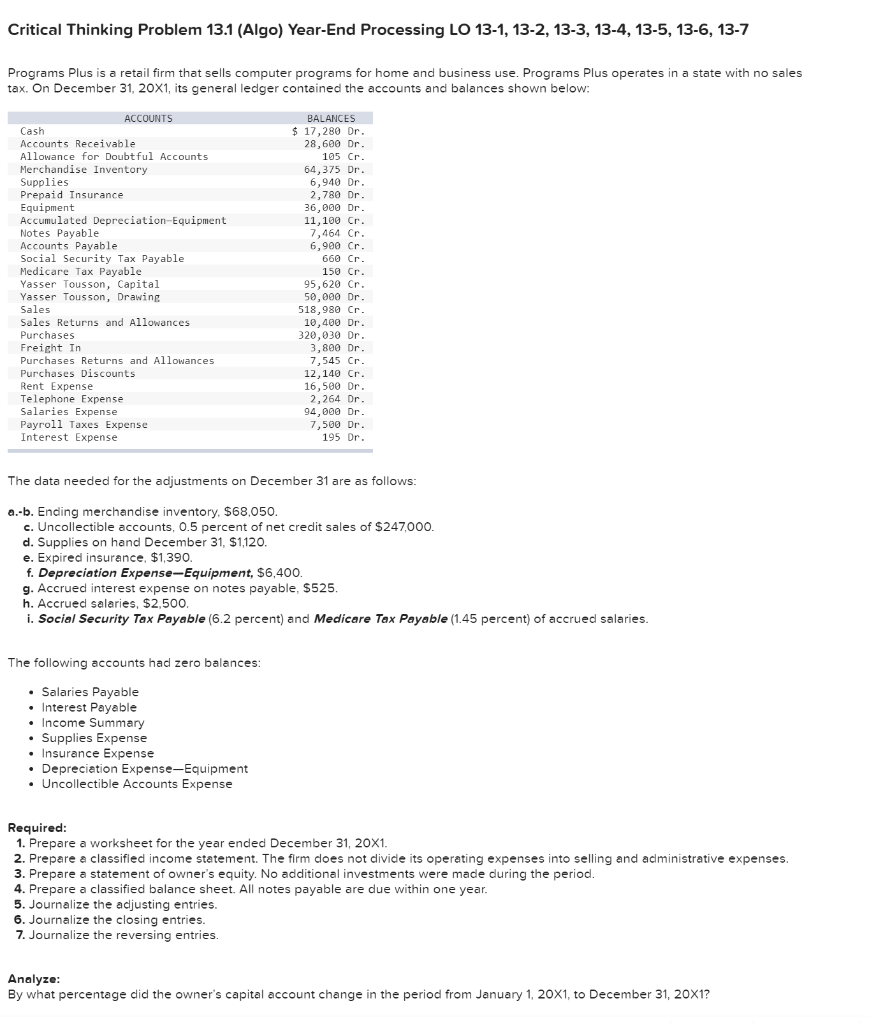

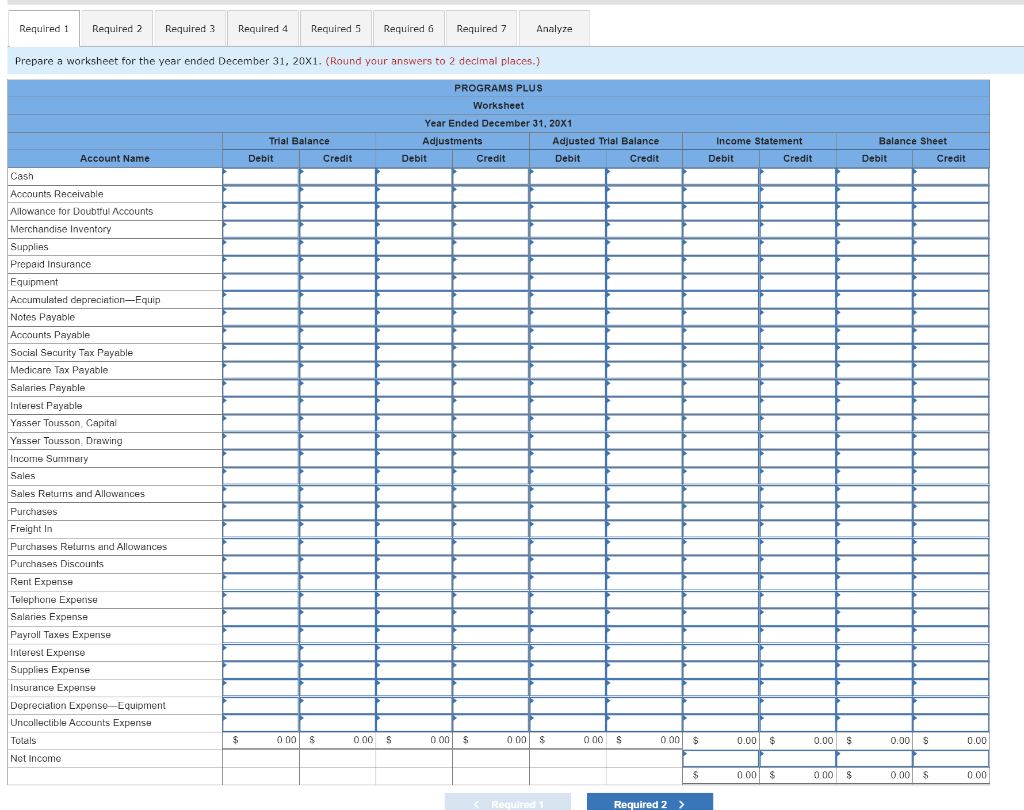

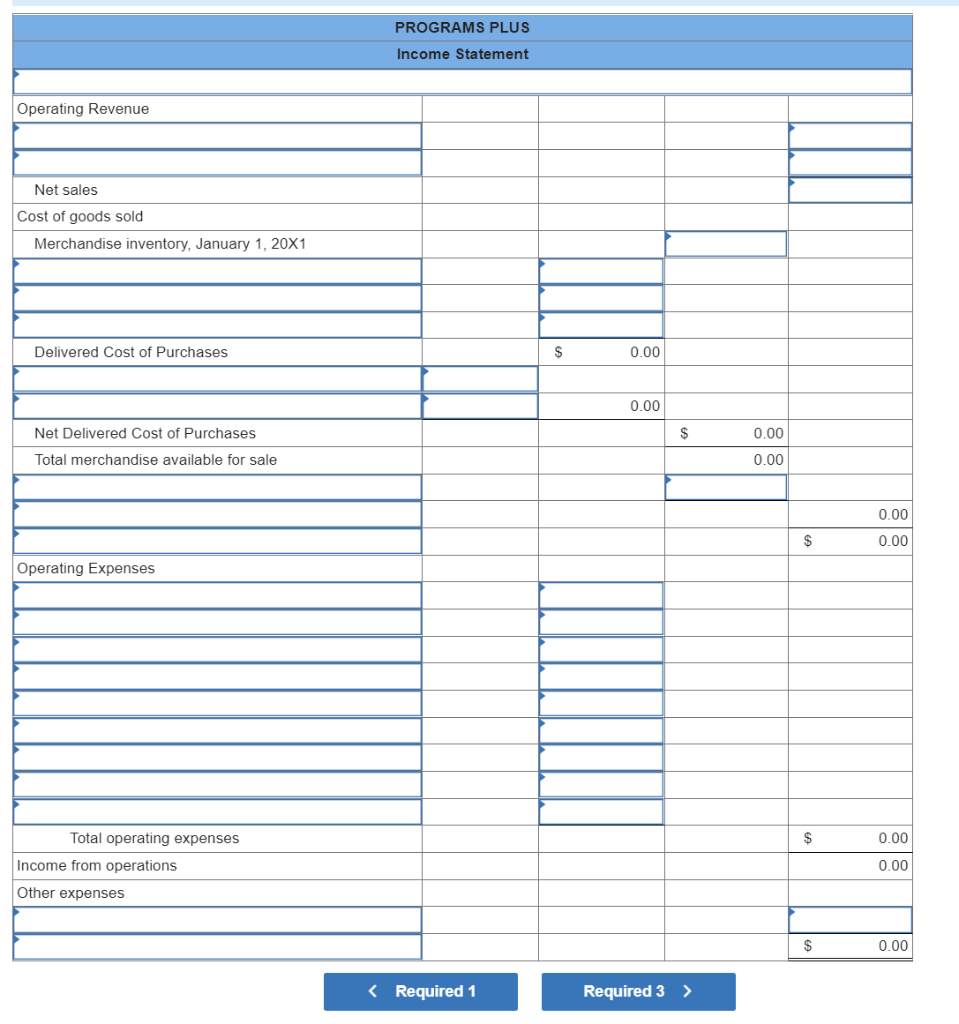

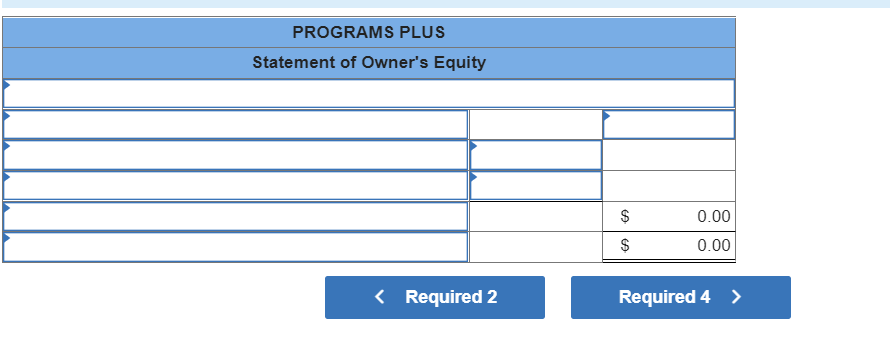

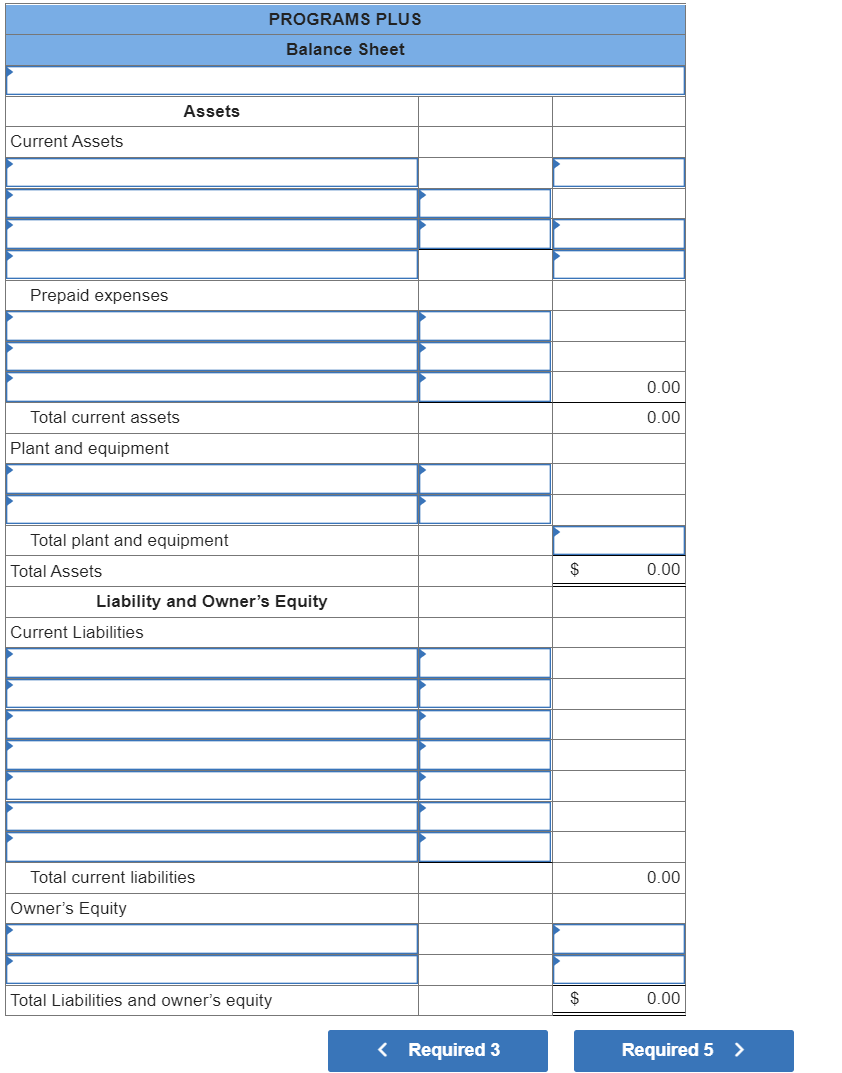

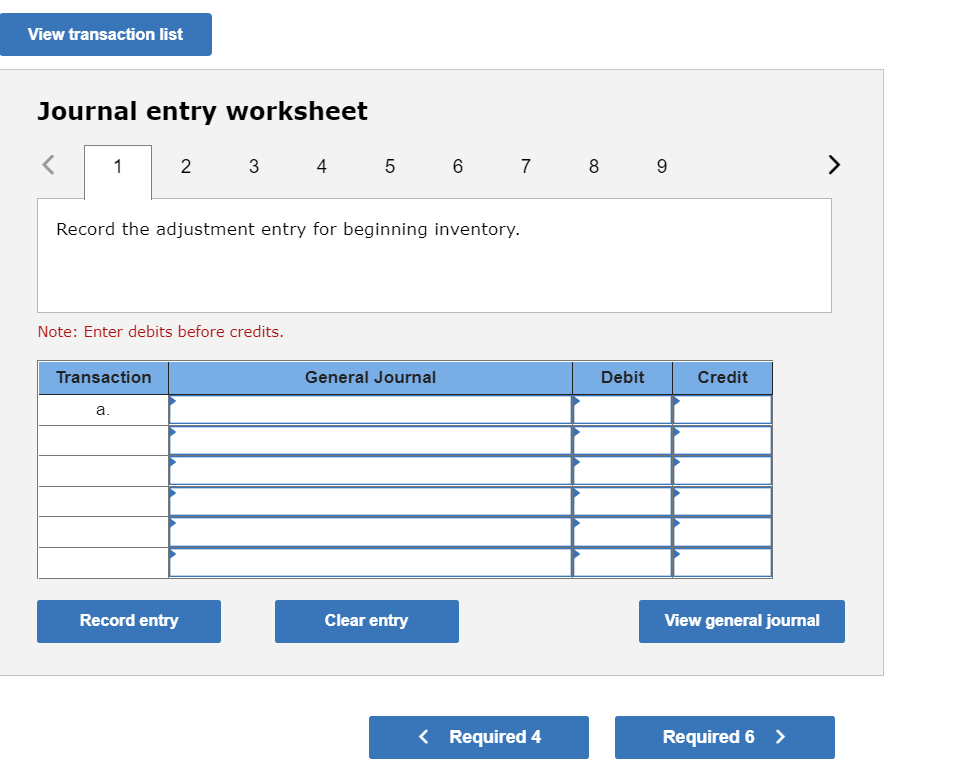

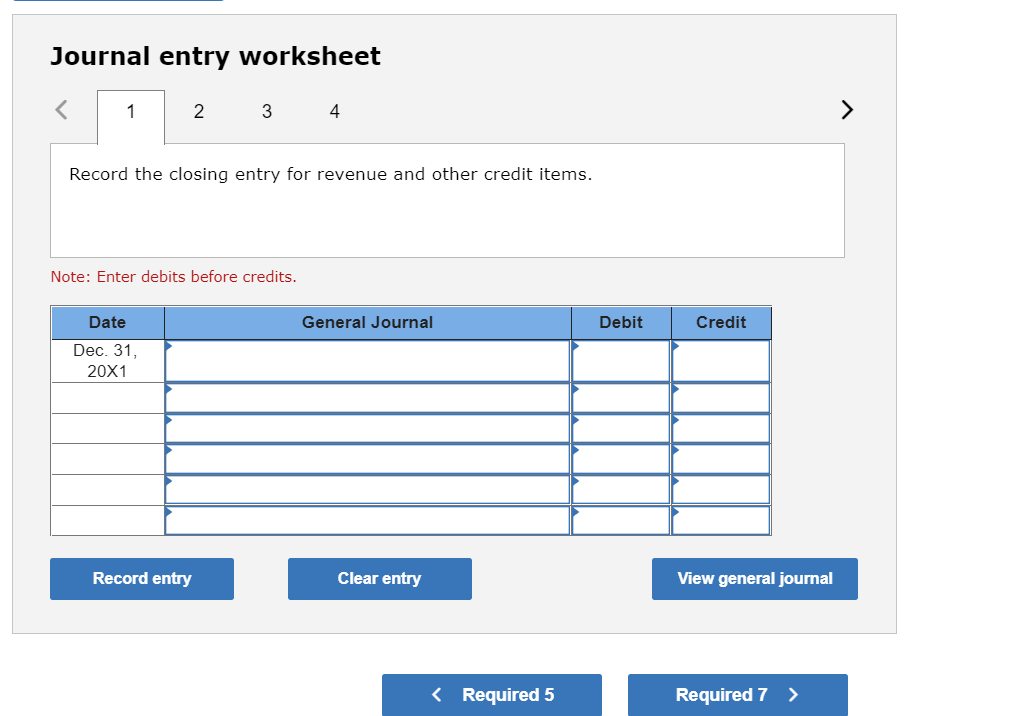

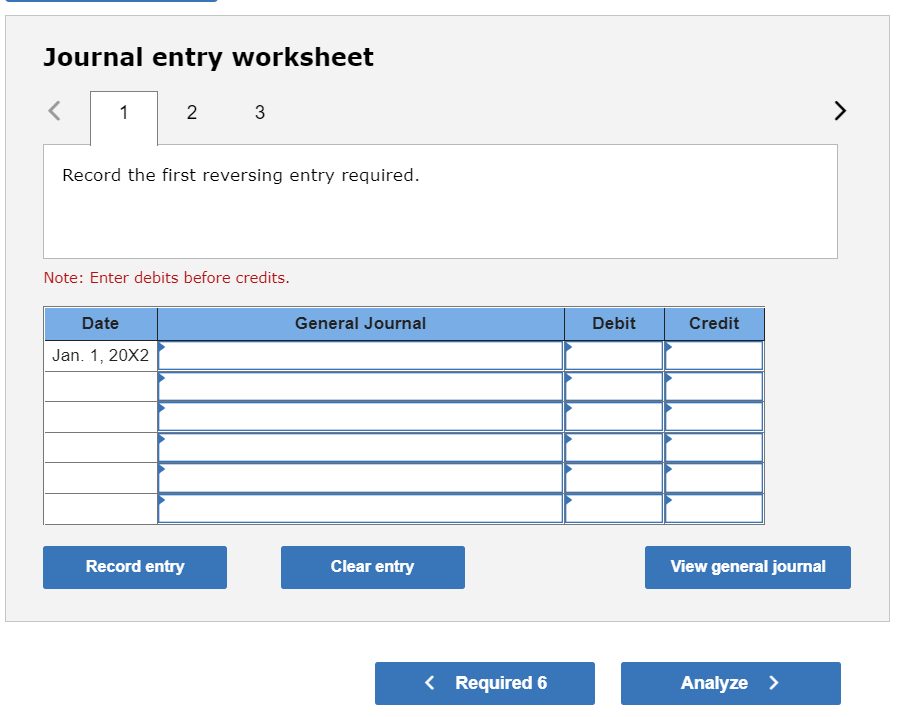

Critical Thinking Problem 13.1 (Algo) Year-End Processing LO 13-1, 13-2, 13-3, 13-4, 13-5, 13-6, 13-7 Programs Plus is a retail firm that sells computer programs for home and business use. Programs Plus operates in a state with no sales tax. On December 31, 20x1, its general ledger contained the accounts and balances shown below: ACCOUNTS Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Social Security Tax Payable Medicare Tax Payable Yasser Tousson, Capital Yasser Tousson, Drawing Sales Sales Returns and Allowances Purchases Freight In Purchases Returns and Allowances Purchases Discounts Rent Expense Telephone Expense Salaries Expense Payroll Taxes Expense Interest Expense BALANCES $ 17,280 Dr. 28,600 Dr. 165 Cr. 64,375 Dr. 6,940 Dr. 2,780 Dr. 36,000 Dr 11,100 Cr. 7,464 Cr. 6,900 Cr. 660 Cr. 150 Cr. 95,620 Cr 50,000 Dr. 518,980 Cr 10,400 Dr. 320,030 Dr. 3,800 Dr. 7,545 Cr 12,140 Cr. 16,500 Dr 2,264 Dr. 94,000 Dr 7,500 Dr. 195 Dr The data needed for the adjustments on December 31 are as follows: a.-b. Ending merchandise inventory, $68,050. c. Uncollectible accounts, 0.5 percent of net credit sales of $247,000. d. Supplies on hand December 31, $1,120. e. Expired insurance, $1,390. f. Depreciation Expense-Equipment, $6,400. g. Accrued interest expense on notes payable, $525. h. Accrued salaries, $2,500. i. Social Security Tex Payable (6.2 percent) and Medicare Tax Payable (1.45 percent) of accrued salaries. The following accounts had zero balances: Salaries Payable Interest Payable Income Summary Supplies Expense Insurance Expense Depreciation Expense-Equipment Uncollectible Accounts Expense Required: 1. Prepare a worksheet for the year ended December 31, 20X1. 2. Prepare a classified income statement. The firm does not divide its operating expenses into selling and administrative expenses. 3. Prepare a statement of owner's equity. No additional invest were made during the period. 4. Prepare a classified balance sheet. All notes payable are due within one year. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entries. Analyze: By what percentage did the owner's capital account change in the period from January 1, 20X1, to December 31, 20X1? Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Analyze Prepare a worksheet for the year ended December 31, 20X1. (Round your answers to 2 decimal places.) , () PROGRAMS PLUS Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet Debit Credit Account Name Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated depreciation-Equip Notes Payable Accounts Payable Social Security Tax Payable Medicare Tax Payable Salaries Payable Interest Payable Yasser Tousson Capital Yasser Tousson, Drawing Income Summary Sales Sales Returns and Allowances Purchases Freight in Purchases Returns and Allowances Purchases Discounts Rent Expense Telephone Expense Salaries Expense Payroll Taxes Expense Interest Expense Supplies Expense Insurance Expense Depreciation Exponso-Equipment Uncollectible Accounts Expense Totals $ 000 $ 000 S 0.00 $ 000 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 Net Income $ 0.00 $ 0.00 S 0.00 $ 0.00 Required 1 Required 2 > PROGRAMS PLUS Income Statement Operating Revenue Net sales Cost of goods sold Merchandise inventory, January 1, 20X1 Delivered Cost of Purchases $ 0.00 0.00 Net Delivered Cost of Purchases $ 0.00 Total merchandise available for sale 0.00 0.00 $ 0.00 Operating Expenses $ 0.00 Total operating expenses Income from operations 0.00 Other expenses $ 0.00 PROGRAMS PLUS Statement of Owner's Equity $ 0.00 0.00 $ PROGRAMS PLUS Balance Sheet Assets Current Assets Prepaid expenses 0.00 Total current assets 0.00 Plant and equipment Total plant and equipment Total Assets $ 0.00 Liability and Owner's Equity Current Liabilities Total current liabilities 0.00 Owner's Equity Total Liabilities and owner's equity $ 0.00 View transaction list Journal entry worksheet Record the adjustment entry for beginning inventory. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Journal entry worksheet Journal entry worksheet Record the first reversing entry required. Note: Enter debits before credits. General Journal Debit Credit Date Jan. 1, 20X2 Record entry Clear entry View general journal Analyze: By what percentage did the owner's capital account change in the period from January 1, 20X1, to December 31, 20X1? Complete this question entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Analyze By what percentage did the owner's capital account change in the period from January 1, 20x1, to December 31, 20X1? (Enter your answer in 1 decimal place.) Percentage change in capital account %