Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Critically compare and review corporate governance trends in two large organisations of your choice. Address the following in your review: 1. Corporate Governance -

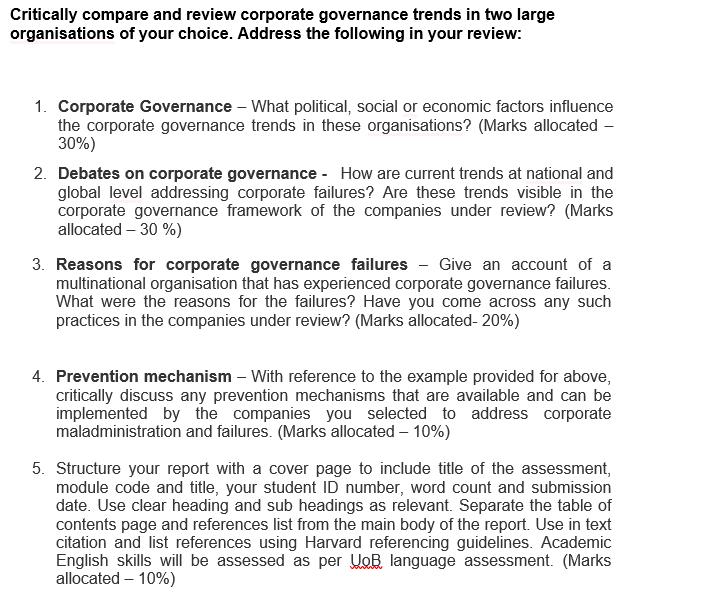

Critically compare and review corporate governance trends in two large organisations of your choice. Address the following in your review: 1. Corporate Governance - What political, social or economic factors influence the corporate governance trends in these organisations? (Marks allocated - 30%) 2. Debates on corporate governance - How are current trends at national and global level addressing corporate failures? Are these trends visible in the corporate governance framework of the companies under review? (Marks allocated 30%) 3. Reasons for corporate governance failures - Give an account of a multinational organisation that has experienced corporate governance failures. What were the reasons for the failures? Have you come across any such practices in the companies under review? (Marks allocated-20%) 4. Prevention mechanism - With reference to the example provided for above, critically discuss any prevention mechanisms that are available and can be implemented by the companies you selected to address corporate maladministration and failures. (Marks allocated - 10%) 5. Structure your report with a cover page to include title of the assessment, module code and title, your student ID number, word count and submission date. Use clear heading and sub headings as relevant. Separate the table of contents page and references list from the main body of the report. Use in text citation and list references using Harvard referencing guidelines. Academic English skills will be assessed as per UOB language assessment. (Marks allocated - 10%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer I can provide a concise comparison of corporate governance trends in two large organizations ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started